Resideo Technologies: a cheap play on the smart-home revolution

Resideo Technologies, a US maker of smart-home devices, has languished in obscurity since it was spun off from its giant parent

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

Security cameras or heating thermostats that can be monitored with a mobile phone are already important tools for many households. The smart-home transformation can automate our daily lives and help protect our homes and families from threats. So this market is set to grow further, but while leading technology companies like Microsoft and Amazon provide the power to deal with all the data it will produce, there are cheaper ways to play this theme.

The established tech players are clearly crucial as they bring the necessary scale – untold numbers of security cameras are set-off every hour, for example, and owners must be alerted wherever they are on their mobile phones. However, without the gadgets doing the monitoring there’s no data to act on. This means the much smaller niche-players that produce, distribute and install all manner of monitors and sensors will also play a key role in connecting our homes.

An unloved orphan

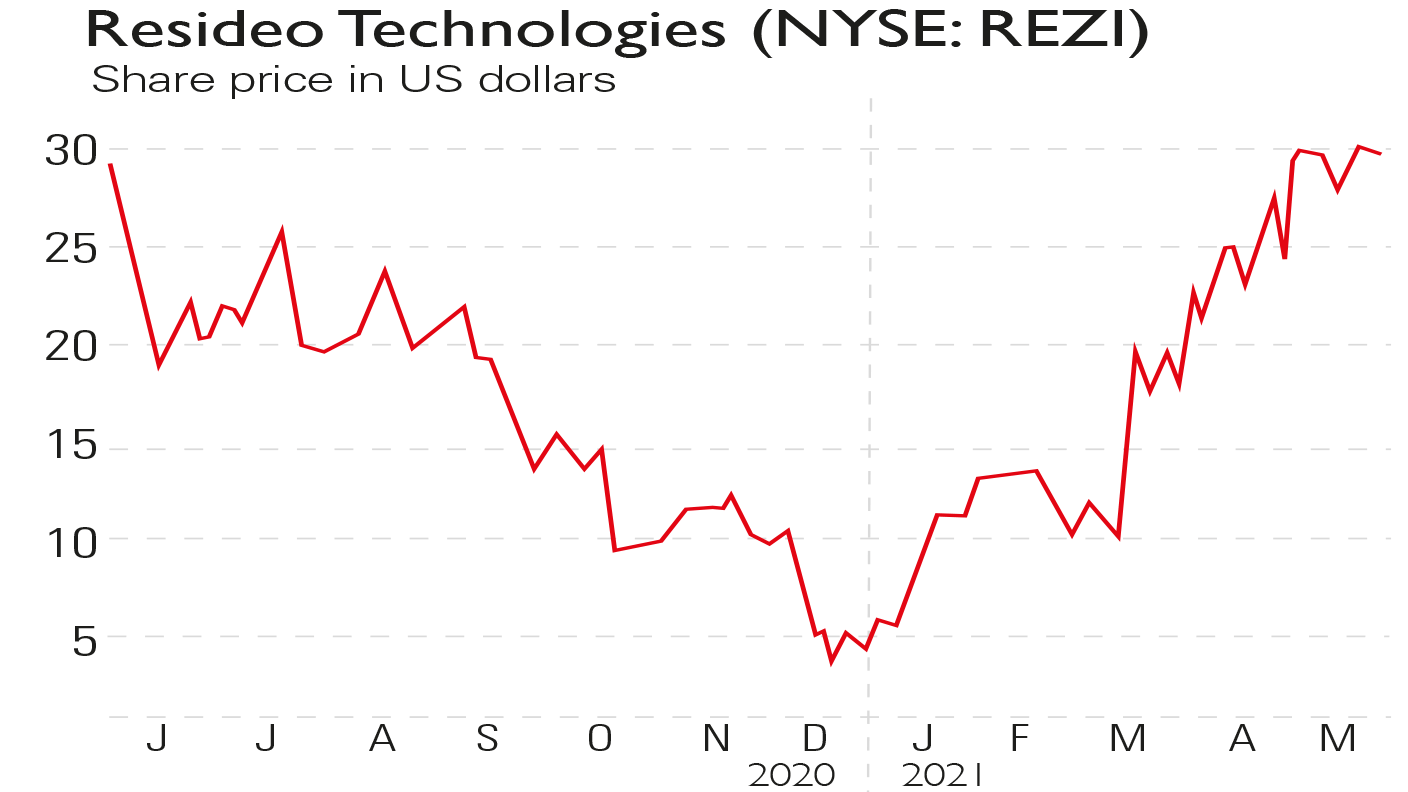

One in this area that stands out as undervalued is Texas-based Resideo Technologies (NYSE: REZI), a $4bn company spun-out of Honeywell, the global industrial conglomerate, in 2018. As often happens when losing a parent company, Resideo’s shareholder support drifted away and interest from analysts dropped because it’s so small compared to the group it left. The result is relative obscurity in stockmarket terms, which in part explains why the shares languish at $29 and a price/earnings (p/e) ratio of 14.5 (a sizeable 50% discount to the market). This looks very attractive given that Resideo is expected to grow earnings by over 20% a year.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Held back by a poor start

Still, it’s difficult to find companies with a good story, double-digit growth and a low valuation, raising the question of why Resideo remains so cheap almost three years after it became an independent company. The shares have been held back by a rocky first year when it undoubtedly lost support because of some poor forecasting and expectation management. Under-delivering earnings and reporting crushed margins all took their toll. From that low point, Resideo has been a turnaround play.

Under new management

The current chief executive, Jay Geldmacher, joined about a year ago: he is a 30-year veteran who’s already led a spin-out company in the industrial technology area and has a record of delivering results. In the last quarter, sales were up 20% to $1.4bn over the year, margins climbed to 25.9% and operating profits grew strongly.

There’s still much to do but Resideo is making the right progress. Its annual sales are around $5bn but it sees a $110bn addressable market across its product and distribution activities. And it has a strong base from which to secure more business in a fragmented marketplace – its products, such as movement and glass-break sensors, cameras, and leak and carbon monoxide monitors, are already present in 150 million homes worldwide and it’s the number-one distributor of security devices. There is also the likelihood that people will increasingly pay to have equipment correctly fitted and maintained, as well as buying products for DIY solutions. Resideo serves both markets to differing degrees.

Resideo's green credentials

In an age when environmental issues are coming to the fore, creating greener or healthier homes can be a sales driver. Remote systems can significantly reduce energy usage and expenditure, as well as other waste (a hidden pipe that drips once a second wastes 2,700 gallons of water a year). Airflow and conditioning devices are also important, given that indoor air quality is often worse than outdoors.

So a lot of the right buttons are being pushed here: green credentials, links to hot tech themes (see below), strong growth and a 50% valuation discount to the market. Given the stock is so cheap, the downside seems limited. Resideo is worth a look.

An overlooked play on popular tech themes

Resideo’s activities of home sensor and device production and distribution aren’t what investors view as strong tech plays, but the firm is operating within the big tech theme of connecting our homes with our devices. It’s also riding on some themes that have been setting other sectors alight – think of the adoption of the 5G mobile network for connecting everything, the remote internet cloud for the vast processing needed, and the internet of things (the term for networking everything from home appliances to cars to medical monitoring and diagnostic equipment).

So while Resideo isn’t going to trade on the heady ratings of mainstream tech stocks, it deserves to be trading higher than it is, given new management is making progress and the turnaround appears to be gaining traction. If management continues to deliver sales in line with or above guidance while building margins, that will attract broader investor interest.

There are currently only about half a dozen analysts covering the stock and their views vary widely. There is some consensus for the idea that the shares should be able to reach a price of $36, from the current $29, but this is probably a bit too conservative. Trying to value it somewhere between its competitors on both the product and distribution side – such as Allegion, Acuity Brands or Wesco – could suggest a price target of above $40 over the next year, if the company stays on track.

It’s worth noting that Resideo is not entirely hidden below the parapet. Billionaire US investor David Einhorn, the founder of hedge fund Greenlight Capital, highlighted what he called the fund’s “medium-sized” position in Resideo in its investor letter earlier this year. He too suggested earnings should grow strongly and seemed happy continuing to hold the shares as turnaround progress continues.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Stephen Connolly is the managing director of consultancy Plain Money. He has worked in investment banking and asset management for over 30 years and writes on business and finance topics.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how

-

Three key winners from the AI boom and beyond

Three key winners from the AI boom and beyondJames Harries of the Trojan Global Income Fund picks three promising stocks that transcend the hype of the AI boom

-

RTX Corporation is a strong player in a growth market

RTX Corporation is a strong player in a growth marketRTX Corporation’s order backlog means investors can look forward to years of rising profits

-

Profit from MSCI – the backbone of finance

Profit from MSCI – the backbone of financeAs an index provider, MSCI is a key part of the global financial system. Its shares look cheap

-

'AI is the real deal – it will change our world in more ways than we can imagine'

'AI is the real deal – it will change our world in more ways than we can imagine'Interview Rob Arnott of Research Affiliates talks to Andrew Van Sickle about the AI bubble, the impact of tariffs on inflation and the outlook for gold and China

-

Should investors join the rush for venture-capital trusts?

Should investors join the rush for venture-capital trusts?Opinion Investors hoping to buy into venture-capital trusts before the end of the tax year may need to move quickly, says David Prosser

-

Food and drinks giants seek an image makeover – here's what they're doing

Food and drinks giants seek an image makeover – here's what they're doingThe global food and drink industry is having to change pace to retain its famous appeal for defensive investors. Who will be the winners?

-

Barings Emerging Europe trust bounces back from Russia woes

Barings Emerging Europe trust bounces back from Russia woesBarings Emerging Europe trust has added the Middle East and Africa to its mandate, delivering a strong recovery, says Max King

-

How a dovish Federal Reserve could affect you

How a dovish Federal Reserve could affect youTrump’s pick for the US Federal Reserve is not so much of a yes-man as his rival, but interest rates will still come down quickly, says Cris Sholto Heaton