Look beyond Merck’s miracle cancer drug for profits

Keytruda, Merk’s cancer treatment, is a winner. But it’s not the only reason to be bullish on the pharma group.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

When former US president Jimmy Carter announced in 2015 that he had skin cancer that had spread to his liver and brain, he thought he had just weeks to live. But the 90-year-old undertook immunotherapy, a ground-breaking treatment that fights cancer with patients’ own immune systems, using Keytruda, a drug from Merck (NYSE: MRK), the global pharmaceutical giant. Now, five years later, Jimmy Carter is clear of cancer and leading a healthy, active life.

In 2015 Keytruda was new and sanctioned only for skin melanoma, an increasingly common condition. Since then it has been approved to treat certain cancers in the lungs, head, neck, bladder, stomach, throat, kidney and cervix, as well as Hodgkin Lymphoma. It is, in short, a blockbuster. Some analysts think it could become the most-prescribed medication on record.

Keytruda is transforming lives as it eliminates sickness and helps people live longer. Data for lung cancer, for example, shows that 25% of patients are still alive after five years, a huge improvement over the historical 5% rate.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

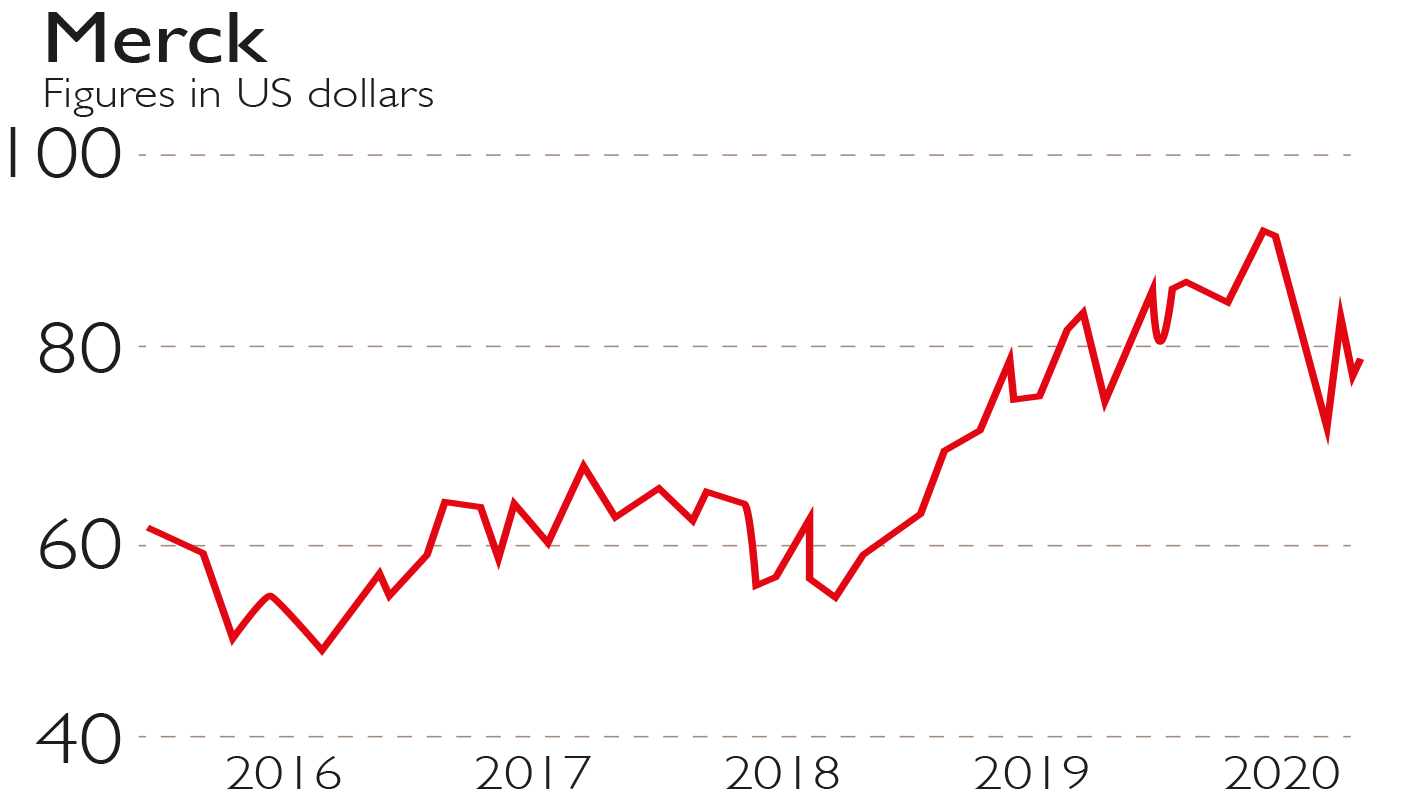

For Merck, the widening application and growing sales of Keytruda have been one factor helping the stock outperform rivals. This year, though, investors have become more cautious and the stock has underperformed its peers and the market.

Changes to the US healthcare system have been a worry, but nerves have settled since committed reformer Bernie Sanders withdrew as a Democrat candidate for president. Covid-19 will have an effect, with people avoiding hospitals and clinics, and delays to elective treatments all leading to a postponement of pharmaceutical use, although this should resume quickly once the crisis ebbs.

For investors who can look beyond this, the current share-price weakness is an opportunity. At a 40% discount to the S&P 500, the benchmark US index, Merck’s shareholders are getting double-digit earnings growth for at least five years. Keytruda is a standout product expected to be hitting sales of $22bn in three years’ time – double last year’s $11bn and nearly six times 2017’s level. Trialling is under way for treating prostate and breast cancers next.

Further potential winners

But it’s not all about Keytruda. Merck is in fact a diverse business with overall sales last year of $46.8bn, of which Keytruda comprised 24%. It has fast-selling and growing medications in diabetes and various vaccinations, along with an animal health business.

The product portfolio is expanding via research and acquisition. Major new cancer treatments are in the wings and there are hopes for its Ebola treatment, which has already been used in Africa with 97% efficacy. Its $10bn of cash and healthy cash flow point to further acquisitions. Meanwhile, Merck is spinning off some legacy and mature brands into a new company. These are cash-generative and investors will be given shares. Shedding the non-growers will boost the growth rate of Merck’s remaining portfolio.

The move has left some investors worried that reducing the size of the healthcare portfolio means an unhealthy focus on Keytruda. However, beyond the short term, management should be proved right as Merck concentrates on its best commercial opportunities and research projects. And more immediately, relying on Keytruda is reasonable: it is, after all, a proven winner.

A giant set to sprint ahead

Merck ticks many boxes for long-term investors who want both capital gains and a decent income. On a forward price/earnings ratio of 15 and a dividend yield of more than 3%, the shares are attractive given the prospect of double-digit profit growth over the next five years. The price is about 20% below the late-2019 peak.

Shareholders can also take comfort from the relatively strong balance sheet and healthy returns on capital of this $193bn giant. Interest on debt is covered over 20 times by earnings and free cash flow per share is adequate for maintaining the payment of dividends to shareholders. The prospect of Merck defaulting on debt repayments is very low.

Covid-19 has clearly unsettled many forecasts of future earnings. Many companies are loath to say how performance might turn out given the uncertainty.

Merck has trimmed expectations, but does see growth this year. Covid-19 will have an impact because treatments are being delayed and hospitals are being re-prioritised near-term, but this is already changing as countries and regions pass their infection peaks. It is not a problem of underlying demand, but rather one of health accessibility, and the treatments will go ahead at some point.

The current price of around $76.50 suggests potential one-year upside based on prevailing forecasts of around 20%-25% to $95. A price of $120 would not be an unreasonable projection on a three- to five-year view.

Consistent returns are always hard to find, but Merck is a quality company that is attractively valued with a healthy balance sheet, a high dividend, strong development pipeline, respected management and a blockbuster, best-selling product. Investment opportunities hardly get much better than this.

Stephen Connolly writes on finance and business, and has worked in investment banking and asset management for over 25 years (SC@plainmoney.co.uk)

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Stephen Connolly is the managing director of consultancy Plain Money. He has worked in investment banking and asset management for over 30 years and writes on business and finance topics.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how

-

Halifax: House price slump continues as prices slide for the sixth consecutive month

Halifax: House price slump continues as prices slide for the sixth consecutive monthUK house prices fell again in September as buyers returned, but the slowdown was not as fast as anticipated, latest Halifax data shows. Where are house prices falling the most?

-

Rents hit a record high - but is the opportunity for buy-to-let investors still strong?

Rents hit a record high - but is the opportunity for buy-to-let investors still strong?UK rent prices have hit a record high with the average hitting over £1,200 a month says Rightmove. Are there still opportunities in buy-to-let?

-

Pension savers turn to gold investments

Pension savers turn to gold investmentsInvestors are racing to buy gold to protect their pensions from a stock market correction and high inflation, experts say

-

Where to find the best returns from student accommodation

Where to find the best returns from student accommodationStudent accommodation can be a lucrative investment if you know where to look.

-

The world’s best bargain stocks

The world’s best bargain stocksSearching for bargain stocks with Alec Cutler of the Orbis Global Balanced Fund, who tells Andrew Van Sickle which sectors are being overlooked.

-

Revealed: the cheapest cities to own a home in Britain

Revealed: the cheapest cities to own a home in BritainNew research reveals the cheapest cities to own a home, taking account of mortgage payments, utility bills and council tax

-

UK recession: How to protect your portfolio

UK recession: How to protect your portfolioAs the UK recession is confirmed, we look at ways to protect your wealth.

-

Buy-to-let returns fall 59% amid higher mortgage rates

Buy-to-let returns fall 59% amid higher mortgage ratesBuy-to-let returns are slumping as the cost of borrowing spirals.