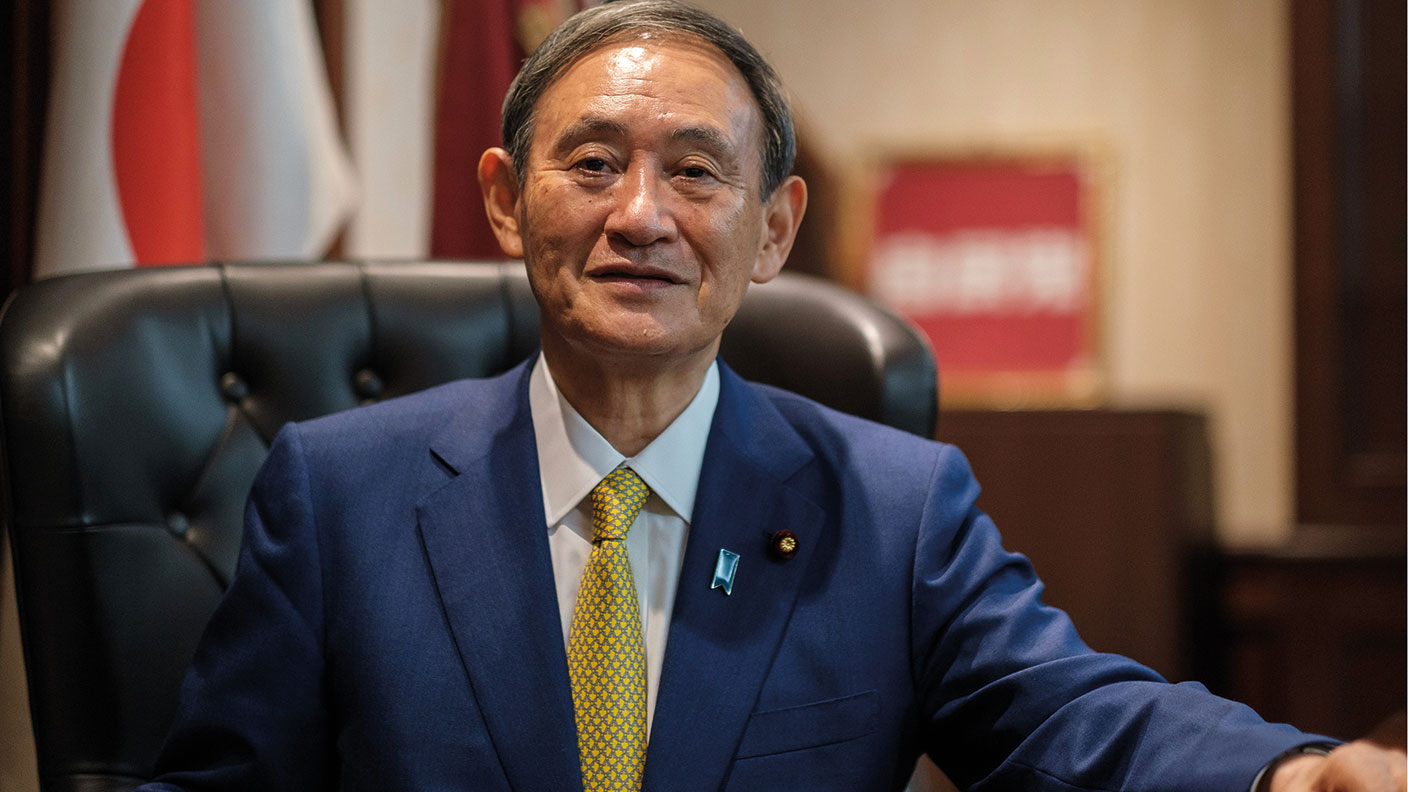

Japanese stockmarket enjoys a “Suga rush” as PM steps down

The Japanese stockmarket has hit a 30-year high following the resignation of prime minister Yoshihide Suga.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Japanese stocks have hit a 30-year high following the resignation of prime minister Yoshihide Suga. Suga, who has only been in office for a year, had become widely unpopular as his government failed to get on top of a surge in Covid-19 infections.

A slow vaccine rollout and the controversial decision to go ahead with hosting the Olympics despite the pandemic also sapped his support. He will step down before a general election scheduled for later this year.

Japan’s Topix index reacted to the news by hitting its highest level since April 1991, says Bloomberg. Investors had once had high hopes for Suga, who vowed to accelerate Japan’s digital shift (see also page 28). In February this year the Nikkei 225 index hit the symbolic 30,000-level for the first time since 1990. Yet it fell back as Covid-19 came to dominate his premiership: “Suga had created an atmosphere of uncertainty… there was a perception that Japan was ‘in a mess’”, says Richard Kaye of Comgest Asset Management Japan. The Topix has gained 6.5% during the past month alone.

Try 6 free issues of MoneyWeek today

Get unparalleled financial insight, analysis and expert opinion you can profit from.

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

In most countries investors dislike the uncertainty of an upcoming election, says Takeshi Kawasaki for Nikkei Asia. Not in Japan. “Looking at the ten early elections held since 1990, stocks rose nearly every time between the day of the lower house being dissolved and the election date”.

What seems to happen is that headlines about Japanese politics grab the attention of foreign money managers. They decide they like what they see and buy. “Typically at the mercy of trends in US equities” thanks to Wall Street’s tendency to set the tone for world markets, Japanese stocks are likely to go their own way over the coming months.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Alex is an investment writer who has been contributing to MoneyWeek since 2015. He has been the magazine’s markets editor since 2019.

Alex has a passion for demystifying the often arcane world of finance for a general readership. While financial media tends to focus compulsively on the latest trend, the best opportunities can lie forgotten elsewhere.

He is especially interested in European equities – where his fluent French helps him to cover the continent’s largest bourse – and emerging markets, where his experience living in Beijing, and conversational Chinese, prove useful.

Hailing from Leeds, he studied Philosophy, Politics and Economics at the University of Oxford. He also holds a Master of Public Health from the University of Manchester.

-

What do rising oil prices mean for you?

What do rising oil prices mean for you?As conflict in the Middle East sparks an increase in the price of oil, will you see petrol and energy bills go up?

-

Rachel Reeves's Spring Statement – live analysis and commentary

Rachel Reeves's Spring Statement – live analysis and commentaryChancellor Rachel Reeves delivered her Spring Statement today (3 March). What was announced?

-

Three Indian stocks poised to profit

Three Indian stocks poised to profitIndian stocks are making waves. Here, professional investor Gaurav Narain of the India Capital Growth Fund highlights three of his favourites

-

UK small-cap stocks ‘are ready to run’

UK small-cap stocks ‘are ready to run’Opinion UK small-cap stocks could be set for a multi-year bull market, with recent strong performance outstripping the large-cap indices

-

Hints of a private credit crisis rattle investors

Hints of a private credit crisis rattle investorsThere are similarities to 2007 in private credit. Investors shouldn’t panic, but they should be alert to the possibility of a crash.

-

Investing in Taiwan: profit from the rise of Asia’s Silicon Valley

Investing in Taiwan: profit from the rise of Asia’s Silicon ValleyTaiwan has become a technology manufacturing powerhouse. Smart investors should buy in now, says Matthew Partridge

-

‘Why you should mix bitcoin and gold’

‘Why you should mix bitcoin and gold’Opinion Bitcoin and gold are both monetary assets and tend to move in opposite directions. Here's why you should hold both

-

Invest in the beauty industry as it takes on a new look

Invest in the beauty industry as it takes on a new lookThe beauty industry is proving resilient in troubled times, helped by its ability to shape new trends, says Maryam Cockar

-

Should you invest in energy provider SSE?

Should you invest in energy provider SSE?Energy provider SSE is going for growth and looks reasonably valued. Should you invest?

-

Has the market misjudged Relx?

Has the market misjudged Relx?Relx shares fell on fears that AI was about to eat its lunch, but the firm remains well placed to thrive