S&P 500 ends five-quarter winning streak

The US stock market’s flagship index has registered its worst quarter since 2022. What next for the S&P 500?

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

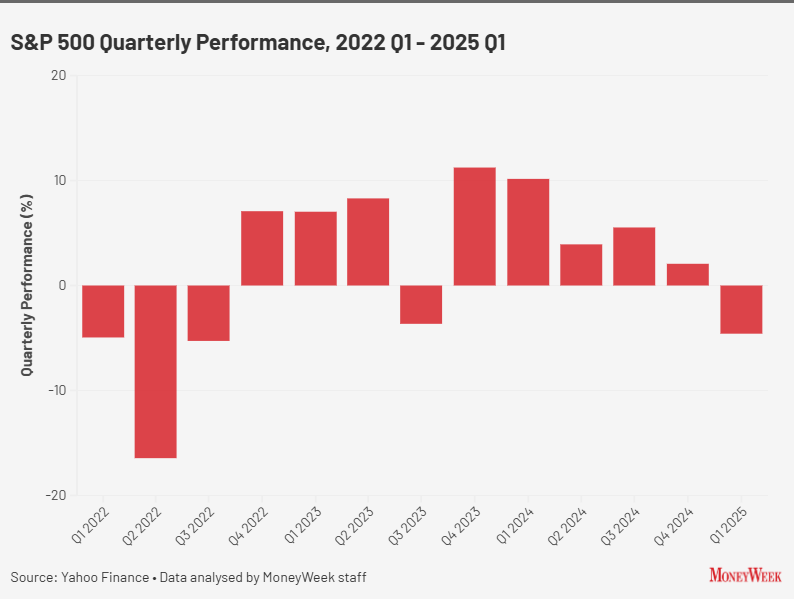

The S&P 500 fell 4.6% during the first quarter of 2025, ending a streak of five consecutive quarterly gains and marking its worst quarter since 2022.

As the benchmark index for the US stock market, the S&P 500 is comprised of the country’s 500 largest publicly-listed companies, and as such is viewed as a bellwether for the health of the US economy. It contains many of the world’s top stocks, and funds that track the stock market will invariably have a heavy weighting towards the S&P 500 given that it holds 17 of the world’s 20 most valuable companies.

As such, its decline is damaging to global investors, but it will also hit pension funds thanks to their exposure to the global stock market.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

“A miserable March has capped off one of the worst quarters for the S&P 500 since 2022,” says Matt Britzman, senior equity analyst, Hargreaves Lansdown.

Prior to March, the S&P had gained in five successive quarters, a streak that goes back to Q3 2023 when the S&P 500 fell 3.7%.

The S&P 500 broke a five-quarter gaining streak in Q1 2025.

Over the long term, though, the S&P 500 has been a strong driver of returns.

We’ll explore the reasons behind its Q1 dip, and ask whether it can return to growth in the long term.

Is the S&P 500 up or down today?

For live information on the S&P 500’s performance today, see the widget below.

Why did the S&P 500 fall in Q1 2025?

Several events have shaken the S&P 500 so far this year.

Firstly, DeepSeek – a Chinese generative AI startup – shook investor confidence in the dominance of US technology firms, especially Nvidia, because it appeared to be able to produce similar results to American AI companies at a fraction of the training costs and infrastructure requirements.

That led to a jittery tech earnings season where stocks fell after results, even if they exceeded market expectations. That, in turn, has led to an extended Magnificent Seven selloff that has dented some of the index’s biggest names.

What has really damaged the index during the second half of the quarter, though, is market pessimism ahead of tariff day – or ‘Liberation Day’ as president Trump has styled it – which takes place tomorrow, on Wednesday 2 April. Fears of the impacts of wide-reaching tariffs on the US economy (where S&P 500 companies are mostly domiciled) and the world economy (where most of its largest constituents generate much of their revenue) have damaged the index.

Sentiment isn’t just low among investors, though. The companies themselves are projecting pessimistic results. Research from FactSet shows that more S&P 500 companies than average have issued negative earnings per share (EPS) guidance for Q1, with 68 out of 107 to have issued guidance so far having made projections below the market consensus prior to their announcement.

Technology companies seem to be driving this pessimism. “At the sector level, the Information Technology sector has the highest number of companies issuing negative EPS guidance of all 11 sectors at 26,” writes John Butters, senior earnings analyst at FactSet.

The S&P 500 over the long term

Over the longer term, though, the S&P 500 has produced strong returns.

Over the last ten years, the index has gained approximately 170%. Over the last 20 years, it has gained around 380%.

There is, of course, no guarantee that these long term trends will continue. However, it’s important to remember that the US is the world’s largest economy, and that historically its downturns – even major ones like the 2008 financial crisis or the bursting of the dot-com bubble – have eventually returned to growth over the long term.

“Volatility looks set to continue in the near term, but if White House fuelled uncertainty turns out to be temporary, this could still be a good time to pick up quality names at a discount,” says Britzman.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Dan is a financial journalist who, prior to joining MoneyWeek, spent five years writing for OPTO, an investment magazine focused on growth and technology stocks, ETFs and thematic investing.

Before becoming a writer, Dan spent six years working in talent acquisition in the tech sector, including for credit scoring start-up ClearScore where he first developed an interest in personal finance.

Dan studied Social Anthropology and Management at Sidney Sussex College and the Judge Business School, Cambridge University. Outside finance, he also enjoys travel writing, and has edited two published travel books.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how