Buying to let in Scotland might be more profitable, but it's also more risky

Scottish university towns yield some of the highest returns for buy to let investors. But with rent controls coming, and probably new taxes too, it’s a lot more risky, says Merryn Somerset Webb.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

A press release arrives from Zoopla. They want me to know that the best possible yields on buy-to-let properties for students are in Scotland.

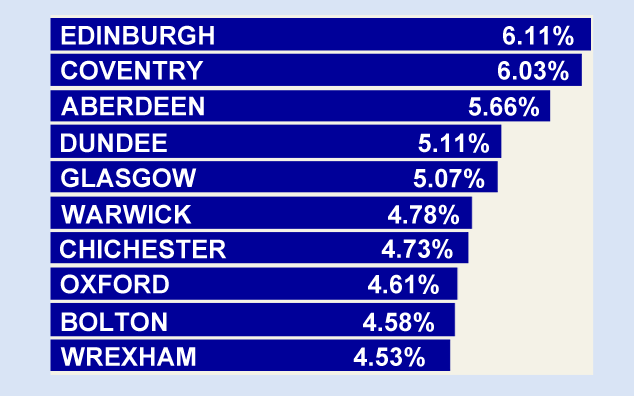

Edinburgh comes top with an average rental yield of 6.1%, while Aberdeen (5.6%), Dundee (5.1%), and Glasgow (5%) also make the top ten in the list of the most lucrative places to buy in the UK.

Zoopla thinks this is great. "Scottish university cities are currently offering fantastic returns for UK landlords", it says. "Many Scottish universities are now internationally renowned, with thriving undergraduate and graduate environments. This means demand for rental accommodation in university areas is very high, as throngs of students compete to live near their campuses. Combined with Scottish house prices still remaining relatively low, this equates to excellent yields."

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Best student buy-to-let towns gross yield

But I suspect it might be missing the point. There's a reason why prices are lower and yields are higher in Scotland. It is that Scotland comes with a higher risk premium than cities in the rest of the UK.

We know pretty much what is going on with the structure of taxation in England and Wales; in Scotland, however, we don't. There is talk of higher rates of income tax and of new income tax bands. There is talk of property taxes, of local income taxes, and of land-value taxes. And, of course, high-value properties in Scotland (such as those in central Edinburgh) are already subject to higher stamp duty rates than those in the rest of the UK.

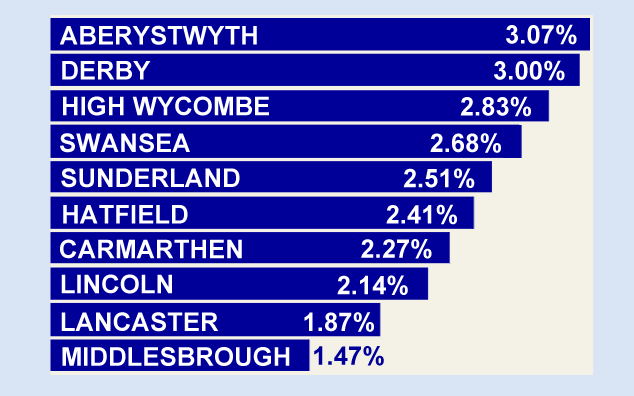

Worst student buy-to-let towns gross yield

And there's another huge risk floating out there for landlords: rent controls. The SNP's programme for government includes a Private Tenancies Bill which includes measures "to provide more predictable rents and protection for tenants against excessive rent increases including the ability to introduce rent controls for pressure areas."

There are also to be new tenancy agreements that will increase "security of tenure" landlords will not be able to evict tenants just because their legal contract has come to an end. See why landlords might demand a slightly higher yield in Scotland than in the rest of the UK? Quite.

Scotland might be more profitable, but with rent controls a given and new taxes almost a dead cert, it is rather more risky too. The one and a half percentage points of yield you get in Edinburgh (an obvious "pressure area") over Oxford simply reflects that risk premium.

The same goes for the commercial sector. The risk premium is lower than 1.5% there (no rent controls on the horizon, I suppose) but I am told that it is somewhere in the region of 0.65%. The lesson? First, don't buy in Scotland without reading the SNP's programme for government. And second, it takes remarkably short time to distort an economy.

PS These numbers might be of interest to those who wonder how much more Scotland might have to pay to borrow money via bond issuance than the UK as a whole does. Might it be somewhere between 0.65 and 1.5 percentage points?

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

New PM Sanae Takaichi has a mandate and a plan to boost Japan's economy

New PM Sanae Takaichi has a mandate and a plan to boost Japan's economyOpinion Markets applauded new prime minister Sanae Takaichi’s victory – and Japan's economy and stockmarket have further to climb, says Merryn Somerset Webb

-

Plan 2 student loans: a tax on aspiration?

Plan 2 student loans: a tax on aspiration?The Plan 2 student loan system is not only unfair, but introduces perverse incentives that act as a brake on growth and productivity. Change is overdue, says Simon Wilson

-

House prices to crash? Your house may still be making you money, but not for much longer

House prices to crash? Your house may still be making you money, but not for much longerOpinion If you’re relying on your property to fund your pension, you may have to think again. But, says Merryn Somerset Webb, if house prices start to fall there may be a silver lining.

-

Prepare your portfolio for recession

Prepare your portfolio for recessionOpinion A recession is looking increasingly likely. Add in a bear market and soaring inflation, and things are going to get very complicated for investors, says Merryn Somerset Webb.

-

Investing for income? Here are six investment trusts to buy now

Investing for income? Here are six investment trusts to buy nowOpinion For many savers and investors, income is getting hard to find. But it's not impossible to find, says Merryn Somerset Webb. Here, she picks six investment trusts that are currently yielding more than 4%.

-

Stories are great – but investors should stick to reality

Stories are great – but investors should stick to realityOpinion Everybody loves a story – and investors are no exception. But it’s easy to get carried away, says Merryn Somerset Webb, and forget the underlying truth of the market.

-

Everything is collapsing at once – here’s what to do about it

Everything is collapsing at once – here’s what to do about itOpinion Equity and bond markets are crashing, while inflation destroys the value of cash. Merryn Somerset Webb looks at where investors can turn to protect their wealth.

-

ESG investing could end up being a classic mistake

ESG investing could end up being a classic mistakeOpinion ESG investing has been embraced with enormous speed and zeal. But think long and hard before buying in, says Merryn Somerset Webb.

-

UK house prices will fall – but not for a few years

UK house prices will fall – but not for a few yearsOpinion UK house prices look out of reach for many. But the truth is that British property is surprisingly affordable, says Merryn Somerset Webb. Prices will fall at some point – but not yet.

-

This isn’t the stagflationary 1970s – but neither is it the low-rate world of the 2010s

This isn’t the stagflationary 1970s – but neither is it the low-rate world of the 2010sOpinion With soaring energy prices and high inflation, it might seem like we’re on a fast track back to the 1970s. We’re not, says Merryn Somerset Webb. But we’re not going back to the 2010s either.