Intuit: an instinct for business

Intuit, the tax and accounting-software firm, is perfectly placed to profit from the spread of self-employment

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

Many hope that Covid-19 lockdowns will lead to a permanent shift to more working from home. In fact, people have been opting for different ways of working for years. Hordes of entrepreneurs didn’t need a pandemic to ditch the daily grind and set out to work where, when and how they wanted. They just got on with it.

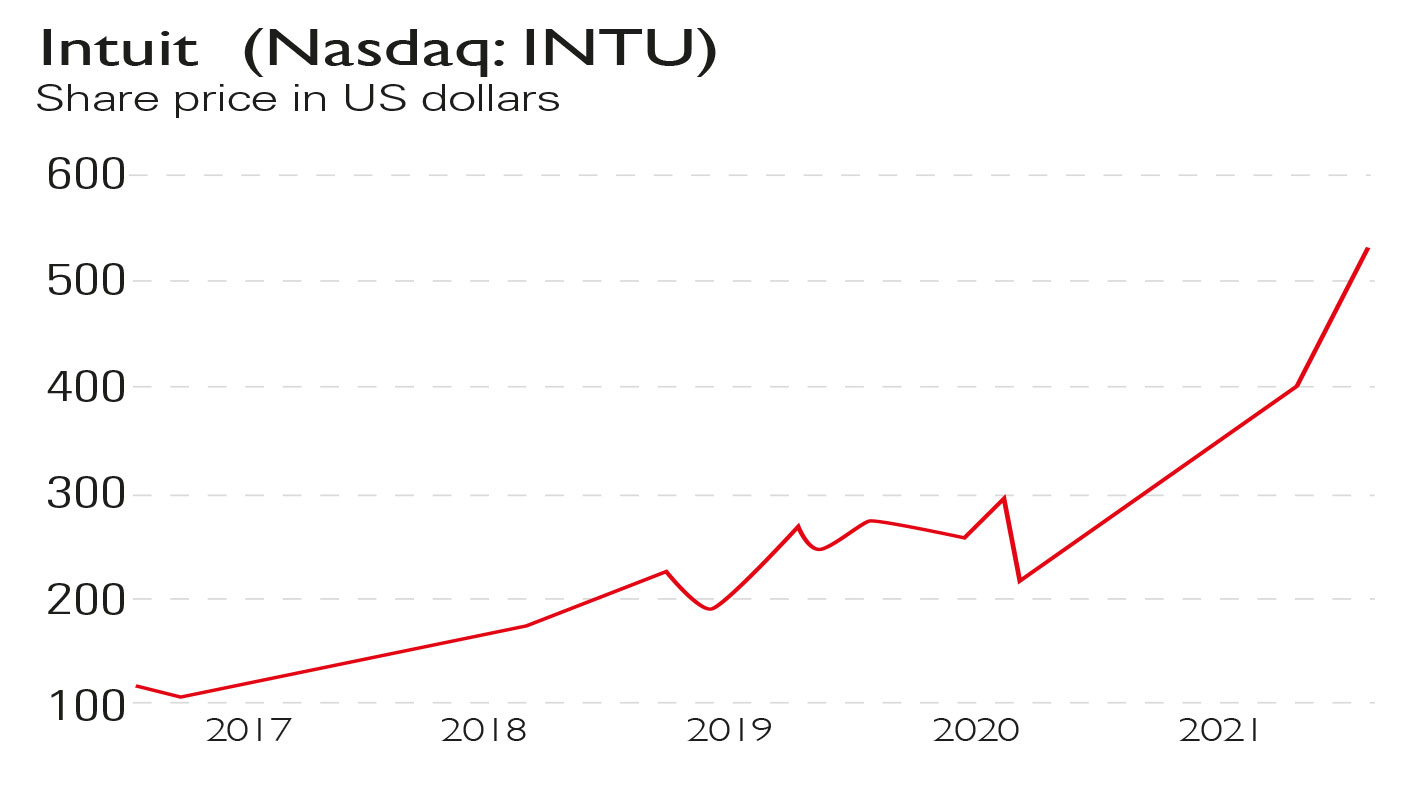

The success of growing numbers of small businesses, entrepreneurs, freelancers and the self-employed provide a tailwind for Intuit (Nasdaq: INTU), which sells tax and accounting software. It is worth $146bn today, but in the early 1980s it was a kitchen-table start-up in San Francisco. It designed its first software package – Quicken – to help US taxpayers with their official returns. This was before Windows was even launched.

Quicken gained traction and Intuit went on to develop its range of services and products to assist not only individuals but also small businesses. The socio-economic backdrop of the 1980s, with free-market leaders such as Ronald Reagan and Margaret Thatcher promoting enterprise, proved auspicious. Nowadays, Intuit’s activities are built around three key areas with solid brand recognition: TurboTax for personal and business-tax administration; QuickBooks, which offers accounting and financial management for small businesses; and Credit Karma, a recent acquisition offering credit reports and helping people manage their personal finances to improve their credit scores and eligibility for products such as mortgages and car loans.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

All this is likely to add up to a record-breaking $9.5bn of sales in the current financial year, up by a fifth on the previous 12 months, with another breakthrough to nearly $11bn next year. These are impressive numbers, coming on the back of a long record of mostly solid “organic” growth. This is the type of expansion that is “home- grown, rather than created by buying other businesses to boost the numbers, so it is highly prized by the market.

Investors are optimistic because more and more people need to do tax returns and they’re getting more complex. Workers are increasingly running small businesses on the side in the burgeoning gig-economy, while people are always tempted to become self-employed.

During Covid-19, moreover, there has been a sharp rise in new companies being registered as far afield as the US, UK, France, Germany and Japan. Food delivery, and stock trading are just two growth areas.

Covid-19 has accelerated the shift towards self-employment, but digitisation is the underlying cause. Until a few years ago, only big businesses could afford to build a fully-functioning sales presence online.

But now anyone has access to apps and sites such as marketplaces to be used as shopfronts (Shopify is an example). Meanwhile, advertising and influencers pull in customers, while the rapid rise in couriers to deliver goods has also helped. Start-ups can now acquire credibility and the means to build scale quickly and cheaply.

They need help with book keeping, budget management, invoice production, bill paying, payment tracking, and stock management. Intuit presents its services as an “ecosystem” offering everyone a one-stop shop keeping customers close.

Intuit arguably knows more about people’s tax and business affairs than anyone else, which means plenty of cross-selling opportunities. The company has what it takes to maintain its strong position in this growth sector and should see off rivals.

A winner to buy on the dips

Intuit has always enjoyed a strong and loyal shareholder fan base, and they had plenty to smile about after the group’s latest quarterly figures were released in May.

Quarterly sales of $4.2bn and earnings per share of $6.07 met the group’s own forecasts. Performance was strong across the board, with the Credit Karma credit-reference division achieving record quarterly revenues of $316m.

Of the two dozen analysts covering Intuit, almost all recommend buying the shares and see them continuing to beat the broader market.

The consensus forecast is for sales to hit $10.9bn in 2022, up from $7.7bn in the last full year reported. Operating cash flow should reach $4.3bn, up from $2.4bn.

I see nothing to disrupt the ongoing trend of more small businesses, freelancers and the self-employed as people eschew corporate life in favour of going it alone. There is plenty of official data to support this. In the UK, for example, since 1980 the number of individual self-employed workers has nearly tripled, according to the Institute for Fiscal Studies.

Intuit has demonstrated that it knows how to serve these users, and its competitors look highly unlikely to catch up with it.

Note too that only 5% of sales currently take place outside the US so there are big opportunities to build a presence in foreign markets – entrepreneurialism is everywhere.

The stock should therefore keep outperforming. The shares don’t look cheap on a forward price/earnings (p/e) multiple of around 50 but the short and long-term record vindicate confidence in the management and the business model. Long-term investors can confidently pick up the shares in this high-quality growth business during periods of market weakness.

Stephen Connolly writes on markets and finance and has worked in investment banking and asset management for nearly 30 years (sc@plainmoney.co.uk)

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Stephen Connolly is the managing director of consultancy Plain Money. He has worked in investment banking and asset management for over 30 years and writes on business and finance topics.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how

-

Three key winners from the AI boom and beyond

Three key winners from the AI boom and beyondJames Harries of the Trojan Global Income Fund picks three promising stocks that transcend the hype of the AI boom

-

RTX Corporation is a strong player in a growth market

RTX Corporation is a strong player in a growth marketRTX Corporation’s order backlog means investors can look forward to years of rising profits

-

Profit from MSCI – the backbone of finance

Profit from MSCI – the backbone of financeAs an index provider, MSCI is a key part of the global financial system. Its shares look cheap

-

'AI is the real deal – it will change our world in more ways than we can imagine'

'AI is the real deal – it will change our world in more ways than we can imagine'Interview Rob Arnott of Research Affiliates talks to Andrew Van Sickle about the AI bubble, the impact of tariffs on inflation and the outlook for gold and China

-

Should investors join the rush for venture-capital trusts?

Should investors join the rush for venture-capital trusts?Opinion Investors hoping to buy into venture-capital trusts before the end of the tax year may need to move quickly, says David Prosser

-

Food and drinks giants seek an image makeover – here's what they're doing

Food and drinks giants seek an image makeover – here's what they're doingThe global food and drink industry is having to change pace to retain its famous appeal for defensive investors. Who will be the winners?

-

Barings Emerging Europe trust bounces back from Russia woes

Barings Emerging Europe trust bounces back from Russia woesBarings Emerging Europe trust has added the Middle East and Africa to its mandate, delivering a strong recovery, says Max King

-

How a dovish Federal Reserve could affect you

How a dovish Federal Reserve could affect youTrump’s pick for the US Federal Reserve is not so much of a yes-man as his rival, but interest rates will still come down quickly, says Cris Sholto Heaton