Are UK Reits the most unloved asset?

Recent updates from UK Reits are looking more positive, but the market remains entirely unimpressed

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

After Covid struck five years ago, several UK real-estate investment trusts (Reits) suspended or slashed their dividends.

There were dire predictions that demand for offices and shops would be so much weaker after the pandemic that payouts would never fully recover. But while real estate has been affected by changes in work and leisure, most Reits have seen their income hold up much better than feared.

The two big diversified Reits sum up the highs and lows. Land Securities paid out 45.55p per share in 2018/19, falling to 23.2p in 2019-2020. It should pay 40.5p this year. British Land fell from 31.47p to 15.04p; it’s now back to 23p.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Yet share prices are mostly back to where they were in 2020 or even lower. This isn’t just true for the office sector, where one can understand why many investors remain cautious. It applies almost across the board, and the reasons why are clear.

UK Reits: are investors too bearish?

Higher interest rates since 2022 have pushed up the cost of debt used to fund most property deals and also increased the returns that investors can get elsewhere (eg, from government bonds). Hence commercial-property values have fallen, which means Reits are regularly announcing valuation write-downs. That never makes for good headlines, even if rents keep rolling in.

For a double whammy, higher yields elsewhere make the Reits’ own payouts look less compelling. Pre-Covid, Land Securities yielded about 4.5%, now it yields 7.5%. Over the same period, the 10-year gilt has gone from about 0.75% to 4.75%.

Still, look at recent updates and you wonder if investors are too bearish. Shaftesbury, which owns large swathes of London’s West End, reported a 7% net asset value total return for 2024. The shares are down 8% over 12 months. London office specialist Derwent reported stable values and solid leasing trends. It’s off 13% over the year. Logistics firms such as Segro, Tritax Big Box and LondonMetric – which were market darlings until early 2022 – reported okay results, yet the shares remain in the red. And so on. Tailwinds may be picking up, but they’ve yet to be noticed.

Except perhaps within the sector, where Reits are snapping each other up or being bought out by private equity. In the past month, KKR has bid for healthcare facilities group Assura, and Blackstone has bid for Warehouse Reit. Specialists clearly see some value in UK property, at least selectively.

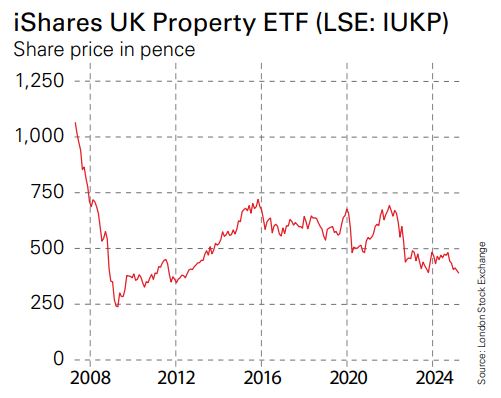

Of course, they may be wrong – real estate is cyclical and in every cycle, experienced investors get big calls wrong. Indeed, the news that Land Securities now plans to sell £2 billion of offices to invest in residential property is hard to understand – selling cash-generating assets near a likely market-bottom to fund ambitious new developments for a completely different type of tenant under a government that is very keen to intervene in the housing sector feels like a bold move, and not necessarily what shareholders want. Still, at these levels and with news improving, the iShares UK Property ETF (LSE: IUKP) sector tracker looks like a promising contrarian play.

This article was first published in MoneyWeek's magazine. Enjoy exclusive early access to news, opinion and analysis from our team of financial experts with a MoneyWeek subscription.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Cris Sholt Heaton is the contributing editor for MoneyWeek.

He is an investment analyst and writer who has been contributing to MoneyWeek since 2006 and was managing editor of the magazine between 2016 and 2018. He is experienced in covering international investing, believing many investors still focus too much on their home markets and that it pays to take advantage of all the opportunities the world offers.

He often writes about Asian equities, international income and global asset allocation.

-

Can mining stocks deliver golden gains?

Can mining stocks deliver golden gains?With gold and silver prices having outperformed the stock markets last year, mining stocks can be an effective, if volatile, means of gaining exposure

-

8 ways the ‘sandwich generation’ can protect wealth

8 ways the ‘sandwich generation’ can protect wealthPeople squeezed between caring for ageing parents and adult children or younger grandchildren – known as the ‘sandwich generation’ – are at risk of neglecting their own financial planning. Here’s how to protect yourself and your loved ones’ wealth.

-

Three key winners from the AI boom and beyond

Three key winners from the AI boom and beyondJames Harries of the Trojan Global Income Fund picks three promising stocks that transcend the hype of the AI boom

-

RTX Corporation is a strong player in a growth market

RTX Corporation is a strong player in a growth marketRTX Corporation’s order backlog means investors can look forward to years of rising profits

-

Profit from MSCI – the backbone of finance

Profit from MSCI – the backbone of financeAs an index provider, MSCI is a key part of the global financial system. Its shares look cheap

-

'AI is the real deal – it will change our world in more ways than we can imagine'

'AI is the real deal – it will change our world in more ways than we can imagine'Interview Rob Arnott of Research Affiliates talks to Andrew Van Sickle about the AI bubble, the impact of tariffs on inflation and the outlook for gold and China

-

Should investors join the rush for venture-capital trusts?

Should investors join the rush for venture-capital trusts?Opinion Investors hoping to buy into venture-capital trusts before the end of the tax year may need to move quickly, says David Prosser

-

Food and drinks giants seek an image makeover – here's what they're doing

Food and drinks giants seek an image makeover – here's what they're doingThe global food and drink industry is having to change pace to retain its famous appeal for defensive investors. Who will be the winners?

-

Barings Emerging Europe trust bounces back from Russia woes

Barings Emerging Europe trust bounces back from Russia woesBarings Emerging Europe trust has added the Middle East and Africa to its mandate, delivering a strong recovery, says Max King

-

How a dovish Federal Reserve could affect you

How a dovish Federal Reserve could affect youTrump’s pick for the US Federal Reserve is not so much of a yes-man as his rival, but interest rates will still come down quickly, says Cris Sholto Heaton