Halma reaches new all-time high

Profits at Halma, one of Britain’s best blue chips, have hit a new record. But could US tariffs now cloud the outlook?

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

The FTSE 100’s “most consistent money-making machine” has done it again, says Rober Lea in The Times. Shares in Halma, a conglomerate focusing on safety, environmental protection and healthcare, are near all-time highs.

Despite fears earlier this year that the group’s 50 companies, which operate autonomously from each other, would be hit by US president Donald Trump’s tariffs, the latest results show that there is “nothing to worry about”. Sales rose 11% and profits 16% in the year to 31 March 2025. Halma has now enjoyed “a 22nd consecutive year of profitable growth and a 46th successive year of rising dividends”.

The latest set of earning figures certainly seem “stellar across the board”, says Stephen Wright of The Motley Fool. Still, the results only cover the period until 31 March, so they don’t include any impact from Trump’s tariffs. Note that nearly half of Halma’s sales stem from the US.

Try 6 free issues of MoneyWeek today

Get unparalleled financial insight, analysis and expert opinion you can profit from.

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Most of this revenue comes from companies in America, and they won’t directly face tariffs themselves. But the trade barriers will create a “much more volatile trading environment”, with an increased level of uncertainty, which could make it much more “challenging” to achieve the group’s forecasts.

Halma's strength through diversification

The knock-on effects of US tariffs on domestic companies “could eventually result in reduced corporate spending”, which could dampen demand for Halma’s products, says Keith Bowman for Interactive Investor. What’s more, currency movements are also expected to hamper progress in the year ahead.

Still, a wide array of products and geographical regions means that any poor performance in one area could be compensated for by positives in another. What’s more, the fact that health and safety related products “are arguably required whatever the economic backdrop” lends an additional degree of security to this well-managed outfit. Halma is poised to benefit from “some resilient long-term growth drivers”, says Hargreaves Lansdown’s Matt Britzman. These include “increasing demand for healthcare, tighter safety regulations, and growing global efforts to address climate change, waste and pollution”.

It even has some exposure to the AI boom, with particularly strong growth coming from one of its firms that plays a critical role in AI data centres. Halma’s ability to generate large amounts of cash has also helped cut debt, which should support future acquisitions, while there is also the company’s “stellar track record” of growing the dividend.

Still, says AJ Bell’s Russ Mould, with the stock on 36 times forward earnings, an “enormous amount of good news” is now priced in. Investors should be wary of “mistaking the reliability of Halma’s business model for safety”. The higher the valuation goes, “the less safe the shares may be, especially in the event of any unexpected, wider market convulsion”.

This article was first published in MoneyWeek's magazine. Enjoy exclusive early access to news, opinion and analysis from our team of financial experts with a MoneyWeek subscription.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

Review: Pierre & Vacances – affordable luxury in iconic Flaine

Review: Pierre & Vacances – affordable luxury in iconic FlaineSnow-sure and steeped in rich architectural heritage, Flaine is a unique ski resort which offers something for all of the family.

-

Could you get cheaper loans under ‘significant’ FCA credit proposals?

Could you get cheaper loans under ‘significant’ FCA credit proposals?The Financial Conduct Authority has launched a consultation which could lead to better access to credit for consumers and increase competition across the market, according to experts.

-

Three key winners from the AI boom and beyond

Three key winners from the AI boom and beyondJames Harries of the Trojan Global Income Fund picks three promising stocks that transcend the hype of the AI boom

-

'AI is the real deal – it will change our world in more ways than we can imagine'

'AI is the real deal – it will change our world in more ways than we can imagine'Interview Rob Arnott of Research Affiliates talks to Andrew Van Sickle about the AI bubble, the impact of tariffs on inflation and the outlook for gold and China

-

Investing in space – finding profits at the final frontier

Investing in space – finding profits at the final frontierGetting into space has never been cheaper thanks to private firms and reusable technology. That has sparked something of a gold rush in related industries, says Matthew Partridge

-

Three promising emerging-market stocks to diversify your portfolio

Three promising emerging-market stocks to diversify your portfolioOpinion Omar Negyal, portfolio manager, JPMorgan Global Emerging Markets Income Trust, highlights three emerging-market stocks where he’d put his money

-

Polar Capital: a cheap, leveraged play on technology

Polar Capital: a cheap, leveraged play on technologyPolar Capital has carved out a niche in fund management and is reaping the benefits

-

SRT Marine Systems: A leader in marine technology

SRT Marine Systems: A leader in marine technologySRT Marine Systems is thriving and has a bulging order book, says Dr Michael Tubbs

-

Coreweave is on borrowed time

Coreweave is on borrowed timeAI infrastructure firm Coreweave is heading for trouble and is absurdly pricey, says Matthew Partridge

-

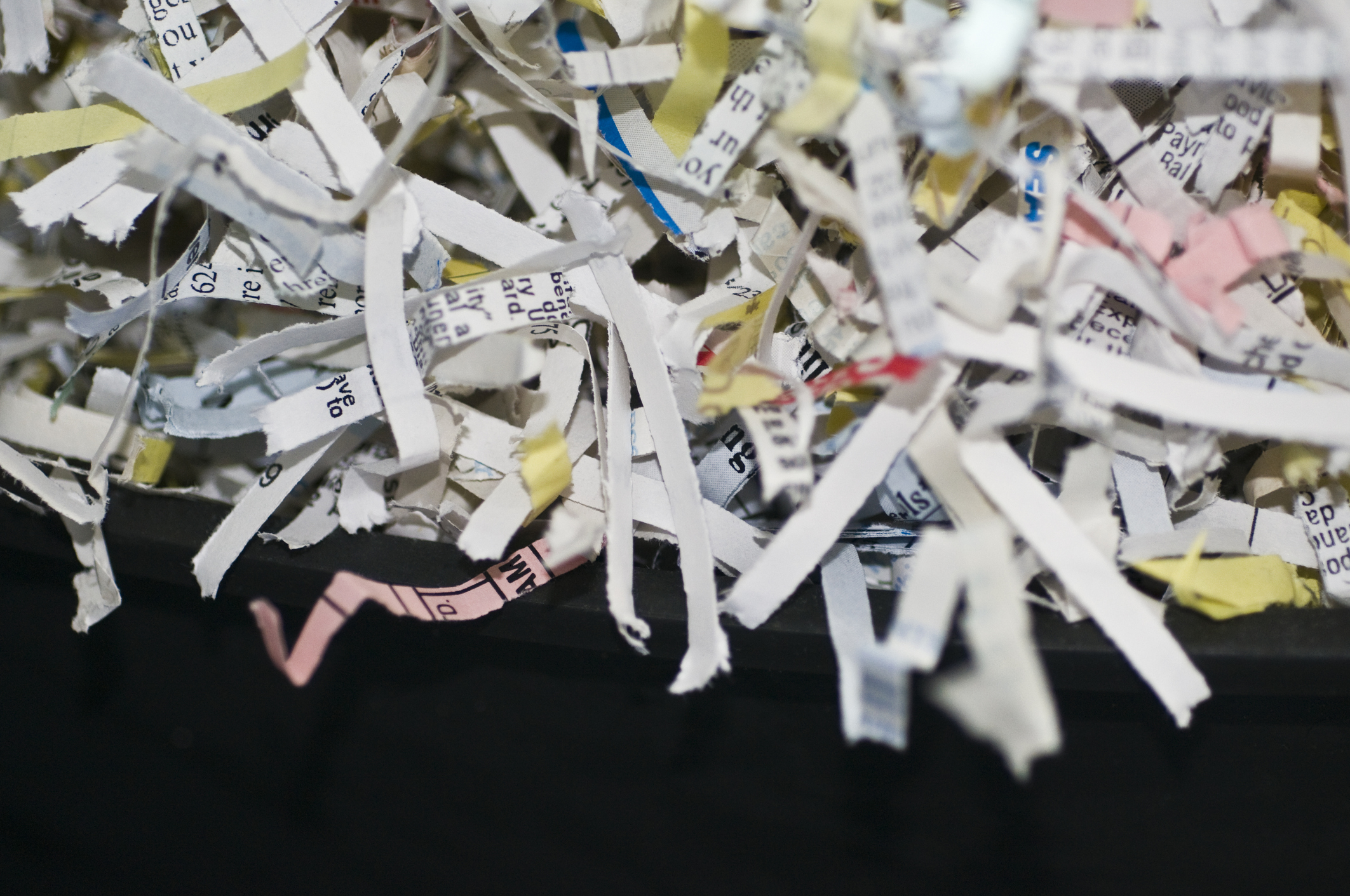

Profit from document shredding with Restore

Profit from document shredding with RestoreRestore operates in a niche, but essential market. The business has exciting potential over the coming years, says Rupert Hargreaves