Tariff day summary

- Donald Trump announced his new tariff regime on 2 April, which the president has called ‘Liberation Day’ for the US;

- A series of new tariffs, including a minimum baseline tariff of 10%, was announced. It will take effect on April 5, 2025 at 12:01 a.m. Eastern Daylight Time (EDT);

- Trump unveiled a 10% tariff on UK imports;

- Tariffs on goods from some other countries will be significantly higher – such as a 34% tariff on China. These take effect from 9 April;

- China has today announced a retaliatory 34% tariff on all US imports;

- A 25% tariff on all foreign-made vehicles began at midnight on 2 April;

- Trump has already imposed tariffs on imports from Canada, Mexico and China, as well as a 25% levy on all steel and aluminium imports;

- Starmer: UK will continue to push for a full trade deal with US;

- Research from Aston Business School suggests that the resultant trade war could cost the global economy $1.4 trillion;

- The S&P 500 fell 4.8% yesterday as investors fled US stocks.

- Follow our global trade blog for the latest news and analysis.

The team at MoneyWeek is covering the week’s developments and analysis live. Scroll for the latest updates.

| Tariffs sink auto stocks | Hedge against tariffs | Trump tariffs and investments |

Tariff eve eve

Welcome to our live blog covering what promises to be a busy week in international trade and markets.

US president Donald Trump is expected to impose widespread tariffs on the US’ global trading partners on Wednesday, which has been dubbed ‘Tariff day’ (making today ‘Tariff eve eve’). More recently, Trump has called it ‘Liberation Day’ – presumably referencing liberation from the rough deal the president believes the US gets from globalisation.

There has been – as there often is with Trump – plenty of toing and froing in the weeks building up to the announcement. While Wednesday may well bring clarity and closure on the new administration’s international trade regime, there could be further twists along the way.

We’re here to cover all of these as they come, along with expert analysis, market reactions, and explainers on what Donald Trump’s tariff regime means for your money.

The tariff tale so far

Tariff day will likely see the widest tranche of tariffs yet unveiled, but they won't be the first of Trump’s second term.

Early on, he followed through on a promise to levy tariffs on imports from Mexico, Canada and China. He imposed 10% tariffs on Chinese imports on 4 February, doubling this to 20% a month later.

On the same day (4 March) as Chinese tariffs were doubled, Trump raised 25% tariffs on goods imports from Mexico and Canada, as well as a 10% tariff on Canadian energy imports. This was followed by exemptions on car imports and other goods, as well as a reduction in the tariff on potash (a fertiliser ingredient) to 10%, in the following days.

Then, on 12 March, Trump levied a 25% tariff on all steel and aluminium imports into the US.

We’ll soon know more about the further-reaching impacts of Trump’s tariff regime, but it could include a 200% tariff on alcohol imports from the EU which Trump has threatened in response to the bloc suggesting it would tax whiskey imports from the US.

What is tariff day?

Tariff day – or “Liberation Day” as Trump has dubbed it – will see a set of far-reaching tariffs, which the president has alluded to since his election campaign last year, come into effect.

In the ‘American First Trade Policy’ memorandum that Trump set out on the day of his inauguration, the US secretary of commerce, Howard Lutnick, was directed to deliver a report on prospective tariff proposals to Trump by 1 April. They are expected to be enacted the following day.

Howard Lutnick, now US secretary of commerce, at the inauguration of president Donald Trump in January. Lutnick will present a report on proposed tariff regimes to Trump tomorrow, ahead of tariff day on 2 April.

“While it is hard to be confident about the ultimate motivation, the logic at least appears to be that the US should use reciprocal tariffs to induce changes in trade partners’ policies that it deems unfair and to have contributed to the US trade deficit,” writes Simon McAdam, deputy chief global economist at Capital Economics.

It’s expected that Lutnick’s proposals will recommend tariff regimes on specific countries or trading blocs (such as the EU) on a case-by-case basis. Trump has referred to these as “reciprocal tariffs”, though they diverge from the traditional understanding of the phrase (which usually pertains to reductions rather than increases in tariffs).

“The goal of reciprocal tariffs could be more about striking deals than creating a permanent source of fiscal revenue or encouraging firms to move production to the US, which are aims that would be better served by blanket tariffs in place for a long time,” says McAdam.

“Liberation Day” and the trade deficit

Why has Trump taken to calling Wednesday “Liberation Day”?

In essence, it boils down to the fact that, at present, the US runs a substantial trade deficit with the rest of the world: it imports more than it exports, to the tune of about $1.2 trillion annually according to the latest Census Bureau data.

Trump views this is a big problem. “We have deficits with almost every country – not every country, but almost – and we’re going to change it,” he said in February.

Explaining “Liberation Day” and his recent talks with Canadian prime minister Mark Carney to the press over the weekend, Trump elaborated: “Many countries have taken advantage of us, the likes of which nobody even thought was possible, for many, many decades.

“That has to stop,” he added.

According to Trump, then, tariff day marks a day of liberation from trade dynamics that have led to its trade deficit rising to its current level.

Is the trade deficit a problem?

Some economists disagree with Trump’s view that the US’ trade deficit is a bad thing, and that the tariffs expected on Liberation Day are necessary to reverse it.

John Mauldin, CEO of Mauldin Economics, writes in his Thoughts from the Frontline newsletter that the deficit is, in large part, simply a side-effect of the US dollar being the world’s reserve currency; that the US dollar is, in other words, the US’ top export.

“The US must constantly export more dollars to meet world demand. This demand for our currency makes it stronger, which in turn makes imports cheaper and exports more expensive,” he explains.

“This has been called an “exorbitant privilege” but in some ways it is also a burden. Americans are incentivized to save less money and spend more of it on imported goods.”

Mauldin goes on to explain that reversing the deficit – meaning the US suddenly ran a trade surplus – would have knock-on effects.

“The rest of the world would be starved for dollars,” he says. “The dollar would strengthen sharply enough to make our exports unaffordable to others. That wouldn’t be good for American manufacturers and their workers.

“Moreover, if this persisted then some other currency would take on the reserve role. I assume that’s not what President Trump wants, but it is where his zero-sum trade policy would ultimately lead.”

Gold surges ahead of Liberation Day

The prospect of widespread tariffs on Liberation Day is good news for gold investors.

Gold prices passed $3,100 for the first time ever this morning, continuing the yellow metal’s impressive rally as investors flock towards the safe haven asset. Though according to Tom Stevenson, investment director at Fidelity International, there could be more to it than that.

“The gold price has risen to a record $3,128 a troy ounce, supported by factors beyond its role as a safe haven during geopolitical and economic uncertainty,” says Stevenson. “Central bank buying, retail buying in India, and other influences have driven the gold price up.”

Trump threatens tariffs on Russian oil over Ukraine peace deal

There is speculation that Liberation Day is less about reducing the US trade deficit, and more about using the threat of tariffs to persuade other countries to get into line behind Trump’s agenda.

On Sunday, the president told NBC News that he was considering putting secondary tariffs on Russian oil if Vladimir Putin doesn’t reach a deal on peace in Ukraine.

That would mean countries buying oil from Russia would be hit with tariffs. According to Trump, these could be anywhere from 25-50%.

It raises the question of the political motivations behind tariff day. Mark Williams, chief Asia economist at Capital Economics, raises the question over whether similar penalties could apply to countries that trade with China.

“The US would have to exert a lot of pressure to coerce most major countries into putting large tariffs on goods from China,” he writes. “However, in a world in which protectionist measures become commonplace, many more countries may choose to raise tariffs on China over coming years to protect their own markets.”

How might tariff day impact the UK?

The FTSE 100 fell 0.9% today, with fears of the potential disruption from tariff day weighing on markets.

“Unease about the effect of Trump’s tariffs has been amplified, causing sharp moves at the start of the week,” says Susannah Streeter, head of money and markets, Hargreaves Lansdown. “London-listed stocks will not be immune to the tariff fall out.”

Prime minister Keir Starmer’s official spokesman said yesterday that he expected the UK to be impacted by the Liberation Day tariffs “alongside other countries”. While talks on a UK-US trade deal have been “constructive”, it appears no agreement will be reached in time for the UK to avoid tariffs on Wednesday.

“The UK’s flagship FTSE 100 index is particularly vulnerable this week. It’s already shed 4.2% since mid-March and could fall another 10% if tariffs hit, though UK insulation might limit losses if Trump spares Britain,” says Tony Redondo, founder at Cosmos Currency Exchange.

Gabriel McKeown, head of macroeconomics at Sad Rabbit, even thinks that the UK could benefit from the turbulence.

“With both the US and EU engaged in a tit-for-tat trade war, the UK could position itself as a neutral trade partner, leveraging its free trade agreements to fill supply chain gaps and present itself as a more stable intermediary,” he says.

Thanks for following the blog today. We'll wrap things up here for this evening, but join us tomorrow morning when there will be plenty of news and reaction to developments in the US overnight.

Tariff day fears make a miserable quarter for the S&P 500

Good morning, and welcome back to our live blog covering the build-up to Liberation Day, when president Donald Trump is expected to unleash a far-reaching tariff regime on the global economy.

Markets have been hit hard as investors worry about the economic impact that these tariffs could have.

The S&P 500 actually gained 0.6% yesterday. However, this wasn’t nearly enough to reverse a damaging few weeks for the index, which has fallen 4.6% in the year to date – breaking a five-quarter winning streak, and marking the largest quarterly decline since 2022.

Keep following for more updates as we bring you the latest tariff news ahead of Liberation Day.

The potential cost of the Liberation Day trade war

This morning, the FT has reported on a study published last week by researchers at Aston Business School that suggests the trade war following Trump’s tariff day could cost the global economy $1.4 trillion.

The research uses statistical models to quantify the potential economic impact under six different scenarios, reflecting different levels of tariffs and retaliation by the countries targeted by them.

A ‘Full Global Retaliation’ scenario – whereby 25% tariffs are levied across the world, and those countries all respond in kind – would result in “extensive global disruptions, including severe US welfare losses (-2.5%), dramatically reduced trade flows worldwide, and a $1.4 trillion global welfare loss”.

On a more optimistic note for British readers, though, it notes that under this scenario “the UK faces trade declines but also gains from rerouting opportunities”.

How can UK investors protect themselves from Liberation Day tariffs?

We saw a retreat by UK stocks yesterday as tensions rose ahead of tariff day. The FTSE 100 has made a stronger start to April, up around 1% so far this morning.

“President Donald Trump’s tariffs war could have far-reaching consequences for Britons, even if the UK manages to escape direct levies,” says Myron Jobson, senior personal finance analyst at Interactive Investor.

Tariffs could fuel global inflation, which would impact the UK. That could force the Bank of England to curtail its interest rate cutting program, or even reverse it with rate hikes.

“This could impact everything from mortgage rates to corporate investment, potentially slowing economic growth,” he says.

Investors with significant US exposure will experience turbulence – indeed, they will have already, with the S&P 500 having fallen 4.6% in the year to date.

“That said, long-term investors should resist the urge to make knee-jerk decisions based on short-term market movements. A well-diversified portfolio remains the best defence against geopolitical shocks,” says Jobson.

He cautions against the Magnificent Seven, which already account for 19% of the FTSE All World index.

Instead, he and Alex Watts, senior investment analyst at Interactive Investor, recommend that US allocations should be diversified across large-, mid- and small-cap stocks.

UK equities are another potential set of winners. "As markets fall in the wake of the materialisation of tariffs that were interpreted as just rhetoric in the months since Trump’s election, it may be worth to consider those regions that simply are less affected," says Watts.

"One such region could be the UK, though with negotiations ongoing between British and US negotiators, the future is not yet clear."

Recap: what’s happening with tariffs today?

Today – 1 April – is the deadline for US commerce secretary Howard Lutnick to report back to Donald Trump with his recommendations for US tariffs on various global trading partners.

These could take the form of universal tariffs on all US imports – perhaps as high as 25%. However, it’s thought to be more likely that bespoke tariffs for each country will be proposed based on certain criteria.

These could be the tariffs that these companies levy on their own US imports, the size of the trade deficit between the countries, or other factors not directly related to international trade.

There are rumours, for example, that the UK could reduce the tax it levies on big tech firms in order to avoid punishing tariffs. Read more here: Will Reeves reform DST?

Tariffs and the global economy

It’s also worth recapping on why tariffs are a big deal for the global economy, and especially for UK consumers.

In essence, tariffs on imports increase the price of those goods and as such drive inflation.

Trump’s tariff day could cause major disruption to global trade.

The US is the world’s largest economy, and it also issues the world’s reserve currency. If its economy struggles, then the global economy is impacted.

“Tariffs and trade wars (or wars of any sort) are not good for the global interconnected economies and world we live in,” says Raymond Backreedy, chief investment officer at Sparrows Capital.

“Past evidence and data (1920s) has shown that isolationist policies tend to dampen global growth and push up inflation, neither of which is good for the economy, jobs and end consumers.”

Which countries will tariffs hit hardest?

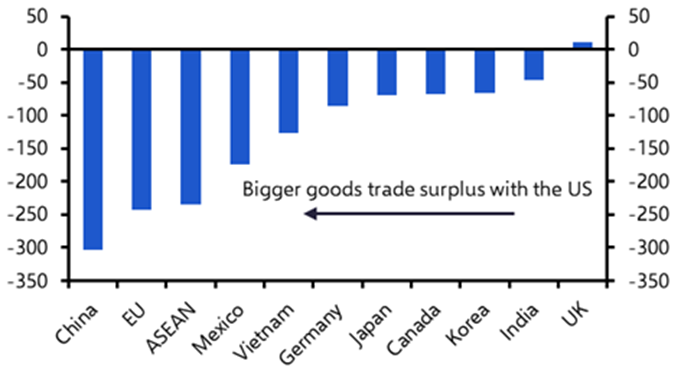

At this stage, it’s impossible to say which countries will see the heaviest tariffs once tariff day takes effect. However, according to Neil Shearing, group chief economist at Capital Economics, the focus is likely to be on “the so-called ‘Dirty 15’”.

These are the countries with which the US runs the largest trade deficits. “That includes China, Mexico, Germany (and by extension, the EU), Japan, South Korea, Taiwan, and Vietnam,” says Shearing.

The countries that stand to be most impacted are those whose economies rely most heavily on exports to the US. While China may well see the heaviest tariffs levied, it isn’t among them: “exports to the US account for only 2-3% of GDP in China, Japan and the euro-zone,” writes Shearing.

“Mexico, Canada, and Vietnam are the most exposed, given the high share of their GDP tied to US trade,” he adds.

Could some countries benefit from tariffs?

We’ve seen that some commentators believe that the UK could stand to gain from tariffs, even if it is hit by them, by acting as a go-between for the US and the EU. Tariffs are likely to hit the EU harder than the UK because the bloc has a larger trade surplus with the US than the UK does.

That said, the UK government has warned today that the UK is likely to be hit by tariffs. Business and trade secretary Jonathan Reynolds today called it “a very serious and significant moment” on the BBC. He added, though, that the UK is in the “best possible position of any country” to reverse any tariffs that are imposed tomorrow.

Could other countries actually benefit from tariffs?

One theory is that tariffs on China – which are expected to be heavy – could divert some of its economic output to other countries. The most obvious rival would be India.

“Trump’s tariffs offer an opportunity to accelerate the rate at which India picks up some of China’s manufacturing share,” says Andy Draycott, portfolio manager at Chikara Investments. “We expect a meaningful increase from 1% as companies shift at least some of their manufacturing capacity to sidestep Sino-US uncertainty.

“Additionally, Trump’s recent threat of reciprocal tariffs on India could catalyse improved economic relations through further Indian concessions as officials have been debating lower duties for a variety of goods to offset the impact of tariffs,” he adds.

All that said, any marginal gains any countries are able to eke out are unlikely to outweigh the hit they'll take from the overall cost that widespread tariffs will cause to the global economy. As reported earlier today, that could be as high as $1.4 trillion.

"Liberation Day" may be more art of the deal

Markets are jittery, but if Trump really is about to throw the global economy into a tariff-driven meltdown, then you might expect bigger movements than we’ve seen so far.

One factor currently keeping investors guessing is that many observers believe that the noise that Trump is making around tariffs is a negotiating tactic in order to wring concessions that he wants from countries.

For example, The Telegraph reports that a UK-US trade deal will be contingent on “free speech” in the UK – alluding to the case against anti-abortion protestor Livia Tossici-Bolt, in which the verdict is due on Friday. The US state department has said that it is “monitoring” the case.

While business secretary Jonathan Reynolds has denied that free speech has entered into discussions, it plays into the narrative that Trump is willing to throw America’s economic heft – and the threat of trade disruption – around in order to achieve his more politicised ends.

“If we cast our minds back to Trump’s first presidency his modus operandi was to continually escalate his threats and negotiating positions until he got whatever he wanted, knowing he represented the might and weight of the United States in all its forms,” says Kasim Zafar, chief investment officer at EQ Investors.

“His use of tariffs in his second presidency was certainly expected, but it’s fair to say the market has been surprised by the extent to which he has allowed tariffs to come into force.”

Tariffs and US economic growth

While individual countries will fret about the impact that US tariffs could have on their economies, the impact on the US economy is arguably the biggest risk to global markets, given the centrality of the US in global trade. A US recession would be no fun for anyone.

However, Samuel Tombs, chief US economist at Pantheon Macroeconomics, is relaxed about the impact of tariffs on the US economy.

Despite revising his Q1 GDP growth forecast down to 1% from 1.5%, Tombs argues that “tariffs will be too small to drive a sustained downturn in consumption” in the US.

“Consumers will feel the full effects of these tariffs gradually over the course of the next year, rather than all at once,” he writes. “Businesses have had a few months to build up inventory… Many businesses change prices only when an updated version of a product is introduced.”

Thanks for following the live blog again today. That's all from us this evening - but join us tomorrow for Liberation Day itself, when we'll find out the full extent of Trump's tariff regime.

BREAKING: Trump aides reportedly pushing for 20% tariffs on US imports

Good morning, and welcome back to our live blog. Liberation Day is here, and overnight we’ve had our first reports of what Trump’s new tariff regime could look like.

The Washington Post reports that Trump’s aides have drafted proposals for 20% tariffs on most imports to the US. The Post cites three people familiar with the matter.

White House advisers have said that multiple options are being considered and that no final decision has yet been reached. Trump also signaled on Monday that tariffs would correspond to those that individual countries imposed on US imports, and that many of its trading partners would be exempt.

Stay with us today as we bring you further updates, analysis and reaction.

Liberation day tariffs will come into effect “immediately”

White House press secretary Karoline Leavitt addressed reporters yesterday and promised that tariffs will take immediate effect today.

“April 2nd 2025 will go down as one of the most important days in modern American history,” she said.

She said that the US has been “one of the most open economies in the world” but that “too many foreign countries have their markets closed to our exports”. Leavitt blamed this for the US’ persistent trade deficit, and industrial decline.

“Those days, of America… being ripped off, are over. American businesses and workers will be put first under president Trump,” she said.

Leavitt also confirmed that tariffs “will be effective immediately” once the tariff announcement is made.

‘Liberation Day’ and reciprocal tariffs: why VAT is key

Let’s have another look at what we’re expecting to happen today.

There is still little clarity on how tariff day or ‘Liberation Day’ will play out, but consensus seems to be that the focus will be on reciprocal tariffs – those on countries that impose higher tariffs on imports from the US than the US imposes on its own imports from those countries.

In itself, that’s not especially controversial. “What’s different about this new plan, however, is that reportedly the US will retaliate against not just other countries’ tariffs, but also their VATs and other non-tariff barriers,” says Lale Akoner, global market analyst at eToro.

Incorporating VAT “would be a bigger hit to global trade in nominal amount than reciprocal tariffs alone”, says Akoner.

“VATs are built into many countries' tax systems and are unlikely to change. So, unlike regular tariffs that can be negotiated, this approach could lock in long-term trade barriers, meaning that it does not just serve as short-term leverage.

"This would hit countries like Mexico, Ireland, and Vietnam the hardest,” she adds.

How can you protect your portfolio from tariffs?

The question that will be front and centre for investors is how they can protect their portfolios against the impact of the incoming tariffs.

It’s not an easy question to answer. The hard truth is that in the short term there will be some volatility, and many experts advise trying to see past that with a long term outlook on your investments.

“For financial planning clients, tariffs, albeit these are extreme, should not be seen as a unique or insurmountable problem,” Finn Houlihan, chartered financial planner and managing director at AAF Financial, tells MoneyWeek.

“Financial planning is in general working with clients with long-term objectives and therefore their investment strategies will be structured inline with these objectives and agreed risk tolerances.”

As Trump is poised to bring further tariffs into effect, how can investors protect their portfolios from the disruption?

Houlihan goes on to explain, though, that tariffs on the scale we’re expecting on Liberation Day “may require some short term tactical adjustments.

“Investment plans can be diversified enough to help protect clients from market volatility stemming from tariffs,” he adds.

Read more, including expert picks for funds that could be shielded from tariffs, in our explainer: How to protect your portfolio from ‘Liberation Day’ tariffs.

US manufacturing and tariffs

One of Trump’s stated goals for Liberation Day is to revitalise US industry by encouraging US consumers to buy US-made goods.

However, some economists believe that tariffs will actually be damaging to US manufacturing, which is already showing signs of weakness in the run-up to Liberation Day.

“The March ISM manufacturing survey brought further evidence that tariff uncertainty is weighing heavily on the sector,” write Samuel Tombs, chief US economist, and Oliver Allen, senior US economist, at Pantheon Macroeconomics.

They attribute a jump in the inventories index to pre-tariff stockpiling, and note that in March “the four other headline components fell, with the new orders index dropping to just 45.2 – its lowest since May 2020 – from 48.6”.

In other words, new manufacturing orders in the US are now at their lowest since the onset of the Covid pandemic.

“The recent plunge in the ratio of new orders to inventories indicates a slump in the sector ahead,” write Tombs and Allen.

“Just how deep this downturn will be hinges on the extent of tariffs announced by President Trump later today and whether a high degree of uncertainty lingers,” they add.

When will Donald Trump announce Liberation Day tariffs?

Trump is scheduled to announce his new tariff regime at an event in the White House’s Rose Garden, beginning today at 4pm ET – 9pm in the UK.

We’ll bring you the headline announcements live here, so keep following the blog this evening for instant updates.

US stocks on edge ahead of tariff announcement

The S&P 500 opened down today, but has since recovered to close to yesterday’s close.

“Concerns continue to swirl about stagflation taking hold in the US, given that tariffs are expected to push up consumer prices and act as a drag on growth, and worries ricochet about further turmoil ahead,” says Susannah Streeter, head of money and markets, Hargreaves Lansdown.

Read more on the S&P 500’s struggles here: S&P 500 ends five-quarter winning streak.

Musk to leave DOGE?

This was never going to be a quiet news day, and even ahead of Liberation Day tariffs, there’s been big news from the US government.

According to a report from Politico citing Trump insiders, Tesla CEO Elon Musk could be leaving his position in Donald Trump’s Department of Government Efficiency (DOGE) within weeks.

Tesla shares opened more than 5% down today following a slump in vehicle deliveries to their lowest level since 2022, but have since rebounded based on the news that Musk could soon return to his businesses.

Find out more in our deep dive here: Tesla shares swing following delivery miss; Musk to leave DOGE?

There's going to be a couple of hours down time on the blog. Join us later this evening, though, for the announcement on Donald Trump's tariff regime - expected at 9pm.

Good evening. Donald Trump will deliver his announcement on new tariffs shortly. Join us as we cover his speech live.

Donald Trump has arrived in the White House Rose Garden to deliver his "Liberation Day" speech.

BREAKING: Donald Trump announces 25% tariffs on all foreign-made automobiles

Donald Trump has announced a 25% tariff on all foreign-made automobiles will be imposed, effective at midnight.

Donald Trump has dubbed today as "Liberation Day"

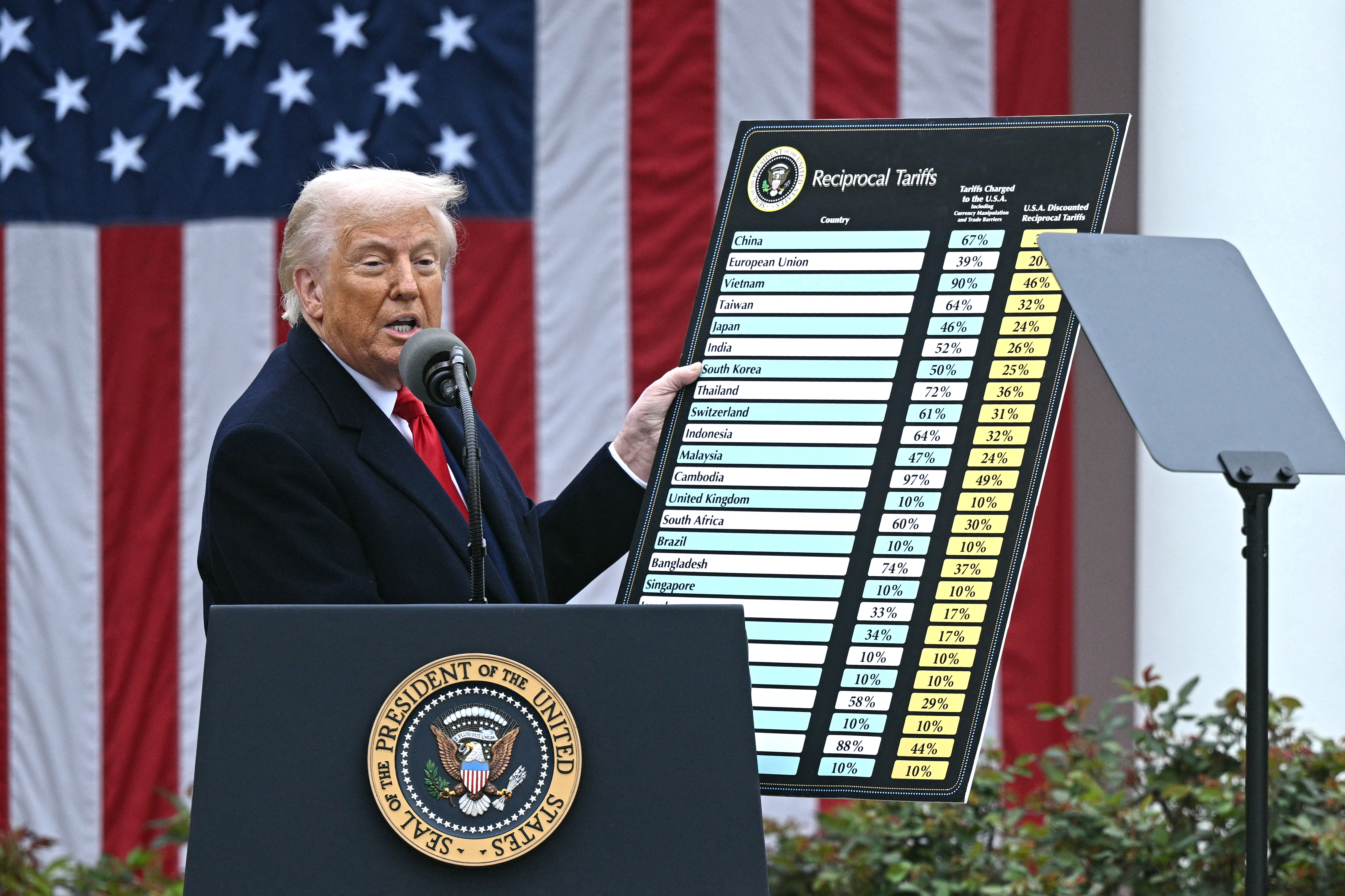

Trump has unveiled a chart showing the tariffs he intends to impose on different countries.

At the top of the list is China. He claims China charges the US 67% in tariffs. The president says the US will charge a “discounted reciprocal tariff” of 34%.

He added: “They charge us, we charge them. We charge them less so how can anyone be upset?”

Turning to the European Union, Trump said: “They’re very tough traders. You think of European Union, very friendly. They rip us off. It’s so sad to see.”

He proceeded to announce a 20% tariff on EU imports, which he said was “essentially half” of a 39% tariff on the US.

US to impose minimum baseline tariff of 10%

The US will establish a “minimum baseline” tariff of 10% on all countries. Trump says it will “help rebuild" the US economy and claims it will "prevent cheating”.

He says the US will charge other countries "approximately half" of the tariffs on the US, calling it "kind reciprocal" – rather than "full reciprocal".

No tariffs for building products in US

The US president says companies who build their product in the US will be exempt from the tariffs.

“If you want your tariff rate to be zero, then you build your product right here in America, because there’s no tariff if you build your plant, your product in America,” he said.

Trump's tariff chart

Trump's "reciprocal tariffs" chart lists a number of countries as well as the EU. To the right is a column titled "Tariffs Charged to the USA Including Currency Manipulation and Trade Barriers".

The final column is named "USA Discounted Reciprocal Tariffs".

Donald Trump unveiled a "reciprocal tariffs" chart during his speech in the White House Rose Garden.

Trump signs executive orders

After concluding his speech on tariffs, Trump has proceeded to sign executive orders in the White House Rose Garden.

UK's Business Secretary responds

The UK's Business Secretary Jonathan Reynolds said: “We will always act in the best interests of UK businesses and consumers. That’s why, throughout the last few weeks, the government has been fully focused on negotiating an economic deal with the United States that strengthens our existing fair and balanced trading relationship.

“The US is our closest ally, so our approach is to remain calm and committed to doing this deal, which we hope will mitigate the impact of what has been announced today.

“We have a range of tools at our disposal and we will not hesitate to act. We will continue to engage with UK businesses including on their assessment of the impact of any further steps we take.

“Nobody wants a trade war and our intention remains to secure a deal. But nothing is off the table and the government will do everything necessary to defend the UK’s national interest.”

Thank you for joining us this evening. We will be back tomorrow with the latest news, analysis and reaction following Trump's tariffs announcement.

Starmer pushing for full deal

Good morning, and welcome back to our live blog.

Prime minister Keir Starmer has addressed UK business leaders in Downing Street this morning to say that he will push for a full trade deal with the US.

“Nobody wins in a trade war. That is not in our national interest,” he said, adding that the UK has “a fair and balanced trade relationship with the US”.

While he stressed that the UK was pushing to secure a trade deal in the national interest, he emphasised that “nothing is off the table” and that he would only agree a deal that was in the national interest.

Liberation Day: market reaction to tariff news

Stocks are down this morning following Trump’s tariff announcement; the FTSE 100 has fallen 1.2% despite the UK having one of the lowest tariff rates applied.

“The UK… may seem to have fared better than some, but its deep ties to the global economy make a slowdown in growth almost unavoidable and the FTSE 100 has been caught up in the global market sell-off,” says Matt Britzman, senior equity analyst, Hargreaves Lansdown.

Asian markets have fallen: the Hang Seng Index, which tracks Hong Kong-listed equities, fell 1.5% today, while the Nikkei 225 is down nearly 2.8%. In Europe, Germany’s DAX is down 1.7%, and the CAC 40 is down slightly over 2%.

How did Trump’s tariffs compare to expectations?

The negative market reaction this morning suggests that the extent of Trump’s tariffs was greater even than many had feared.

There had been questions in the run-up whether Trump would opt for blanket tariffs, or if he would deploy a case-by-case approach. The reality was a bit of both; a baseline 10% tariff on imports from all countries, with some countries and regions subject to higher individual rates.

“President Donald Trump’s country-specific reciprocal tariffs turned out to be bigger than expected, with our calculations pointing to an import-weighted average tariff of 15.0%,” Neil Shearing, group chief economist and Paul Ashworth, chief North America economist, at Capital Economics, wrote in their report.

In terms of the countries and regions that have been most heavily impacted, they write: “In very general terms, Canada and Mexico have got off lightly, while those in Asia, particularly China and Vietnam, have been hit hard. The European Union and Japan sit somewhere in the middle.”

UK working on retaliatory tariffs

Business and trade secretary Jonathan Reynolds has told the House of Commons this morning that the UK is launching a consultation with businesses on the potential impact of retaliatory tariffs against the US.

He told MPs that the UK being in the lowest tariff bracket of all countries “vindicated” the pragmatic approach that the UK has so far been taking to negotiations with the US.

Business and trade secretary Jonathan Reynolds on Tuesday, before the tariff day announcements. Reynolds today told Parliament that the government is considering potential retaliatory tariffs against the US.

“The UK is in a unique position to do a deal” with the US, he said. “However, we reserve the right to take any action we deem necessary if a deal is not secured.”

Over the next four weeks, he said, the government will consult on products that could be included in any potential retaliation.

Securing a deal with the US in the meantime would, he said, pause this consultation.

Dollar surprisingly falls

The dollar index has fallen around 2% since Trump’s tariff announcement, while the Euro and the Yen have gained.

That’s a surprise – you’d have expected the dollar to gain following such a protectionist announcement.

Deutsche Bank sent a note to clients today warning of a dollar confidence crisis.

“Developments since the start of the year make us worried about a broader undermining of confidence in the US economic outlook and the medium-term desirability of dollar allocations,” the note read.

It warned that continuing dollar declines, a drop in US equities and a rise in term premium in US treasuries would signal that global investors are withdrawing capital from the US.

"We would caution that if the dollar decline accelerates, it would be a highly unwelcome development for global central banks," it added. "The last thing the ECB wants is an externally imposed disinflationary shock from a loss in dollar confidence and a sharp appreciation in the euro on top of tariffs."

US equities slump as markets open

Stock markets are now open in the US, and it's grim reading.

The S&P 500 is down over 3.1%. The Dow is down 2.7% and the Nasdaq Composite is down 4.7%.

Companies with significant Asian supply chains are plummeting. Apple shares are down 9.5% - while Nike shares have fallen 11%.

Can Nvidia relocate its supply chain?

Nvidia is another big tech name leading today’s stock market selloff. The stock is down 5.8% so far today. A 32% tariff on Taiwanese imports will impact it heavily given its reliance on Taiwan Semiconductor Manufacturing (TSMC) despite both committing hundreds of billions into building their operations in the US.

“Around 90% of the world’s most advanced semiconductors, including mobile processors, AI GPUs, and high-performance computing chips, are manufactured in Taiwan by TSMC,” says Lale Akoner, global markets analyst at eToro. “This has significant implications for Nvidia and other semiconductor companies that rely heavily on TSMC for chip production.”

Read more here: Nvidia shares fall further after tariff hit.

Tariff recap

Yesterday Trump announced “reciprocal” tariffs on all of the US’s trading partners. These were at a baseline rate of 10% on all imports.

However, some countries were hit with higher tariffs based on the Trump administration’s assessment of their tariff rate on goods coming from the US.

Some of these include:

- China (34%)

- India (26%)

- Vietnam (46%)

- EU (20%)

The UK is on the baseline 10% rate. The UK government has confirmed that it is continuing to negotiate a trade deal with the US, but that in the meantime it will consult on the potential impact of retaliatory tariffs.

S&P 500 down over 4%

The US stock selloff continues; the S&P 500 has fallen over 4% so far today.

John Higgins, chief markets economist at Capital Economics, has downgraded his forecast for the index for the year-end.

"A supportive economic backdrop is usually a precondition for a bubble to inflate in the stock market," he comments on yesterday's tariff announcement, though the downgrade is also predicated on an assumption that the AI boom that has driven markets for several years will slow this year.

Tariffs, the UK economy and your money

While the facts of a baseline tariff on all goods imports to the US, as well as specific products (cars, aluminium and steel so far) facing higher tariffs, is bad news economically, many in the UK may have breathed a sigh of relief when it emerged that the country is on the baseline 10% tariff.

What does it all mean for the UK economy and your finances?

Investments and pensions will see considerable volatility in the short term.

“However, there’s a silver lining,” says Edmund Greaves, financial expert at Mouthy Money. “If the UK dodges the worst of Trump’s wrath, some investors might see Britain as a relative safe haven, potentially boosting demand for UK assets.”

Higher trade costs will likely push global inflation up, and along with it global interest rates.

“Higher US rates often push up yields on UK Government bonds (gilts), increasing the cost of everything from mortgages to Government debt,” says Greaves. “For Brits, this could mean pricier loans or credit card bills if the Bank of England is forced to follow suit.”

As the UK’s largest trading partner, there could be an impact on the economy from reduced trade with the US, which could impact jobs and economic growth.

Again, though, there’s a potential twist: “if US tariffs divert cheap goods (such as Chinese steel) to the UK, prices for some items could fall, easing inflation in some areas,” says Greaves.

That's all from us for today. Join us tomorrow for more news and reaction to the fallout of Trump's tariff regime.

Stock market selloff continues

Good morning, and welcome back to our live blog as we track the fallout from Donald Trump's bombshell tariff regime.

The rollout of the new tariffs is "going very well", the president said yesterday - as the S&P 500 fell 4.8%.

The FTSE 100 has fallen 1.4% this morning, and more bad news could be on the way for US stocks, with S&P 500 futures 0.7% lower this morning.

More updates and analysis on the way.

Magnificent Seven selloff: group sheds $1 trillion

Yesterday saw the biggest Magnificent Seven selloff in the group’s history, with $1.03 trillion in market capitalisation wiped off the seven stocks’ valuations.

Here’s how each individual constituent fared yesterday:

Stock | Share price change – 3 April 2025 |

|---|---|

Alphabet | -4.0% |

Amazon | -9.0% |

Apple | -9.3% |

Meta | -9.0% |

Microsoft | -2.4% |

Nvidia | -7.8% |

Tesla | -5.5% |

Pre-market trading figures suggest that most of them could be in for further losses today.

How to respond to the tariff day selloff

Such a huge decline in the stock market is bound to cause panic, but financial professionals are urging investors to stay as calm as possible. Investing for the long term often requires gritting your teeth through market downturns.

“Wholesale moves in and out of investments to capitalise on short term price movements can add risk to your investing,” says Ed Monk, associate director, Fidelity International. “As always, investing for the long-term in a well-diversified spread of assets is advised.”

That’s not to say you shouldn’t make some tactical adjustments to protect your wealth and capitalise on specific opportunities, though. Besides allocating to bonds, gold and dividend stocks, Monk also suggests keeping some cash on the sidelines in order to be able to take advantage of the stock market selloff.

“With interest rates still elevated the return on cash remains attractive to those looking for a risk-free way to beat inflation,” he says. “While inflation could rise as a result of trade tariffs, it is currently still possible to get a return from cash that is running ahead of price rises.”

We have another live blog running today covering more money tips ahead of the new tax year, alongside the stock market selloff. Give it a read before the weekend!

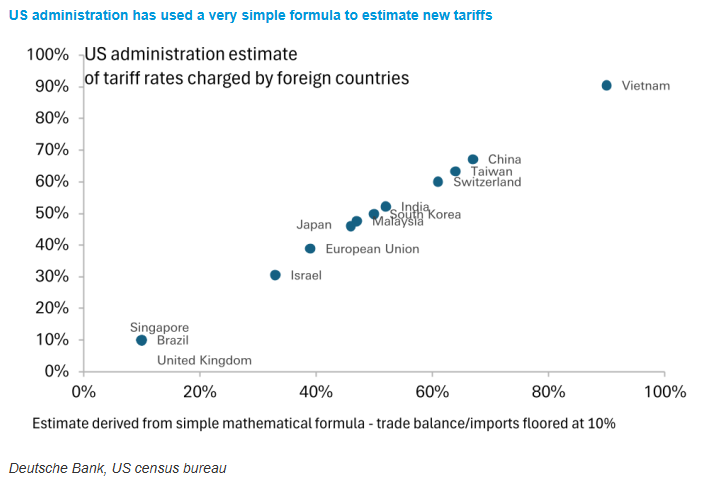

How were tariffs calculated?

According to Trump, the tariff rate applied to each country was decided based on the effective tariff rates that country applies to goods it imports from the US, plus “currency manipulation and other trade barriers” – VAT rates among them.

Analysis has shown, though, that the US trade team appears to have used a more straightforward formula. The tariffs levied on each country correspond perfectly to, as George Saravelos, global head of FX research at Deutsche Bank puts it, “the ratio of a country's goods trade deficit with the US over that country's exports to the US”.

“The bigger the nominal trade deficit a country has with the US adjusted for the absolute size of that country's imports, the bigger the tariff,” explains Saravelos.

Countries for which this formula yields a number below 10% appear to have been put on 10% tariffs.

China begins tariff retaliation

China’s finance ministry has announced additional tariffs of 34% on all goods imports from the US, to take effect from 10 April, reports Reuters.

Export controls are also being introduced on medium and heavy rare-earth minerals, which are key components of various products including electric vehicles and missile systems.

The impact of tariffs on the US economy

Trump hopes that the revenue the US government will accrue through tariffs will outweigh any economic hit. Economists at Capital Economics estimate that this revenue will amount to around $700 billion, once any retaliatory measures are taken into account.

Whether or not that is enough to avoid a US recession depends on how it is spent, they argue.

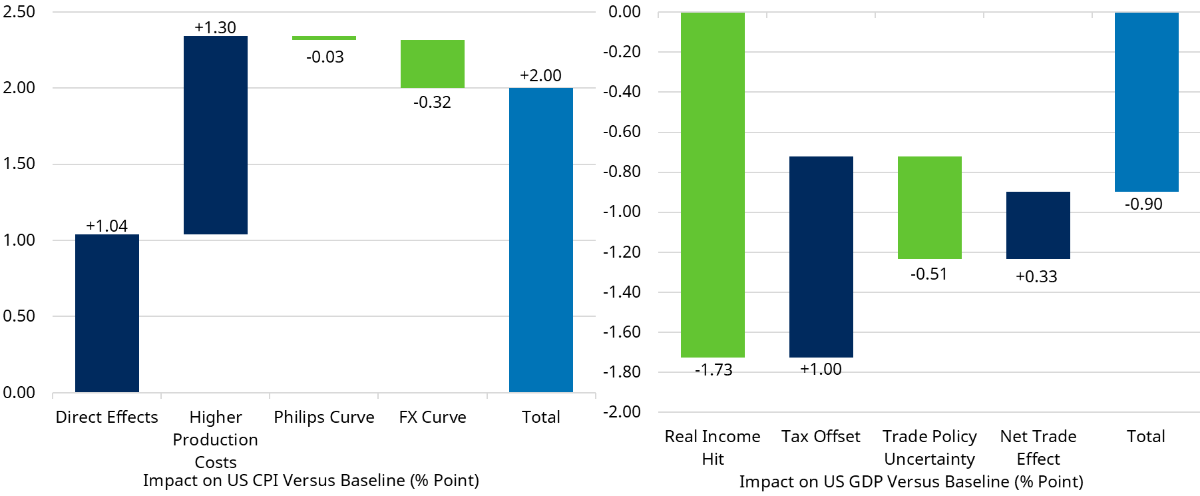

However, the damage to the US economy caused by the tariffs could be severe.

“The administration’s actions to-date are estimated to lift the effective US tariff rate by a further 17.6 percentage points to 25.3%,” says George Brown, economist at Schroders. “Before accounting for any retaliation, we judge this would roughly push up US prices by 2% and hit growth to the tune of 0.9%.”

It’s worth noting that Brown’s comments – and the analysis below – predate the news of China’s retaliatory tariffs.

Despite that, Brown already viewed the initial round of tariffs as like to add 2% to US inflation, and to take 0.9% off US growth.

Schroders believes that Trump’s tariffs will be a sharp stagflationary shock for the US economy, adding 2% to inflation and taking 0.9% off growth.

It leaves monetary policymakers in the US in a very difficult situation.

“For the Federal Reserve, the stagflationary impact of the tariffs puts them between a rock and a hard place,” says Brown. “In the near-term, we think the path of least resistance will be inertia, given the heightened uncertainty around what the economic impact of tariffs will be.”

Which stocks have survived the selloff?

Overall, US-listed stocks lost over $3 trillion in market value yesterday, marking the steepest single-day decline in its stock market since the onset of the Covid pandemic in 2020.

We’ve heard from various experts that have discussed where investors can put their money to protect themselves from the selloff. Defensive assets like bonds and gold are recurring themes, though even gold prices dipped yesterday.

Pete Walden, managing director of BullionbyPost.co.uk, says “Ordinarily, this kind of uncertainty would support a rally in gold. After all, gold is traditionally seen as the ultimate safe haven asset.”

However, during a stock market selloff on the scale we’re seeing, “gold can sometimes fall alongside equities — not because it’s lost its appeal, but because investors need to raise cash quickly. Many are forced to sell hard assets like gold to meet margin calls on stock positions.

“It’s a liquidity-driven move, not a reflection of gold’s long-term value”, he adds.

But assuming you’re only interested in equities, have any come off well?

“Traditional defensive havens offered some refuge with gains seen in consumer staples and utilities,” says Derren Nathan, head of equity research Hargreaves Lansdown.

For example, shares in Coca-Cola – perhaps the ultimate consumer staple – gained 2.6% yesterday. On the utilities front, NextEra Energy also racked up 2.4% gains.

Stay calm amid stock market selloff

The stock market is in chaos right now, especially in the aftermath of China ratcheting up the trade war. However, at times like this it’s important to remain calm and take a long-term perspective to investing.

Vanguard emailed customers yesterday urging them to “stay focused on your long-term goals”.

“The stock shock has shown up in even sharper losses with European indices sinking deeper into the red,” says Susannah Streeter, head of money and markets, Hargreaves Lansdown.

“These kinds of market moves can feel incredibly uncomfortable, but anyone who has lived through any market turmoil in the past knows how important it is to focus on your long-term investment horizons and ride out short-term storms,” Streeter adds.

“Investors should ensure they’re well diversified, without too much concentration on a particular market, and with money spread across different asset classes and geographies.”

Focusing on owning quality companies and drip-feeding investments in order to take advantage of lower prices are also approaches she recommends.

S&P 500 opens 2% down

US markets are open, and the S&P 500 has started the day 1.9% below its previous close. Further falls have brought it quickly down to 2.9% losses, though.

Will we see another session like yesterday's? Analysts at historical market data provider BMLL Technologies estimate that $3.4 trillion of value was wiped off the value of US stocks yesterday.

Even the penguins…

When we say Trump’s tariffs are far-reaching, we mean it.

Heard and McDonald Islands – a pair of islands around 2,845 miles south-west of Australia and inhabited entirely by penguins and seals – have been included in Trump’s tariff chart (though, thankfully, only at the 10% baseline rate).

King penguins on the Australian territory of Heard Island will now, technically, be hit by 10% tariffs on all US exports.

“It just shows and exemplifies the fact that nowhere on Earth is safe from this,” said Anthony Albanese, prime minister of Australia.

The islands are an Australian territory, but haven’t been visited by humans for nearly ten years.

Fed chair warns of tariff stagflation

Jerome Powell, chair of the Federal Reserve, gave prepared remarks to a conference in Virginia today, and warned that the unexpected scale of Trump’s tariffs will raise inflation and hamper growth in the US economy.

“It is now becoming clear that the tariff increases will be significantly larger than expected,” said Powell. “The same is likely to be true of the economic effects, which will include higher inflation and slower growth.”

Retail investors are buying the dip

Markets have closed in the UK, with the FTSE 100 ending the session 4.9% down.

However, British investors apparently aren’t perturbed. Trading platform eToro has released data showing that retail investors took the opportunity to snap up shares at reduced prices yesterday amid the stock market selloff.

“Retail investors bought the dip on April 3, the first full trading day after Trump’s ‘Liberation Day’, not out of panic but based on conviction that the sell-off was an overreaction to macro news, specifically new US tariffs that caused a sharp market drop,” says Lale Akoner, global market analyst at eToro.

eToro’s data showed that more long positions were opened than closed yesterday, and that the number of long positions opened was 44% above the March average. Magnificent Seven stocks like Amazon, Nvidia and Tesla dominated, as well as Nike, which retail investors piled into despite its shares falling 14% on fears regarding its Asian-centric supply chains.

“Retail investors bought in because they believed the assets were fundamentally strong, the drop was temporary, and opportunity often lies in chaos,” says Akoner.

Thanks for following the live blog this week. We're signing off for the weekend now, but in the meantime, here's MoneyWeek's digital editor, Kalpana Fitzpatrick, on how to cope with the stock market turmoil.

Stay calm, keep focused on the long term - and have a good weekend!

Good morning,

Thanks for following this live blog. We're moving our live coverage of the unfolding trade tariff story, and its implications for the stock market, over to a new blog. You can follow that here.

We'll be particularly focused on bringing you expert opinion on how to weather the global economic storm.

If there are any specific questions or topics you'd like us to cover in relation to the tariffs, email them in to editor@moneyweek.com with the subject line 'Tariff question' and we will do our best to answer them.