The nine best robotics stocks

Merryn Somerset Webb picks the most interesting robotics stocks worth buying now.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

I said at the Moneyweek Workshop on Saturdaythat I would pop up a list of all the robotics stocks that Jim Mellon suggests we look at in his new book, Fast Forward (you can order the book here).

I want to be clear that I am not recommending these stocks as immediate buys (and Jim isn't necessarily doing so either) just pointing out that they are ways into interesting companies doing interesting things in extraordinary areas, and as such are worth looking at.

So here we go.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

There is Kuka (Germany: KU2) which is one of the world leaders in automotive robots. It is huge 7,800 employees and a market capitalisation of €1.6bn and makes a robot so precise that it can "perform repeated tasks to an accuracy of 0.05mm", something I gather is very impressive. It is not cheap, but it is solid and growing.

Next, Fanuc Corp (Tokyo: 6954). This isn't exactly a new company it has been around since 1956, and I remember talking about it as a broker in the 1990s. But it is a good one. It has low debt, piles of cash and good profit margins, and is a clear leader in the business of industrial automation.

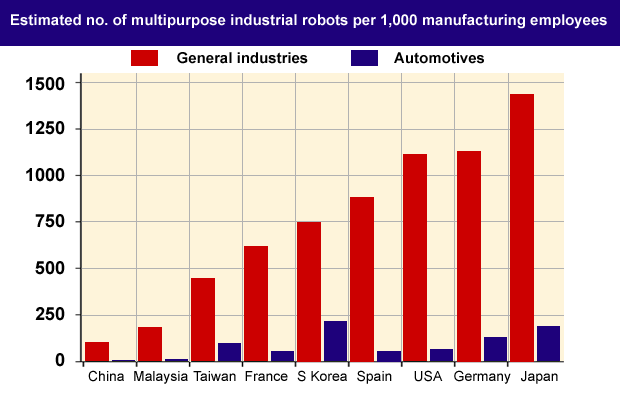

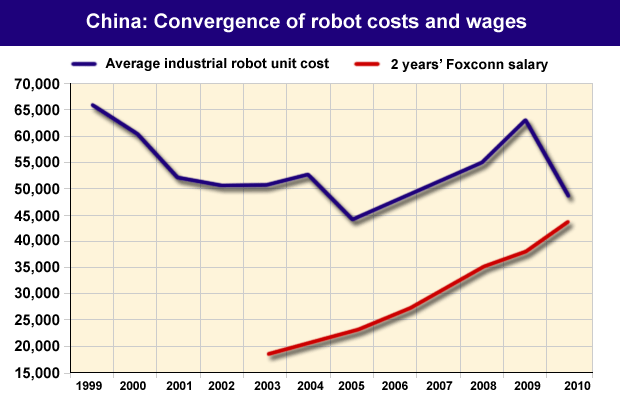

Anyone in any doubt about the future for this industry need only look at the chart below sent to me by Carmignac Gestion.

It shows the huge rise in demand for Fanuc's robots, something the second chart explains nicely: if robots don't cost much more than people, why have people?

Intuitive Surgical (Nasdaq: ISRG) is also interesting. It makes the da Vinci Surgical System. One day, this could turn into a genuinely robotic surgeon, but for the moment it has mechanical probes controlled by a human surgeon with a console and a high resolution screen.

Also in surgery is Hansen Medical (Nasdaq: HNSN). This one is a pioneer in intravascular robotics. It has seen weak earnings and a collapsing share price over that last few years, but, says Jim, "its technology is sound."

Other possibilities are Krones (Germany: KRN), another German firm that makes packing robots;iRobot Corporation (Nasdaq: IRBT), which sells robots into consumer and security markets; and HIWIN Technologies Corp (Taiwan: 2049), which makes precision machinery.

Then there is Google. This is one of the most highly valued companies in the world, but given its huge R&D efforts in automation and robotics, it would be "unwise" for a robotics investor to ignore it.

One more company to watch is Kawada Industries (Tokyo: 3443). This is a huge firm with a nice robotics division its robot is designed to work alongside humans, and can be taught new tasks without the need for programming expertise. You don't want to buy Kawada industries, but it is worth keeping an eye on it in case it decides to spin off its robotics division.

If you want to investigate more robotics companies a good place to start would be at www.robostoxetfs.com where you can see a list of the 80-odd companies held by the only ETF operating in the sector.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

Early signs of the AI apocalypse?

Early signs of the AI apocalypse?Uncertainty is rife as investors question what the impact of AI will be.

-

Reach for the stars to boost Britain's space industry

Reach for the stars to boost Britain's space industryopinion We can’t afford to neglect Britain's space industry. Unfortunately, the government is taking completely the wrong approach, says Matthew Lynn

-

House prices to crash? Your house may still be making you money, but not for much longer

House prices to crash? Your house may still be making you money, but not for much longerOpinion If you’re relying on your property to fund your pension, you may have to think again. But, says Merryn Somerset Webb, if house prices start to fall there may be a silver lining.

-

Prepare your portfolio for recession

Prepare your portfolio for recessionOpinion A recession is looking increasingly likely. Add in a bear market and soaring inflation, and things are going to get very complicated for investors, says Merryn Somerset Webb.

-

Investing for income? Here are six investment trusts to buy now

Investing for income? Here are six investment trusts to buy nowOpinion For many savers and investors, income is getting hard to find. But it's not impossible to find, says Merryn Somerset Webb. Here, she picks six investment trusts that are currently yielding more than 4%.

-

Stories are great – but investors should stick to reality

Stories are great – but investors should stick to realityOpinion Everybody loves a story – and investors are no exception. But it’s easy to get carried away, says Merryn Somerset Webb, and forget the underlying truth of the market.

-

Everything is collapsing at once – here’s what to do about it

Everything is collapsing at once – here’s what to do about itOpinion Equity and bond markets are crashing, while inflation destroys the value of cash. Merryn Somerset Webb looks at where investors can turn to protect their wealth.

-

ESG investing could end up being a classic mistake

ESG investing could end up being a classic mistakeOpinion ESG investing has been embraced with enormous speed and zeal. But think long and hard before buying in, says Merryn Somerset Webb.

-

UK house prices will fall – but not for a few years

UK house prices will fall – but not for a few yearsOpinion UK house prices look out of reach for many. But the truth is that British property is surprisingly affordable, says Merryn Somerset Webb. Prices will fall at some point – but not yet.

-

This isn’t the stagflationary 1970s – but neither is it the low-rate world of the 2010s

This isn’t the stagflationary 1970s – but neither is it the low-rate world of the 2010sOpinion With soaring energy prices and high inflation, it might seem like we’re on a fast track back to the 1970s. We’re not, says Merryn Somerset Webb. But we’re not going back to the 2010s either.