With its Woodford woes behind it, now could be the time to buy Hargreaves Lansdown shares

Hargreaves Lansdown, the UK’s leading investment platform, has had a tough three years, but the shares look cheap

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

In a Royal Albert Hall speech to the Institute of Directors just over 30 years ago, Gerald Ratner – then head of the world’s biggest jewellery group, with more than 2,500 stores – made a few ill-advised jokes about some of his firm’s products. He even called one “total crap”. The net result was a dramatic plunge in the group’s share price, a slump in sales and the departure of Ratner the next year.

The consistent backing for one-time superstar fund manager Neil Woodford by Bristol-based investment platform Hargreaves Lansdown (LSE: HL.) didn’t appear likely to rival Ratner’s faux pas. Quite the contrary: Woodford had forged a reputation as a top UK stockpicker during his 25 years at Invesco Perpetual. When he left in April 2014 to set up his own operation, Woodford Investment Management, it was hard to see what could go wrong.

And indeed, Woodford got off to a very strong start from a business perspective, with his flagship Woodford Equity Income growing to almost £10bn in assets. The rest is well-known history. Dire performance led to the 2019 suspension and eventual closure of the fund, Woodford’s dismissal as manager and the closure of his firm.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Hargreaves Lansdown’s problem was that its support for Woodford had been too strong and too successful. HL’s clients owned £3.4bn of the flagship fund in 2016. What’s more, the firm kept Woodford Equity Income and the smaller Income Focus fund on its Wealth 50 “best buy” list right up to the time that dealing in Equity Income was suspended.

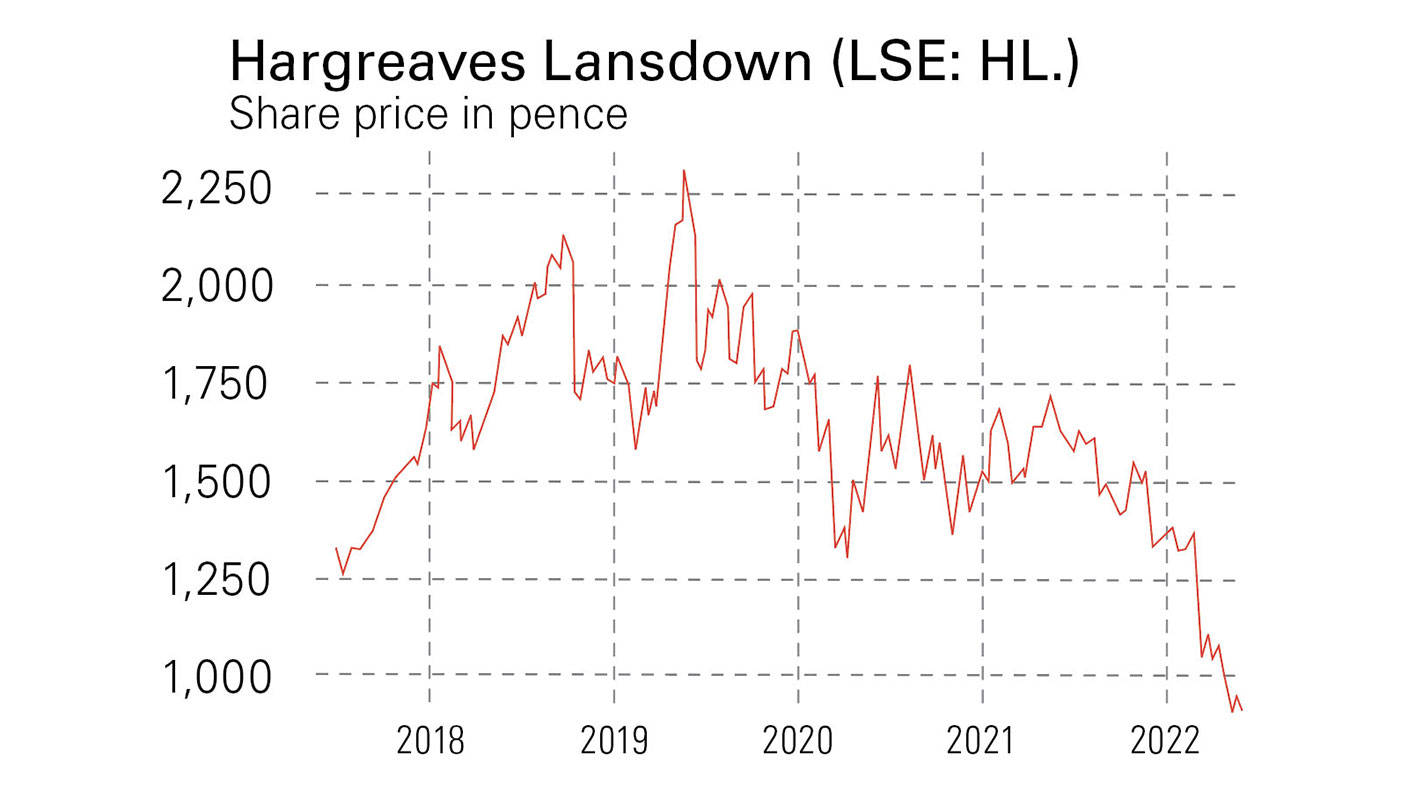

So when Woodford’s reputation turned from gold to mud, some of it stuck to HL. The company had previously been a stockmarket favourite: in May 2019, just before the Woodford woes came to a head, HL’s shares were trading at more than £24 each, up more than ten times over the previous decade. Today they stand at little more than one third of that level following a near-50% decline over the last 12 months.

Prolonging the agony

A lack of decisive action by regulators at the Financial Conduct Authority (FCA) is prolonging the agony in the eyes of some. “Four years since the suspension of the Woodford fund, there still hasn’t been any official report… there needs to be a certainty that people who were participants in that need to be sued or exonerated,” said Nick Train of Lindsell Train, which holds HL, at a recent event.

It would be wrong to attribute all the blame for HL’s share price plunge on the Woodford scandal. “I think it’s right to call out the FCA, but it has been years since this thing went wrong,” Mike Barrett of The Lang Cat, a financial services consultancy, tells FT Adviser. “For the majority of Hargreaves’ customers, Woodford [has caused] reputational damage at best, rather than anything direct.”

Instead, HL’s shares have also suffered badly from events, such as Russia’s invasion of Ukraine, that have rattled markets. In the firm’s update for the four months ended 30 April 2022, CEO Chris Hill laments “the challenging backdrop driven by unprecedented macro-economic and geo-political events that has impacted markets and investor confidence”. What’s more, Train has also cited HL’s lack of investment in its own platform as another problem. “For years we’ve been badgering Hargreaves to stop paying so much out in special dividends and to invest more in the functionality [of its investment platform]”, he said.

So the firm has had issues. Yet it remains the UK’s leading platform for DIY investors, with a 43% market share by assets under administration (AUA) and 40% by execution only (XO) stockbroking revenues. By now the plunge in the share price must surely be discounting the worst of the Woodford saga damage. This decline could be providing opportunities for investors to snap up this well-placed business at a bargain price.

Still delivering strong profits

In its trading update on 12 May, Hargreaves Lansdown reported client growth of 90,000 since 1 July 2021. Net new business totalled £4.8bn and assets under administration (AUA) amounted to £132.3bn at 30 April 2022.

Although the latter figure represents a drop from £141.2bn as at the end of December 2021, administered assets would have been £2.5bn higher but for adverse market movements of £11.4bn. What’s more, all these numbers compare favourably with the end of December 2020 AUA of £120.6bn, which in turn was 16% higher than as at 31 December 2019. The 2022 year-to-date client retention rate is 92.4%.

Revenue for the four months to 30 April 2022 met expectations at £196.5m, compared with £233.2m for the corresponding period in 2021. The company has reiterated its guidance for the current accounting year.

Analysts’ average earnings per share (EPS) estimates for the 12 months to the end of June 2022 are 48p, rising slightly to 49p for the following 12 months. Granted, these forecasts contrast with EPS for the year to 30 June 2021 of 62.5p. They put the stock on a forward price/earnings (p/e) ratio of 17.5, which – though a lot cheaper than in the recent past – still isn’t screamingly low. But HL has historically attracted a premium valuation due to its earnings quality. Further, the 40p per share dividend forecast for the year to the end of June 2022 puts it on an appealing 4.7% yield.

Clearly there are risks, of which the most obvious is that the Woodford issues may continue to weigh on sentiment. Beyond that, the share price has moved broadly in line with UK equity markets in the past. These could suffer if interest rates are raised higher than expected or if the economy continues to slow. Russia’s invasion of Ukraine adds to the uncertainty. Still, at its current depressed level, Hargreaves Lansdown could be a great long-term recovery play.

SEE ALSO:

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

David J. Stevenson has a long history of investment analysis, becoming a UK fund manager for Oppenheimer UK back in 1983.

Switching his focus across the English Channel in 1986, he managed European funds over many years for Hill Samuel, Cigna UK and Lloyds Bank subsidiary IAI International.

Sandwiched within those roles was a three-year spell as Head of Research at stockbroker BNP Securities.

David became Associate Editor of MoneyWeek in 2008. In 2012, he took over the reins at The Fleet Street Letter, the UK’s longest-running investment bulletin. And in 2015 he became Investment Director of the Strategic Intelligence UK newsletter.

Eschewing retirement prospects, he once again contributes regularly to MoneyWeek.

Having lived through several stock market booms and busts, David is always alert for financial markets’ capacity to spring ‘surprises’.

Investment style-wise, he prefers value stocks to growth companies and is a confirmed contrarian thinker.

-

How a ‘great view’ from your home can boost its value by 35%

How a ‘great view’ from your home can boost its value by 35%A house that comes with a picturesque backdrop could add tens of thousands of pounds to its asking price – but how does each region compare?

-

What is a care fees annuity and how much does it cost?

What is a care fees annuity and how much does it cost?How we will be cared for in our later years – and how much we are willing to pay for it – are conversations best had as early as possible. One option to cover the cost is a care fees annuity. We look at the pros and cons.