How to invest as we move into a new era

As we move away from pandemic panic and into world of risk acceptance, higher energy prices and higher interest rates, your priority as an investor should be to protect the real value of your assets.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

January is a time for resolutions – and most of us can think of very necessary financial resolutions aplenty. But rather than focus on any one quick fix, this might be the year to remember the actual point of saving and investing. It is not the accumulation for the sake of accumulation. It is to buy choice: choice over when and how you work, choice over how you live, and choice over when you retire – to buy you flexibility and freedom. You build wealth now so you can use it later. That’s all.

This means that your core financial priority should usually be protecting the “real” value of the assets (and hence the financial freedom) you already have. I mention it this year in particular, because this is not going to be straightforward in 2022. We are in a transition phase in almost every way. We are shifting from endless pandemic panic and knee-jerk “something must be done” policy-making to a new era of risk acceptance, from an era of cheap energy to the opposite, from one of very low interest rates to one of rising rates and – possibly – from one where capital holds all the cards to one where a fast-rising dependency ratio means labour holds at least some of them.

There’s also a growing sense that the most recent wave of technological disruption might have stalled. The likes of Apple, Google and Amazon were once huge disrupters and drivers of disinflation. Now they are monopolies or duopolies that it’s tough for anyone else to disrupt.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

How to invest during the transition

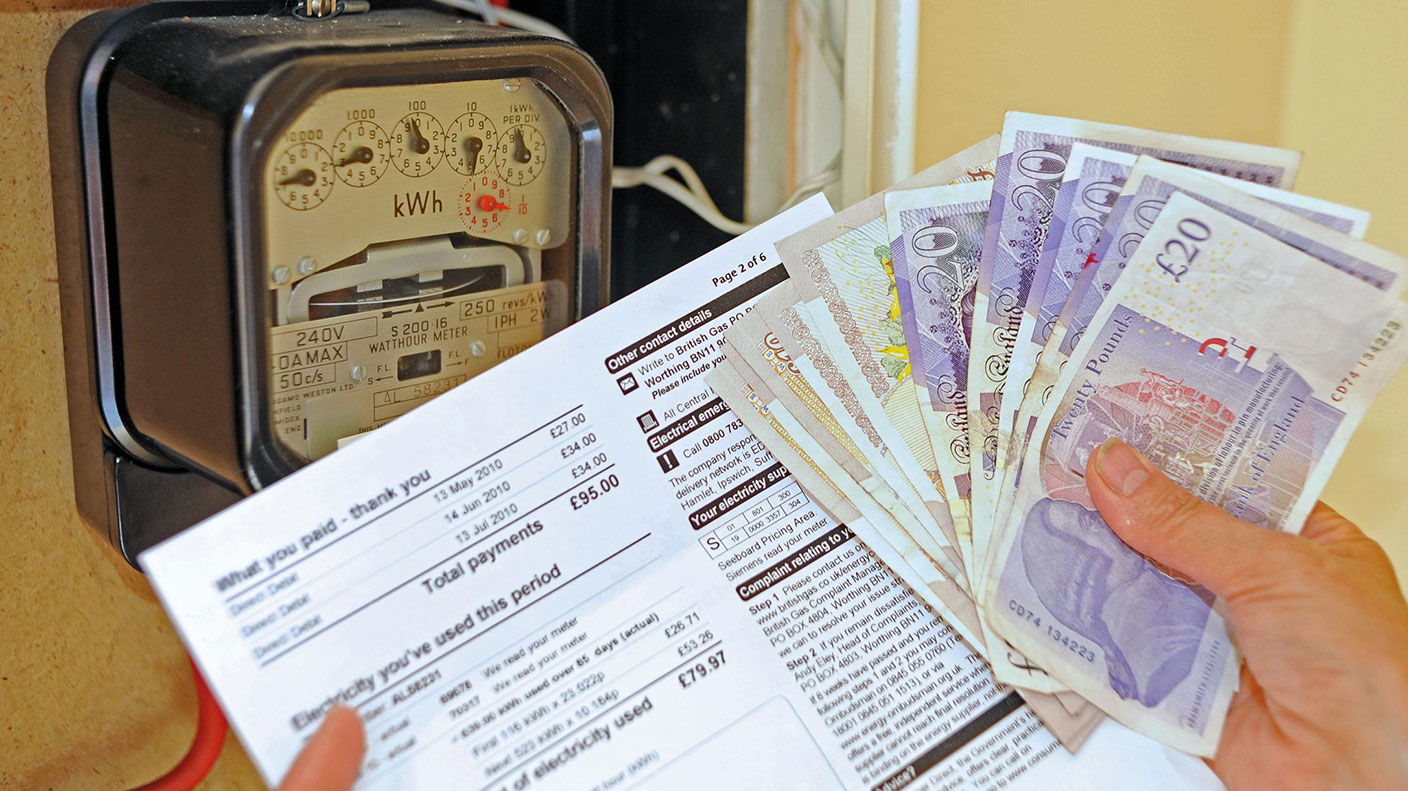

Some of these things are good in all sorts of ways (we are very pro rising real wages for example). But the inflationary pressures they produce are also going to hit your purchasing power hard. One hint as to how? If you are on a fixed-rate energy deal at the moment, check to see what the same deal would cost today. You will be shocked.

Persistent inflation also suggests tighter monetary policy. 2021 was the year in which central banks believed inflation was transient; 2022 may well be the one in which they realise they were very wrong and actually did something about it. Expect higher interest rates. That in turn is going to affect stockmarkets – all those high-growth stocks worth infinity because they were valued against interest rates close to zero may suddenly be worth rather less. Pay some of the highest valuations in history and you should not be surprised if you get some of the lowest returns.

With all this happening how can you preserve capital? There are specific trusts devoted to this (look at Personal Assets, Capital Gearing and Ruffer). In the search for value you might also look at one of our old favourites, the Miton Global Opportunities Trust (MIGO). It is effectively a trust of trusts – the managers find and buy undervalued trusts with a view to holding them until that changes. Right now, notes Max in this week's issue of MoneyWeek magazine, the average discount to net asset value of the top 12 holdings is in the region of 18%. A consistent long-term performer, MIGO returned around 25% last year, and nearly 80% over the last five. We also look at Cathie Woods’ Disruptive Innovation ETF – which holds the Zooms of the world. It rose 150% in 2020 (it holds the kind of stocks that love lockdowns and low interest rates) but fell 21% last year. I know which I would rather hold going into our new year of transition. Happy New Year.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

Japanese stocks rise on Takaichi’s snap election landslide

Japanese stocks rise on Takaichi’s snap election landslideJapan’s new prime minister Sanae Takaichi has won a landslide victory in a snap election, prompting optimism that her pro-growth agenda will benefit Japanese stocks

-

Alphabet 'is planning a 100-year bond': would you back Google for 100 years?

Alphabet 'is planning a 100-year bond': would you back Google for 100 years?Google owner Alphabet is reported to be joining the rare century bond club

-

Three key winners from the AI boom and beyond

Three key winners from the AI boom and beyondJames Harries of the Trojan Global Income Fund picks three promising stocks that transcend the hype of the AI boom

-

RTX Corporation is a strong player in a growth market

RTX Corporation is a strong player in a growth marketRTX Corporation’s order backlog means investors can look forward to years of rising profits

-

Profit from MSCI – the backbone of finance

Profit from MSCI – the backbone of financeAs an index provider, MSCI is a key part of the global financial system. Its shares look cheap

-

'AI is the real deal – it will change our world in more ways than we can imagine'

'AI is the real deal – it will change our world in more ways than we can imagine'Interview Rob Arnott of Research Affiliates talks to Andrew Van Sickle about the AI bubble, the impact of tariffs on inflation and the outlook for gold and China

-

Should investors join the rush for venture-capital trusts?

Should investors join the rush for venture-capital trusts?Opinion Investors hoping to buy into venture-capital trusts before the end of the tax year may need to move quickly, says David Prosser

-

Food and drinks giants seek an image makeover – here's what they're doing

Food and drinks giants seek an image makeover – here's what they're doingThe global food and drink industry is having to change pace to retain its famous appeal for defensive investors. Who will be the winners?

-

Barings Emerging Europe trust bounces back from Russia woes

Barings Emerging Europe trust bounces back from Russia woesBarings Emerging Europe trust has added the Middle East and Africa to its mandate, delivering a strong recovery, says Max King

-

How a dovish Federal Reserve could affect you

How a dovish Federal Reserve could affect youTrump’s pick for the US Federal Reserve is not so much of a yes-man as his rival, but interest rates will still come down quickly, says Cris Sholto Heaton