This fintech stock is part of the future of money

Financial technology stocks have sold off in recent months, but companies such as SoFi Technologies offer attractive long-term prospects

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

Financial technology stocks – the fintech companies disrupting how we use and manage money in the digital age – have struggled in difficult markets this year. Their 30% fall is almost twice that of technology stocks generally and nearly three times the US stockmarket overall. You might well begin to think the much-heralded financial revolution from a sector that’s given us star stocks like Paypal and Square (now called Block) has collapsed. But this isn’t true – get it right and the potential rewards from using technology to muscle in on the daily financial needs of hundreds of millions of people every hour of every day remain huge, with double-digit long-term growth rates widely predicted.

The setback is less a loss of confidence in fintech as a concept, and more a correction of stockmarket overexuberance. The pandemic saw big take-up of fintech apps for sending money, buying goods or even trading cryptocurrency online. The companies involved – whether dealing with consumers or automating the back-office – were able to leapfrog years in their business plans overnight. The big opportunities inherent in the digitisation of finance were hitting home with a broadening investor audience.

Excitement led predictably to over-reaction. The fall-out now is reality being baked into prices alongside broader concerns about inflation, interest rates and geopolitics.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Fintech is big but the potential will be realised over years, not months. The weak sentiment is as frustrating for companies as for investors. There are businesses delivering on promises and exceeding expectations, yet their share prices languish. However, these are opportunities if you take a long-term view.

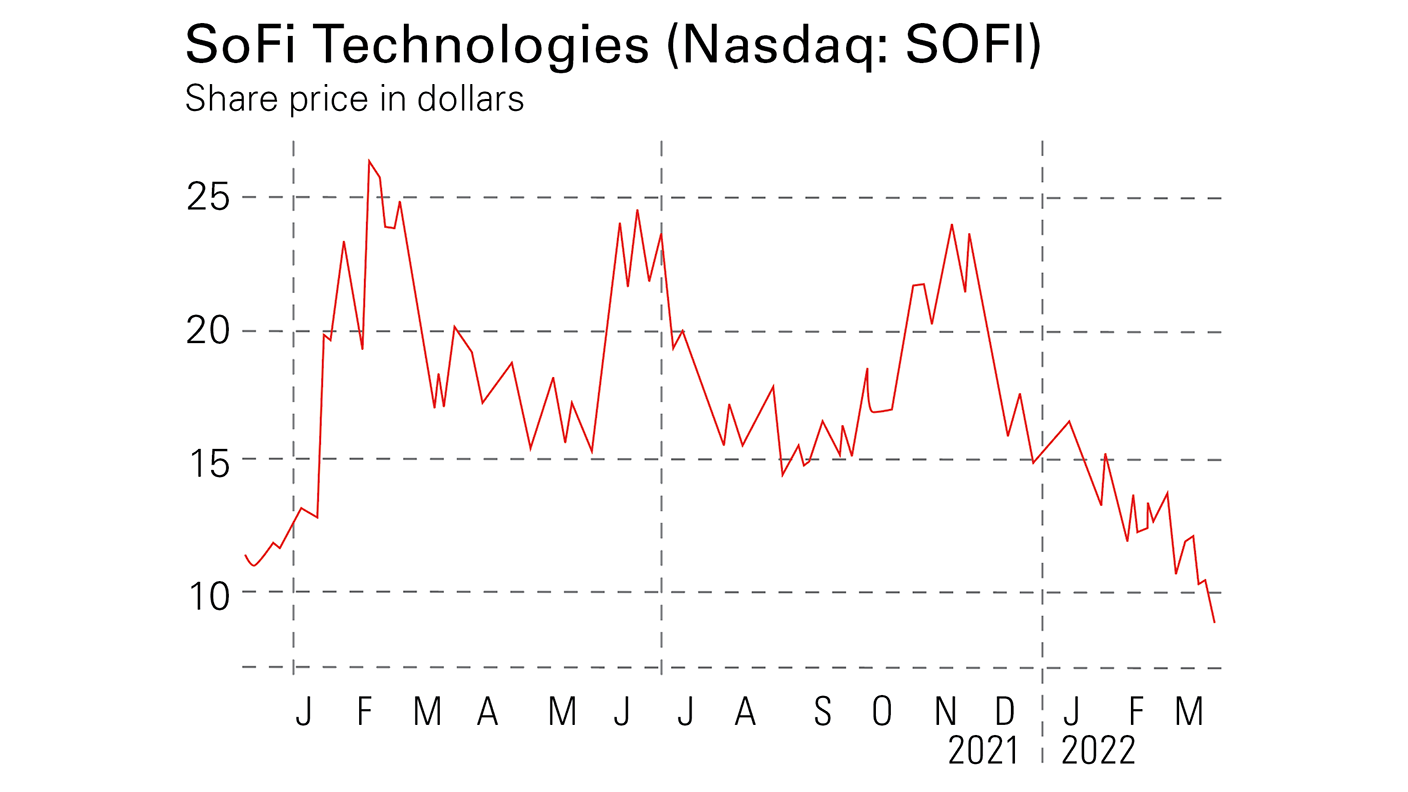

A rollercoaster ride

A good example is small but fast-growing US fintech SoFi Technologies (Nasdaq: SOFI). This business started a decade ago at Stanford University to provide affordable education loans for students using alumni money – the name was originally formed from “Social Finance”. The group is still active in lending, but it’s no longer confined to students – it’s become a broader online financial services provider operating nationwide.

SoFi joined the stockmarket last spring by merging with a special purpose acquisition company (Spac). It hit a high of $24.95 soon after the merger was complete, but the stock has now fallen back to just under $8, an all-time low. But this rollercoaster run is hard to reconcile with the company’s solid financial performance.

Chief executive Anthony Noto – who was formerly chief financial officer at Twitter – recently announced record results with adjusted sales last year climbing over 60% to $1bn for the first time. The company has exceeded its own forecasts for adding new registered clients – what it calls “members” – to reach 3.5 million, up by 87% from the start of the year. And it lifted product sales significantly.

SoFi also announced it’s now a bank in its own right. This gives market presence and should lift margins as it can now take deposits and use these to fund loans directly. It can set its own interest rates and keep this rather than sharing with third party loan providers. That should be beneficial as interest rates rise.

A wide range of services

SoFi has also completed its $1.1bn acquisition of Technisys, an innovative, cloud-based banking technology solution business that can help make its platforms best-in-class, as well expand its existing offering of financial technology capability to third parties.

The company is upbeat and said it will beat analysts’ estimates. Lower costs as a bank, accelerating sales and a rising need for consumer credit in an inflationary environment are positive. Moreover, the breadth of its financial offerings from lending to investing is rare in a relatively young company and in a sector that is dominated by companies focused on one or two narrower activities such as payment processing. What’s more, SoFi’s technological innovation is appealing to younger, newer generations, which should keep working in its favour too.

Analysts see sales rising over 40% a year near term with widening margins. SoFi is small and speculative but, given its record and positive outlook, the depressed price seems close to the bottom, suggesting decent upside appreciation over the next few years.

SoFi’s strong momentum

San Francisco-based SoFi Technologies offers a wide range of online services. These include current and savings accounts – with innovations like early paycheque cashing and cashback deals – as well as issuing credit cards. It also offers cryptocurrency dealing, limit trading and access to public offers including electric carmaker Rivian, last year’s big new issue. Lending accounted for 26% of sales in late 2021 versus 57% in 2020.

These activities suggest scope to deliver in varied conditions. This is augmented by the tech services SoFi offers to companies building their own industry presence. Fintech is a growth area and the firm is investing to build on the $195m of sales last year from delivering technology and know-how to other businesses.

Management sees group sales growing 55% to about $1.6n in this first year as a fully-fledged bank. The key is its “one-stop shop” offering, and using this to attract and retain “members” (through product offers, rewards and general financial and careers advice) and cross-selling across the board. The pandemic-related federal-government moratorium on student loan repayments should be gone by May, paving the way for a resumption in student refinancing, an area where it is active.

Fintech competition is stiff but SoFi’s management deserves credit for delivering on its promises while driving sales faster than anticipated. The underlying business continues to show positive momentum, yet the shares are at nearly $8 – almost a third of their peak last year – giving it a total market cap of $6.6bn. SoFi could appeal to those who like to take a bit of risk and who might reasonably expect to see the price back in the teens over the medium term.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Stephen Connolly is the managing director of consultancy Plain Money. He has worked in investment banking and asset management for over 30 years and writes on business and finance topics.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how

-

Three key winners from the AI boom and beyond

Three key winners from the AI boom and beyondJames Harries of the Trojan Global Income Fund picks three promising stocks that transcend the hype of the AI boom

-

RTX Corporation is a strong player in a growth market

RTX Corporation is a strong player in a growth marketRTX Corporation’s order backlog means investors can look forward to years of rising profits

-

Profit from MSCI – the backbone of finance

Profit from MSCI – the backbone of financeAs an index provider, MSCI is a key part of the global financial system. Its shares look cheap

-

'AI is the real deal – it will change our world in more ways than we can imagine'

'AI is the real deal – it will change our world in more ways than we can imagine'Interview Rob Arnott of Research Affiliates talks to Andrew Van Sickle about the AI bubble, the impact of tariffs on inflation and the outlook for gold and China

-

Should investors join the rush for venture-capital trusts?

Should investors join the rush for venture-capital trusts?Opinion Investors hoping to buy into venture-capital trusts before the end of the tax year may need to move quickly, says David Prosser

-

Food and drinks giants seek an image makeover – here's what they're doing

Food and drinks giants seek an image makeover – here's what they're doingThe global food and drink industry is having to change pace to retain its famous appeal for defensive investors. Who will be the winners?

-

Barings Emerging Europe trust bounces back from Russia woes

Barings Emerging Europe trust bounces back from Russia woesBarings Emerging Europe trust has added the Middle East and Africa to its mandate, delivering a strong recovery, says Max King

-

How a dovish Federal Reserve could affect you

How a dovish Federal Reserve could affect youTrump’s pick for the US Federal Reserve is not so much of a yes-man as his rival, but interest rates will still come down quickly, says Cris Sholto Heaton