What to do when the market moves against us

As crazy as it sounds, the best attitude for any trader is to expect a loss on every trade. John C Burford explains why.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

Over the weekend, we saw some dramatic developments in the markets. The heightened tensions over Ukraine have investors fleeing to the safety of the US dollar and gold/silver. This had led to a corresponding hit on equities.

So this morning, I want to follow up on the euro story. It is a vivid and current illustration of how to handle a market when it suddenly moves against you.

On Friday, my analysis of the state of the EUR/USD produced an ambiguous picture, because I only had three waves down. This is what I wrote: "But if the market rallies strongly from here, that would tend to cancel out this (bearish) interpretation. And a rally above the 1.3760 highs would definitely negate it."

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

The problem is this: with only three waves, there existed the potential either for an A-B-C correction up, or the start of an impulsive five-wave move down.

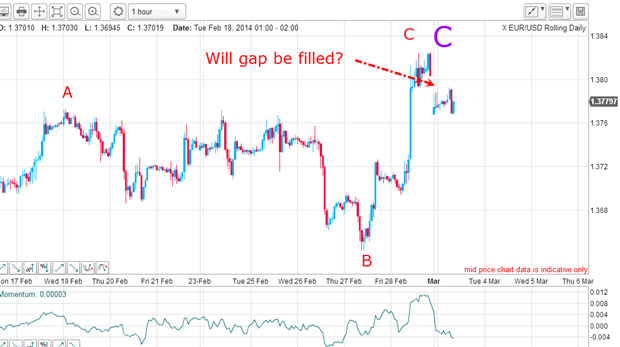

Later that day, the market embarked on a massive short squeeze. And that propelled the market above the 1.3760 level and to a 1.3820 high. In a single one-hour period, the market rallied by one full cent a very sharp move typical of short squeezes.

So my short trade taken inside the Chinese hat in the 1.3730 area would have been protected. By moving the stop to break-even, I had avoided any damage.

The question is this: because of the negation of my bearish five-wave picture I had last week, has the outlook now turned bullish? In other words, can I now expect new highs above the old high at 1.39?

Don't ever expect to win

Since the market had declined by well over 150% of my initial risk to the purple wave 1 low, I had moved my protective stop to break-even, just in case. But later that day, the market defied my expectations and roared upwards and took me out.

Being wrong is a common occurrence, and that is why the best attitude for any trader is to expect a loss on every trade. I know this sounds crazy, but it avoids the common amateur mistake of believing your analysis (or guess) must be right, and that you will soon be collecting untold riches. Who needs a stop strategy when it's a shoo-in for a juicy profit?

Professionals move their protective stops as soon as they can to reduce their risk. To them, entry into a trade takes little effort. It's the management of the trade that separates the pros from the amateurs. Be a pro and do likewise!

My best guess for the Elliot waves

I still have the 1.39 high as the most likely rally top from the mid-2002 low, and I have no reason to suspect this high will likely be exceeded. This means that I am reasonably confident a new bear market has started.

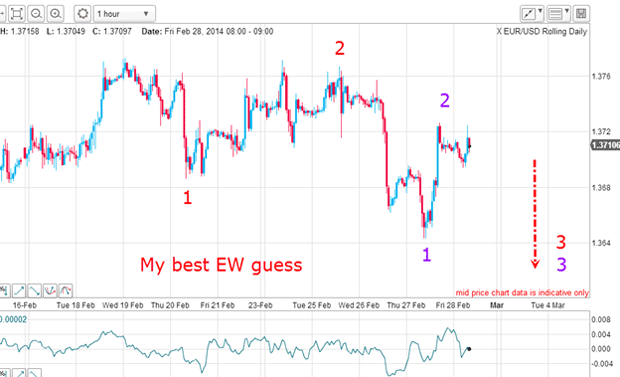

With this stance, here is my new best guess for the Elliott waves on the chart I drew after Friday's close:

The move off the December 1.39 high is in a clear impulsive five-wave pattern. That establishes the new trend as down. The purple A-B-C is the large relief rally to the five-wave down move.

Within the purple C wave, I now have a new (red) A-B-C. The A wave is showing a clear five-wave pattern and the B wave is containing its own A-B-C (this was the point of contention Friday morning).

Now, with the C wave rally to the 1.3820 level, the market is ready to resume the downtrend. All Elliott wave rules have been observed.

Is this the beginning of a bear market?

The market created an opening gap, which is an unusual and noteworthy event. This brings up the inevitable question: will the gap get filled in?

If it doesn't, the market may go on to form another five down sequence, which is the hallmark of a new bear trend. That is what I shall be looking for.

Also, the thrust to Friday's high took out the barrage of buy-stops above the 1.3760 resistance level in the short squeeze. With this considerable buying power now used up, is there enough new buying to push the market even higher? This is what the market is discovering this morning.

The crucial point is that it would take a rally above Friday's high to negate my new Elliott wave labels. These are the ones I will stick with unless Friday's high is taken out, of course.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

John is is a British-born lapsed PhD physicist, who previously worked for Nasa on the Mars exploration team. He is a former commodity trading advisor with the US Commodities Futures Trading Commission, and worked in a boutique futures house in California in the 1980s.

He was a partner in one of the first futures newsletter advisory services, based in Washington DC, specialising in pork bellies and currencies. John is primarily a chart-reading trader, having cut his trading teeth in the days before PCs.

As well as his work in the financial world, he has launched, run and sold several 'real' businesses producing 'real' products.

-

How a ‘great view’ from your home can boost its value by 35%

How a ‘great view’ from your home can boost its value by 35%A house that comes with a picturesque backdrop could add tens of thousands of pounds to its asking price – but how does each region compare?

-

What is a care fees annuity and how much does it cost?

What is a care fees annuity and how much does it cost?How we will be cared for in our later years – and how much we are willing to pay for it – are conversations best had as early as possible. One option to cover the cost is a care fees annuity. We look at the pros and cons.