Halifax: House prices near a two-year high – will they continue to rise?

Despite affordability pressures, house prices grew at their fastest annual rate in almost two years in August, Halifax says

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

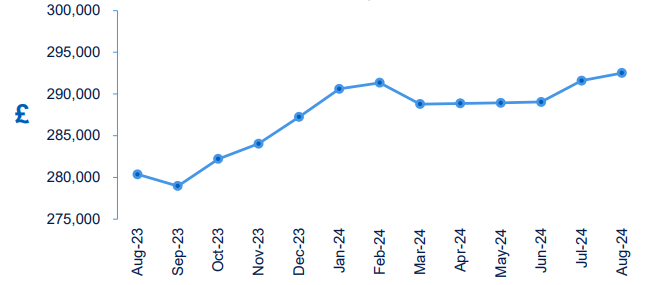

House prices were up 4.3% in August compared to the same period a year ago, according to the latest data from the Halifax house price index. This is the strongest rate of annual growth since November 2022.

On a monthly basis, house prices rose at a slower rate in August than July, inching up by 0.3% compared to the previous month’s 0.9%, but remained in positive territory. The average property now costs £292,505.

The strong annual growth rate is partly down to the comparison with weaker house price data this time last year. However, experts believe there is still room for optimism.

Try 6 free issues of MoneyWeek today

Get unparalleled financial insight, analysis and expert opinion you can profit from.

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Amanda Bryden, head of mortgages at Halifax, says: “Recent price rises build on a largely positive summer for the UK housing market. Prospective homebuyers are feeling more confident thanks to easing interest rates. That optimism is reflected in the latest mortgage approval figures, now at their highest level in almost two years.”

Are house prices picking up?

After a period of weakness in 2023, green shoots are starting to emerge in the UK housing market as the economic backdrop improves.

The Bank of England cut interest rates by 0.25% on 1 August, bringing them down from a sixteen-year high. Mortgage rates have been falling in recent months in anticipation of the cut, and have fallen further since it was announced.

This is good news for the property market, which stalled last year as higher mortgage rates and cost-of-living pressures took their toll on prospective buyers.

While Halifax data shows that house prices grew by 1.7% last year, other sources painted a bleaker picture. The Office for National Statistics (ONS) said house prices fell by 1.4% in 2023, while Nationwide said they fell by 1.8%.

Buyers are still facing affordability pressures today, but green shoots are starting to appear as the economic outlook improves. Last month, property website Zoopla reported an increase in market activity, with buyer demand a fifth higher than it was a year ago.

Falling interest rates should continue to support this trend and, as buyers return to the market, house prices could receive another welcome boost.

“Such has been the resilience of house prices that the average property is now just £1,000 shy of the record high set in June 2022 (£293,507),” says Bryden.

“With market activity picking up and the possibility of further interest rate reductions to come, we expect house prices to continue their modest growth through the remainder of this year,” she adds.

Halifax HPI: average house price in the UK

Where are house prices rising the fastest?

Northern Ireland continues to hold the title for the fastest regional house price growth in the UK. Prices rose by 9.8% on an annual basis in August, according to Halifax. The average property in Northern Ireland now costs £201,043.

House prices in Wales are up 5.5% compared to a year ago, while prices in Scotland are up by a more modest 1.7%. The average property now costs £224,433 and £205,144 respectively.

In England, prices are rising fastest in the North West, with the average property now costing £232,917, up 4% on last year. London remains the most expensive place to buy in the UK with the average home costing £536,056, but prices in the capital have been rising at a slower rate than elsewhere (1.5%).

While strong house price growth in some regions is good news for those who are already on the property ladder, it is less positive for first-time buyers. Many have already seen the purchasing power of their deposits eroded significantly in recent years thanks to a period of high inflation.

As affordability pressures bite, many first-time buyers are broadening their property search to consider a wider range of areas. Halifax data released earlier this week showed Manchester and Slough have emerged as first-time buyer hotspots outside of London, where homes are selling for less than the average UK price.

Manchester is known for its strong jobs market and vibrant cultural scene, while Slough has recently benefitted from the completion of the Elizabeth line, with easy connections into central London and Reading.

See our article on first-time buyer hotspots for the top 10 areas house-hunters are choosing.

Is now a good time to buy a house?

If you are thinking about buying a house, there are a number of different factors to consider.

Mortgage rates have fallen from their highs, but could be set to fall further over the months to come if further rate cuts materialise from the Bank of England. The catch-22 is that house prices typically rise as interest rates come down.

Sarah Coles, head of personal finance at Hargreaves Lansdown, says we could see a “slackening in demand” in the housing market from buy-to-let investors, who may “take fright over Budget-related speculation that capital gains tax could be set to rise”. It is possible that this will slow house price growth somewhat, although the extent of this is yet to be seen.

In general, it’s less about trying to time the market perfectly than deciding whether you can afford to move right now. “Rising prices and relatively high mortgage rates pose a huge challenge for first-time buyers, so an awful lot rests on the kind of deposit you can build,” Coles adds.

Those who can afford to take the next step shouldn’t leave it too long, as they risk being hit by higher stamp duty. In 2022, the government temporarily increased the residential nil-rate threshold from £125,000 to £250,000 for regular buyers, while increasing it from £300,000 to £425,000 for first-time buyers. However, this temporary measure comes to an end on 31 March 2025.

For now, it remains a buyer’s market on the whole, with recent Zoopla data showing that housing stock has hit a seven-year high of 33 homes per agent. As a result, buyers have some flexibility on the price they are willing to pay. The property website found that 1 in 5 homes listed in August had to make an asking price reduction of 5% or more to attract buyer interest.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Katie has a background in investment writing and is interested in everything to do with personal finance, politics, and investing. She previously worked at MoneyWeek and Invesco.

-

Financial education: how to teach children about money

Financial education: how to teach children about moneyFinancial education was added to the national curriculum more than a decade ago, but it doesn’t seem to have done much good. It’s time to take back control

-

Investing in Taiwan: profit from the rise of Asia’s Silicon Valley

Investing in Taiwan: profit from the rise of Asia’s Silicon ValleyTaiwan has become a technology manufacturing powerhouse. Smart investors should buy in now, says Matthew Partridge