Spectra Systems: a 'boffin-led' tech stock with business acumen

Patient investors will get paid well as they wait for success from Spectra Systems, a promising Aim stock, says Jamie Ward

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

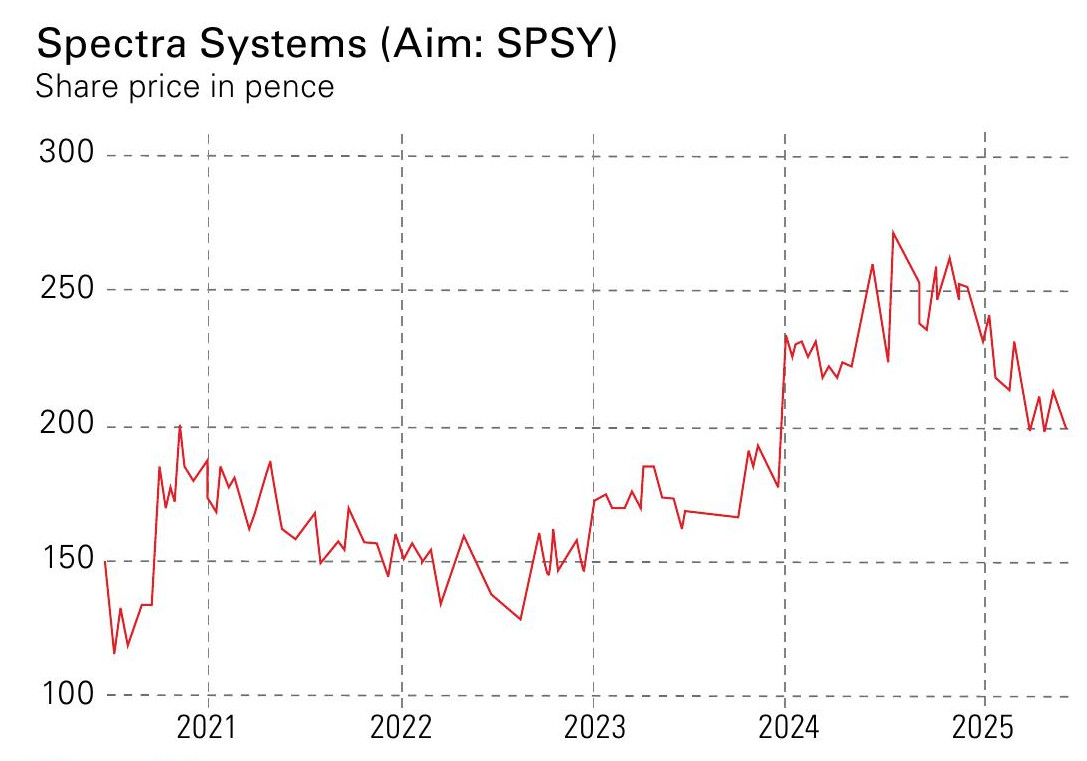

Some listed companies quietly compound wealth for investors without ever making mainstream headlines. One such is Spectra Systems (Aim: SPSY), a niche technology firm that has rewarded shareholders handsomely since its listing on the junior market in 2011.

While many “boffin-led” companies struggle to commercialise their innovations, Spectra has bucked the trend. Its management team is led by CEO Nabil Lawandy, who has a PhD in chemical physics and was a professor of physics at Brown University for 18 years. The company blends technical brilliance with rare business acumen – an unusual and potent combination. With new products in development and management bullish about future opportunities, Spectra’s next chapter could be just as rewarding as its past if these initiatives succeed.

Spectra develops security and authentication technology, primarily for banknotes and secure documents. Central banks, government agencies and commercial customers rely on its products to combat counterfeiting and fraud. For investors, Spectra has been a hidden gem, delivering strong revenue growth and consistent profitability while maintaining a robust balance sheet.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Spectra’s total return to investors has been exceptional. The shares have gone up more than tenfold in the last eight years, with a good amount of dividends adding to the total return. In an era where many technology firms prioritise growth at all costs, Spectra stands out for its disciplined approach. The company is cash-generative, with high margins and a record of returning excess capital to shareholders.

How Spectra Systems leapt the early hurdles

Yet it hasn’t all been smooth sailing. Spectra’s early years as a listed company were marked by challenges, including delays in contract wins and periods of opaque revenue recognition. However, the company’s resilience and ability to refine its commercial strategy allowed it to overcome these hurdles. By focusing on high-value contracts with central banks and secure printing firms, it has built a business that enjoys strong client retention and recurring revenues. It has successfully adapted to the evolving security needs of its clients, ensuring that its offerings remain relevant and indispensable.

The story of many science-led companies is one of technical brilliance paired with commercial naivety. That is not the case at Spectra. The CEO is an inventor with more than 80 patents, but he also understands markets. Under his leadership, Spectra has consistently commercialised its technology, won key contracts and expanded its addressable market. Its ability to bridge the gap between innovation and real-world application is a major part of its success. Unlike many Aim-listed tech firms that rely on endless capital raises to stay afloat, Spectra has grown organically, avoiding shareholder dilution and remaining profitable.

Spectra’s pipeline of new products offers further reason for optimism. The company is developing technology beyond its traditional core, positioning itself in high-growth adjacent markets. One of the more promising areas of development is its work in secure polymer banknotes. With countries shifting from paper to polymer notes, the demand for advanced security features is rising. Spectra is developing new authentication materials specifically designed for polymer substrates, a move that could deepen its relationships with central banks and provide a new revenue stream.

Another promising innovation is in secure gaming. Spectra has developed authentication technologies that could be applied to the lottery and casino industries, helping operators prevent fraud and improve security. Given the multi-billion-dollar size of the global gaming market, this could represent a significant new opportunity should demand materialise. Spectra is also working on a cutting-edge method of detecting counterfeit pharmaceuticals. These drugs cost the global economy billions annually, so a robust solution could be highly valuable.

Management remains confident about the future. In recent updates, the company has pointed to a strong pipeline of opportunities, with the CEO emphasising that Spectra is well-positioned to capitalise on structural growth trends in banknote security, authentication and secure transactions. The company’s continued investment in research and development should ensure it stays ahead of emerging threats and remains indispensable to its clients.

Aim's quiet success story

Small-cap stocks always come with risks – particularly those with exposure to large contracts – but Spectra’s established relationships, strong balance sheet and diversified innovation pipeline should prove resilient. Its ability to identify commercial applications for its technology and execute effectively sets it apart from its peers.

Spectra is one of Aim’s quiet success stories. It is worth watching closely. If its next phase of growth is as successful as its past, the company could continue delivering exceptional returns, making it an under-the-radar winner for years to come.

The market seems not to have fully cottoned on to its potential. The shares aren’t trading at bargain-basement prices, admittedly, but they also don’t seem fully to capture the substantial growth that could lie ahead. Adding a touch of sweetness to an already appealing proposition, the company offers a rather attractive dividend yield exceeding 4%. This means shareholders can enjoy a steady income stream while patiently awaiting the moment when the market wakes up to Spectra’s true value.

This article was first published in MoneyWeek's magazine. Enjoy exclusive early access to news, opinion and analysis from our team of financial experts with a MoneyWeek subscription.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Jamie is an analyst and former fund manager. He writes about companies for MoneyWeek and consults on investments to professional investors.

-

Early signs of the AI apocalypse?

Early signs of the AI apocalypse?Uncertainty is rife as investors question what the impact of AI will be.

-

Reach for the stars to boost Britain's space industry

Reach for the stars to boost Britain's space industryopinion We can’t afford to neglect Britain's space industry. Unfortunately, the government is taking completely the wrong approach, says Matthew Lynn

-

Three key winners from the AI boom and beyond

Three key winners from the AI boom and beyondJames Harries of the Trojan Global Income Fund picks three promising stocks that transcend the hype of the AI boom

-

'AI is the real deal – it will change our world in more ways than we can imagine'

'AI is the real deal – it will change our world in more ways than we can imagine'Interview Rob Arnott of Research Affiliates talks to Andrew Van Sickle about the AI bubble, the impact of tariffs on inflation and the outlook for gold and China

-

Investing in space – finding profits at the final frontier

Investing in space – finding profits at the final frontierGetting into space has never been cheaper thanks to private firms and reusable technology. That has sparked something of a gold rush in related industries, says Matthew Partridge

-

Three promising emerging-market stocks to diversify your portfolio

Three promising emerging-market stocks to diversify your portfolioOpinion Omar Negyal, portfolio manager, JPMorgan Global Emerging Markets Income Trust, highlights three emerging-market stocks where he’d put his money

-

Polar Capital: a cheap, leveraged play on technology

Polar Capital: a cheap, leveraged play on technologyPolar Capital has carved out a niche in fund management and is reaping the benefits

-

Britain heads for disaster – what can be done to fix our economy?

Britain heads for disaster – what can be done to fix our economy?Opinion The answers to Britain's woes are simple, but no one’s listening, says Max King

-

'Investors will reap long-term rewards from being bullish on UK equities'

'Investors will reap long-term rewards from being bullish on UK equities'Opinion Nick Train, portfolio manager, Finsbury Growth & Income Trust, highlights three UK equities where he’d put his money

-

How to profit from the UK leisure sector in 2026

How to profit from the UK leisure sector in 2026The UK leisure sector had a straitened few years but now have cash in the bank and are ready to splurge. The sector is best placed to profit