Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

This article was first published in MoneyWeek magazine issue no 988 on 27 February 2020. To make sure you don't miss out in future, and get to read all our articles as soon as they're published, sign up to MoneyWeek here and get your first six issues free.

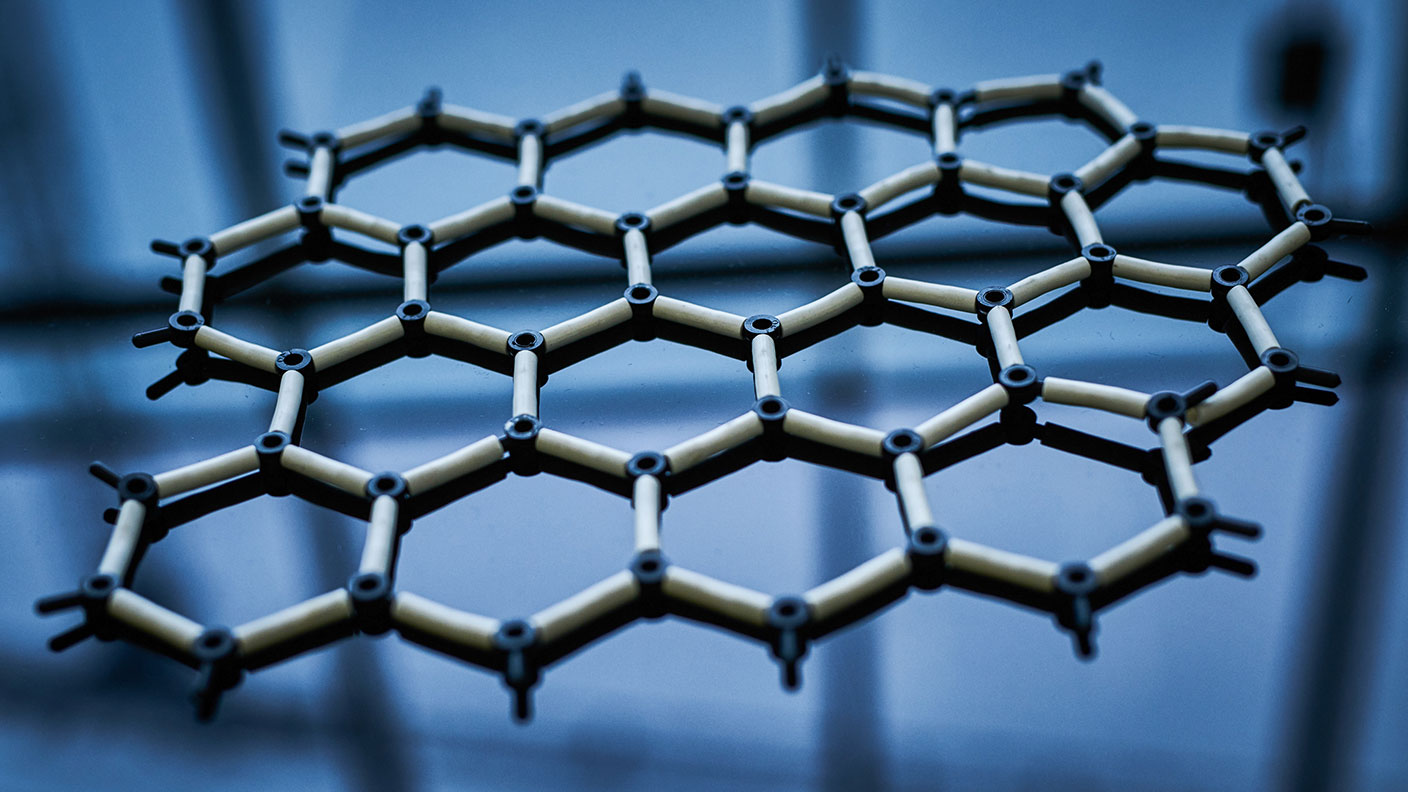

In the past few years you may have heard about graphene, the “miracle material” that will revolutionise everything from bulletproof vests and computer chips to spaceships and water filters. You will certainly be hearing a lot more about it over the next few years.

Graphene is a single layer of carbon atoms arranged in a honeycomb lattice, a form of carbon derived from the graphite you can find in your bog-standard pencil. The substance was first isolated in 2004 by Andre Geim and Kostya Novoselov, professors at the University of Manchester. The pair were trying to construct a transistor with graphite, a process that entailed making the sheets of graphite thinner and thinner.

Article continues belowTry 6 free issues of MoneyWeek today

Get unparalleled financial insight, analysis and expert opinion you can profit from.

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

They placed sticky tape on a pencil lead and peeled off a layer of graphite. They repeated the peeling process until the graphite was one atom thick, then dissolved the tape away, leaving graphene. The discovery earned Geim and Novoselov the Nobel Prize for physics in 2010.

An unusually versatile material...

Despite being a million times thinner than a human hair, graphene is 200 times stronger than steel. It is an excellent conductor of heat and electricity, making it suitable for electronic circuits; it is also extremely flexible, transparent, and can be made water resistant.

So expectations are high. And, clearly, there could be big profits in the offing for the company that could harness all these marvellous qualities. So there is a great deal of money going into researching how best to commercialise graphene.

The EU’s Graphene Flagship project, launched in 2013, aims to bring together industrial and academic researchers from 23 countries to “take graphene from the realm of academic laboratories into European society in the space of ten years”. It reckons the market is worth around €100m a year now, a figure that could climb to €550m by 2025.

China is also throwing its weight behind the research, with the Beijing Graphene Research Institute being founded in 2018. According to Nanowerk.com, which reports on the nanotechnology sector, two thirds of the 31,000 patents that had been granted in the area of graphene production by 2018 went to China.

... with a huge range of applications

Graphene’s flexibility, transparency, durability and conductivity means it can be used for a vast array of purposes. One is touchscreens: the University of Sussex has developed a flexible screen using graphene and silver nanowires that could replace the current brittle screens.

Graphene also has potential in batteries, replacing current lithium-ion ones. Graphene batteries could be smaller, lighter, store more energy and charge up in a matter of seconds. In electronics, traditional silicon-based chips are reaching the limits of what they can do. Their size and conductivity tempers the speeds at which they can operate. Graphene chips can be made much smaller and conduct both heat and electricity much faster.

Not only would a graphene-based integrated circuit chip use less power, it could run up to 1,000 times faster, according to researchers from Northwestern University, The University of Texas, University of Illinois, and University of Central Florida.

The industries adopting graphene

Graphene’s uses are no longer merely theoretical. It is being incorporated into products already. Its extremely low-friction properties mean it is ideal for use in aerospace components that could be less than half the weight of carbon-fibre composites.

Airbus and partners Aernnova and Grupo Antolin-Ingenieria have integrated the material into the leading edge of the tail on the new Airbus A350. As well as being lighter – thus saving fuel – graphene enhances composites’ ability to deal with mechanical and thermal stress, which is important in a component subject to extremes of temperature and pressure.

Graphene composite materials have also been incorporated into bulletproof materials. Durham-based Graphene Composites has developed armour-plating small and light enough to be put into a rucksack and a bulletproof curtain for use in war-torn areas.

It also proposes harnessing power from lightning strikes via graphene-composite conductor cables held aloft by weather balloons. That will almost certainly be a commercial non-starter, but demonstrates the range of uses it could theoretically be put to.

A big bump in the road

So much for the good news. Now for some of the bad. For all its miraculous properties and the fact that you can make it with the contents of any schoolchild’s pencil case, it is proving extremely difficult to produce economically in commercial quantities; researchers have struggled to make more than a few grams. Basing a revolutionary industry on peeling off pencil lead with Sellotape isn’t going to work. So the race is on to produce large quantities of affordable, high-quality graphene.

“Mechanical exfoliation” is the technical term for the Sellotape method. But this doesn’t really scale up for commercial production. Another method with some promise is “chemical vapour deposition” (CVD). This involves reacting methane, which is rich in carbon, with copper to leave sheets of graphene. But this is not ideal either. It is time-consuming, expensive, uses a rather dirty cocktail of chemicals, and does not produce high-quality graphene: it is difficult to remove the resulting graphene sheet from the copper substrate without damaging it.

A third method is “liquid phase exfoliation” (LPE), in which graphite powder is separated into graphene flakes by suspending it in liquid and applying high forces. This method has even been proved to work in a kitchen blender. But none of these methods is ideal. The trouble is quality control. According to Peter Bøggild, writing in Nature magazine in October 2018, much of the “graphene” available from commercial producers should more accurately be described as graphite powder. “Size really matters,” he says. Once you get more than ten layers of graphene together, you’ve really only got a very thin piece of graphite. And that behaves very differently from graphene: “depending on the practical application, graphene and graphite powders can give entirely different results”.

A study published in September 2018 in Advanced Materials, a peer-reviewed scientific journal, tested graphene from 60 producers and concluded “unequivocally that the quality of the graphene produced in the world today is rather poor, not optimal for most applications”.

Most firms were not producing graphene at all, but, rather, “graphite microplatelets”. The fervour surrounding graphene has created “a Wild West for business opportunists”, says Bøggild, who warns that many of graphene’s applications “might never leave the starting block” unless quality control improves.

What next for the sector?

So is it all just pie in the sky? Will it ever be possible to make graphene of good enough quality in commercial quantities, or is the technology just going to wither and die? We can perhaps draw comfort from the story of silicon, which was first isolated in 1824 by Jacob Berzelius, a Swedish chemist. But the first silicon transistor wasn’t made until 1954. And we didn’t get the first personal computers powered by circuits containing silicon chips until around 1977.

So a long gestation period isn’t unusual for such a potentially transformative technology. But the danger is that graphene goes the way of nuclear fusion: technology that is just a few years away from becoming mainstream – and always will be.

Against this backdrop finding companies to invest in is a struggle. Last July, Kate Burgess in the Financial Times warned that the graphene industry was not proving a productive hunting ground for investors, with tales of profit warnings, share-price falls and disappearances of many of the Aim market’s graphene hopefuls.

As a rule of thumb, she says, when investing in “paradigm-shifting ideas”, just “one in ten ventures succeed”. Despite graphene’s many excellent qualities, it “does nothing to stretch the pound in investors’ pockets”. Note too that the Financial Conduct Authority, the City regulator, maintains a “graphene investment scams” warning page.

The companies to keep an eye on

Graphene makers don’t seem to be the best bets. We have previously tipped Applied Graphene Materials (Aim: AGM), which specialises in producing anti-corrosion coatings, along with composites and inks. It is still loss-making, however. Indeed, its operating loss increased in the year to the end of July, and revenue fell by a third. But it has a new CEO, which may improve matters. Other tips have included Hexcel (NYSE: HXL) and Japan’s Toray Industries (Tokyo: 3402), both of which at least make money.

We’ve also highlighted CVD Equipment (Nasdaq: CVV), which focuses on equipment for chemical vapour deposition. It remains loss-making. For a similar speculative punt, you could try Aixtron (Frankfurt: AIXA), a profitable German company in the same subsector.

Aixtron was spun out of Aachen University in 1983 and has been investigating the use of graphene in semiconductors in association with the EU’s Graphene Partnership, and its latest machines enable it to produce single-layer graphene coatings on metal foils and wafers. It has no debt and made a pre-tax profit of €74.7m in the first three-quarters of 2019 on revenues of €184.6m.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.