I couldn’t see through the euro fog – but a perfect trading opportunity presented itself

John C Burford was taking a break from spread betting the euro – until this irresistible trade popped up.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

On Monday I wrote that I would stand aside from spread bettingthe euro until the fog cleared.

I lied.

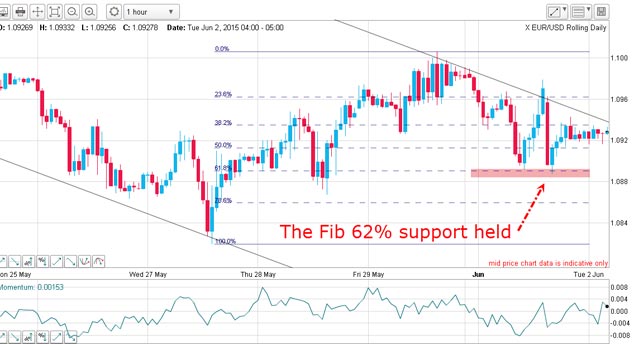

I just couldn't resist trading after pulling a wonderful chart later that day. The move down off the upper tramline was in a clear A-B-C and the market was entering traditional Fibonacci support at the 50% - 62% zone (marked in pink). If it was going to turn back up, it would very probably turn here.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

If the market were to turn up here, the upper tramline would be tested again, perhaps even broken. After all, the market was still heavily short the euro/long the dollar.

If this were to occur, there would be an almighty short squeeze that would light a fire under the euro rocket.

The higher-risk play was to go long at that Fibonacci support, while the lower-risk trade was to set a buy stop just above the upper tramline.

But the market was not going to give up its riches easily (it rarely does!). After the first bounce off the 62% level, the market hit the upper tramline and bounced back down off that resistance. It was playing hardball.

However, the second test of the 62% level proved to be successful and yesterday, the market just took off, breaking the upper tramline resistance.

The huge short squeeze that I predicted produced a 250 pip rally yesterday right to my third tramline T3.

Remember, I always draw the third tramline, T3, when the market moves out of the trading channel contained between my original tramline pair. That gives me my first target.

Note that the market in hitting T3 also comes within a whisker of the Fibonacci 62% retrace of the entire wave down off the 17 May high.

This conjunction means that there is big resistance here and what more excuse do you need to take partial profits according to my split bet strategy?

In just one day, my trade made a profit of around 250 pips. Incidentally, that adds to the other profits made in recent campaigns.

(Almost) always ignore the news

Actually, I do keep an eye open to what the media is saying. And in recent days, the Greece loans saga (will they or won't they default?) has filled the columns. Sentiment has been running very bearish the euro (as shown by Commitments of Traders data and other sentiment measures).

Therefore, the path of least resistance has been up for EUR/USD.

In a nutshell that is what swing traders attempt to do find the path of least resistance. When that path appears blocked, they bank the profits and look to see if an opposite trade makes sense.

That is precisely what I have been doing in my EUR/USD campaign. Here are my main trades this year:

I have found that this particular market obeys my tramline, Fibonacci and Elliott wave principles better that almost every other market. That is why I highly recommend novice traders focus on this market above all others.

In fact, I find that many traders look at far too many markets at the same time. That is not necessary because there are many swing trading opportunities available in just two or three. Keep looking!

Anyway, I sincerely apologise for my appalling lying.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

John is is a British-born lapsed PhD physicist, who previously worked for Nasa on the Mars exploration team. He is a former commodity trading advisor with the US Commodities Futures Trading Commission, and worked in a boutique futures house in California in the 1980s.

He was a partner in one of the first futures newsletter advisory services, based in Washington DC, specialising in pork bellies and currencies. John is primarily a chart-reading trader, having cut his trading teeth in the days before PCs.

As well as his work in the financial world, he has launched, run and sold several 'real' businesses producing 'real' products.

-

How a ‘great view’ from your home can boost its value by 35%

How a ‘great view’ from your home can boost its value by 35%A house that comes with a picturesque backdrop could add tens of thousands of pounds to its asking price – but how does each region compare?

-

What is a care fees annuity and how much does it cost?

What is a care fees annuity and how much does it cost?How we will be cared for in our later years – and how much we are willing to pay for it – are conversations best had as early as possible. One option to cover the cost is a care fees annuity. We look at the pros and cons.