Vertex Pharmaceuticals is an uncommon opportunity in rare diseases

Vertex Pharmaceuticals operates in a profitable subsector and is poised for further success, says Dr Michael Tubbs

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

Vertex Pharmaceuticals (Nasdaq: VRTX) specialises in treatments for rare diseases. It has eight approved medicines on the market. Seven of these are medicines for various types of cystic fibrosis (CF), a disease for which Vertex is the only drug company with approvals from America’s Food and Drug Administration (FDA).

It has been developing new CF drugs for 20 years and aims to offer treatments for every possible CF variant. It was the first company to receive FDA approval, in December 2023, for Casgevy – a genome-edited cell therapy for sickle-cell disease and another blood disorder, beta thalassaemia. These are serious illnesses requiring continuing treatment.

CF is a life-shortening, genetic disease causing thick mucus to build up in the lungs, pancreas and digestive system. There are 94,000 CF patients in the US, Europe, Australia and Canada. Symptoms include a chronic cough, shortness of breath, frequent lung infections (pneumonia, bronchitis), constipation and sinus pain.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

For children it causes slow growth, clubbed fingers and delayed puberty. Sickle-cell disease causes extended painful episodes (sickle-cell crises); increased risk of infections; anaemia (leading to tiredness and shortness of breath); serious joint complications; swelling of hands and feet; and delayed growth and development in children.

Vertex Pharmaceuticals has a well-stocked pipeline

Vertex’s pipeline is well-stocked, with four new drugs in Phase III-clinical trials (the final phase before regulatory approval) for type-1 diabetes, diabetic peripheral neuropathy, and two kidney diseases.

There are also Phase I/II clinical trials for CF, type-1 diabetes, polycystic kidney disease and myotonic dystrophy type 1 (serious muscular dystrophy).

In addition, there are eight research programmes covering all the disease areas mentioned above. They should enter clinical trials soon. Finally, Vertex has outlicensed a portfolio of programmes (two in clinical trials) to Merck Germany that are first-in-class treatments for multiple types of cancer. Merck should be a useful partner for these, since it already has three oncology drugs on the market and eight in clinical trials in its pipeline.

Journavx, Vertex’s nonopioid pain-signal inhibitor for moderate-to-severe acute pain, was approved by the FDA in January 2025. It is the first new-class pain medicine approved for 20 years and has a potentially large market, since 80 million Americans are prescribed a medicine for this type of pain.

Meanwhile, a recent clinical trial of VX-880, a stem cell-derived treatment for type-1 diabetes, has shown encouraging results after six months – nine of 12 participants no longer needed insulin, and two others displayed significant reductions in the amount of insulin required. Vertex received FDA approval for another new medicine in December 2024 – Alyftrek, a triple-combination treatment for CF.

Investment on the rise

Vertex’s results for the 2023 financial year show revenue of $9.9 billion, an increase of 11% from 2022 driven by Trikafta/Kaftrio for CF, which was up 16.4% to $8.9 billion. The US accounted for $6 billion with $3.8 billion from other countries.

Investment in research and development (R&D) in 2023 was $3.2 billion plus $0.53 billion of acquired R&D, giving a total of $3.7 billion compared with $2.7 billion in 2022, an increase of 39% to advance the pipeline. The $3.69 billion represents an R&D intensity (R&D as % sales) of 37.4%, compared with a typical pharmaceutical company’s intensity of 15%- 20% (the figure for Pfizer, for instance, is 18.3%).

At the 2023 results announcement, the group projected that 2024 revenues would reach between $10.6 billion and $10.8 billion, but the 2024 results reported revenue of $11.02 billion, which gives growth of 12%. With Casgevy’s buildup, two new drugs launching in 2025 and three others likely to complete Phase-III trials in 2026, further growth is likely over the next few years.

A steady rise in profitable growth

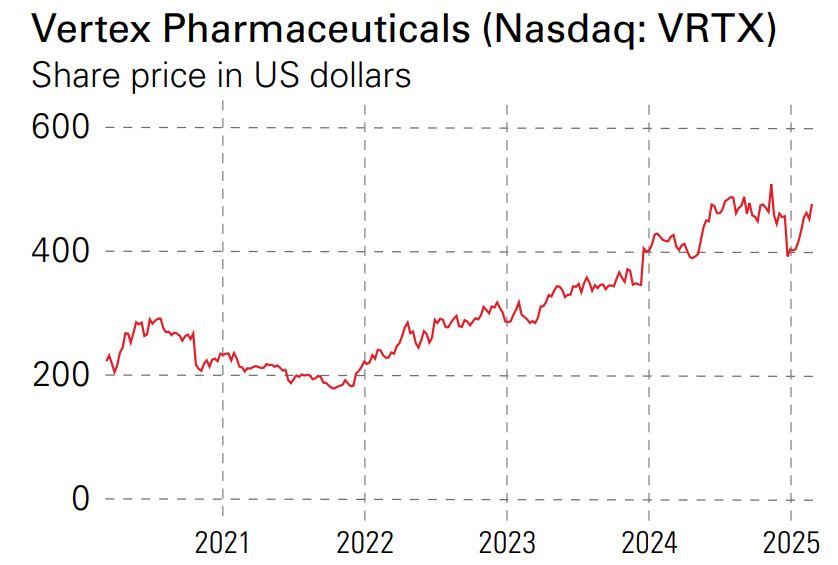

Vertex has a market value of $122 billion with a recent share price of $476. The average estimate of earnings per share (EPS) for 2025 is $18.50, up from $14.05 in 2023. The share price is well below fair value, calculated by discounted cash flow of $708, probably because full-year 2024 EPS were a negative $2.08.

The reason for the loss in 2024 is that Vertex agreed to acquire Alpine Immune Sciences in April to gain its expertise in protein engineering and immunotherapy.

In addition, Alpine brings povetacicept, a pipeline drug for IgA nephropathy (a serious kidney disease) which entered its Phase-III clinical trial in late 2024 and has the potential to benefit patients with other serious autoimmune kidney diseases.

The acquired R&D from Alpine was $4.5 billion and this tipped Vertex into a loss of EPS $13.9 per share for the second quarter of 2024. Even though the third and fourth quarters showed a profit, the overall result for 2024 was still a loss of $2.08. EPS are expected to reach $17.90 in 2025, rising to $20.40 in 2026 and $23.40 in 2027.

Thanks to the growing revenue from CF, Casgevy’s build-out and further launches of new products in 2025 and 2026, Vertex now seems set for steady profitable growth. There is no dividend. At the recent share price of $476, the forward price/ earnings (p/e) ratio is 26.6 for 2025, falling to 23.3 for 2026.

The share price ranged from $448 to $517 in the second half of 2024, so the current price of $476 offers a reasonable entry point for a growing and profitable specialist in rare diseases.

This article was first published in MoneyWeek's magazine. Enjoy exclusive early access to news, opinion and analysis from our team of financial experts with a MoneyWeek subscription.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Highly qualified (BSc PhD CPhys FInstP MIoD) expert in R&D management, business improvement and investment analysis, Dr Mike Tubbs worked for decades on the 'inside' of corporate giants such as Xerox, Battelle and Lucas. Working in the research and development departments, he learnt what became the key to his investing; knowledge which gave him a unique perspective on the stock markets.

Dr Tubbs went on to create the R&D Scorecard which was presented annually to the Department of Trade & Industry and the European Commission. It was a guide for European businesses on how to improve prospects using correctly applied research and development.

He has been a contributor to MoneyWeek for many years, with a particular focus on R&D-driven growth companies.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how

-

Three key winners from the AI boom and beyond

Three key winners from the AI boom and beyondJames Harries of the Trojan Global Income Fund picks three promising stocks that transcend the hype of the AI boom

-

RTX Corporation is a strong player in a growth market

RTX Corporation is a strong player in a growth marketRTX Corporation’s order backlog means investors can look forward to years of rising profits

-

Profit from MSCI – the backbone of finance

Profit from MSCI – the backbone of financeAs an index provider, MSCI is a key part of the global financial system. Its shares look cheap

-

'AI is the real deal – it will change our world in more ways than we can imagine'

'AI is the real deal – it will change our world in more ways than we can imagine'Interview Rob Arnott of Research Affiliates talks to Andrew Van Sickle about the AI bubble, the impact of tariffs on inflation and the outlook for gold and China

-

Should investors join the rush for venture-capital trusts?

Should investors join the rush for venture-capital trusts?Opinion Investors hoping to buy into venture-capital trusts before the end of the tax year may need to move quickly, says David Prosser

-

Food and drinks giants seek an image makeover – here's what they're doing

Food and drinks giants seek an image makeover – here's what they're doingThe global food and drink industry is having to change pace to retain its famous appeal for defensive investors. Who will be the winners?

-

Barings Emerging Europe trust bounces back from Russia woes

Barings Emerging Europe trust bounces back from Russia woesBarings Emerging Europe trust has added the Middle East and Africa to its mandate, delivering a strong recovery, says Max King

-

How a dovish Federal Reserve could affect you

How a dovish Federal Reserve could affect youTrump’s pick for the US Federal Reserve is not so much of a yes-man as his rival, but interest rates will still come down quickly, says Cris Sholto Heaton