Pensioners to pay “retirement tax” within three years, according to state pension forecasts

The state pension is set to reach £12,592 by 2027, meaning it will exceed the tax-free personal allowance. We look at the latest forecasts, and how frozen tax thresholds affect retirees

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

Retirees will have to start paying income tax on their state pension in less than three years, according to official forecasts.

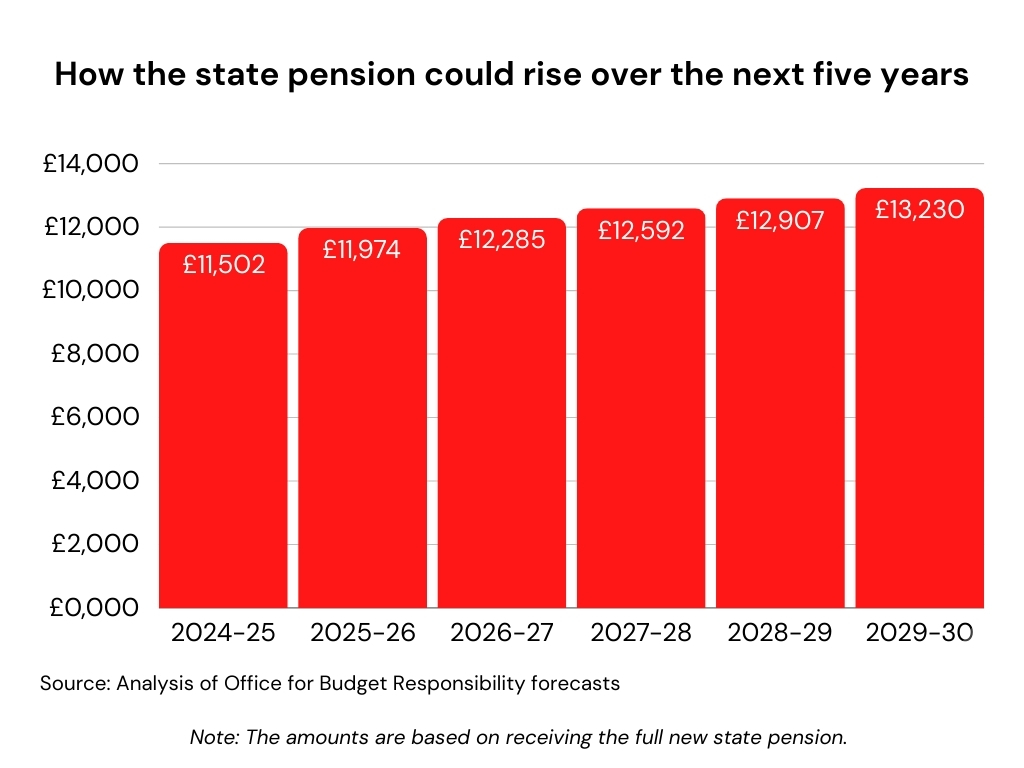

The full new state pension will reach £12,592 a year (£242 a week) in April 2027, meaning it will breach the £12,570 tax-free personal allowance.

The state pension will then increase to £13,230 a year by 2029.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

This is according to forecasts from the Office for Budget Responsibility (OBR), which were published alongside the Autumn Budget last month.

The OBR predicts that after an 8.5% hike in the state pension in April this year, and a 4.1% rise next April, the state pension will rise more slowly, at 2.6% in April 2026 (in line with inflation), and then 2.5% for the next few years.

This is in line with the state pension triple lock, which guarantees that the payout will increase every April by 2.5%, wage growth or inflation, whichever is highest.

But even with this slow growth, pensioners face paying a “retirement tax” on their state pension income in just a few years’ time.

Ian Cook, chartered financial planner at Quilter Cheviot, warns that retirees will be in the “perverse situation” where they have to start “paying back their state pension to HMRC due to frozen allowances”.

The personal allowance is frozen at its current level until 2028, as announced in the Budget.

Alice Haine, personal finance analyst at Bestinvest by Evelyn Partners, a wealth manager, called the situation “worrying” and “unfair”, adding: “This will put pressure on the government to unfreeze the personal allowance to prevent retirees being taxed on this vital benefit.”

Why will pensioners have to pay a retirement tax?

The term “retirement tax” was coined on the election campaign trail earlier this year when former prime minister Rishi Sunak claimed that a Labour government would subject the state pension to a "retirement tax”.

The Tories previously announced “triple lock plus” to avoid the state pension being liable for income tax. This was to be a new personal allowance for pensioners, which would rise in line with the triple lock - therefore keeping pace with the state pension and reducing the risk of pensioners being taxed.

However, Labour did not commit to such a policy. The government has also chosen to keep the personal allowance in the deep freeze, which former chancellor Jeremy Hunt had previously announced.

Millions of pensioners already pay tax on their state pension due to the complicated nature of the payout. According to analysis by the consultancy, LCP, 2.5 million - or one in five pensioners - receive a state pension higher than the personal allowance and are therefore losing part of it to income tax.

Many pensioners also pay income tax because they receive extra money on top of their state pension, such as from part-time work or a private pension.

But, younger pensioners who only receive the new state pension, and are eligible for the full amount, also face paying a retirement tax due to future rises in the payout.

Haine notes: “Landing retirees with no other sources of income with tax demands will be unfair and extremely worrying for pensioners who are already struggling to get by after the cost-of-living crisis.”

Cook adds that if the state pension breaches the personal allowance, “any private pension provision other than the tax-free cash lump sum would become taxable at their highest marginal rate, resulting in large tax bills for many pensioners depending on how much they were drawing from their pensions”.

How much will the state pension rise by?

The new state pension is currently worth £221.20 a week (£11,502.40 a year). It will increase by 4.1% in April next year, meaning a jump of £472 and a new annual total of £11,974.

In April 2026, it is forecast to rise by 2.6%, giving retirees on the full new state pension an annual income of £12,285.

A further jump of 2.5% in 2027 means the state pension will rise to £12,592 - breaching the personal allowance.

Another 2.5% rise will see the payment increase to £12,907 in 2028, and then to £13,230 by 2029.

This adds up to a 15% rise in the state pension between now and 2029.

Haine comments: “The OBR expects pay growth to slow dramatically over the next few years and inflation is expected to remain closer to the Bank of England’s target of 2% apart from 2026 where it is expected to come in at 2.6%.

“This means the state pension should rise by 2.6% in April 2026 and then by the minimum guarantee of 2.5% for the three years after that.”

If you’re not sure how much state pension you’ll receive in retirement, you can use the government’s online checker.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Ruth is an award-winning financial journalist with more than 15 years' experience of working on national newspapers, websites and specialist magazines.

She is passionate about helping people feel more confident about their finances. She was previously editor of Times Money Mentor, and prior to that was deputy Money editor at The Sunday Times.

A multi-award winning journalist, Ruth started her career on a pensions magazine at the FT Group, and has also worked at Money Observer and Money Advice Service.

Outside of work, she is a mum to two young children, while also serving as a magistrate and an NHS volunteer.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how