The dollar has turned in the charts

The pound's rally has ended, and it's the turn of the dollar to take over. John C Burford goes in search of the elusive turning point.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

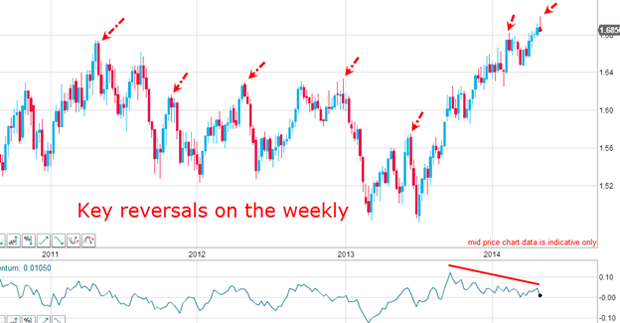

I have pointed out before that different markets possess different characters. And one of the biggest differences between markets is the nature of the shape of the large market turns. These are the turns that produce the major highs and lows on the daily and weekly charts that we are familiar with.

The large-cap stock market indexes such as the Dow and the S&P make the most of their major tops in a fairly smooth rolling-over fashion. But in markets such as currencies, gold and crude oil, the tops are more often made in a far more spiky manner.

These spike tops are called key reversals. At tops, they are easily spotted on a candlestick chart by a pigtail which pushes into new high ground. The market then closes lower than the previous period's close. This produces a red candlestick on the chart, which stands out against the predominantly green candles of the rally.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

When such a key reversal appears on the weekly chart (or better yet monthly), that is often found to be a harbinger of a major trend change. This is a fairly rare event.

On the daily chart, it is not such an accurate indicator of a trend change. But with the accompanying key reversal for the week, I believe this key reversal in the dollar from down to up is just such a signal.

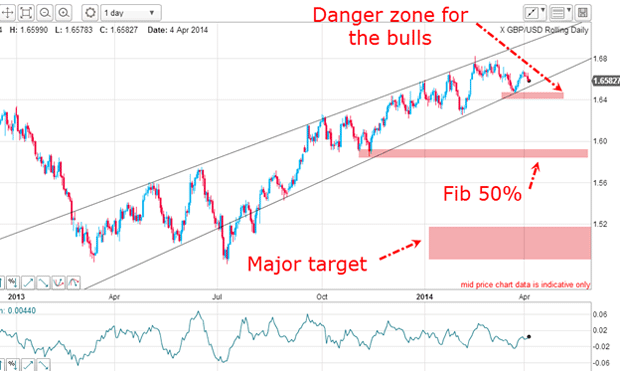

Today, I will show this on the GBP/USD chart a market I last covered on 4 April.

This is an unusual market

There has been a topping key reversal on average every six months. Last week's key reversal has occurred after a huge one-way rally off the July 2013 low at the 1.50 level.

There have been no decent corrections to this rally and that is most unusual in this market. The last time this occurred was in the big slide of 2008, where the market fell from the 2.00 area to the historic low of 1.35 within six months (the six-month cycle lives in GBP/USD!)

One further point on key reversals: on a short-term chart (shorter than the daily), we see many of these reversals, and usually they can be ignored as they are not a reliable reversal indicator at such a small scale.

Perception trumps reality

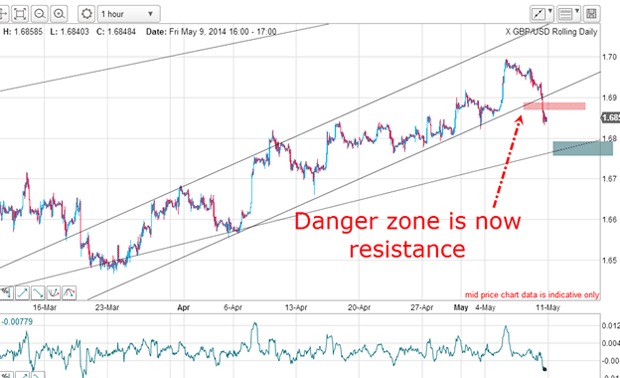

My danger zone for the rally was under the lower wedge line. But as it turns out, that zone was never in danger - the market rallied from there to approach the round number 1.70 level last Thursday. But it was not to make that precise point.

The market fell a handful of pips short before embarking on the ferocious sell-off following the news that the European Central Bank (ECB) would perhaps address the high value of the euro in June. There is no doubt that the Bank has been concerned that the high euro value has been seen to have restricted exports from the eurozone.

There is a misguided perception that a high currency value hampers exports. But historically, there has been little correlation between the two. In fact, UK manufacturing exports have shown signs of growth recently, despite a high value of the pound. But as always, widespread perceptions trump reality.

The rally is running out of steam

The rally off the 5 February low has displayed a gradual weakening with the negative-momentum divergence (red bar) and the failure to hit the upper wedge line. This is typical behaviour at a major top.

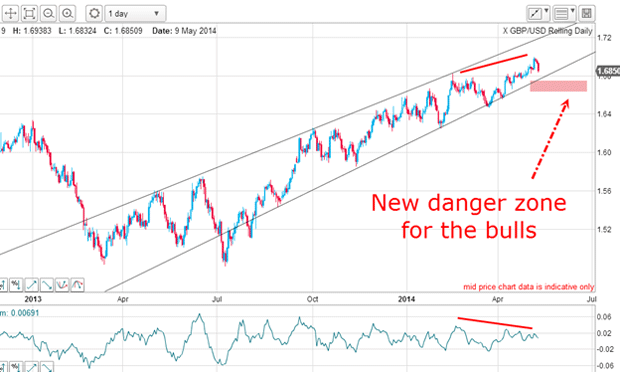

Here is the hourly chart which I drew before the ECB announcement on Thursday (ignore the date stamp on the chart):

I have an excellent tramline pair with the market testing the lower tramline. The final thrust towards 1.70 also missed the upper tramline, indicating the rally was running out of steam.

On this short-term basis, the danger zone for the bulls was just under my lower tramline and a great place to enter a short trade.

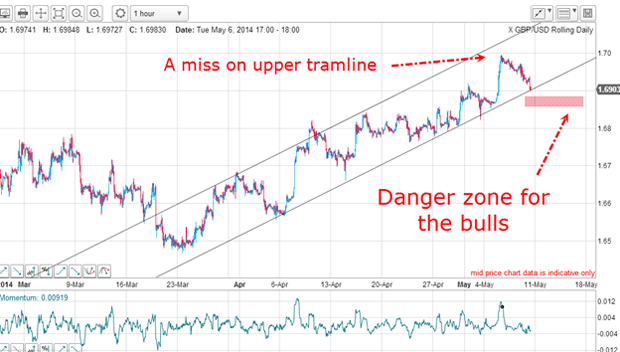

This is the position this morning:

The danger zone has been broken and now becomes resistance. The next support zone is on the lower tramline (marked in grey).

This is shaping up to be the year of the dollar

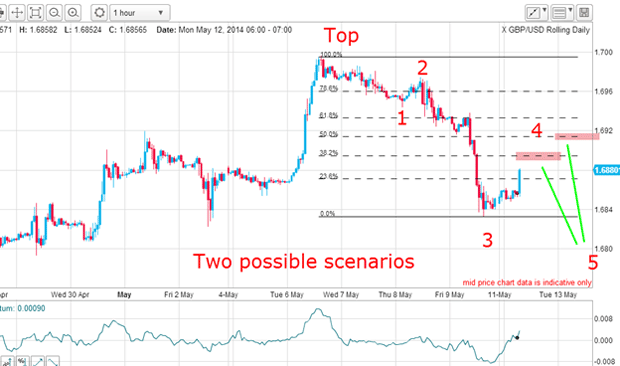

Here is the hourly chart as I write:

If I am to get my five waves down, I have two possible scenarios as my roadmap. I already have a long and very strong wave 3 and the market is rallying towards my wave 4 high as I write. It could top out at one of the Fibonacci levels shown and then back off to make a new low in wave 5. That is my ideal picture.

But, as I have shown in many recent charts of the Dow, with only the three waves down, this could be an A-B-C (a corrective pattern), leading to new highs above 1.70.

So, now I have an absolute level where I can say with confidence the tide has turned and that is a break of the 1.6830 level and that it should occur within a few days to preserve the right look' of my budding five-wave pattern.

One of my forecasts for 2014 that I made last December is that this will be the year of the dollar and this could be the start of the long haul back for the beleaguered currency.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

John is is a British-born lapsed PhD physicist, who previously worked for Nasa on the Mars exploration team. He is a former commodity trading advisor with the US Commodities Futures Trading Commission, and worked in a boutique futures house in California in the 1980s.

He was a partner in one of the first futures newsletter advisory services, based in Washington DC, specialising in pork bellies and currencies. John is primarily a chart-reading trader, having cut his trading teeth in the days before PCs.

As well as his work in the financial world, he has launched, run and sold several 'real' businesses producing 'real' products.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how