Pinewood Technologies: a drive for growth

Pinewood Technologies’ platform is one of the best in the business. Investors should buy in

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

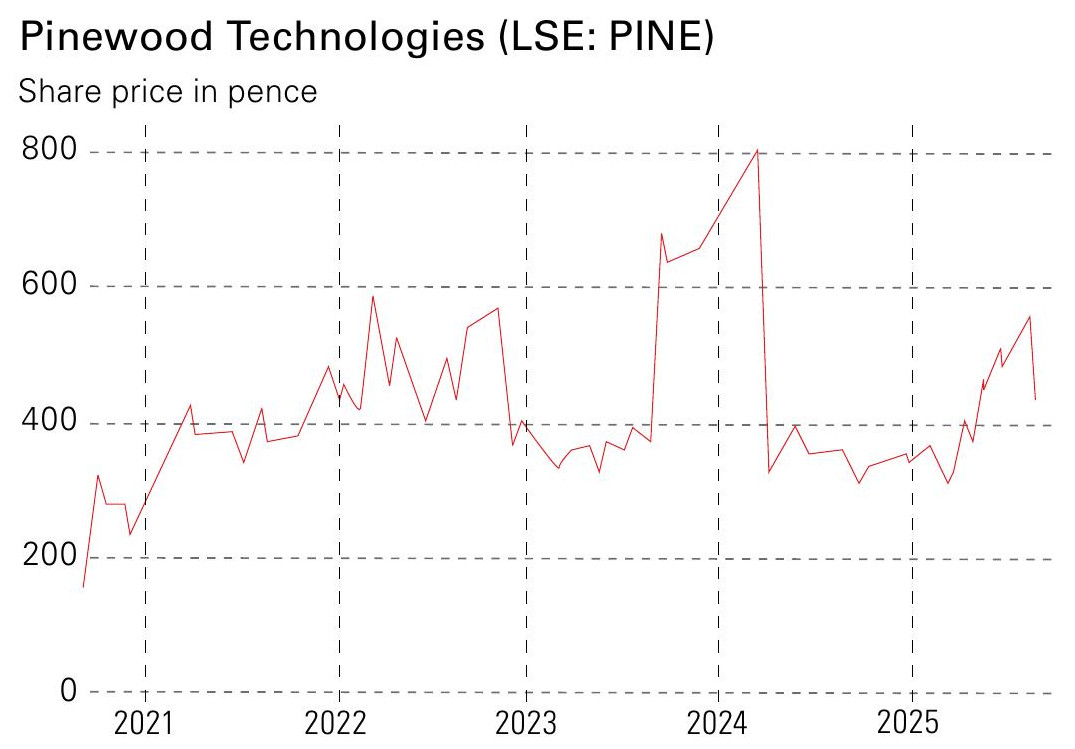

There are not many world-leading technology companies listed in London anymore, but one of those still remaining is Pinewood Technologies (LSE: PINE). Until 2024, the company was better known as Pendragon, one of the UK’s largest owners and operators of car dealerships under the Evans Halshaw and Stratstone brands. These divisions overshadowed what was a gem of a tech platform hidden under the bonnet.

Pendragon sold the physical side of the business for nearly £400 million at the beginning of 2024 to the US dealer group Lithia & Driveway. The deal made a lot of strategic sense, considering the platform’s profitability and potential. In the 13 months to the end of January 2024, just before the deal was completed, the discontinued operations generated £4.3 billion in revenue and a profit before tax of £81.6 million, a profit margin of around 2%. The software side of the business reported revenue of £24.5 million and a profit before tax of £9.9 million, a margin of 40.4%.

Legacy tech at Pinewood Technologies

Pinewood’s software arm has been in operation for some time. It was founded in 1981 with the launch of the complete automotive record system (CARS), created to help dealers manage various aspects of their operations. The software was designed to streamline the entire process, from prospecting and vehicle management to workshop and parts management, and accounting, utilising a central database that employees not trained explicitly in complex software would find easy to use.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

This so-called dealer management system (DMS) was initially sold as a cost-effective way to manage an operation, effectively eliminating the need for at least one person in each department. It also helped smooth the relationship between franchised dealers and manufacturers, as manufacturers could use the system to maintain control over their franchisees. It’s much easier to control the product when the management is done via an easily accessible piece of software that’s used by hundreds or thousands of other outlets.

Pendragon initially acquired the software in 1998 for £2 million. The business started off with 17 staff and three years later the workforce had grown to 90. Pendragon was a customer of Pinewood when it acquired the company and in the following years utilised its capital and scale to drive an aggressive expansion. In 2001, Pinewood won a contract to supply the DMS system to Ford’s 744 UK car dealerships, with an agreement also to take the software into Europe.

However, one of the problems of the integrated business was the fact that, however good Pinewood’s software was, it was always going to be part of one of the largest dealer groups in the country, a point of contention in what can be quite a competitive market. As a standalone business, the group has the freedom to pursue customers across the UK and global markets without any concerns about competition.

For example, in October last year Pinewood announced it had entered into a five-year contract with Marshall Motor Group to implement its software. Marshall is one of the largest franchise dealer groups in the UK, with 120 dealerships, and is part of the Constellation Automotive Group (which owns the likes of We Buy Any Car). It was the first non-associated major dealership group to adopt the firm’s software since Lithia acquired its physical business, putting the software in four of the top-20 UK dealer groups.

As part of the deal with Lithia, Pinewood agreed to establish a joint venture in North America, with pilots set to start in 2025. The agreement was billed as a way into the $6.5 billion vehicle-systems market in North America by gaining a foothold in over 300 dealerships owned by the joint-venture partner. In mid-2025, Pinewood agreed to acquire the 51% stake in the joint venture it did not already own. The joint-venture stake was valued at $76.5 million on an independent basis, and Pinewood funded the acquisition through the issuance of 14.6 million new shares to its former partner, with the latter entering into a five-year contract to roll out the software by the end of 2028. The rollout is expected to generate annual recurring revenue of $40 million by 2028, and could rise to as much as $60 million.

Pinewood Technologies: growth ahead

Pinewood has been in transition for the past two years, and it’s now primed to grow rapidly. The company outlined medium-term guidance alongside its fiscal first half of 2025 results last week, suggesting underlying Ebitda would hit between £58 million and £62 million in fiscal 2028, implying a 56% compound annual growth rate.

Revenue was up 21.7% in the first half of the year and 85.7% of total revenue is recurring, with net user churn at just 0.3%. The company’s gross margin declined slightly, but only to 86.7%, down from 90% in the prior period, although analysts at Berenberg believe it’s only a matter of time before it returns to 90%. The acquisition of technology group Seez in March is expected to enhance the company’s AI capabilities and accelerate vertical sales.

Sadly, Pinewood’s growth story is well known, and the stock is not cheap. It is trading at a forward price-to-earnings (p/e) ratio of 74.7. But what the company lacks in value, it makes up for with growth. Berenberg has the company trading at a p/e multiple below 20 by fiscal 2028, but more interestingly, the free cash-flow yield is expected to trend up into the high single digits, hitting at least 7% by fiscal 2027. Analysts also believe the company will have accumulated £94 million-worth of cash on the balance sheet at this stage, compared with the market capitalisation of £513 million. In other words, it’s clear this is a highly cash-generative, cash-rich business with a long runway for growth over the coming years.

This article was first published in MoneyWeek's magazine. Enjoy exclusive early access to news, opinion and analysis from our team of financial experts with a MoneyWeek subscription.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Rupert is the former deputy digital editor of MoneyWeek. He's an active investor and has always been fascinated by the world of business and investing. His style has been heavily influenced by US investors Warren Buffett and Philip Carret. He is always looking for high-quality growth opportunities trading at a reasonable price, preferring cash generative businesses with strong balance sheets over blue-sky growth stocks.

Rupert has written for many UK and international publications including the Motley Fool, Gurufocus and ValueWalk, aimed at a range of readers; from the first timers to experienced high-net-worth individuals. Rupert has also founded and managed several businesses, including the New York-based hedge fund newsletter, Hidden Value Stocks. He has written over 20 ebooks and appeared as an expert commentator on the BBC World Service.

-

Early signs of the AI apocalypse?

Early signs of the AI apocalypse?Uncertainty is rife as investors question what the impact of AI will be.

-

Reach for the stars to boost Britain's space industry

Reach for the stars to boost Britain's space industryopinion We can’t afford to neglect Britain's space industry. Unfortunately, the government is taking completely the wrong approach, says Matthew Lynn

-

Early signs of the AI apocalypse?

Early signs of the AI apocalypse?Uncertainty is rife as investors question what the impact of AI will be.

-

8 of the best properties for sale with beautiful kitchens

8 of the best properties for sale with beautiful kitchensThe best properties for sale with beautiful kitchens – from a Modernist house moments from the River Thames in Chiswick, to a 19th-century Italian house in Florence

-

Review: Eliamos Villas Hotel & Spa – revel in the quiet madness of Kefalonia

Review: Eliamos Villas Hotel & Spa – revel in the quiet madness of KefaloniaTravel Eliamos Villas Hotel & Spa on the Greek island of Kefalonia is a restful sanctuary for the mind, body and soul

-

Three key winners from the AI boom and beyond

Three key winners from the AI boom and beyondJames Harries of the Trojan Global Income Fund picks three promising stocks that transcend the hype of the AI boom

-

RTX Corporation is a strong player in a growth market

RTX Corporation is a strong player in a growth marketRTX Corporation’s order backlog means investors can look forward to years of rising profits

-

Profit from MSCI – the backbone of finance

Profit from MSCI – the backbone of financeAs an index provider, MSCI is a key part of the global financial system. Its shares look cheap

-

'AI is the real deal – it will change our world in more ways than we can imagine'

'AI is the real deal – it will change our world in more ways than we can imagine'Interview Rob Arnott of Research Affiliates talks to Andrew Van Sickle about the AI bubble, the impact of tariffs on inflation and the outlook for gold and China

-

Should investors join the rush for venture-capital trusts?

Should investors join the rush for venture-capital trusts?Opinion Investors hoping to buy into venture-capital trusts before the end of the tax year may need to move quickly, says David Prosser