Gold hits my second Fibonacci target!

The price of gold has rallied to a significant point in the charts, says John C Burford. But where is it likely to go next?

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Stock markets have taken centre stage in recent days. But I thought I would cover gold today since it has stealthily made it to my second upper Fibonacci target.

In my last post on 20 January, I noted that it had rallied to my first target in the $1,260 area. I also noted that the bounce off the 31 December $1,182 low appeared genuine and that this low would probably hold for some time.

When I applied my tramlines to the hourly chart, I noted that the gap created on 2 January was a signal that the market wanted to move up. This gap was created on a solid tramline break, and that gave me a clear buy signal.

Try 6 free issues of MoneyWeek today

Get unparalleled financial insight, analysis and expert opinion you can profit from.

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

This gold gap mirrored the gap in the Dow chart that I have been highlighting in recent posts. Both occurred on the same day, which confirmed the contra relationship that currently exists between them. And both gaps gave good trading signals.

Are we in a C wave?

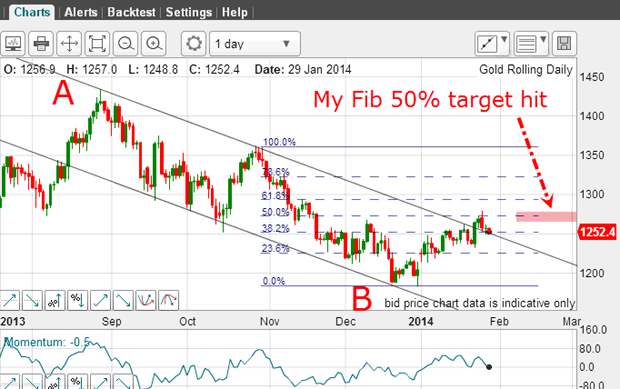

This is the current position showing the hit on my second target:

This is the daily chart showing the A and B Elliott wave labels. If this is correct, we should be in a C wave and the upper tramline break is supportive of this idea. This C wave should reach a level at least close to the A wave top above $1,400.

The key consideration this morning is this: the current pull-back off the Fibonacci 50% target is a possible kiss on my upper tramline. This implies the next move is a scalded cat bounce' up and away from the tramline. This is a very common pattern, and I have shown many examples of these in my emails.

The next move in gold is likely to be up

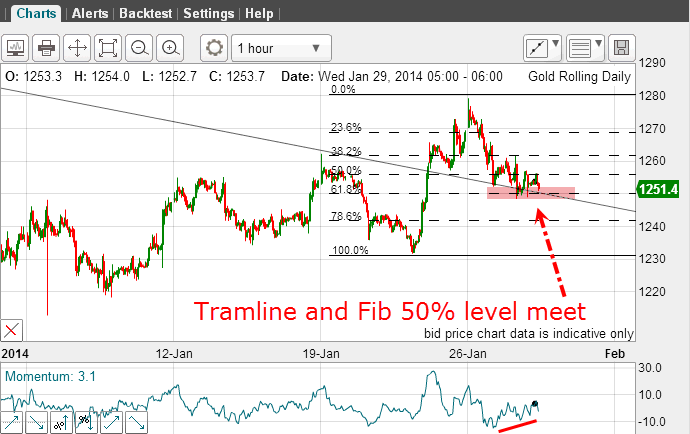

Let's zoom in for a closer look:

I have drawn in the Fibonacci levels for the last significant wave up. And the market is currently testing the Fibonacci 62% level. This is also where it meets the upper tramline. Both levels are areas of support, which means there is extra-strong support at this $1,250 level. A crossing of two lines of support or resistance such as this is a major event. It can often provide excellent low-risk trade entries.

Also note the positive momentum divergence (red bar) at the low. This indicates a lessening of short-term selling pressure.

Putting all this together, I can make a case that the next move in gold is likely to be up.

Gold is at a short-term crossroads

With the market having risen by a little over $100 off the low, this increase in bullishness is not surprising. But is it enough to erase the excess gloom?

In bull markets, traders talk about the froth' when prices get too stretched. There seems to be no equivalent phrase in bear markets when they become oversold. What is the opposite of froth, I wonder?

In any case, gold is at a short-term crossroads today. And with the Fed announcement due out later today, the resolution should not be far off.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

John is is a British-born lapsed PhD physicist, who previously worked for Nasa on the Mars exploration team. He is a former commodity trading advisor with the US Commodities Futures Trading Commission, and worked in a boutique futures house in California in the 1980s.

He was a partner in one of the first futures newsletter advisory services, based in Washington DC, specialising in pork bellies and currencies. John is primarily a chart-reading trader, having cut his trading teeth in the days before PCs.

As well as his work in the financial world, he has launched, run and sold several 'real' businesses producing 'real' products.