Galliford Try has firm foundations for strong growth

Builder Galliford Try has a finger in a wide range of pies, notably important work in the public sector

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

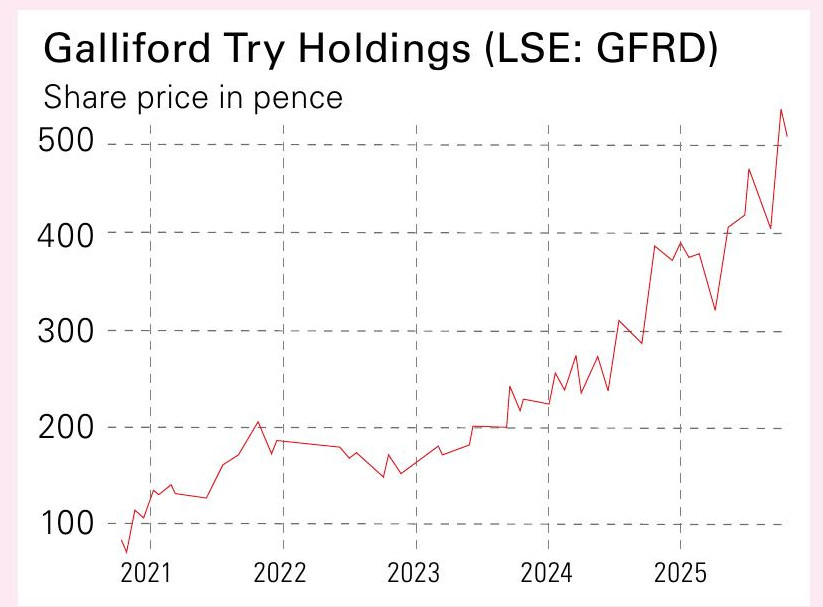

Galliford Try Holdings (LSE: GFRD) is a British construction company worth £534 million, with a diversified set of customers. In Scotland, it operates as Morrison Construction. Galliford has changed markedly since 2020, when it sold its housing businesses to Bovis for £1 billion and then invested in growth and the acquisition of several infrastructure businesses.

These include Lintott, MCS Control Systems, Ham Baker Engineering (a company active in the water industry) and AVRS (which operates in the energy and nuclear sectors). Galliford serves a wide range of markets, including defence, education, facilities management, health and infrastructure; 91% of clients stem from the public and regulated sectors.

Infrastructure is a priority for the government. Galliford intends to increase revenue to more than £2.2 billion by 2030, from £1.77 billion in 2024, and achieve divisional margins of at least 4% (up from 2.5%).

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Galliford Try taps into a wide array of sectors

Examples of recent projects in nine different sectors are: a commercial office development in Reading (the value of the contract was £84 million); East Lothian Community Hospital (£72 million); Catterick Garrison (£60 million); Carlisle Southern Link Road (£140 million); Brent Cross affordable homes (£75.8 million); Barony schools campus, East Ayrshire (£59 million); HM Prison Rye Hill (£95 million); fire safety improvements at HMP’s Wakefield and Moorland (£100.9 million); and Keadby Pumping Station in the East Midlands (£35 million).

Several procurement systems feed the pipeline of orders. Examples include the Cabinet Office’s Crown Commercial Service (CCS), which serves the Ministry of Defence and the Ministry of Justice; the Department for Education’s school-building framework (which covers the lion’s share of school building in England); and the NHS’s ProCure 23 Framework (Galliford is one of six companies serving the NHS).

Galliford is also involved in procurement frameworks for all 13 of the UK’s major water companies and Hub Scotland (Galliford is in four of five regional hubs for Scottish public buildings, from stations to schools).

And the company has this year won a place on the National Grid’s (NG) five-year major works framework for upgrading the grid. The anticipated value of the contract is £9 billion over five years. The work is a part of NG’s overall £59 billion upgrade).

Galliford has three divisions: building, infrastructure and specialised services.

Building accounts for 51.5% of revenue. The division designs, constructs and refurbishes assets in sectors where it has expertise, such as education, health, defence, justice and commercial.

Infrastructure provides 48.1% of sales and consists of activity in the highways and environment subsectors (notably water and sewage, where Galliford is one of the largest contractors). Specialist services includes facilities management, fire stopping and cladding, digital infrastructure, and investments (such as public-private partnerships, or PPPs). Specialised services revenues are mainly reported within building or infrastructure, with the PPP component providing 0.43% of total revenue.

Galliford’s results for the year to 30 June 2025 showed revenue of £1.875 billion, up 6.3%. The order book totalled £4.1 billion (equal to more than two years’ turnover) and includes 92% of projected sales for the current year and 75% of next year’s. The largest sectors in the order book include work in the environment, highways, education and defence subsectors.

In August 2025 Galliford was nominated one of four finalists in the Best Place to Work – Large Firm category for the Construction News Workforce Awards. Galliford also has the London Stock Exchange Green Economy Mark for activities benefiting the environment.

Galliford Try's income and profitability

Galliford’s results for the year to 30 June 2025 show sales of £1.875 billion, up 6.3%, with adjusted pre-tax profit rising 28.6% to £45 million. Earnings per share (EPS) rose 23.4% to 33.7p, and the dividend per share climbed 22.6% to 19p; the payout has more than trebled over the past four years. Net cash totalled £237.6 million.

The divisional operating margin was raised to 3% from 2.5% in 2024, and is therefore well on the way to the 2030 target of 4%. The shares rose 11% after the 2025 results. CEO Bill Hocking said that all the businesses have performed well since 30 June, and trading has been slightly ahead of expectations for 2025-2026. A buyback of £10 million has been announced for 2025-2026, following one for the same amount in 2024. Galliford has a record of profitable growth and intends to deliver its 2030 strategy of raising revenue to more than £2.2 billion by supplementing growth in its core markets of building, highways and environment with growth in adjacent markets. These include the private-rental sector, green retrofit, and the affordable-homes market.

Galliford Try has a recent share price of 539p, a forward price/ earnings (p/e) ratio of 15.4 and a useful forward dividend yield of 3.5%. Analysts’ one-year price target is 598p.

Hocking holds 1.95 million shares worth £10.5 million, so he has a substantial personal stake in his company’s success. If the group succeeds in hitting its 2030 targets, revenue will be doubled from 2021 and up 24% from 2024, reaching in excess of £2.2 billion. And the divisional operating margin, 2% in 2021 and 3% in 2025, will be raised to 4% by 2030. The overall construction sector is in a downcycle, so now is a good time to invest in Galliford Try with its reasonable valuation, targeted revenue and margin growth, and 3.53% dividend yield.

This article was first published in MoneyWeek's magazine. Enjoy exclusive early access to news, opinion and analysis from our team of financial experts with a MoneyWeek subscription.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Highly qualified (BSc PhD CPhys FInstP MIoD) expert in R&D management, business improvement and investment analysis, Dr Mike Tubbs worked for decades on the 'inside' of corporate giants such as Xerox, Battelle and Lucas. Working in the research and development departments, he learnt what became the key to his investing; knowledge which gave him a unique perspective on the stock markets.

Dr Tubbs went on to create the R&D Scorecard which was presented annually to the Department of Trade & Industry and the European Commission. It was a guide for European businesses on how to improve prospects using correctly applied research and development.

He has been a contributor to MoneyWeek for many years, with a particular focus on R&D-driven growth companies.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how

-

Three key winners from the AI boom and beyond

Three key winners from the AI boom and beyondJames Harries of the Trojan Global Income Fund picks three promising stocks that transcend the hype of the AI boom

-

RTX Corporation is a strong player in a growth market

RTX Corporation is a strong player in a growth marketRTX Corporation’s order backlog means investors can look forward to years of rising profits

-

Profit from MSCI – the backbone of finance

Profit from MSCI – the backbone of financeAs an index provider, MSCI is a key part of the global financial system. Its shares look cheap

-

"Botched" Brexit: should Britain rejoin the EU?

"Botched" Brexit: should Britain rejoin the EU?Brexit did not go perfectly nor disastrously. It’s not worth continuing the fight over the issue, says Julian Jessop

-

'AI is the real deal – it will change our world in more ways than we can imagine'

'AI is the real deal – it will change our world in more ways than we can imagine'Interview Rob Arnott of Research Affiliates talks to Andrew Van Sickle about the AI bubble, the impact of tariffs on inflation and the outlook for gold and China

-

Should investors join the rush for venture-capital trusts?

Should investors join the rush for venture-capital trusts?Opinion Investors hoping to buy into venture-capital trusts before the end of the tax year may need to move quickly, says David Prosser

-

Food and drinks giants seek an image makeover – here's what they're doing

Food and drinks giants seek an image makeover – here's what they're doingThe global food and drink industry is having to change pace to retain its famous appeal for defensive investors. Who will be the winners?

-

Tony Blair's terrible legacy sees Britain still suffering

Tony Blair's terrible legacy sees Britain still sufferingOpinion Max King highlights ten ways in which Tony Blair's government sowed the seeds of Britain’s subsequent poor performance and many of its current problems