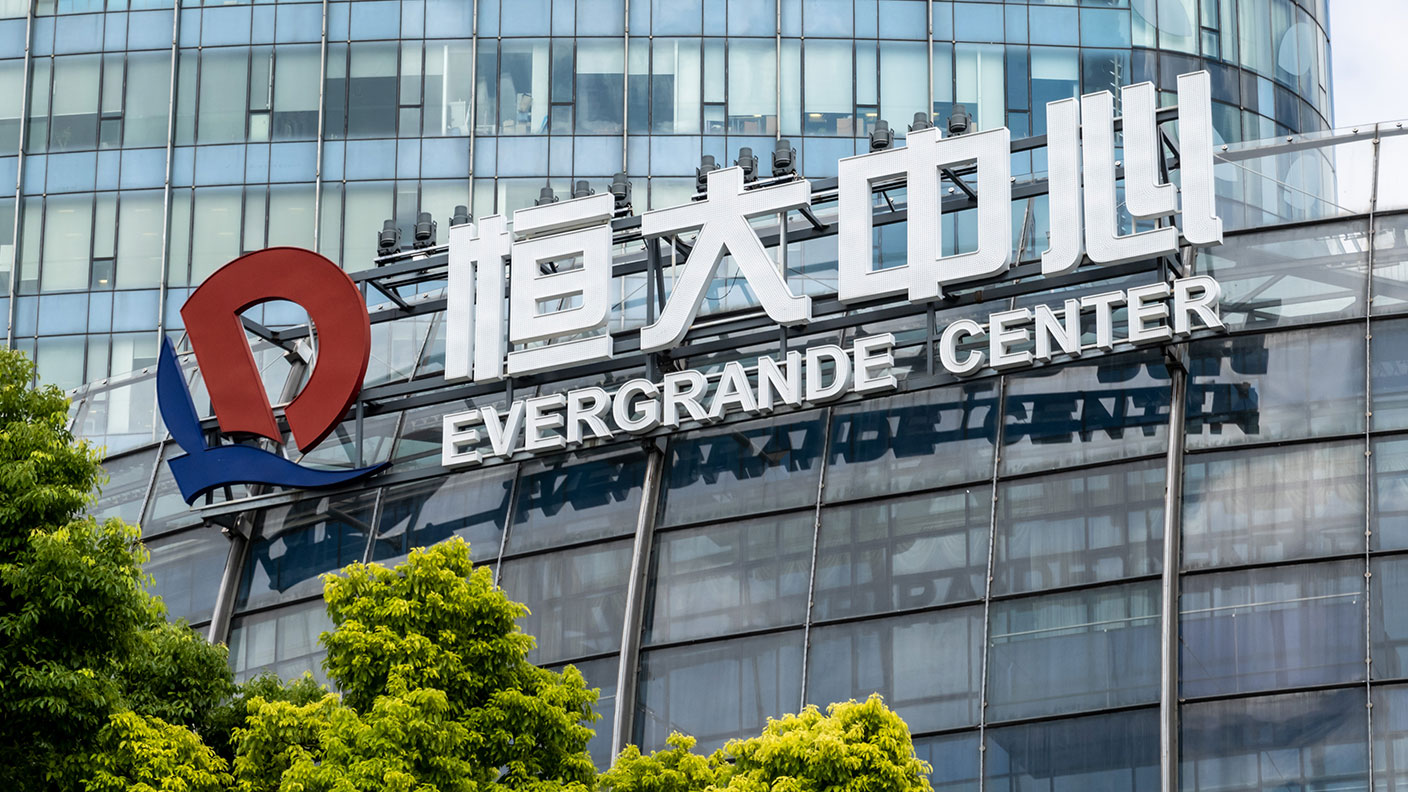

China’s property woes are coming to a head – so what happens now?

Chinese property giant Evergrande is in big trouble. And with no bailout plan yet, markets are getting nervy. John Stepek looks at how things might go from here, and how it affects you.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

Before we get started this morning, I just wanted to let you know that early bird tickets for this year’s MoneyWeek conference are now available! Grab yours now! Given what’s going on in markets this very day, I think you’ll want to make sure you attend: here’s where to book.

So now onto the main topic – you might have noticed that markets were feeling a bit jittery last week. Turns out that they’re finally waking up to what’s going on with troubled Chinese property developer Evergrande.

The collapse has been a long time in the making, but now we are very much in “push comes to shove” territory.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Whatever the Chinese government has planned, we’re likely to find out this week.

Why the Evergrande situation is likely to come to a head this week

Evergrande has been described as China’s Lehman Brothers. It’s a big, heavily-indebted company whose debt has trickled into lots of parts of the economy in a fairly opaque manner. That debt is tied to property markets and house prices, which have been sliding in recent months as China has cracked down on speculation.

So the fear is that if China just let Evergrande go bust then we’d have something similar to what happened after 2008 in the US.

The obvious retort to this has been that 2008 set the strategy book for every other possible crash – for governments and central banks to step in and bail everyone out. That eventually happened after 2008. It eventually happened after the eurozone crisis. It happened during the pandemic (see below). And the assumption has been that it would happen for Evergrande.

However, while Beijing has been doing some stuff behind the scenes (injecting money into the system on Friday for example, and lining up some restructuring specialists for Evergrande), a grand bailout plan hasn’t been unveiled yet. And markets are now getting nervy.

One problem with these things is that it’s much better to step in before a run gets going. The Federal Reserve’s actions in 2020, at the height of the pandemic panic in markets, show that the US central bank has taken that lesson to heart. At the first sniff of credit markets shutting down, the Fed just went all-out to underwrite the entire market, and not just in the US.

Yet the problems with Evergrande are starting to creep into the rest of the Chinese property sector, because people are waking up and realising that this is not just about Evergrande – lots of companies build or sell houses, and houses just aren’t selling right now.

So why does it seem likely that a solution will come this week? Well, as Eoin Treacy of FullerTreacyMoney.com points out, the Chinese holidays (the market is shut on Monday and Tuesday) make this a pretty good week for the authorities to step in – while markets are shut – to make their move.

But more importantly, Evergrande has interest payments to make on two notes on Thursday. They’re not expected to be paid, but some sign of the Chinese government erecting a firebreak to prevent “widespread contagion” might be forthcoming.

John Authers puts it well when he says in his latest Bloomberg newsletter that Evergrande is more likely to be an LTCM moment rather than a Lehman one. He’s referring to the US bailing out giant hedge fund Long-Term Capital Management in the late 1990s, rather than letting it collapse.

Don’t go selling everything

I still think this is probably the most likely outcome. That said, people might well be overestimating the power of the Chinese government. It’s worth remembering that one key reason we favour capitalism and free markets over communism and central planning is because the former is more efficient than the latter.

This is not even politics, it’s just logic. If one person tries to guess what 1,000 people are likely to need for the coming five years and plans supply and demand accordingly, you’re going to get a worse outcome than if those 1,001 people can just interact freely to adjust supply and demand in real-time.

This centralised nature means that Beijing has an awful lot of competing and conflicting priorities, and there’s a lot of complexity to deal with here. Lots of stuff could go wrong. So that’s why I’m loath simply to rule out something more akin to a Lehman Brothers moment, even if it’s not my central scenario.

But what does it mean for you as an investor?

As I said last time, I still don’t think there’s any point in you making big changes to your portfolio over this. To be clear, when I say this, I’m making some big assumptions. I’m assuming that a) you have a clear view of your own asset allocation; b) that you have a clear long-term investment plan (ie how much do you need, what for, and by when?); and c) that you are up to date with these things.

If you’re not nodding along to all or any of those points, then you should take some time to resolve them. You certainly shouldn’t be trying to second-guess the Chinese government when your own investment housekeeping isn’t in order.

That’s not me guilt-tripping you about your admin, it’s just that if you don’t know what your plan is, then you’ll make short-term mistakes and you’ll almost certainly lose money by doing so.

With all that said, there are probably two main ways this can go. One is that China – through overconfidence or recklessness or a surfeit of communist joie de vivre – simply steps back and lets the cards fall where they may. Put bluntly, that would terrify everyone.

That said, if you’re living and investing largely outside of China and its sphere of influence (which you most likely are) then you have to remember that even if China’s authorities don’t step in, then our own are likely to do so if it looks as though there’s a serious risk of contagion outside China.

Moreover, if China does step in with a convincing bailout package, then there’s every chance that investors decide it’s “off to the races” time again, just as they did when the eurozone crisis finally had a line drawn under it.

In the longer run, a slowdown in the Chinese economy is something that global markets will have to contend with, but we can discuss that at a later date.

For now my point is this: Evergrande might be scary and you will see some scary headlines. But if you have a plan you’re happy with, there’s no reason to change it. And you certainly shouldn’t flog everything and jump to 100% cash because if you don’t have a crystal ball – that’s pretty much never a good idea.

If you haven’t already, book your ticket for the MoneyWeek Wealth Summit in November – it’s virtual, but I’ll be there with Merryn, so we’re likely to have a better idea of the outcome by then – so you can ping me all your difficult questions on it, on the day.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how

-

Halifax: House price slump continues as prices slide for the sixth consecutive month

Halifax: House price slump continues as prices slide for the sixth consecutive monthUK house prices fell again in September as buyers returned, but the slowdown was not as fast as anticipated, latest Halifax data shows. Where are house prices falling the most?

-

Rents hit a record high - but is the opportunity for buy-to-let investors still strong?

Rents hit a record high - but is the opportunity for buy-to-let investors still strong?UK rent prices have hit a record high with the average hitting over £1,200 a month says Rightmove. Are there still opportunities in buy-to-let?

-

Pension savers turn to gold investments

Pension savers turn to gold investmentsInvestors are racing to buy gold to protect their pensions from a stock market correction and high inflation, experts say

-

Where to find the best returns from student accommodation

Where to find the best returns from student accommodationStudent accommodation can be a lucrative investment if you know where to look.

-

The world’s best bargain stocks

The world’s best bargain stocksSearching for bargain stocks with Alec Cutler of the Orbis Global Balanced Fund, who tells Andrew Van Sickle which sectors are being overlooked.

-

Revealed: the cheapest cities to own a home in Britain

Revealed: the cheapest cities to own a home in BritainNew research reveals the cheapest cities to own a home, taking account of mortgage payments, utility bills and council tax

-

UK recession: How to protect your portfolio

UK recession: How to protect your portfolioAs the UK recession is confirmed, we look at ways to protect your wealth.

-

Buy-to-let returns fall 59% amid higher mortgage rates

Buy-to-let returns fall 59% amid higher mortgage ratesBuy-to-let returns are slumping as the cost of borrowing spirals.