New EPC rules for landlords: how much will it cost to upgrade your property to make it more energy efficient by 2030?

A government consultation on ensuring all rental properties have a minimum EPC rating of C ended this month. If you're landlord, you have have until 2030 to update your rental property, but may want to act now as costs could run into thousands.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

The cost of running a buy-to-let portfolio is set to rise further after the government resurrected plans to make rental properties more energy efficient.

Landlords have already been hit with higher mortgage rates and lower rental yields amid slowing house price growth as well as new rental regulations that will ban no-fault evictions.

Now, property investors are also facing the challenge of boosting the energy efficiency of their rental properties by 2030.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

A consultation that ended earlier this month suggests that from 2030, all rental homes will need a minimum energy performance certificate (EPC) rating of C, up from the current requirement for a score of E.

The aim is to bring down energy bills for tenants by making homes greener.

The government says the average cost for a landlord to upgrade their rental properties will be between £6,100 and £6,800 but other research suggests the figure will be higher.

Energy data firm epIMS said the average landlord is thought to have eight properties within their portfolio and with the average cost to bring a sub-C rated home up to compliance coming in at £8,000, that’s a potential required investment cost of £64,000 over the next five years.

Craig Cooper, chief operating officer at epIMS, said: “The worry is that forcing a mandatory EPC C rating on the nation’s landlords could cause more to exit the sector, exacerbating the current rental crisis in the process.”

The National Residential Landlords Association (NRLA) added that funding may be needed to support landlords to make the required changes.

Ben Beadle, chief Executive of the NRLA, said: “We all want to see rented homes as energy efficient as possible, but that will require a realistic plan to achieve this.

“The chronic shortage of tradespeople to carry out energy efficiency works needs to be addressed, alongside a targeted financial package to support investments in the work required as called for by the Committee on Fuel Poverty and Citizens Advice.

“Importantly a realistic timetable is needed if the 2.5 million private rented homes, which will not currently meet the government’s proposed standards, are to be improved.”

There are also calls for a more phased approach for new and existing tenancies.

Paragon Bank has suggested that the 2030 target should be for new tenancies, with 2033 given as an aim for extended tenancies and 2035 for all.

Louisa Sedgwick, managing director of mortgages for Paragon Bank, said: “Increasing the delivery timeline and maintaining flexible exemptions allows for a smoother transition without exacerbating the demand and supply imbalance, which is already expected to grow due to forecast population growth and demographic changes.”

What is an energy performance certificate?

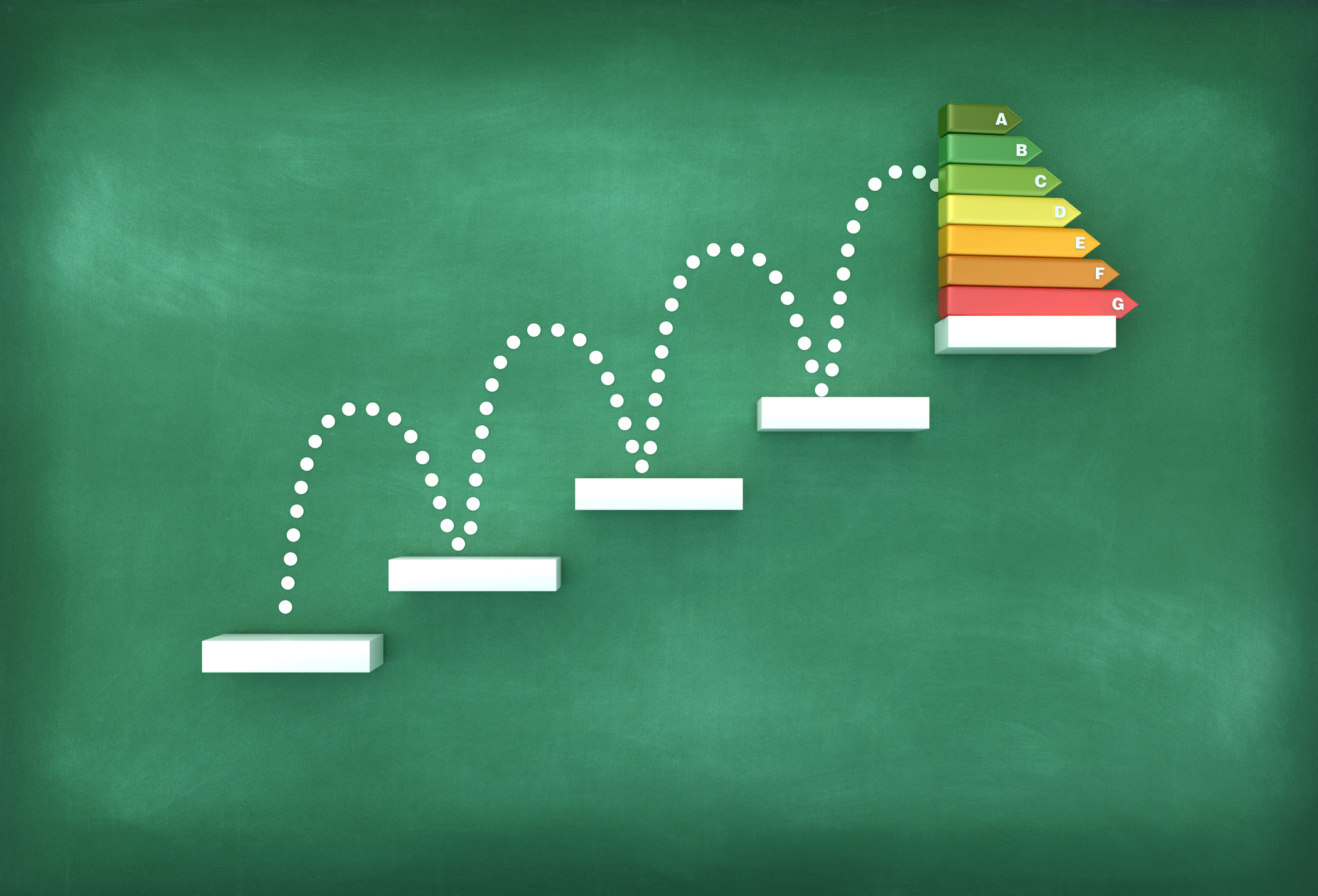

An energy performance certificate gives a home a rating from A to G based on how energy efficient it is.

The higher the rating, the lower the energy bills are likely to be.

All homes listed for sale or rent must have a valid EPC, giving potential buyers and tenants an idea of how much the gas and electricity bills will be at a property.

Currently, homes rented out by landlords must have a minimum EPC rating of E.

Plans to raise the minimum to C by 2030 were scrapped by former prime minister Rishi Sunak in October 2023 but the Labour government did vow to resurrect them.

The argument is that a higher EPC rating will help bring bills down for tenants, while there is also research that it can boost house prices.

You can search for EPCs via the "find an energy certificate" tool on the government website.

How can landlords boost their rental property’s EPC rating?

The Department for Energy Security and Net Zero (DESNZ) said landlords would have a choice over how to meet energy efficiency standards.

This will require them to meet a fabric standard through installing measures such as loft insulation, cavity wall insulation or double glazing, before moving on to a range of other options including batteries, solar panels and smart meters.

There will be a maximum cap of £15,000 per property for landlords, meaning they wouldn't be required to spend more than this to bring their property up to the standards. Support may be available from the Boiler Upgrade Scheme and Warm Homes: Local Grant.

Some landlords could get an affordability exemption, which would lower the cost cap to £10,000 and could be applied based on lower rents or council tax band.

It is estimated that over 2.5 million privately rented properties currently hold an EPC rating of below a C so there is lots of work for landlords to do.

However, Cooper suggested that it may be easier than some think.

He said: “An EPC rating is actually compiled using a points based system and so achieving a C rating could be well within their reach by making just a few small improvements to their rental properties.”

For example, a score of between 92-100 SAP points gives a rating of A, 81-91 points gives a rating of B, and 69-80 points gives a rating of C.

Cooper added: “This is important knowledge for landlords because it means that a property with a rating of D could be just one point, and therefore one minor improvement, away from upgrading to a C.

“The good news is that there are a raft of smaller, more cost-effective changes that can be made to a property which are likely to boost an EPC rating, such as installing PV panels over internal or external wall insulation.

"For those who are looking to meet that all-important C requirement, accredited energy assessors are best qualified to advise on what will and won’t work, to avoid wasting money on costly improvements.”

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Marc Shoffman is an award-winning freelance journalist specialising in business, personal finance and property. His work has appeared in print and online publications ranging from FT Business to The Times, Mail on Sunday and the i newspaper. He also co-presents the In For A Penny financial planning podcast.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how