Nationwide: House prices rise for sixth month in a row, but stamp duty changes loom

House prices continued to rise in February, but stamp duty changes and new affordability pressures could create headwinds later this year

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

The UK property market continued its trend of growth in February ahead of the looming stamp duty deadline.

House prices rose by 0.4% on a monthly basis and 3.9% on an annual basis, according to the latest figures from building society Nationwide. This compared to growth rates of 0.1% and 4.1% respectively in January. February marks the sixth consecutive increase in the monthly figure.

Resilience in the market is partly being driven by a more supportive economic backdrop, as lower mortgage rates and easing affordability pressures have started to bring some buyers back to the market. Interest rates are now on a downward trajectory and wage growth outpaced house price inflation last year, giving prospective homeowners more purchasing power.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Despite this, challenges remain. The average first-time buyer is now paying five times their annual salary when purchasing a property, research published by Nationwide earlier this year showed. This is significantly higher than the long-term average of 3.9 times earnings.

Ongoing affordability pressures are likely to keep house prices in check over the course of the year – particularly once stamp duty thresholds drop at the start of April, making it more expensive for many to purchase a house.

Household budgets will also take a hit over the months to come, with inflation expected to rise to 3.7% in the third quarter. Furthermore, a series of bill hikes are due in April, affecting everything from council tax to energy bills. Changes to employers’ National Insurance contributions could also dampen wage growth from this date.

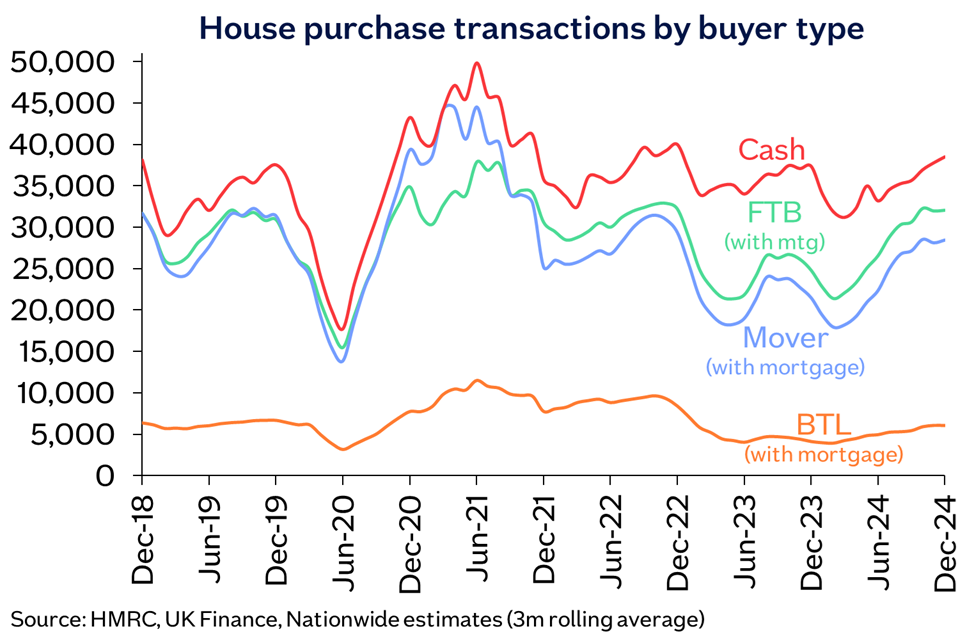

Commenting on the latest figures, Robert Gardner, chief economist at Nationwide, said: “Housing market activity has remained resilient in recent months, despite ongoing affordability challenges. Indeed, the second half of 2024 saw a noticeable pick up in total housing transactions, which were up 14% compared with the same period in 2023.

“However, taking 2024 as a whole, transactions were still modestly (6%) lower than the levels prevailing before the pandemic struck in 2019.”

He added that upcoming stamp duty changes are likely to result in a “jump of transactions in March”, followed by a “corresponding period of weakness in the following months”.

What’s driving activity in the housing market?

Data from Nationwide suggests first-time buyer transactions continued to recover over the course of 2024, with mortgage completions for the year just 5% below 2019 levels.

“This represents a solid performance, given the interest rate environment,” Gardner said. “For example, five-year fixed mortgage rates are currently around 4.4% for borrowers with a 25% deposit, compared to around 2% in 2019.”

Cash transactions have also been a big driver of activity, and are now 2% above pre-pandemic levels.

Meanwhile, the recovery in buy-to-let purchases has been more muted, as the below chart shows. This is perhaps unsurprising given that landlords have been hit by scaled-back tax reliefs and higher stamp duty rates in recent years. Despite this, not all buy-to-let purchases are necessarily captured in the data, as some landlords undertake cash purchases.

While overall activity levels have proved resilient in recent months, sellers should be cautious when setting an asking price given headwinds on the horizon. Coupled with the rising cost of living, stamp duty changes are likely to put a dent in the recovery when it comes to transaction volumes.

Commenting earlier this month, Colleen Babcock, a property expert at Rightmove, said new sellers are already starting to show some pricing restraint. “Agents report that some of the steam is coming out of new sellers’ price expectations to fit the changing market conditions, which is a sensible reaction to attract buyer interest, and it will also help to support activity levels,” she explained.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Katie has a background in investment writing and is interested in everything to do with personal finance, politics, and investing. She previously worked at MoneyWeek and Invesco.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how