Johnson & Johnson vaccine approval is another shot in the arm for the world

Johnson & Johnson’s vaccine has been approved in the US, a sign that the world is making solid progress against Covid-19. Matthew Partridge reports

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

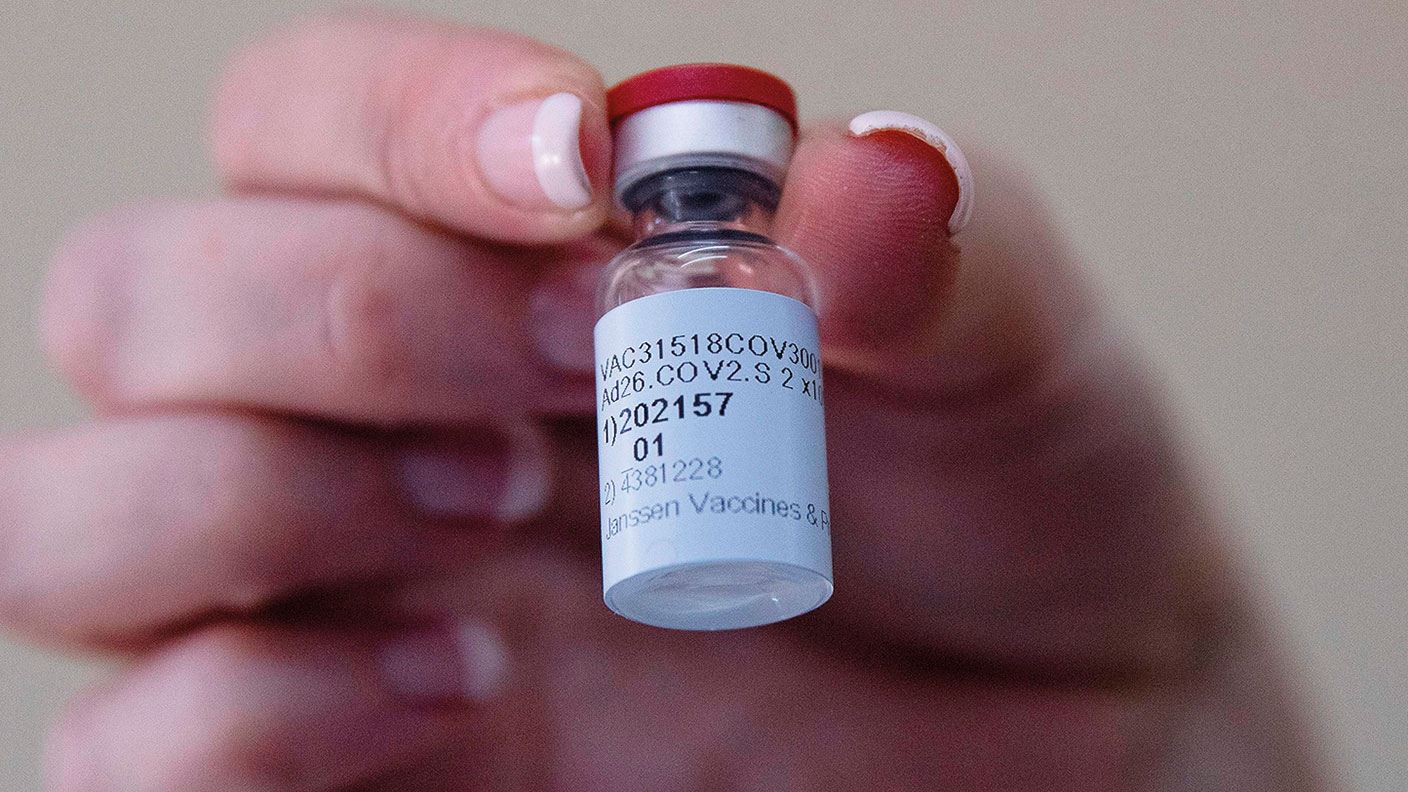

Good news for Johnson & Johnson (J&J): the US Food and Drug Administration (FDA) has formally approved the company’s Covid-19 vaccine, says Oliver Milman in The Observer. The move comes after studies showed that it was not only 85% effective in preventing severe cases of Covid-19, but also offered “complete protection” against Covid-19-related hospitalisation and death after 28 days. As a result, the J&J vaccine will become only the third jab to be authorised for use in the United States. What’s more, unlike the Pfizer and Moderna vaccines, which are already in circulation, J&J’s vaccine only needs a single shot and “can be stored at common refrigerator temperatures for up to three months”.

J&J’s vaccine may have been approved, but it may take some time to reach American arms, say Hannah Kuchler and Donato Paolo Mancini in the Financial Times. J&J says “production problems” mean that it will only be able to hand over four million doses to the US government, rather than the ten million originally expected, although it still expects to meet its promise to deliver 100 million by June. It has also had problems in Europe, where its plans to “scale up its vaccine... manufacturing from a small facility to a large one in the Netherlands” took longer than anticipated.

Dispelling the lockdown gloom

Despite the delay, the approval of J&J’s vaccine should help dispel the “lockdown gloom”, says Robert Cyran on Breakingviews. Other manufacturers are also boosting production, with Pfizer planning “to more than double output from nearly five million doses a week to 13 million”. Moderna “thinks it will double production to 40 million a month by April”. Throw in the fact that there are “more new vaccines on the horizon”, and it likely that most of the populations of wealthy countries will be vaccinated relatively quickly, which “will make things easier for less wealthy countries, too”.

Try 6 free issues of MoneyWeek today

Get unparalleled financial insight, analysis and expert opinion you can profit from.

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

But not all vaccine makers are doing equally well, says Nils Pratley in The Guardian. While J&J, Pfizer and Moderna are forecast to make a “chunky profit”, AstraZeneca’s decision to sell the initial batch of vaccines at a much lower price means its only benefit “has been goodwill”. In fact, it may not get even that, thanks to “opportunists in Brussels” angry about production delays and officials in France and Germany talking down its efficacy for over-65s – even though it’s been approved for all ages by the European Medicine Agency.

All this makes AstraZeneca’s decision to sell its 7.7% stake in Moderna particularly unfortunate, says Alex Ralph in The Times. While the move netted AstraZeneca a profit of $1.1bn on an investment of $400m, the decision to cash in early means that it has missed out in the surge of Moderna’s share price “from about $29 a year ago to a peak of $186 last month”. AstraZeneca would have been sitting on a “significantly larger paper profit”, possibly three times as much, had it retained its stake in the US biotech.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

Has the market misjudged Relx?

Has the market misjudged Relx?Relx shares fell on fears that AI was about to eat its lunch, but the firm remains well placed to thrive

-

Dario Amodei: The AI boss in a showdown with Trump

Dario Amodei: The AI boss in a showdown with TrumpAnthropic’s CEO Dario Amodei was on an extraordinary upward trajectory when he found himself on the wrong side of the American president. He is about to be severely tested.

-

Has the market misjudged Relx?

Has the market misjudged Relx?Relx shares fell on fears that AI was about to eat its lunch, but the firm remains well placed to thrive

-

8 of the best properties for sale with minstrels’ galleries

8 of the best properties for sale with minstrels’ galleriesThe best properties for sale with minstrels’ galleries – from a 15th-century house in Kent, to a four-storey house in Hampstead, comprising part of a converted, Grade II-listed former library

-

The rare books which are selling for thousands

The rare books which are selling for thousandsRare books have been given a boost by the film Wuthering Heights. So how much are they really selling for?

-

How to invest as the shine wears off consumer brands

How to invest as the shine wears off consumer brandsConsumer brands no longer impress with their labels. Customers just want what works at a bargain price. That’s a problem for the industry giants, says Jamie Ward

-

A niche way to diversify your exposure to the AI boom

A niche way to diversify your exposure to the AI boomThe AI boom is still dominating markets, but specialist strategies can help diversify your risks

-

New PM Sanae Takaichi has a mandate and a plan to boost Japan's economy

New PM Sanae Takaichi has a mandate and a plan to boost Japan's economyOpinion Markets applauded new prime minister Sanae Takaichi’s victory – and Japan's economy and stockmarket have further to climb, says Merryn Somerset Webb

-

Early signs of the AI apocalypse?

Early signs of the AI apocalypse?Uncertainty is rife as investors question what the impact of AI will be.

-

8 of the best properties for sale with beautiful kitchens

8 of the best properties for sale with beautiful kitchensThe best properties for sale with beautiful kitchens – from a Modernist house moments from the River Thames in Chiswick, to a 19th-century Italian house in Florence