Digital art: a new chapter in art history or just a fad?

How will history judge Beeple and the new digital way of making art?

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

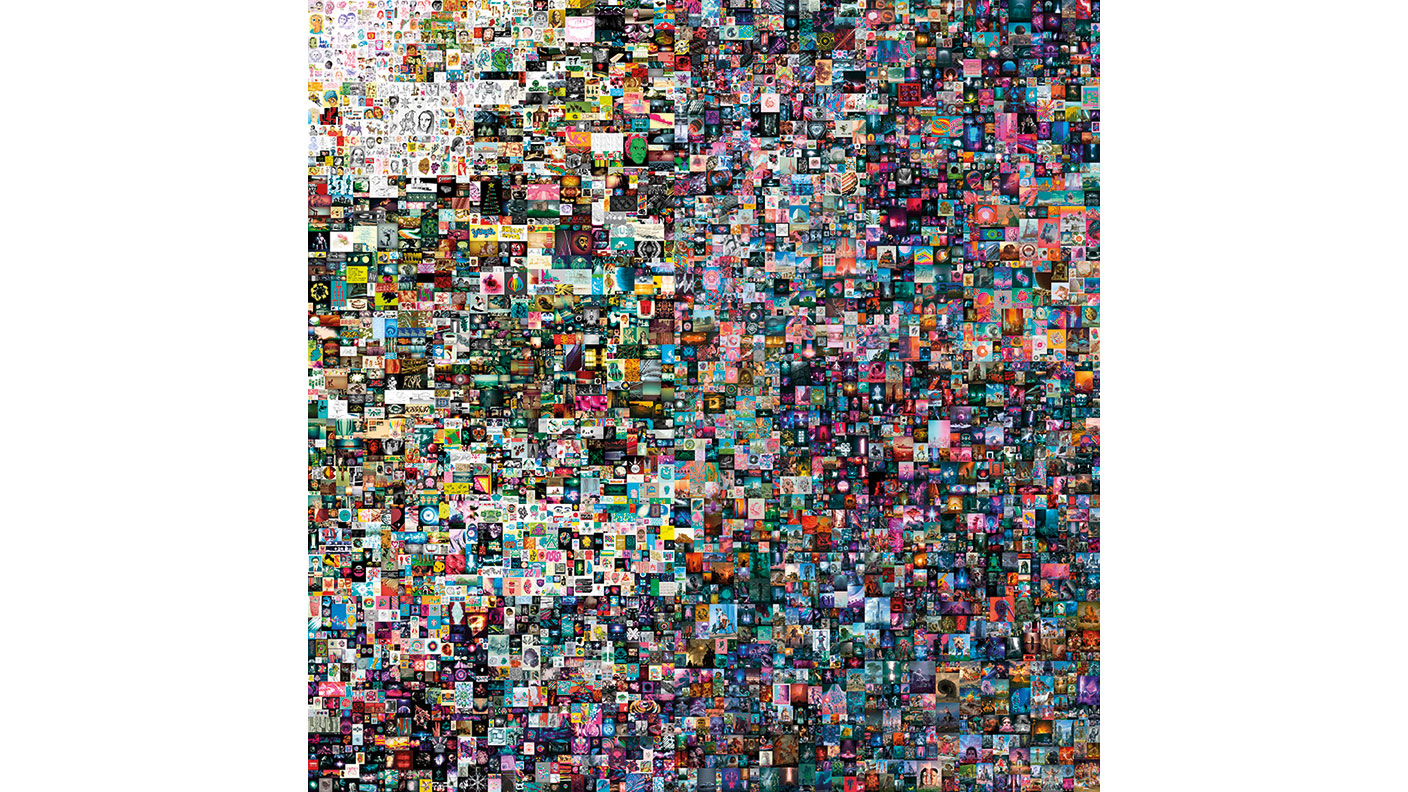

A fortnight ago, Everydays: The First 5,000 Days, the first purely digital artwork to be sold by a major auction house, fetched $69.3m. That was a high price indeed for a non-fungible token (NFT) – a concept so fresh that Christie’s didn’t even try to put an estimate on it. Never mind that that figure wasn’t the $92.2m that a fusty old “masterwork” by Sandro Botticelli fetched in January. That painting had taken 500 years to get to that price, a new record for the Renaissance artist. Beeple’s artwork, the NFT, took 25 days from its completion (“minting”) to the moment the virtual hammer came down. Even Beeple, real name Mike Winkelmann, was shocked, as a video of the final moments of the online auction shows. Banksy must be kicking himself for having mostly stuck to walls.

That said, earlier this month the burning of an “original Banksy” was filmed so that it would live forever after in the digital realm only as an NFT. The work, entitled Morons, had previously been valued at $95,000, according to NME. The newly minted NFT sold for $382,000.

But is it art? And does it matter? “It took the world centuries to stop talking (and thinking) about the artiness of art and denigrate the discussion to the level of pure dollars – whereas the newly minted NFT space still hasn’t got... around to the art part of the conversation since its inception,” says art dealer and writer Kenny Schachter on Artnet News. Schachter boasts that he even turned his own grandmother into an NFT and “sold her for a few grand”.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

If NFTs prove to be a short-lived fad – a symptom of too many young people with too much time and too much money – then so be it. Traditional artists are cashing in now and it’s giving the artists, particularly the younger ones, a platform from which to be noticed. Even established figures such as Damien Hirst are, as James Pickford puts it in the Financial Times, “planning to jump on the NFT bandwagon”. Last week, Hirst revealed details of a “secret art project”, called The Currency, to be sold later this year, which “challenges the concept of value through money and art”. It will be based on 10,000 works of art on paper, made five years ago and stored in a vault, and created with the same technology as used by Beeple.

That’s no surprise – Beeple’s success almost defies comprehension. “It doesn’t make any sense to me,” says the BBC’s art critic Will Gompertz. “But then nor did someone paying $450m to buy Salvator Mundi in 2017, an over-restored wreck of a painting that some… attribute to Leonardo da Vinci… Everydays: The First 5,000 Days will go down in history either as the moment before the short-lived cryptoart bubble burst, or as the first chapter in a new story of art.” In a three-decade-long career, “I’ve never seen anything” stir things up so rapidly, says Schachter. “You ignore this movement (and it’s nothing less) at your own expense. Trust me.”

A lockdown-driven splurge on things

The Sandro Botticelli and the Beeple artwork (pictured above) may seem “worlds apart”, says Andrea Felsted on Bloomberg. “But their desirability is driven by similar factors… an undiminished appetite among wealthy collectors for prestige investments, as well as an influx of younger, tech-savvy buyers whom galleries and dealers have managed to reach online.” These buyers have, to an extent, saved the art market despite the closure of art fairs and galleries. At $50.1bn, global sales of art and antiques in 2020 managed to avoid the $39.5bn previous low set in the aftermath of the financial crisis in 2009, according to a report for Art Basel and UBS Group. Global online sales rose to a record $12.4bn last year, double the value of 2019. Many collectors have seen their wealth rise during the various lockdowns, and “those with money to spare have splurged on things”.

The frenzy has spilled over into the “riskiest” and “wackiest” assets, including digital ephemera and media, cryptocurrencies, collectables such as trading cards and even trainers, says Erin Griffith in The New York Times. Artists Grimes and Steve Aoki made millions from their digital artwork, even before Beeple’s headline-grabbing sale, while in the music world, US electronic DJ Justin Blau, known by his stage name 3lau, was “blown away” by the $11.7m he made selling NFTs related to one of his previously released albums. The reselling of collectable trainers has “exploded” on online platforms, such as StockX, and trading-card sales have taken off, too. One autographed card from 2000, featuring American football star Tom Brady, sold for a record $1.3m this month, while a similar card fetched half a million dollars in January. “Predicting when and how the party will end is anyone’s guess.”

Auctions

Hermès handbags were the best-performing collectables of 2020 for the second year in a row, according to the latest edition of Knight Frank’s The Wealth Report. The Hermès handbags sub-index of the Knight Frank Luxury Investment Index (KFLII), which tracks the prices of the designer fashion accessories, rose by 17%. A regular feature of auction sales, Hermès handbags benefited from a heightened “appetite for relatively affordable luxury pick-me-ups during the Covid-19 pandemic, particularly in Asia where many bag collectors are based”, says Knight Frank’s Andrew Shirley. The record-setting sale of the year took place in Hong Kong in November, where a Hermès Himalaya Niloticus Crocodile Retourné Kelly 2 handbag (pictured) sold for HK3.4m (£327,300) with Christie’s.

Over the past ten years the sub-index has gained 108%. Fine wine finished the year in second place in the KFLII, rising 13% due in part to Bordeaux prices “firming up” despite the pandemic. The value of classic cars gained 6%, watches 5%, and collectable furniture 4% – all against an average of 3% for the KFLII. Indeed, the sub-index for rare whisky, the standout winner of the past decade with growth of 478%, fell by 4% in 2020, while art was by far the biggest loser of last year due to the pandemic-induced fall-off in auction sales, down 11%. However, sales of works by younger “red-chip” artists did better than most, particularly in Asia.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how

-

Adventures in Saudi Arabia

Adventures in Saudi ArabiaTravel The kingdom of Saudi Arabia in the Middle East is rich in undiscovered natural beauty. Get there before everybody else does, says Merryn Somerset Webb

-

Review: Constance Moofushi and Halaveli – respite in the Maldives

Review: Constance Moofushi and Halaveli – respite in the MaldivesTravel The Constance resorts of Moofushi and Halaveli on two idyllic islands in the Maldives offer two wonderful ways to unwind

-

Affordable Art Fair: The art fair for beginners

Affordable Art Fair: The art fair for beginnersChris Carter talks to the Affordable Art Fair’s Hugo Barclay about how to start collecting art, the dos and don’ts, and more

-

Review: Gundari, a luxury hotel in the Greek island of Folegandros

Review: Gundari, a luxury hotel in the Greek island of FolegandrosNicole García Mérida stayed at Gundari, a luxurious hotel on Folegandros, one of the lesser-known islands in the southern Cyclades in Greece

-

Fine-art market sees buyers return

Fine-art market sees buyers returnWealthy bidders returned to the fine-art market last summer, amid rising demand from younger buyers. What does this mean for 2026?

-

Review: Castiglion del Bosco, A Rosewood Hotel – a Tuscan rural idyll

Review: Castiglion del Bosco, A Rosewood Hotel – a Tuscan rural idyllTravel Play golf, drink exquisite wine and eat good food at Castiglion del Bosco, A Rosewood Hotel, all within the stunning Val d’Orcia National Park in Tuscany

-

Review: A cultural tour of North India

Review: A cultural tour of North IndiaTravel Jessica Sheldon explores North India's food and art scene from three luxurious Leela Palace hotels in New Delhi, Jaipur and Udaipur

-

The best luxury saunas, spas and icy plunges

The best luxury saunas, spas and icy plungesRestore your mind and body with luxury fire and ice experiences, from warming saunas to icy plunges