Starling Bank to use AI to help you with your money - how will it work?

Starling Bank is using AI to show customers how their daily spending is impacting their bank balance, we analyse if the tool is offering anything new and if it can improve your finances.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

If you have ever wondered how much that daily latte or serving of avocado on toast is really affecting your savings, then Starling Bank’s latest tool may help you.

The app-based bank has launched an artificial intelligence (AI) banking tool that lets customers learn more about their spending habits.

It comes as AI continues to become more prevalent within financial services.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Investors are already backing the sector with chipmaker Nvidia continuing to see its share price soar despite Trump tariff concerns.

The Financial Conduct Authority has also partnered with Nvidia to launch an AI testing lab for financial services providers to try out new ideas before launching to the public.

The technology is already helping develop AI tools for financial advisers to use with their clients as well as for the public to manage their finances.

Starling Bank is well known for providing tools that help its customers budget and save money, but it's latest offering will now use AI to help you understand how your daily spending habits are damaging your bank balance and what you need to do to boost it.

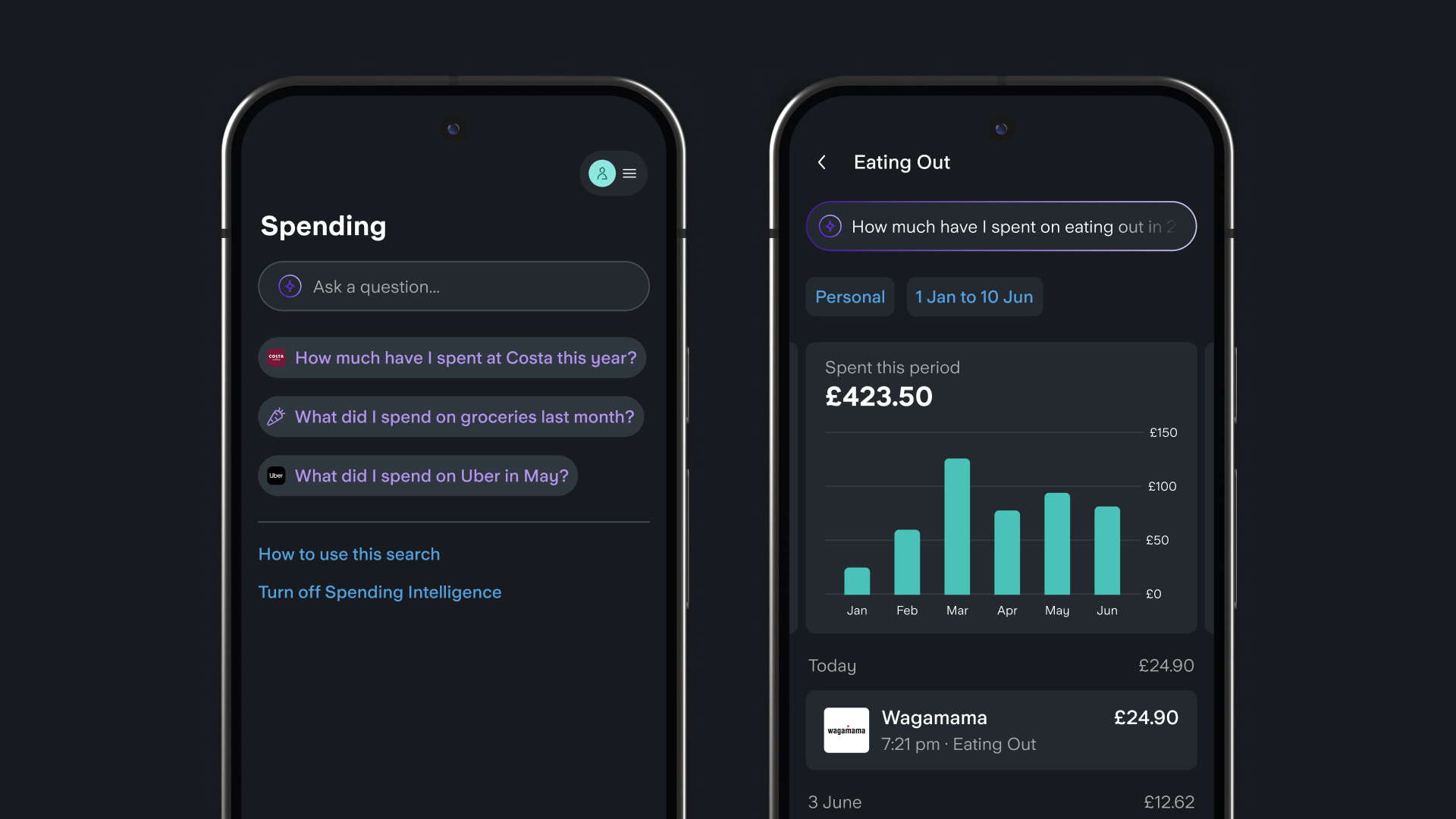

With Starling's 'Spending Intelligence', customers can type or use their voice, and ask questions such as 'how much did I spend on bills last year?', 'how much did I spend on my cat last month?' or 'how much did I spend on groceries yesterday?' before receiving a series of graphs and analytics.

The bank's aim is to give customers better understanding of where their money is going, so they can make more informed decisions on how to budget, spend and save.

Harriet Rees, chief information officer at Starling Bank, said: “At Starling we believe that knowledge is power, and it’s the first step to taking active control of your money. Now, customers can use AI to feed their natural curiosity about their finances so that they can make informed decisions about their budgeting, and better utilise Starling’s suite of money management tools.

“We believe that anyone and everyone can be good with money, so we’ve designed this feature so that people can engage with their finances in a way that feels natural to them. The more you talk or type, the more you’ll learn about your money management.”

How Starling's Spending Intelligence tool works

Starling’s Spending Intelligence tool is built using the Google Gemini AI.

Customers will find the feature on top of the spending tab in their Starling app, where transactions are listed by retailer and fall into more than 50 customisable categories such as bills, transport, groceries and holidays.

The tool lets you ask questions about specific spending such as how much money is going towards eating out.

The AI will then provide a graph and analytics that helps build a bigger picture of your spending habits over time.

Customers have to opt in to use Spending Intelligence and can opt out at any time. All data remains securely within Starling’s Google Cloud environment and is not used for AI training purposes.

So far, the tool will only tell you about your spending but there are plans for it to make savings recommendations.

Is Starling's Spending Intelligence tool any good?

Anything that helps monitor spending is going to be useful but this technology is already available with many other banking apps that will categorise spending.

The main difference with Starling is that you can now ask questions, which will save time on searching through the app.

You just have to make sure you are asking the correct questions to get the answer you need though.

Knowing where your money is going is one thing, but this app may be more useful when it can tell you how much you can afford to save.

There are already other savings apps such as Chip and Plum that will do this for you or Moneybox which will round up your spending to put the difference in a savings account.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Marc Shoffman is an award-winning freelance journalist specialising in business, personal finance and property. His work has appeared in print and online publications ranging from FT Business to The Times, Mail on Sunday and the i newspaper. He also co-presents the In For A Penny financial planning podcast.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how