Nikkei 225 reaches record high: should you invest in Japan?

Japanese equities have soared to an all-time high. But do they still offer good value and should you invest?

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

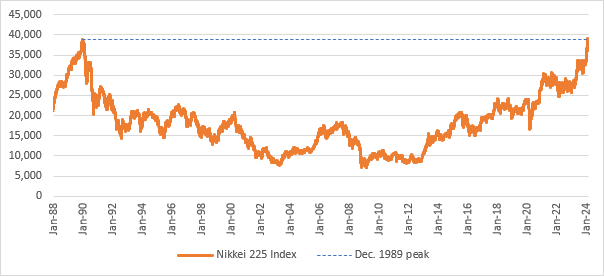

The Nikkei 225 has hit a record high, surpassing its December 1989 peak.

Japan’s main stock market index has enjoyed a year of sustained growth, supported by several factors including moderate inflation and accommodative central bank policy.

It comes as other markets such as the S&P 500 have hit record highs in recent weeks.

Try 6 free issues of MoneyWeek today

Get unparalleled financial insight, analysis and expert opinion you can profit from.

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

While inflation has become a dirty word in most economies over the past two years, in Japan it is a slightly different story. Japan’s economy has struggled with a deflation problem since the 1990s, so a current CPI rate of 2.6% looks pretty good.

Commenting on the strong market performance, Jeremy Osborne, investment director of the Fidelity Japan Trust, comments that “[u]pbeat earnings results, including from index heavyweights, accompanied by share buyback announcements have also served to galvanise market sentiment”.

He adds that “the broader shift in the economy to moderate inflation supports growth in wages” and, by extension, “consumer spending and investment”.

We look at what this performance means for investors. What can they expect next, and is now a good time to invest in Japanese equities?

What does this mean for investors?

If you had invested £1,000 in the Nikkei 225 at the bottom of the market on 27 February 2009, your stake would be worth £3,791 today, according to data from Morningstar Direct.

Of course, timing the market perfectly is very difficult – investing is more about patience and consistency. But the point still stands. You could have made a pretty nice return if you had decided to invest in Japanese equities in recent years.

Despite this, Osborne suggests that investors are currently under-allocating to Japan.

“Cumulative net buying by overseas investors remains well below the 2015 peak witnessed during the era of ‘Abenomics’, which was characterised by the growth-led approach of loose monetary policy, fiscal stimulus and structural reforms,” he says.

“Although we have seen renewed buying since March 2023, global active funds remain net underweight in Japan, albeit less so than they were during the Covid-19 outbreak.”

Do Japanese equities still offer good value?

Investing after a period of strong performance isn’t always a good idea. It could mean that the stocks are overvalued and likely to take a tumble once investors realise and sell out.

That said, guessing the exact moment when the market will rise or fall is notoriously difficult, and sitting on the sidelines could mean you miss out on returns.

What’s more, despite their recent strong performance, the data suggests Japanese equities are still offering good value for money.

Highlighting this point, Osborne points to the price bubble that Japan went through in the mid-eighties to early-nineties. “Japanese equities traded on a forward price-to-earnings (PE) multiple north of 50x”, he says.

Against this backdrop, “the current multiple of around 15x does not look expensive historically nor relative to other markets”, he adds, “especially considering current interest rates”. In comparison, the P/E ratio on the MSCI USA Index is currently 20.6.

Should you invest in Japanese equities?

As well as offering good value for money, Japanese equities could see further growth if recent corporate governance reforms initiated by the Tokyo Stock Exchange pay off.

The exchange is encouraging “essential initiatives such as research and development (R&D), human and capital investment, and realigning business portfolios to better allocate resources”, Osborne explains.

These developments should help businesses create additional value which, in turn, can be passed on to shareholders. Previously, the deflationary environment made it difficult for companies to invest in their future in this way, Osborne adds.

The risk for investors is that Japan returns to a deflationary environment or, conversely, that rising interest rates cause company valuations to slide.

Investors should also keep an eye on events on the global stage. For example, economic weakness in China and the US could have an impact on the Japanese market.

Furthermore, we could be in for another harmful energy shock if geopolitical risks flare up – but “this is likely to be a global headwind rather than isolated to Japan”, Osborne says.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Katie has a background in investment writing and is interested in everything to do with personal finance, politics, and investing. She previously worked at MoneyWeek and Invesco.

-

Financial education: how to teach children about money

Financial education: how to teach children about moneyFinancial education was added to the national curriculum more than a decade ago, but it doesn’t seem to have done much good. It’s time to take back control

-

Investing in Taiwan: profit from the rise of Asia’s Silicon Valley

Investing in Taiwan: profit from the rise of Asia’s Silicon ValleyTaiwan has become a technology manufacturing powerhouse. Smart investors should buy in now, says Matthew Partridge