Duke Royalty: a princely return for income investors

Britain’s only listed royalty-finance company chooses its clientele wisely, making it a compelling income play

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

With interest rates well below inflation, it is difficult to find deposit accounts offering over 0.4%. I have therefore previously highlighted several large, stable companies with modest dividend yields just above deposit-account returns, but with reasonable growth prospects. This month I am recommending a smaller company with a unique business model that enables it to offer a much higher yield with moderate risk.

The company is Duke Royalty (Aim: DUKE), which lends companies money in return for a royalty on future sales. It provides finance at a lower cost than private equity and does not take control away from the owners, as private-equity lenders do.

Duke typically offers between £5m and £20m and can give a decision on making the money available in about eight weeks. The royalty agreement can be likened to a corporate mortgage where both principal and royalty are paid back over a period of 25 to 40 years. The initial yield on Duke’s investment is 12%-14% of capital provided and the royalty rate is reset upwards or downwards each year (between a 6% increase and a 6% fall, depending on the client’s sales performance), so Duke participates consistently in a client’s growth. The company can buy back the royalty after three years by paying the initial principal along with a 20% redemption premium.

Try 6 free issues of MoneyWeek today

Get unparalleled financial insight, analysis and expert opinion you can profit from.

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Royalty finance

Royalty finance is well established in North America, where it is a $50bn sector, and Duke has brought the idea to the UK and Europe. Duke is the only listed UK royalty company, having taken over its only British competitor, Capital Step, in 2019. Typical clients are well-established, profitable, owner-managed medium-sized businesses wishing to expand by acquisition, buy out a minority shareholder, or finance a management buyout from a larger company.

Duke tempers the risk in its investments by stipulating that royalty payments should be worth significantly less than 50% of a company’s cash flow. Duke seeks firms with a sustainable competitive advantage. It avoids start-ups, oil and gas, mining and biotech companies, and aims to diversify by industry and geography. Two of Duke’s typical client companies are United Glass Group (UGG) and Brightwater Selection. UGG is one of the UK’s leading glass merchants and processors. Duke provided it with funding of £6.5m in April 2018, which allowed it to refinance existing debt and buy out a minority equity stake in a key subsidiary. A second investment of £4.5m facilitated the acquisition of London Architectural Glass and purchase of a key facility’s freehold.

Brightwater Selection, a recruitment company, was a management buyout funded with £1.9m from Duke. A further £7.7m was provided to Brightwater in January 2020 to acquire PE Global, a leading healthcare and life sciences recruiter in Ireland. Duke’s results for the year to the end of March 2020, the last before the virus, show that it had 12 royalty partners (clients) and made substantial follow-on investments in three of them, so that £20.4m of new capital was deployed during the year.

To finance expansion, it raised new equity of £17.5m and refinanced a revolving credit facility on better terms; the facility was also increased to £30m. Cash revenue for the year was £10.4m, up by 91%, with net cash inflow from operating activities £6.8m, up by 65%, and total dividends for the year 2.95p per share, up by 5%. Given the uncertainties in 2020 about the effects of Covid-19, Duke wisely preserved cash by paying the first two quarterly dividends of 2020/2021 as scrip dividends of 0.5p.

Still, the positive trading update for the third quarter of 202/2021 said the cash position had improved, so a cash dividend of 0.5p was paid. The results for the year to the end of March 2021 showed operating net cash flow up to £8.94m from £6.78m in 2020 and £4.11m in 2019. The 2020/2021 results encompassed the virus period and demonstrated the resilience of Duke’s royalty model.

A juicy and growing dividend

Duke’s costs are fixed so increases in revenue work straight through to the bottom line. It is therefore encouraging that 2021 has so far seen five new royalty deals, including a £6.2m investment in Fabrikat (a well-established steel fabricator), and a new €10m agreement in June with Fairmed Healthcare Group of Switzerland .

There were more deals in July, August and September. Further investments have been made into existing partners, such as £6.5m in UGG to fund another acquisition. The first royalty partner in North America has been secured. Three exits so far in 2021 have raised £18m. Duke has liquidity of more than £55m to fund its growing pipeline of opportunities.

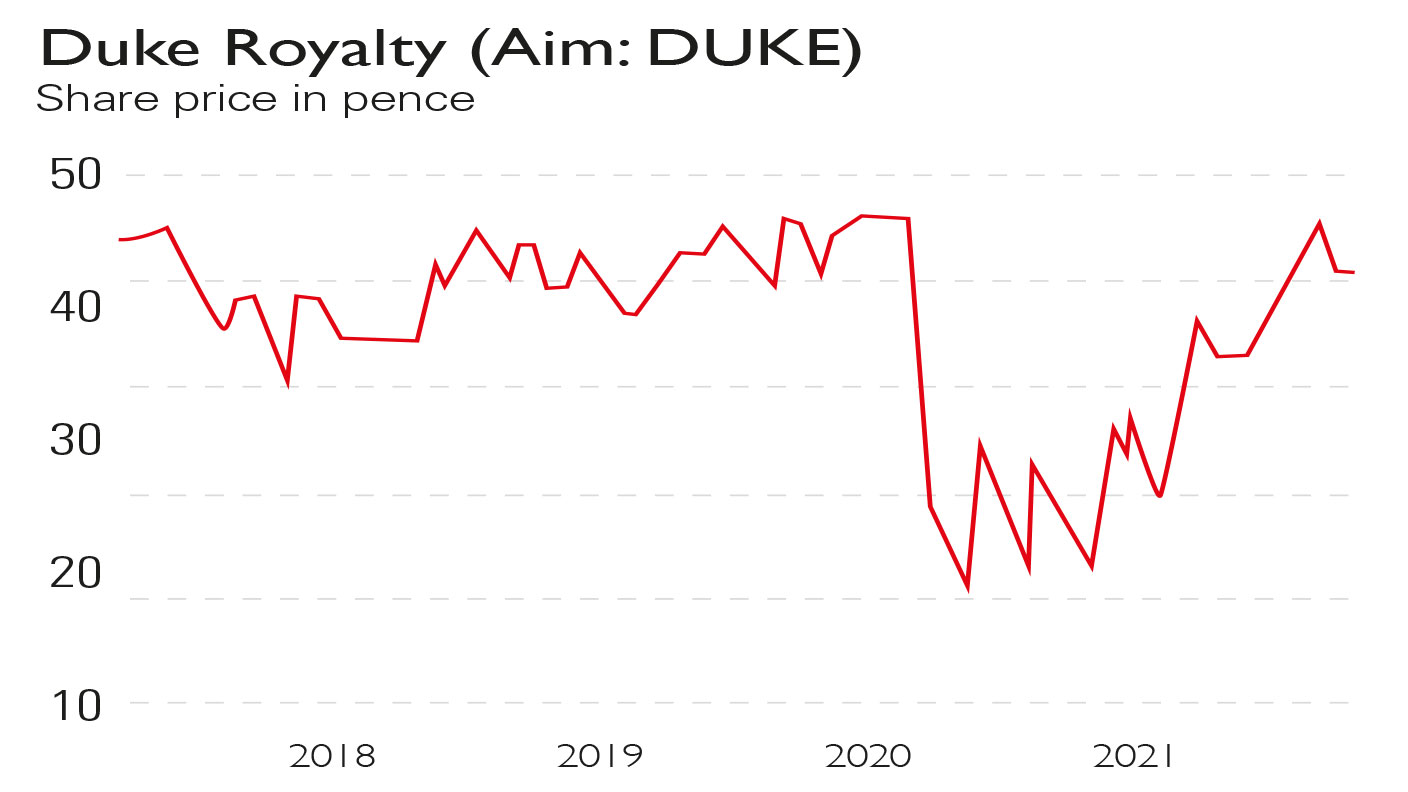

In assessing Duke as an investment, the key issue is whether the dividend can increase. This is determined by the number of new royalty partners and whether partners are well chosen and can grow their businesses to increase royalty payments. The virus in 2020 provided a stiff test of clients’ quality and it is reassuring that the key measure of operating cash flow per share has increased from 2019 to 2020 and then again, to 3.68p per share, in 2021. This gives investors confidence in Duke’s prospects. Its shares cost 50p in late 2019, fell to 19p and are now around 43p. Dividends of 2.25p were paid in 2020-2021, giving a trailing yield of 5.3%. The annual dividend yield has ranged from 5% to 8% since flotation in 2017.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Highly qualified (BSc PhD CPhys FInstP MIoD) expert in R&D management, business improvement and investment analysis, Dr Mike Tubbs worked for decades on the 'inside' of corporate giants such as Xerox, Battelle and Lucas. Working in the research and development departments, he learnt what became the key to his investing; knowledge which gave him a unique perspective on the stock markets.

Dr Tubbs went on to create the R&D Scorecard which was presented annually to the Department of Trade & Industry and the European Commission. It was a guide for European businesses on how to improve prospects using correctly applied research and development.

He has been a contributor to MoneyWeek for many years, with a particular focus on R&D-driven growth companies.

-

What do rising oil prices mean for you?

What do rising oil prices mean for you?As conflict in the Middle East sparks an increase in the price of oil, will you see petrol and energy bills go up?

-

Rachel Reeves's Spring Statement – live analysis and commentary

Rachel Reeves's Spring Statement – live analysis and commentaryChancellor Rachel Reeves will deliver her Spring Statement today (3 March). What can we expect in the speech?

-

Three Indian stocks poised to profit

Three Indian stocks poised to profitIndian stocks are making waves. Here, professional investor Gaurav Narain of the India Capital Growth Fund highlights three of his favourites

-

UK small-cap stocks ‘are ready to run’

UK small-cap stocks ‘are ready to run’Opinion UK small-cap stocks could be set for a multi-year bull market, with recent strong performance outstripping the large-cap indices

-

Hints of a private credit crisis rattle investors

Hints of a private credit crisis rattle investorsThere are similarities to 2007 in private credit. Investors shouldn’t panic, but they should be alert to the possibility of a crash.

-

Investing in Taiwan: profit from the rise of Asia’s Silicon Valley

Investing in Taiwan: profit from the rise of Asia’s Silicon ValleyTaiwan has become a technology manufacturing powerhouse. Smart investors should buy in now, says Matthew Partridge

-

‘Why you should mix bitcoin and gold’

‘Why you should mix bitcoin and gold’Opinion Bitcoin and gold are both monetary assets and tend to move in opposite directions. Here's why you should hold both

-

Invest in the beauty industry as it takes on a new look

Invest in the beauty industry as it takes on a new lookThe beauty industry is proving resilient in troubled times, helped by its ability to shape new trends, says Maryam Cockar

-

Should you invest in energy provider SSE?

Should you invest in energy provider SSE?Energy provider SSE is going for growth and looks reasonably valued. Should you invest?

-

Has the market misjudged Relx?

Has the market misjudged Relx?Relx shares fell on fears that AI was about to eat its lunch, but the firm remains well placed to thrive