Are UK Reits the most unloved asset?

Recent updates from UK Reits are looking more positive, but the market remains entirely unimpressed

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

After Covid struck five years ago, several UK real-estate investment trusts (Reits) suspended or slashed their dividends.

There were dire predictions that demand for offices and shops would be so much weaker after the pandemic that payouts would never fully recover. But while real estate has been affected by changes in work and leisure, most Reits have seen their income hold up much better than feared.

The two big diversified Reits sum up the highs and lows. Land Securities paid out 45.55p per share in 2018/19, falling to 23.2p in 2019-2020. It should pay 40.5p this year. British Land fell from 31.47p to 15.04p; it’s now back to 23p.

Try 6 free issues of MoneyWeek today

Get unparalleled financial insight, analysis and expert opinion you can profit from.

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Yet share prices are mostly back to where they were in 2020 or even lower. This isn’t just true for the office sector, where one can understand why many investors remain cautious. It applies almost across the board, and the reasons why are clear.

UK Reits: are investors too bearish?

Higher interest rates since 2022 have pushed up the cost of debt used to fund most property deals and also increased the returns that investors can get elsewhere (eg, from government bonds). Hence commercial-property values have fallen, which means Reits are regularly announcing valuation write-downs. That never makes for good headlines, even if rents keep rolling in.

For a double whammy, higher yields elsewhere make the Reits’ own payouts look less compelling. Pre-Covid, Land Securities yielded about 4.5%, now it yields 7.5%. Over the same period, the 10-year gilt has gone from about 0.75% to 4.75%.

Still, look at recent updates and you wonder if investors are too bearish. Shaftesbury, which owns large swathes of London’s West End, reported a 7% net asset value total return for 2024. The shares are down 8% over 12 months. London office specialist Derwent reported stable values and solid leasing trends. It’s off 13% over the year. Logistics firms such as Segro, Tritax Big Box and LondonMetric – which were market darlings until early 2022 – reported okay results, yet the shares remain in the red. And so on. Tailwinds may be picking up, but they’ve yet to be noticed.

Except perhaps within the sector, where Reits are snapping each other up or being bought out by private equity. In the past month, KKR has bid for healthcare facilities group Assura, and Blackstone has bid for Warehouse Reit. Specialists clearly see some value in UK property, at least selectively.

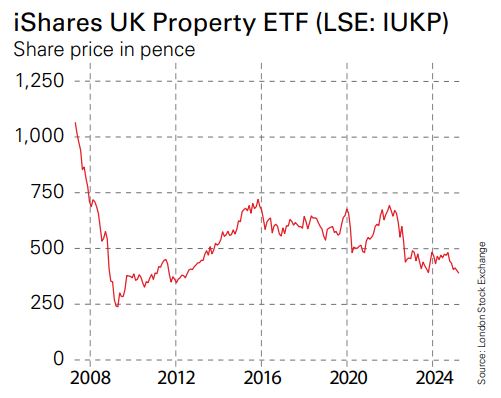

Of course, they may be wrong – real estate is cyclical and in every cycle, experienced investors get big calls wrong. Indeed, the news that Land Securities now plans to sell £2 billion of offices to invest in residential property is hard to understand – selling cash-generating assets near a likely market-bottom to fund ambitious new developments for a completely different type of tenant under a government that is very keen to intervene in the housing sector feels like a bold move, and not necessarily what shareholders want. Still, at these levels and with news improving, the iShares UK Property ETF (LSE: IUKP) sector tracker looks like a promising contrarian play.

This article was first published in MoneyWeek's magazine. Enjoy exclusive early access to news, opinion and analysis from our team of financial experts with a MoneyWeek subscription.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Cris Sholt Heaton is the contributing editor for MoneyWeek.

He is an investment analyst and writer who has been contributing to MoneyWeek since 2006 and was managing editor of the magazine between 2016 and 2018. He is experienced in covering international investing, believing many investors still focus too much on their home markets and that it pays to take advantage of all the opportunities the world offers.

He often writes about Asian equities, international income and global asset allocation.

-

What do rising oil prices mean for you?

What do rising oil prices mean for you?As conflict in the Middle East sparks an increase in the price of oil, will you see petrol and energy bills go up?

-

Rachel Reeves's Spring Statement – live analysis and commentary

Rachel Reeves's Spring Statement – live analysis and commentaryChancellor Rachel Reeves will deliver her Spring Statement on 3 March. What can we expect in the speech?

-

Three Indian stocks poised to profit

Three Indian stocks poised to profitIndian stocks are making waves. Here, professional investor Gaurav Narain of the India Capital Growth Fund highlights three of his favourites

-

UK small-cap stocks ‘are ready to run’

UK small-cap stocks ‘are ready to run’Opinion UK small-cap stocks could be set for a multi-year bull market, with recent strong performance outstripping the large-cap indices

-

Hints of a private credit crisis rattle investors

Hints of a private credit crisis rattle investorsThere are similarities to 2007 in private credit. Investors shouldn’t panic, but they should be alert to the possibility of a crash.

-

Investing in Taiwan: profit from the rise of Asia’s Silicon Valley

Investing in Taiwan: profit from the rise of Asia’s Silicon ValleyTaiwan has become a technology manufacturing powerhouse. Smart investors should buy in now, says Matthew Partridge

-

‘Why you should mix bitcoin and gold’

‘Why you should mix bitcoin and gold’Opinion Bitcoin and gold are both monetary assets and tend to move in opposite directions. Here's why you should hold both

-

Invest in the beauty industry as it takes on a new look

Invest in the beauty industry as it takes on a new lookThe beauty industry is proving resilient in troubled times, helped by its ability to shape new trends, says Maryam Cockar

-

Should you invest in energy provider SSE?

Should you invest in energy provider SSE?Energy provider SSE is going for growth and looks reasonably valued. Should you invest?

-

Has the market misjudged Relx?

Has the market misjudged Relx?Relx shares fell on fears that AI was about to eat its lunch, but the firm remains well placed to thrive