Large cap stocks start to struggle – is it time for investors to reassess their focus?

Buying quality large caps worked very well last decade. A more volatile world will be a bigger challenge for these star stocks, says Cris Sholto Heaton

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

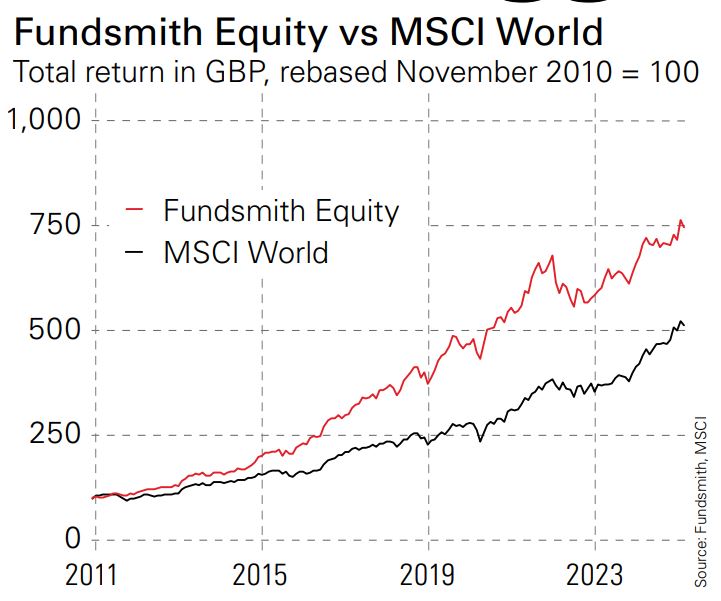

One of the best strategies during the last market regime was to buy quality large caps, as epitomised by Terry Smith. Quality is rather a flexible concept in investment – most people prefer to say they hold good businesses rather than trash – but broadly this meant companies with high return on equity, low leverage, and steady earnings that produce reliable cash flows and strong global growth prospects.

A decade ago, quality investors favoured areas such as consumer staples – often developed-market firms with exposure to emerging markets. Later, some of these stocks started to struggle amid slower emerging-market growth and the return of inflation after the pandemic, while the tech sector began to lead markets. So quality investors shifted a little towards software or data services, where the best businesses have steady recurring revenue, low capital intensity and the ability to lock in loyal customers.

Still, relatively few quality investors were drawn to Nvidia (semiconductors have always been a cyclical sector) and certainly not to firms such as Tesla. Since these stocks have had a huge influence over the last few years, quality has been unable to outstrip the market as easily as it did before the pandemic and many funds with this approach are doing less well.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

A changing portfolio

You can see these shifts play out in Fundsmith’s history. In February 2015, the fund had 40% in consumer staples, by far its largest position. By February 2020, technology was the top sector at 29%, slightly ahead of consumer staples. Then last month, it held 32% in health care, with 20% in consumer staples. Fundsmith has been more flexible than some other quality strategies and the steady move into healthcare could help performance rebound if tech is reaching a peak.

However, the tricky question for quality large-cap strategies – not just Fundsmith – is whether the entire approach faces a much tougher environment. The last era was hugely favourable for large multinationals. Globalisation gave them the chance to expand into new markets around the world, while politicians and regulators were often very relaxed about waving through cross-border mergers and acquisitions. Big companies grew ever bigger and more profitable.

There are compelling reasons to think this may be over. In the short term, tariffs will mostly hurt firms that ship goods across borders, rather than services. But in the longer term, fragmentation and antagonism create a more hostile world for multinationals. The US slaps more tariffs on European goods. Europe cranks up regulation on US tech giants. The US strikes back against European firms… and so on in a vicious circle.

If this happens, the obvious conclusion is to favour local over multinational (and small over large). I don’t think that outcome is certain, and this volatile market is not the time to rotate out of large global defensives into small caps. However, investors should be alert over the next few years for signs that the trend has changed and quality large caps may no longer be a stand-out strategy.

This article was first published in MoneyWeek's magazine. Enjoy exclusive early access to news, opinion and analysis from our team of financial experts with a MoneyWeek subscription.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Cris Sholt Heaton is the contributing editor for MoneyWeek.

He is an investment analyst and writer who has been contributing to MoneyWeek since 2006 and was managing editor of the magazine between 2016 and 2018. He is experienced in covering international investing, believing many investors still focus too much on their home markets and that it pays to take advantage of all the opportunities the world offers.

He often writes about Asian equities, international income and global asset allocation.

-

Can mining stocks deliver golden gains?

Can mining stocks deliver golden gains?With gold and silver prices having outperformed the stock markets last year, mining stocks can be an effective, if volatile, means of gaining exposure

-

8 ways the ‘sandwich generation’ can protect wealth

8 ways the ‘sandwich generation’ can protect wealthPeople squeezed between caring for ageing parents and adult children or younger grandchildren – known as the ‘sandwich generation’ – are at risk of neglecting their own financial planning. Here’s how to protect yourself and your loved ones’ wealth.

-

Three key winners from the AI boom and beyond

Three key winners from the AI boom and beyondJames Harries of the Trojan Global Income Fund picks three promising stocks that transcend the hype of the AI boom

-

RTX Corporation is a strong player in a growth market

RTX Corporation is a strong player in a growth marketRTX Corporation’s order backlog means investors can look forward to years of rising profits

-

Profit from MSCI – the backbone of finance

Profit from MSCI – the backbone of financeAs an index provider, MSCI is a key part of the global financial system. Its shares look cheap

-

'AI is the real deal – it will change our world in more ways than we can imagine'

'AI is the real deal – it will change our world in more ways than we can imagine'Interview Rob Arnott of Research Affiliates talks to Andrew Van Sickle about the AI bubble, the impact of tariffs on inflation and the outlook for gold and China

-

Should investors join the rush for venture-capital trusts?

Should investors join the rush for venture-capital trusts?Opinion Investors hoping to buy into venture-capital trusts before the end of the tax year may need to move quickly, says David Prosser

-

Food and drinks giants seek an image makeover – here's what they're doing

Food and drinks giants seek an image makeover – here's what they're doingThe global food and drink industry is having to change pace to retain its famous appeal for defensive investors. Who will be the winners?

-

Barings Emerging Europe trust bounces back from Russia woes

Barings Emerging Europe trust bounces back from Russia woesBarings Emerging Europe trust has added the Middle East and Africa to its mandate, delivering a strong recovery, says Max King

-

How a dovish Federal Reserve could affect you

How a dovish Federal Reserve could affect youTrump’s pick for the US Federal Reserve is not so much of a yes-man as his rival, but interest rates will still come down quickly, says Cris Sholto Heaton