Tinkering with the pensions tapering system

The problems caused by the annual pension contribution allowance have been partially addressed, says David Prosser.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

Ministers hope Budget measures announced last week will solve the row over tax on pension contributions that has prompted senior doctors to refuse extra work or even to retire early. But the changes don’t only apply to NHS staff. Anyone previously caught out by complicated rules that reduce pension contribution allowances for high earners could benefit.

The problem centres on the annual allowance: the amount that savers may pay into their private pensions each year. For most people, the cap is £40,000 or your annual earnings if this sum is lower; go over this allowance and you face punitive tax charges. But many high earners only qualify for a reduced annual allowance. Their maximum contribution tapers down according to their income, potentially to as little as £10,000.

Reform or scrap?

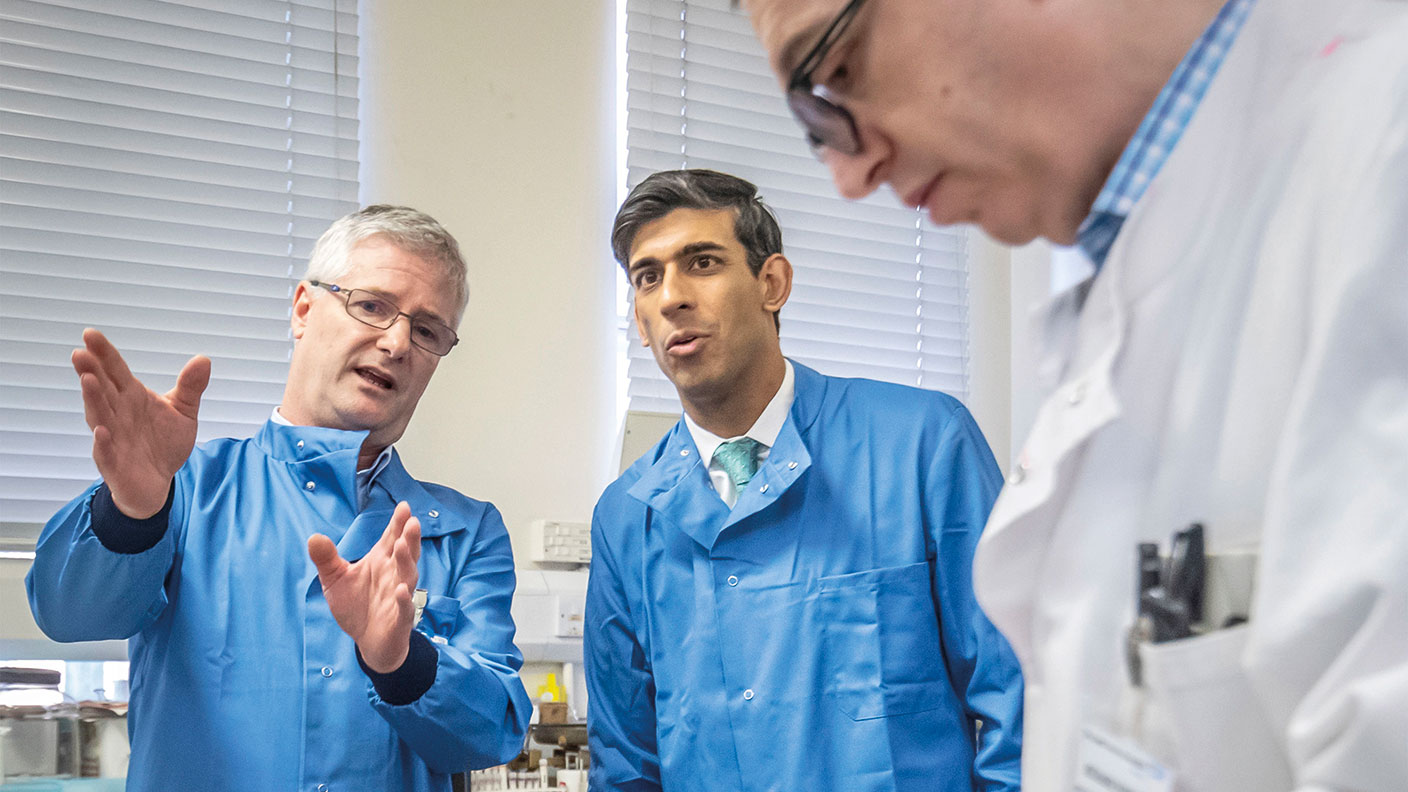

Many have called for these complex rules to be scrapped. Instead Chancellor Rishi Sunak substantially increased the income levels that currently bring 250,000 people into the tapering system. This will make a big difference to many of those savers, with the changes costing the Treasury £180m in the 2020-2021 tax year, rising to £670m by 2024-2025.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

To see how you’re affected, first work out your “threshold income”. This is the total of your pre-tax income for the year – including your earnings, your savings and investment income, and any other income you may have. Confusingly, HM Revenue & Customs talks about “net income” in its advice on threshold income. It doesn’t mean income after tax, but the money left after various deductions you are allowed to make. For most people, the only deduction relevant here is your pension contribution.

For any contributions you have made where HMRC has given you tax relief, whether through a workplace scheme or a personal plan, you can include the value of the tax relief in the deduction. The second figure you need to know is your “adjusted income”. This is your threshold income plus any contributions to your pension made by your employer.

So for most people threshold income is total income minus any pension contributions made. Adjusted income is threshold income plus employers’ pension contributions made on their behalf. In the current tax year, anyone with an adjusted income of £150,000 or less doesn’t have to worry about the tapered annual allowance. Anyone above this level is also off the hook if their threshold income is less than £110,000.

However, if you’re above both figures, you get a reduced annual allowance. Your allowance (including your contributions and your employer’s) comes down by £1 for every £2 you’re over the £150,000 income limit. The maximum reduction is £30,000, so if you have income of £210,000 or more, your annual allowance is £10,000.

Same story, new numbers

The Budget keeps this system but changes the figures. From 6 April, the threshold income and adjusted income limits are increasing to £200,000 and £240,000 respectively.

This will take many people out of the tapering system altogether, including most NHS workers. In addition, many of those still caught in the tapering net will be able to make more pension contributions each year without worrying about tax charges.

But it’s not all good news. There will now be a new minimum annual allowance of £4,000. As a result, anyone with an income of more than £300,000 will see their annual allowance drop below the current £10,000 minimum, until they hit the £4,000 minimum at income of £312,000 or more.

Still, most people with a tapered annual allowance will be better off now. They’ll be able to pay more into their pensions, claiming more tax relief as they do so. And even those who do pay tax penalties because they exceed their annual allowance will face lower bills.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

David Prosser is a regular MoneyWeek columnist, writing on small business and entrepreneurship, as well as pensions and other forms of tax-efficient savings and investments. David has been a financial journalist for almost 30 years, specialising initially in personal finance, and then in broader business coverage. He has worked for national newspaper groups including The Financial Times, The Guardian and Observer, Express Newspapers and, most recently, The Independent, where he served for more than three years as business editor.

-

How a ‘great view’ from your home can boost its value by 35%

How a ‘great view’ from your home can boost its value by 35%A house that comes with a picturesque backdrop could add tens of thousands of pounds to its asking price – but how does each region compare?

-

What is a care fees annuity and how much does it cost?

What is a care fees annuity and how much does it cost?How we will be cared for in our later years – and how much we are willing to pay for it – are conversations best had as early as possible. One option to cover the cost is a care fees annuity. We look at the pros and cons.

-

Rishi Sunak: MoneyWeek Talks

Rishi Sunak: MoneyWeek TalksPodcast On the MoneyWeek Talks podcast, Rishi Sunak tells Kalpana Fitzpatrick that we need better numeracy skills to improve financial literacy and boost the economy.

-

Is an inheritance tax (IHT) cut on the way?

Is an inheritance tax (IHT) cut on the way?Tax Talk that the government might cut or scrap inheritance tax in its Autumn Statement is rife. We look at how it could be reformed, and what difference it would make.

-

Act now to bag NatWest-owned Ulster Bank's 5.2% easy access savings account

Act now to bag NatWest-owned Ulster Bank's 5.2% easy access savings accountUlster Bank is offering savers the chance to earn 5.2% on their cash savings, but you need to act fast as easy access rates are falling. We have all the details

-

Moneybox raises market-leading cash ISA to 5%

Moneybox raises market-leading cash ISA to 5%Savings and investing app MoneyBox has boosted the rate on its cash ISA again, hiking it from 4.75% to 5% making it one of top rates. We have all the details.

-

October NS&I Premium Bonds winners - check now to see what you won

October NS&I Premium Bonds winners - check now to see what you wonNS&I Premium Bonds holders can check now to see if they have won a prize this month. We explain how to check your premium bonds

-

Government considering cuts to inheritance tax, reports say

Government considering cuts to inheritance tax, reports sayThe Sunday Times reported government officials are considering cuts to inheritance tax ahead of the general election.

-

The best packaged bank accounts

The best packaged bank accountsAdvice Packaged bank accounts can offer great value with useful additional perks – but get it wrong and you could be out of pocket

-

Bank of Baroda closes doors to UK retail banking

Bank of Baroda closes doors to UK retail bankingAfter almost 70 years of operating in the UK, one of India’s largest bank is shutting up shop in the UK retail banking market. We explain everything you need to know if you have savings or a current account with Bank of Baroda