How many ounces of gold does it take to buy an average house in the UK?

House prices have soared in recent years. But what, asks Dominic Frisby, if you look at them using a more durable form of money – gold?

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

Before we get started on today’s glorious mash-up of two of our readers’ favourite subjects, I just wanted to let you know that you can now get your – FREE – tickets to come and see me and Merryn interviewing Russell Napier in Edinburgh on the evening of Saturday April 30th.

We’ll be talking in Russell’s Library of Mistakes, which has just moved to newer, larger premises (there are a lot of financial mistakes to fit in). It promises to be a fun night – the tickets are free, as I already mentioned, but there are only 60 available, so book now!

And now, over to Dominic…

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Today we return to one of my favourite subjects, and one that we periodically visit on these pages: UK house prices measured in gold…

It makes sense to measure house prices with a less flexible form of money

As regular readers will know, I am firmly of the mind that unaffordable housing in the UK (and indeed across most of the developed world) is as much a consequence of our system of money and credit as it is of dumb, prohibitive planning laws.

If interest rates reflected actual inflation, the story would be very different. And I’m not talking about the consumer price index (CPI) measure targeted by the Bank of England (and even that now stands at over 6%). I’m talking about the inflation of the money supply, whether via debt expansion or quantitative easing (QE), and the resulting costs felt.

House prices are currently rising at roughly 11% a year, and you’re telling me inflation is only 6%? Pull the other one.

The incremental effects of these rises – 4% one year, 12% the next – over many decades have made house prices ludicrously unaffordable to young people. It’s been going on since at least the early 1990s, and the days when Ken Clarke was chancellor. Salaries have not kept up.

If interest rates rose to reflect our current 11% house price inflation then the ensuing rush for the exit would pretty quickly make house prices affordable again. The entire house-of-cards economy would come crashing down too, but that’s another matter.

For this reason, we conduct the occasional exercise of measuring house prices in sound money. Gold has served this role since the Stone Age, and so we bow to the wisdom of Mother Nature, and use it here.

The pound in your pocket has lost a lot of value compared to a house…

The average price of a house in the UK is now £280,000 according to the Office for National Statistics and the Land Registry. The average salary is £31,285, so house prices are at nine times earnings.

The house prices to earnings ratio in most big cities, especially in the south, is much more distorted than that. It was three times when I bought my first flat in London in 1993.

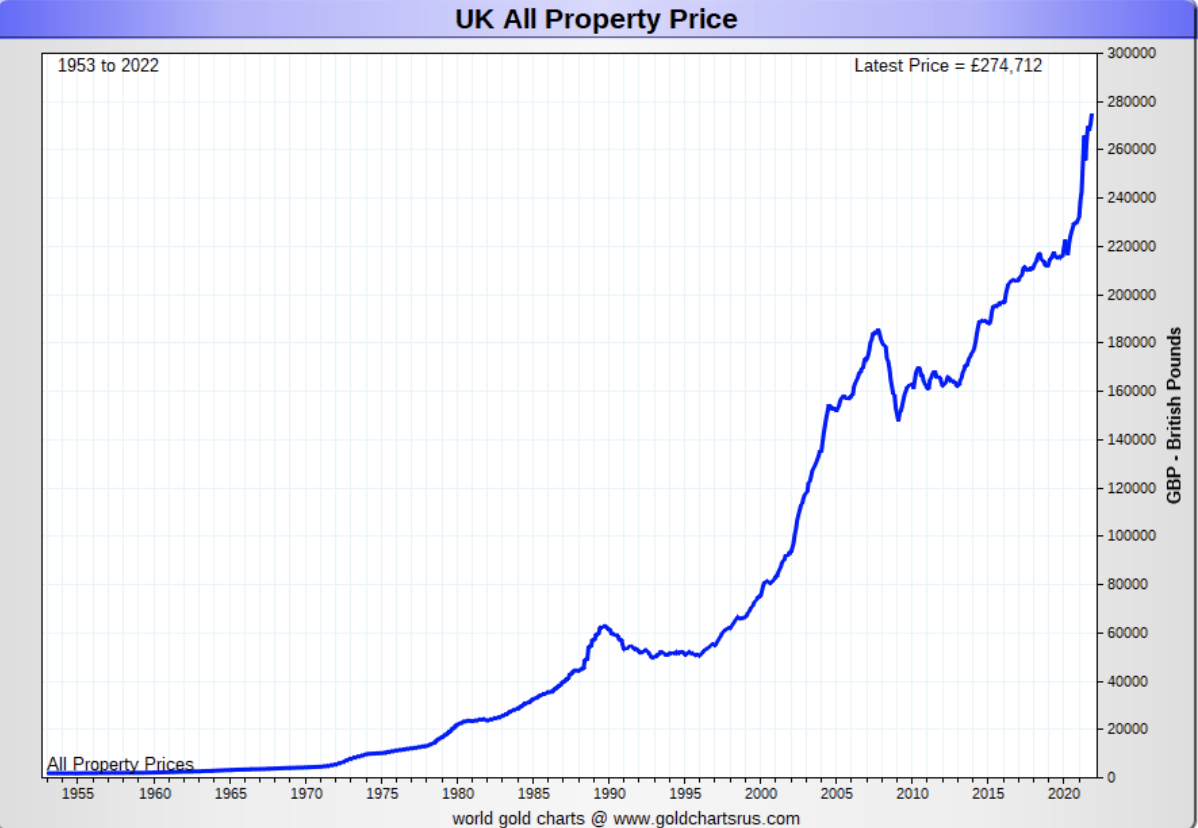

We’ll start with house prices in pounds.

This chart goes all the way back to 1953, when mortgages barely existed. Debt is the big driver of house prices – if there is no debt in a market, prices will reflect local cash levels and be much lower. Introduce debt, and up go prices. (Debt, even with all that QE, remains the biggest supply of new money).

On the other hand, debt makes it possible to do things now you would otherwise not be able to do – like buy a house.

But keep debt costs low and more money enters the system, prices stay high and the economy “grows”. That’s why the authorities prefer to keep interest rates down.

“You’ve never had it so good”, was the government’s cry at the time, as the Tories actively encouraged a “property-owning democracy”. Stamp duty was cut and the government lent money to building societies, so they could issue mortgages. Home ownership rose from 29% in 1951 to 45% by 1964, and the train of higher prices was put in motion. They rose by over 50% during that period.

The above chart is astonishing in its relentless rise higher. It looks like bitcoin! The crash of the early 1990s, in which hundreds of thousands of people lost their homes amind surging interest rates, is a mere blip. Far fewer lost their homes in 2008, because rates were slashed.

But looked at from another perspective, you can see just how much value your money has lost. In 1953, the average house cost £1,891. Today it’s 150 times that. The pound has lost more than 99% of its purchasing power in 70 years.

Money. Huh! It’s a fraud. But you can’t do without it.

… but the gold in your vault has not

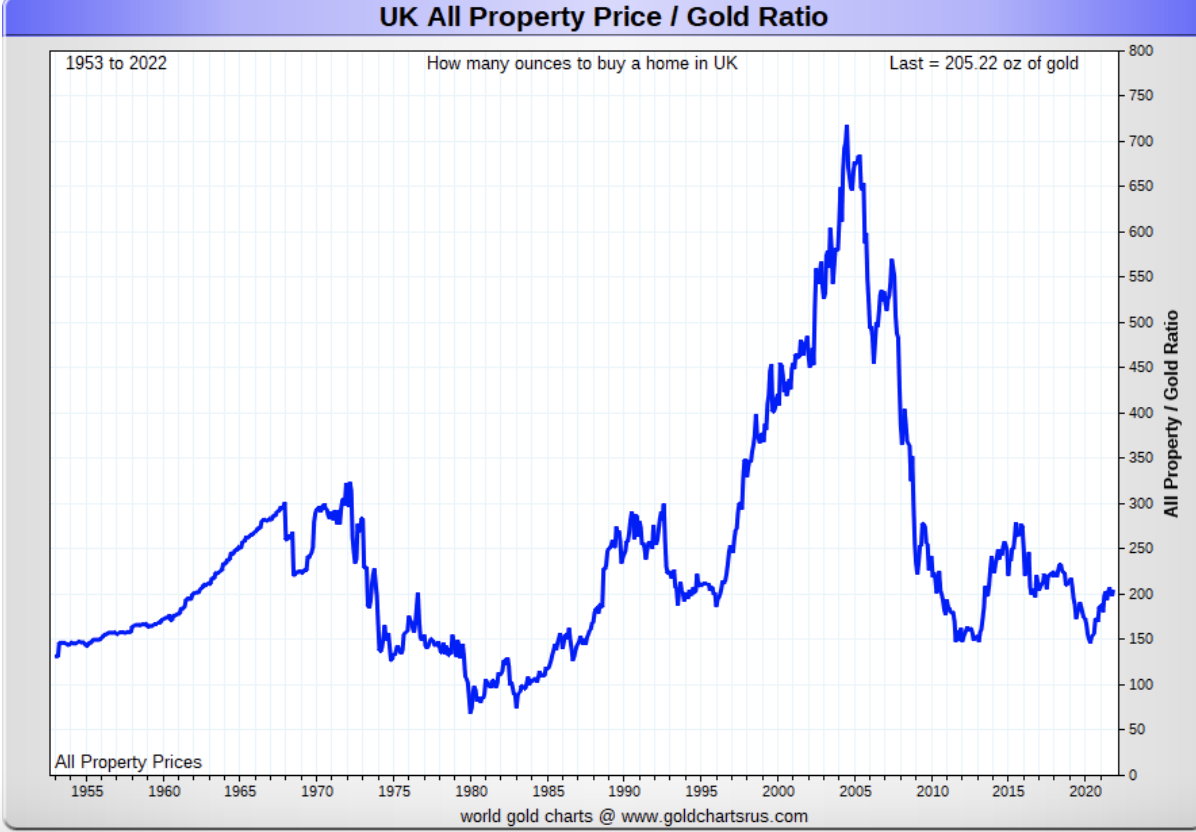

Next we turn our attention to UK house prices measured in a much sounder form of money - one that central banks can’t print. This is the same house prices measured in gold since 1953.

As you can see, it’s rather a different story.

Back in 1953 the average house cost 150 ounces of gold. Same price as in 2020.

Wait a minute, what?

And today a house will cost you 205 ounces of gold.

Wait a minute you’re telling me house prices are only up 30% since 1953?

If you measure them in gold, yup.

In 1980 you could buy the average UK house for 50 ounces of gold. You could have done so in the 1930s as well (not shown on the chart).

In 2004, with gold sitting at around $400 an ounce, and the average house at £150,000, it took over 700 ounces to buy a house. The noughties aside, the long-term “normal” price of a British house in gold terms is a range of somewhere between 150 and 300 ounces.

So what’s next for the house price to gold ratio?

I thought the end was nigh for the housing bubble in 2007. I was wrong. I didn’t foresee them slashing interest rates like that. Wow betide anyone who calls the top in housing. The only thing that will send house prices lower is increased rates – though even at 3% or 4% there would be problems.

No policy-maker wants falling house prices on their watch, partly because they own houses, partly because of the damage to their reputation and partly because they don’t want to see people lose their homes (never mind those who can’t afford). So I very much doubt that we will see rates reach the levels that real (and even CPI) inflation suggests they should be.

Perhaps the Bank of England’s hands will be forced, maybe by problems in the gilt market, spiralling food and energy prices, or the rising cost of deglobalisation. But never underestimate the ability of central bankers to print and obfuscate.

On the other hand, gold looks like it wants to go higher. It’s gold – it has a propensity to disappoint (to put it mildly), but, from war to riots to inflation, it is not like there is currently a shortage of fundamental drivers to push it higher.

So I would argue that that ratio will come back to 150 ounces a house before it goes to 300.

And, who knows, a little bit of a crisis will send it back to 50 ounces.

“Yes, yes”, my father used to say. “But you can’t live in gold. And gold doesn't pay rent.”

He has a point. But so do I. Central banking has left a generation homeless. Fiat money has done terrible things to society.

Dominic’s film, Adam Smith: Father of the Fringe, about the unlikely influence of the father of economics on the greatest arts festival in the world is now available to watch on YouTube.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how

-

What's behind the big shift in Japanese government bonds?

What's behind the big shift in Japanese government bonds?Rising long-term Japanese government bond yields point to growing nervousness about the future – and not just inflation

-

Halifax: House price slump continues as prices slide for the sixth consecutive month

Halifax: House price slump continues as prices slide for the sixth consecutive monthUK house prices fell again in September as buyers returned, but the slowdown was not as fast as anticipated, latest Halifax data shows. Where are house prices falling the most?

-

Rents hit a record high - but is the opportunity for buy-to-let investors still strong?

Rents hit a record high - but is the opportunity for buy-to-let investors still strong?UK rent prices have hit a record high with the average hitting over £1,200 a month says Rightmove. Are there still opportunities in buy-to-let?

-

Pension savers turn to gold investments

Pension savers turn to gold investmentsInvestors are racing to buy gold to protect their pensions from a stock market correction and high inflation, experts say

-

Where to find the best returns from student accommodation

Where to find the best returns from student accommodationStudent accommodation can be a lucrative investment if you know where to look.

-

The world’s best bargain stocks

The world’s best bargain stocksSearching for bargain stocks with Alec Cutler of the Orbis Global Balanced Fund, who tells Andrew Van Sickle which sectors are being overlooked.

-

Revealed: the cheapest cities to own a home in Britain

Revealed: the cheapest cities to own a home in BritainNew research reveals the cheapest cities to own a home, taking account of mortgage payments, utility bills and council tax

-

UK recession: How to protect your portfolio

UK recession: How to protect your portfolioAs the UK recession is confirmed, we look at ways to protect your wealth.