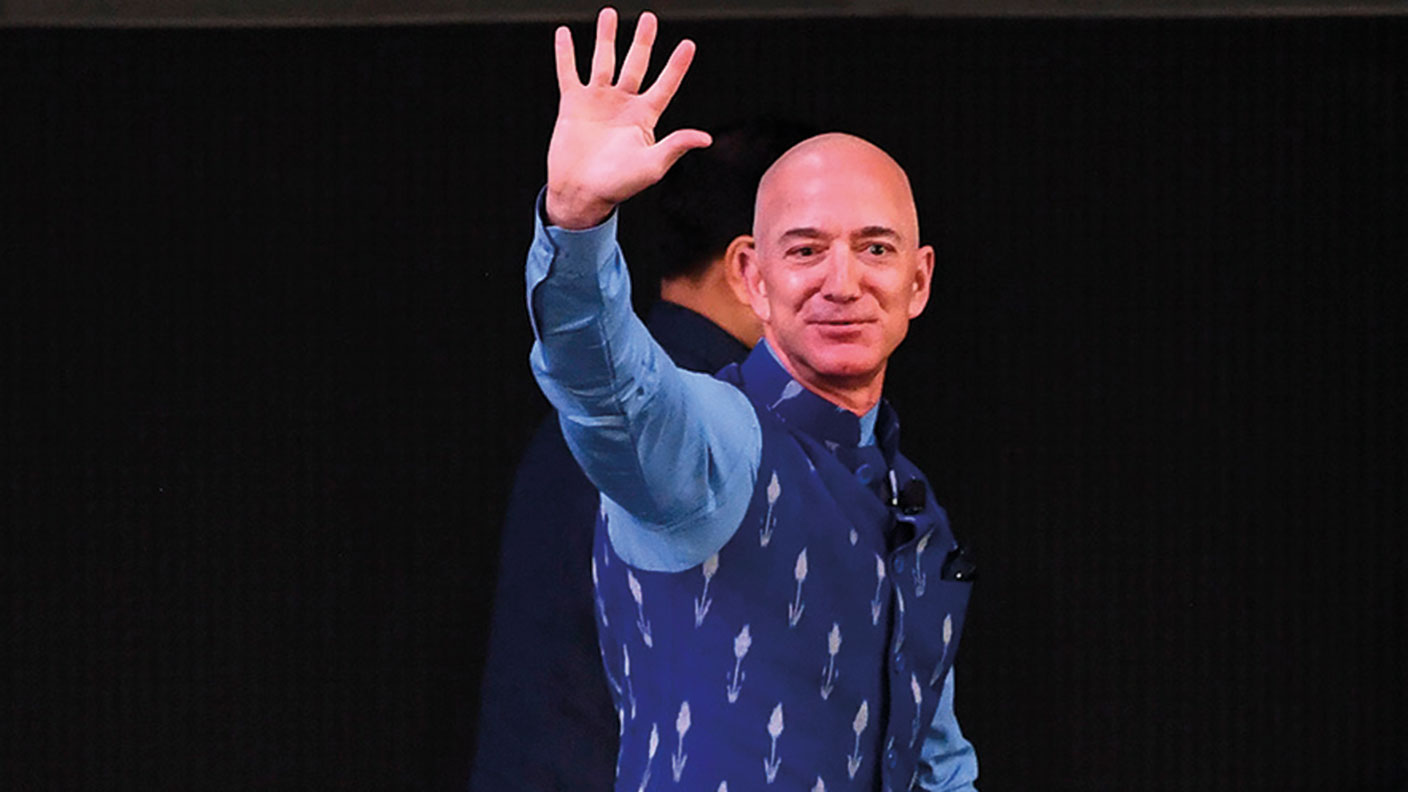

What’s in store for Amazon after Jeff Bezos bows out?

Jeff Bezos, Amazon’s founder and CEO, is stepping down after 27 years in charge. What will change at the e-commerce behemoth? Matthew Partridge reports

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

In a “surprise move”, Amazon announced last week that its founder Jeff Bezos is stepping down as CEO, says James Titcomb in The Daily Telegraph. Bezos will move to the role of executive chairman in the third quarter of this year, allowing him “more time for interests in other areas”. Andy Jassy, the current head of Amazon’s successful cloud-computing division, will replace Bezos as CEO. The announcement came as the company posted record sales, surpassing $100bn in a single quarter for the first time as it benefited from lockdowns that have “pummelled physical retailers”.

Bezos won’t disappear, say Nils Pratley in The Guardian. As chairman he “will still run the board” and have “freedom to roam wherever he wishes”. If Bezos and Jassy disagree, “everybody knows who will prevail” given that Bezos “owns 10% of the shares”. The move may be a largely cosmetic device to enable him to “avoid the next grilling in front of US lawmakers” over Amazon’s treatment of small businesses, workers or anti-trust issues. With Bezos still making the big corporate decisions “real change at Amazon may be hard to detect”.

The “everything store”

Investors should certainly not expect the business model of the so-called “everything store” to change radically under the new management team, says Lex in the Financial Times. Not only will Bezos still “oversee the business” in his new role, even after his departure, but his replacement is also hardly someone who will look to shake things up. Jassy “has been with Amazon for 24 years, joining straight out of Harvard Business School” and is both a “loyal employee and successful business developer”.

Try 6 free issues of MoneyWeek today

Get unparalleled financial insight, analysis and expert opinion you can profit from.

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Still, things are unlikely to remain completely the same, says Jim Armitage in the Evening Standard. The move “could signal a shift in the group’s focus towards more business-to-business operations”. Jassy has successfully run Amazon Web Services (AWS), which now “powers around 45% of the world’s cloud-hosted websites”. AWS was already “the biggest profit generator at Amazon before lockdown”, but with the restrictions driving businesses “to digitise their systems and power them remotely through the cloud”, it has “grown massively since”. There have even been rumours that AWS could be split from the company, though Jassy’s elevation makes this unlikely.

AWS has been “one of Amazon’s jewels”, booking “more than half of its operating profit despite accounting for just 12% of total sales”, says Jennifer Saba on Breakingviews. But it must keep growing fast as the rest of the business faces increased pressure. Operating costs shot up by 42% in the fourth quarter “because costs associated with worldwide shipping rose about two-thirds”. It expects sales volumes to drop by 25% this quarter compared with the previous three months as vaccines and the end of lockdown create more choice about where to buy goods.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

8 of the best properties for sale with minstrels’ galleries

8 of the best properties for sale with minstrels’ galleriesThe best properties for sale with minstrels’ galleries – from a 15th-century house in Kent, to a four-storey house in Hampstead, comprising part of a converted, Grade II-listed former library

-

The rare books which are selling for thousands

The rare books which are selling for thousandsRare books have been given a boost by the film Wuthering Heights. So how much are they really selling for?

-

8 of the best properties for sale with minstrels’ galleries

8 of the best properties for sale with minstrels’ galleriesThe best properties for sale with minstrels’ galleries – from a 15th-century house in Kent, to a four-storey house in Hampstead, comprising part of a converted, Grade II-listed former library

-

The rare books which are selling for thousands

The rare books which are selling for thousandsRare books have been given a boost by the film Wuthering Heights. So how much are they really selling for?

-

How to invest as the shine wears off consumer brands

How to invest as the shine wears off consumer brandsConsumer brands no longer impress with their labels. Customers just want what works at a bargain price. That’s a problem for the industry giants, says Jamie Ward

-

A niche way to diversify your exposure to the AI boom

A niche way to diversify your exposure to the AI boomThe AI boom is still dominating markets, but specialist strategies can help diversify your risks

-

New PM Sanae Takaichi has a mandate and a plan to boost Japan's economy

New PM Sanae Takaichi has a mandate and a plan to boost Japan's economyOpinion Markets applauded new prime minister Sanae Takaichi’s victory – and Japan's economy and stockmarket have further to climb, says Merryn Somerset Webb

-

Early signs of the AI apocalypse?

Early signs of the AI apocalypse?Uncertainty is rife as investors question what the impact of AI will be.

-

8 of the best properties for sale with beautiful kitchens

8 of the best properties for sale with beautiful kitchensThe best properties for sale with beautiful kitchens – from a Modernist house moments from the River Thames in Chiswick, to a 19th-century Italian house in Florence

-

Three key winners from the AI boom and beyond

Three key winners from the AI boom and beyondJames Harries of the Trojan Global Income Fund picks three promising stocks that transcend the hype of the AI boom