A nightmare 1970s scenario for investors is edging closer

Inflation need not be a worry unless it is driven by labour market shortages. Unfortunately, writes macroeconomist Philip Pilkington, that’s exactly what we’re seeing today. Investors should beware

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

With inflation front and centre in the financial news, many are asking whether we might see a return to the 1970s. Shortages, double-digit inflation, stagnation – it is certainly not a nice prospect. So it is tempting to take comfort in the view that at first glance at least, the inflation we are currently experiencing looks likely to be transient, meaning we need not worry too much about runaway inflation.

This is certainly the judgement of the central banks, and one their representatives have repeated on many occasions. But it is also the conclusion that my former colleague, James Montier, and I came to from our recent study of the “reopening” of the British economy after World War II. What we saw then were sharp, but one-off price rises in a variety of products that had been subject to rationing during and after the war.

True, the sharp shocks to used car and rent prices, which we have seen in 2021, are a different beast to the rising egg and cheese prices of the late-1940s, but the underlying dynamics appeared to be echoing one another. As pent-up demand surged, prices responded briefly and then – in the late 1940s – quietened down. No inflationary spiral took place because wages did not chase prices higher and so consumers merely took a one-off hit on their real (after-inflation) income. Today’s conditions seemed to be unfolding similarly.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Labour pains

Since we undertook this study, however, something drastic has changed: labour shortages have begun to appear. As of August, job openings in the US stood at 10.1 million while hires stood at only 6.1 million. Some are blaming this on the generous welfare benefits extended during the pandemic, which they argue make staying at home preferable to working for at least some people. However, these labour shortages are appearing all over the world, not just the US.

In the UK, for example, the Recruitment and Employment Confederation (REC) and the accountancy firm KPMG have calculated that staffing shortages are the worst we have seen since 1997. Similar reports are emerging from Germany, France and Israel – with the services sectors being the worst hit. When a trend sets in across the world at the same time, it is logical to look for a common cause. The common cause in this case seems obvious given a moment’s reflection: Covid-19.

The economists’ emotion of choice to explain human motivation is, invariably, greed. But this can blind us to more powerful emotional forces. One that we have been exposed to more than usual in the past year and a half is fear. Fear usually overrides greed because people, wisely enough, will place their health over their wealth. This raises an obvious question: what if the labour shortages are due to a percentage of the population being too scared to go to work?

A fearful prospect

Polls taken in 2020 by YouGov in both the US and the UK showed that around half of respondents were scared to go to work. More recent polling of general fear among the population has shown some decline in 2021, but not as much as you might expect, given positive developments in the time. Between March 2020 and January 2021, before the vaccine rollout, around 55% of Americans said they were “very” or “somewhat” scared that they would contract Covid-19. This summer, after the vaccine had been rolled out, this number fell to around 40% – a decline, but not exactly a collapse in fear.

There are murky hints in the psychological literature too. National surveys by the US Census Bureau show that anxiety has skyrocketed. In January to June 2019, around 11% of Americans surveyed said that they experienced anxiety. In December 2020, this number had shot up to 42%. Now, general anxiety is probably not enough to keep an individual out of the labour force. Harvard Medical School, however, has relayed anecdotal evidence that there may also have been a large rise in agoraphobia in the population – that is, a fear of going outside or interacting in social situations.

It seems unlikely that a full half of the population, or even a third, are too scared to return to work. But let’s assume that even a fraction of those people who say they are scared, are so scared that they simply will not go out to work. This could easily be enough to generate labour shortages. Even if only around, say, one in 30 people have been terrified into dropping out of the labour force, this would have substantial impacts on the employment market, and therefore on wages. Economists should team up with psychologists now and study these trends in more depth – they could be some of the most important of the decade ahead.

A cure worse than the disease

But any disruption caused by fear of the virus could pale in comparison to that caused by objections to the vaccine. The polling data on fear of Covid-19 itself is vague, but the data on reactions to the vaccine is crystal clear. In September 2020, 24% of Americans surveyed by the KFF health policy think tank said they would “definitely not” get the vaccine. By February 2021, this number had dropped to 15%. So it’s clear that the number of people in this category has been shrinking as the pandemic has lingered on – but it seems reasonable to assume that it is unlikely to shrink much further from here.

Now consider that many companies and organisations are considering making vaccines compulsory as a condition of employment. If those polling numbers are to be believed, this could conceivably impact up to 15% of the labour force. That’s an enormous number. But even if we assume that just a fraction of the vaccine-fearful are threatened with such mandates, the impact on the labour market could be profound.

If we conservatively say that 3% of the population are too scared to go to work because of the virus and a further 5% will be shut out due to refusal to take the vaccine, we could see more than one in 12 workers disappear from the labour pool. That is easily enough to cause a chronic labour crisis, a rise in wages and spiralling inflation.

Remembrance of inflations past

It is worth remembering what caused the inflation of the 1970s. The really nasty stuff started with the oil price hike by oil cartel Opec in 1973. That was a “punishment” meted out by the Arab states for America’s involvement in the Yom Kippur War. But as with egg and cheese prices in the late-1940s, or used car and rent prices in our own time, such a “supply shock” can only lead to more general inflation if wages start to chase prices higher (a so-called “wage-price spiral”). Enter the trade unions. Riding the waves of 1960s radicalism, unions in the 1970s were bristling with self-confidence – and bulging with members. In the 1970s, American trade union membership was hovering at around 25% – versus the 10% number we see today. In the UK, membership was even higher – with around 45% of the workforce unionised versus the 25% we see today.

These unions were able to create labour shortages through strike action, and as prices rose in the face of the oil price shock they readily did so. In the US during that period, the number of strikes involving more than 1,000 workers hovered around 400 a year – a number that dwarfs the approximately 20 or so we see today. The effects of these labour shortages were as dramatic as they were predictable: the average rate of inflation in the US between 1973 and 1981 was 9%, while in the UK it was even higher, at nearly 15%.

Pity the rentier

Inflation has more than a few ill-effects on the economy and on society. More so than perhaps any other economic phenomenon, it feels unfair. In an inflation, people often feel as though they are being ripped-off – inflation breeds distrust of authority, conspiracy theory and political instability. Lenin once said that the best way to destroy the capitalist system was to debauch the currency. And it’s clear, from both distant and recent history, that inflation and political upheaval – and even societal collapse – go hand-in-hand. Just a decade ago, political regimes across the Arab world collapsed in the face of riots triggered by food price inflation in 2009-2010 – Lenin-disciple Muammar Gaddafi could not have missed the irony.

For those who save and invest, inflation is a hell like no other. Financial markets in an inflation become at once stagnant and unstable. What is more, these are not simply psychological effects – it’s not just down to investors becoming less willing to pay up for earnings. Consider the rate of growth of real earnings-per-share (EPS) for US stocks. Historical data going back to 1871 shows that when inflation is more than 5%, real EPS growth typically barely musters 1% a year; when inflation goes above 10%, real EPS growth collapses, falling by 2% a year. Compare this to an optimal inflation regime of around 2%-5% where real EPS has historically grown at a healthy 13% annually, and you can see why financial markets respond badly to inflation.

Even investing in bonds becomes a chaotic prospect. Bond yields and bond prices move inversely – as one goes up, the other goes down. Yields tend to rise under inflationary conditions (because investors don’t want to accept a 1% yield, say, when inflation is at 4%). And when bond yields are higher, bond pricing becomes more volatile. Historic data shows that when US Treasury yields sit between around 0% and 9%, prices tend only to move by between -2% and 2% a year. But when they sit above 9%, they tend to move between -4% and 4% a year – nearly double the range. This makes bond investing a more volatile game in inflations. That might be great news for specific types of hedge fund, but its terrible for average investors.

A perfect storm

The picture gets even worse when we consider interest rates and valuations. Heading into the inflation of the 1970s, the S&P 500 was trading at a Shiller multiple (that is, the ten-year price/earnings ratio) of around ten times, while ten-year Treasuries were yielding a healthy 6%. This implied the annual return on a standard 60/40 portfolio – that is, 60% equities, 40% bonds – was around 7.5%. Today the S&P 500 trades at a Shiller multiple of around 39, and ten-year Treasuries yield a measly 1.3%. This implies an annual return on a 60/40 portfolio of close to 0%.

In short, markets are priced for perfection. Pension funds and endowments are already living on a prayer. Their prospects look bad enough without a visit from the inflation monster. If it comes calling, they could be facing their worst crisis in recorded history. Active investors, meanwhile, will have to get creative – very creative. Looking at the oil price shock of the 1970s, you might conclude that in inflation you just shift the portfolio to commodities and gold. It might work – but it might not. The dynamics this time are different, driven by a virus and not an Arab war. At best, commodities and gold should only be seen as one part of an overall portfolio strategy to weather an inflationary storm. I look at some other possible strategies in the box below.

Protecting your portfolio from inflation

What is a poor investor do? History does not paint a pretty picture. During the inflationary years of 1972-1982 real (after-inflation) returns on the S&P 500 were effectively flat. Having your money in the stockmarket could protect it from debasement, but that was all – it could not generate spendable returns. Yet when you compare the stockmarket with bonds, it looks like a positively excellent bet – US equities yielded an average of 1.3% a year during this period versus 0% on corporate bonds, and a dismal loss of 1.8% a year on ten-year Treasuries.

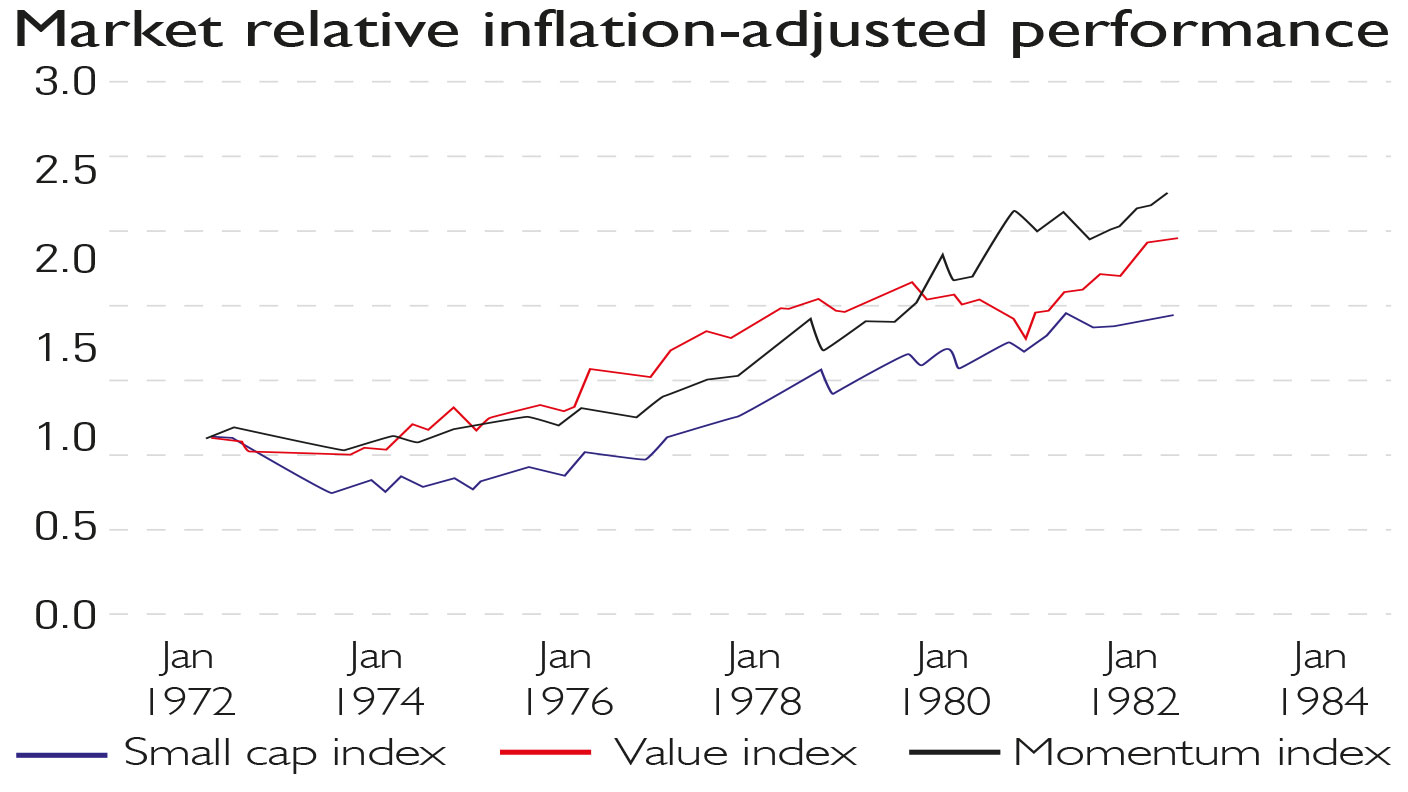

If you did take a punt on stocks in an inflationary environment, does history indicate that there might be any way to boost your returns and thus prevent your portfolio from simply treading water? Possibly. “Factors” (which are specific characteristics that have historically enabled companies that share them to beat the wider market over time) appear to have performed well during inflationary periods. In the 1972-1982 period, tilting your portfolio toward the momentum, value and small cap factors would have given it a boost, with the three factors far outstripping their historical average outperformance, as the chart shows.

Value (red line) and momentum (black line) stocks both vastly outperformed the market in the period. After adjusting for inflation, they had doubled in value relative to the market which was effectively flat. In other words, for every dollar an investor in the total index earned, investors in these factors earned two. These are actual, spendable gains. (Most people correctly assume that value and momentum are polar opposite strategies and in cyclical terms this is often correct; however over the long run, both generate excess returns and clearly during the 1972-1982 inflation they did this in lockstep.)

Small cap (blue line) stocks did poorly initially, but were able to stage something of a comeback, eventually accumulating a 50% premium to the market – again, real spendable gains. Meanwhile, the stocks that did badly were (logically) the flipside of these factors, such as growth stocks and large caps.

That said, stockmarkets cannot be judged without reference to how expensive they are. The US market in particular stands out on this basis. If we start experiencing heavy inflation and multiples on the S&P 500 remain at today’s nosebleed heights, it might be worth thinking twice before going all in.

And while there are now plenty of exchange-traded funds (ETFs) which allow private investors to track the hallowed factors mentioned before, investing in these can be a complicated business which requires more than a little skill and thoughtfulness, not to mention making sure that you’re using the right ETF. Also just because they did well in the last inflation, that’s not a guarantee that they will repeat this in the next.

So before jumping into any of these strategies with both feet, it is well worth considering the security that inflation-indexed bonds offer – although if inflation doesn’t turn out to be here to stay, they may turn out to be a very frustrating investment. And that is an added point to note– inflation is not a sure thing. Crystal balls cost more in credibility than they are worth. The Covid-19 fear factor may dissipate; employers may realise that vaccine mandates will cost them dearly, or vaccine-hesitant workers might throw in the towel.

But if we keep these dynamics in mind, they will help us to identify a serious inflationary environment if we enter one. At that point, tough asset allocation decisions will have to be made.

• Philip Pilkington is a macroeconomist and investment professional. He is the author of the book The Reformation in Economics, and blogs at Fixing the Economists and on Twitter @philippilk

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Philip Pilkington is a macroeconomist and investment professional. He is the author of the book The Reformation in Economics, and blogs at Fixing the Economists and on Twitter @philippilk

-

Can mining stocks deliver golden gains?

Can mining stocks deliver golden gains?With gold and silver prices having outperformed the stock markets last year, mining stocks can be an effective, if volatile, means of gaining exposure

-

8 ways the ‘sandwich generation’ can protect wealth

8 ways the ‘sandwich generation’ can protect wealthPeople squeezed between caring for ageing parents and adult children or younger grandchildren – known as the ‘sandwich generation’ – are at risk of neglecting their own financial planning. Here’s how to protect yourself and your loved ones’ wealth.

-

Three key winners from the AI boom and beyond

Three key winners from the AI boom and beyondJames Harries of the Trojan Global Income Fund picks three promising stocks that transcend the hype of the AI boom

-

RTX Corporation is a strong player in a growth market

RTX Corporation is a strong player in a growth marketRTX Corporation’s order backlog means investors can look forward to years of rising profits

-

Profit from MSCI – the backbone of finance

Profit from MSCI – the backbone of financeAs an index provider, MSCI is a key part of the global financial system. Its shares look cheap

-

'AI is the real deal – it will change our world in more ways than we can imagine'

'AI is the real deal – it will change our world in more ways than we can imagine'Interview Rob Arnott of Research Affiliates talks to Andrew Van Sickle about the AI bubble, the impact of tariffs on inflation and the outlook for gold and China

-

Should investors join the rush for venture-capital trusts?

Should investors join the rush for venture-capital trusts?Opinion Investors hoping to buy into venture-capital trusts before the end of the tax year may need to move quickly, says David Prosser

-

Food and drinks giants seek an image makeover – here's what they're doing

Food and drinks giants seek an image makeover – here's what they're doingThe global food and drink industry is having to change pace to retain its famous appeal for defensive investors. Who will be the winners?

-

Barings Emerging Europe trust bounces back from Russia woes

Barings Emerging Europe trust bounces back from Russia woesBarings Emerging Europe trust has added the Middle East and Africa to its mandate, delivering a strong recovery, says Max King

-

How a dovish Federal Reserve could affect you

How a dovish Federal Reserve could affect youTrump’s pick for the US Federal Reserve is not so much of a yes-man as his rival, but interest rates will still come down quickly, says Cris Sholto Heaton