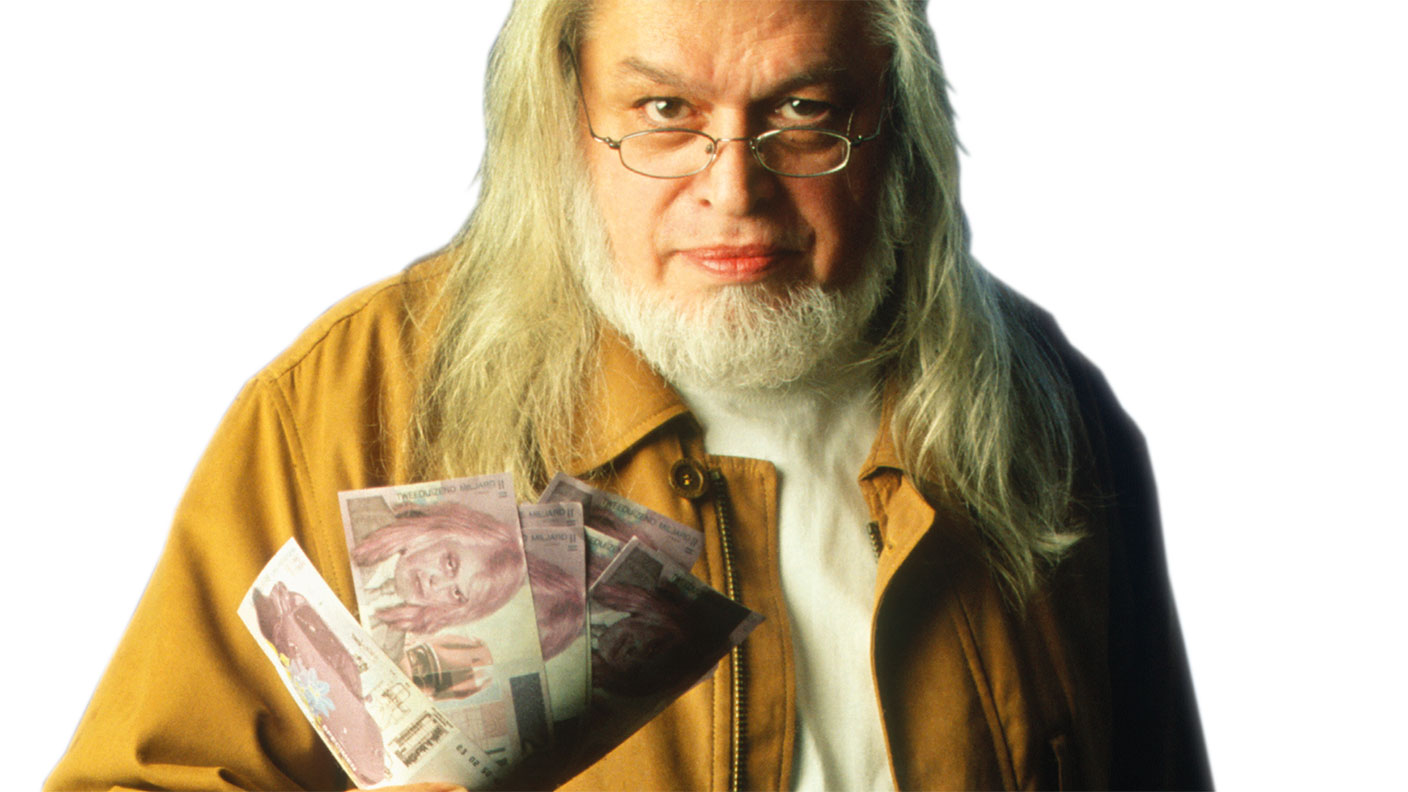

Great frauds in history: Jean-Pierre van Rossem's money-making machine

Jean-Pierre van Rossem told investors he had a supercomputer able to make money by predicting market movements. He didn't.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Belgian Jean-Pierre van Rossem (born 1945) was a star economics student at the University of Ghent, making money on the side writing other students’ dissertations. He became a Marxist, then won a scholarship to study under Lawrence Klein, a Nobel Prize-winner who pioneered the use of computers to predict market fluctuations. Van Rossem later started his own company in the US, but went bankrupt financing a heroin habit and served time for fraud.

What was the scam?

Upon release he returned to Europe, later claiming he intended to join the Baader-Meinhof gang of far-left militants, but running off instead with the wife of a rich industrialist (“I decided to punish capitalism by taking his wife”). To finance her shopping habit, as he put it, he then set up in business as a stockmarket guru, founding MoneyTron, an investment firm that had a supercomputer able to predict market movements.

Where did he get that?

It’s a mystery as nobody ever got to see the machine, which was kept behind a locked door. Van Rossem still attracted large sums from wealthy investors, including members of the Belgian royal family, by the simple expedient of appearing to be wealthy and successful. By 1989 he claimed the firm was managing $7bn in assets. In reality, he was running a Ponzi scheme, taking money from new investors to pay older ones and bankroll his own extravagant lifestyle. At one point he owned the Formula 1 racing team Onyx, a $4m yacht, two aircraft and 108 Ferraris.

Try 6 free issues of MoneyWeek today

Get unparalleled financial insight, analysis and expert opinion you can profit from.

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

What happened next?

Van Rossem’s empire collapsed in 1990 after a $50m cheque to a French businessman bounced. He was later convicted of fraud and sentenced to five years in jail. “The good news is that there will be one capitalist less in the world, the bad news is that he is me,” he said. Parliamentary immunity delayed his sentence until 1995, however: he was elected to parliament as a libertarian dedicated to making everyone rich and abolishing marriage and the monarchy.

Lessons for investors

As Van Rossem himself said: “If you show a million returns to millionaires, they no longer ask questions.” Swindlers down the ages have known this truth. Be sceptical.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

Review: Pierre & Vacances – affordable luxury in iconic Flaine

Review: Pierre & Vacances – affordable luxury in iconic FlaineSnow-sure and steeped in rich architectural heritage, Flaine is a unique ski resort which offers something for all of the family.

-

Could you get cheaper loans under ‘significant’ FCA credit proposals?

Could you get cheaper loans under ‘significant’ FCA credit proposals?The Financial Conduct Authority has launched a consultation which could lead to better access to credit for consumers and increase competition across the market, according to experts.

-

Halifax: House price slump continues as prices slide for the sixth consecutive month

Halifax: House price slump continues as prices slide for the sixth consecutive monthUK house prices fell again in September as buyers returned, but the slowdown was not as fast as anticipated, latest Halifax data shows. Where are house prices falling the most?

-

Rents hit a record high - but is the opportunity for buy-to-let investors still strong?

Rents hit a record high - but is the opportunity for buy-to-let investors still strong?UK rent prices have hit a record high with the average hitting over £1,200 a month says Rightmove. Are there still opportunities in buy-to-let?

-

Pension savers turn to gold investments

Pension savers turn to gold investmentsInvestors are racing to buy gold to protect their pensions from a stock market correction and high inflation, experts say

-

Where to find the best returns from student accommodation

Where to find the best returns from student accommodationStudent accommodation can be a lucrative investment if you know where to look.

-

The world’s best bargain stocks

The world’s best bargain stocksSearching for bargain stocks with Alec Cutler of the Orbis Global Balanced Fund, who tells Andrew Van Sickle which sectors are being overlooked.

-

Revealed: the cheapest cities to own a home in Britain

Revealed: the cheapest cities to own a home in BritainNew research reveals the cheapest cities to own a home, taking account of mortgage payments, utility bills and council tax

-

UK recession: How to protect your portfolio

UK recession: How to protect your portfolioAs the UK recession is confirmed, we look at ways to protect your wealth.

-

Buy-to-let returns fall 59% amid higher mortgage rates

Buy-to-let returns fall 59% amid higher mortgage ratesBuy-to-let returns are slumping as the cost of borrowing spirals.