House prices: from boom to even bigger boom

UK house prices have risen to new to record highs, says Nicole Garcia Merida. Demand continues to outpace supply, but continued low interest rates, the return of 95% mortgages and the stamp-duty holiday extension all play their part.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

The increase in house prices we’ve seen since the start of the pandemic can’t really be called a “mini-boom” any longer, with average property prices rising to record highs and demand slowly but surely outpacing supply.

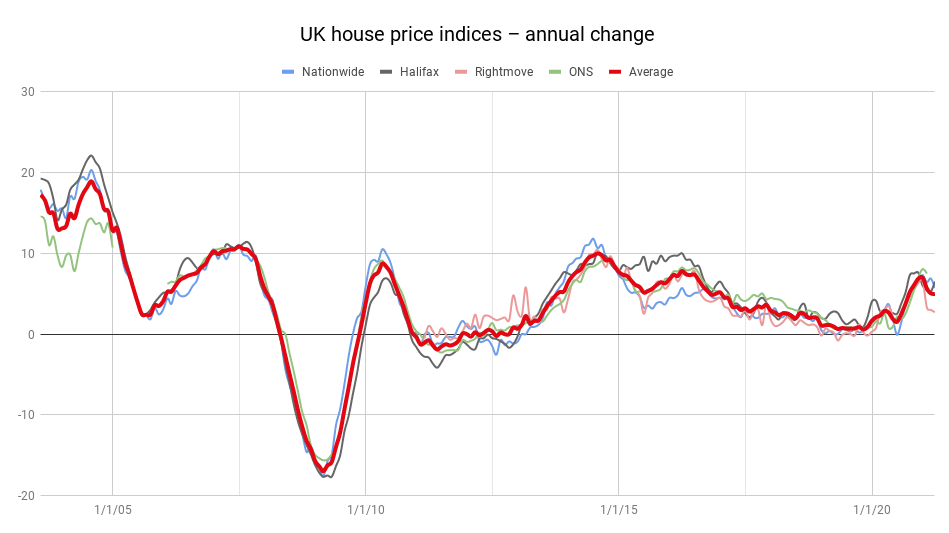

As of March 2021 the average property in the UK was worth £254,606, up 1% from the £251,856 high of February according to the Halifax house price index, and up 6.5% from a year ago, or £15,430 more.

“Few could have predicted quite how well the housing market would ride out the impact of the pandemic so far,” says Russell Galley, managing director at Halifax. “Let alone post growth of more than £1,000 per month on average.”

Try 6 free issues of MoneyWeek today

Get unparalleled financial insight, analysis and expert opinion you can profit from.

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Indeed, growth has been such that the return to record highs “can’t really be called a mini-boom at all any more”, says Nicky Stevenson, managing director at estate agent group Fine & Country. “Hordes of buyers chasing a relatively small pool of homes” are behind the price increase, as dwindling supply coupled with the stamp duty tax holiday prompts people to offer more, spend more, and encourage sellers to ask for more. “Demand is totally eclipsing supply and that’s forcing buyers to chase prices,” adds Stevenson.

An increase in supply is no guarantee prices will regulate themselves in the coming months, either. Halifax’s house price index revealed mortgage approvals fell in February by 9.9%; that figure is still 19.5% higher than it was in February 2020. The government’s 95% mortgage guarantee scheme, which we covered here, coupled with low interest rates are set to boost house prices further as more people are able to buy homes.

“The sheer volume of prospective buyers is partly due to the return of first time buyers, as securing a higher loan-to-value mortgage has got a lot easier over the past month or two,” says Rhys Schofield, managing director at Peak Mortgages & Protection. This “bottleneck” is the driving force behind the increase in prices, according to Schofield.

Meanwhile, says Schofield, the lack of stock could be because those moving home have less of an incentive to do so due to the stamp duty “cliff edge”. This translates to fewer starter homes becoming available. “House builders also shifted the vast majority of their stock at the end of last year and have limited units available within the next six months. We've even had a client reserve a property through one of the bigger national housebuilders, which won't actually be built until early 2022.”

The prospect of summer and outdoor space in which to entertain, especially given ongoing restrictions and the uncertainty around when they’ll be lifted coupled with the concern of them coming back, is pushing people to move in droves.

The March 2021 RICS UK residential survey showed sales market activity picked up sharply throughout the month, with 42% of surveyors citing an increase in new buyer enquiries for March. That’s the strongest return since September of last year. Agreed sales were also up, with 50% of contributors reporting an increase – a “sharp acceleration” from last month when only 7% did, and the strongest reading since last August.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Nic studied for a BA in journalism at Cardiff University, and has an MA in magazine journalism from City University. She has previously worked for MoneyWeek.

-

Do you face ‘double whammy’ inheritance tax blow? How to lessen the impact

Do you face ‘double whammy’ inheritance tax blow? How to lessen the impactFrozen tax thresholds and pensions falling within the scope of inheritance tax will drag thousands more estates into losing their residence nil-rate band, analysis suggests

-

Has the market misjudged Relx?

Has the market misjudged Relx?Relx shares fell on fears that AI was about to eat its lunch, but the firm remains well placed to thrive

-

What's behind the big shift in Japanese government bonds?

What's behind the big shift in Japanese government bonds?Rising long-term Japanese government bond yields point to growing nervousness about the future – and not just inflation

-

Halifax: House price slump continues as prices slide for the sixth consecutive month

Halifax: House price slump continues as prices slide for the sixth consecutive monthUK house prices fell again in September as buyers returned, but the slowdown was not as fast as anticipated, latest Halifax data shows. Where are house prices falling the most?

-

Rents hit a record high - but is the opportunity for buy-to-let investors still strong?

Rents hit a record high - but is the opportunity for buy-to-let investors still strong?UK rent prices have hit a record high with the average hitting over £1,200 a month says Rightmove. Are there still opportunities in buy-to-let?

-

Pension savers turn to gold investments

Pension savers turn to gold investmentsInvestors are racing to buy gold to protect their pensions from a stock market correction and high inflation, experts say

-

Where to find the best returns from student accommodation

Where to find the best returns from student accommodationStudent accommodation can be a lucrative investment if you know where to look.

-

The world’s best bargain stocks

The world’s best bargain stocksSearching for bargain stocks with Alec Cutler of the Orbis Global Balanced Fund, who tells Andrew Van Sickle which sectors are being overlooked.

-

Revealed: the cheapest cities to own a home in Britain

Revealed: the cheapest cities to own a home in BritainNew research reveals the cheapest cities to own a home, taking account of mortgage payments, utility bills and council tax

-

UK recession: How to protect your portfolio

UK recession: How to protect your portfolioAs the UK recession is confirmed, we look at ways to protect your wealth.