The mystery of America’s gold and why an audit matters

How much gold does the US actually have? Dominic Frisby explains why it matters

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Two rumours have been swirling around the gold markets for many years. Some have called them conspiracy theories. Others note that conspiracy theories often prove true. What’s the difference between conspiracy and truth? About 30 years.

The first notion is that China has far more gold than it says it does. We actually now know this to be true. The other is that America has far less than the 8,133 tonnes of gold it says it possesses.

This has been doing the rounds since 1971, when Peter Beter, a lawyer and financial adviser to former president John F. Kennedy, said he had been informed that gold in Fort Knox had been removed. He went on to write a best-selling book about it: The Conspiracy Against the Dollar.

Try 6 free issues of MoneyWeek today

Get unparalleled financial insight, analysis and expert opinion you can profit from.

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

The problem is a total lack of transparency on the part of the US authorities, something that, according to current US president Donald Trump, and the head of the Department of Government Efficiency, Elon Musk, will not be the case for much longer.

Roosevelt triggers a boom

But to understand this situation we need to go back in time, all the way to 1933, when the US left the gold standard in order to bolster growth. US president Franklin D. Roosevelt famously devalued the US dollar in relation to gold, revaluing gold upwards by 70%, from $20 an ounce (oz) to $35/oz. US gold reserves would increase to unprecedented levels in the next 15 years.

Some of the gold came from US citizens. It was now illegal for them to own gold and they had to hand any they owned over to the authorities. Some came from the fact that the government then bought all US mined supply (the upwards revaluation of gold triggered a mining boom) and any gold imported to the US assay office. The US even began buying gold on foreign markets to protect the new higher price at higher levels.

Thus US official holdings in 1939 on the eve of World War II totalled 15,679 tonnes. They would only increase. With Nazi invasions and expansion, European nations sent all the gold they could across the Atlantic, either for safekeeping or to buy essential supplies; 1949 saw the high watermark of US gold holdings – 22,000 tonnes, as much as half of all the gold ever mined.

In July 1944, with it clear that the Allies were going to win the war, representatives from the 44 Allied nations met at the Mount Washington Hotel in Bretton Woods for the United Nations Monetary and Financial Conference to design a new system of money for the new world order.

International accounts would be settled in dollars, and those dollars were convertible to gold at $35/oz. Countries had to maintain exchange rates within 1% of the US dollar. In effect, the US was on a gold standard, and the rest of the world was on a dollar standard.

The system relied on the integrity of the US dollar’s gold-backing to work, and that integrity was in question, even before the end of the war. The June 1945 Federal Reserve Act reduced required gold reserves for notes outstanding from 40% to 25%, and against deposits from 35% to 25%. Between 1944 and 1954, because of increased supply, the dollar lost a third of its purchasing power, though the $35 Bretton Woods price remained.

US government spending was soaring, and it began running balance of payments deficits – made worse by the costs of foreign aid, America’s new welfare systems and maintaining a military presence in Europe and Asia. Gold began leaving the US. By 1965 reserves had fallen by 9,500 tonnes, down 40% from the 1949 peak.

Successive US administrations tried to stop the outflow, without success. Dwight D. Eisenhower banned Americans from buying gold overseas, Kennedy imposed the “equalisation tax” on foreign investments, and Lyndon B. Johnson discouraged Americans from travelling altogether. “We may need to forgo the pleasures of Europe for a while,” he said.

Fears that the dollar would devalue following the election (won by Kennedy) sent the gold price in London to $40/oz. The Bank of England, in collusion with the Federal Reserve, began increasing gold sales to keep the price down.

Thus did the London gold pool begin, with the addition of six major European nations the following year (Belgium, France, the Netherlands, West Germany, Italy and Switzerland), which co-ordinated sales to suppress, or “stabilise”, to use their word, the gold price and defuse unwanted, upward market pressure.

But the pool struggled against growing demand. In 1965, an ounce of gold was still $35, but the purchasing power of the dollar had decreased by 57% from 1945, while gold reserves had also fallen sharply. The culprit was the costs of the US government, in particular the Vietnam War and president Johnson’s enormous welfare spending.

Bretton Woods under pressure

With inflation rising at home and international confidence in the dollar waning, these programmes were not just costly – they undermined Bretton Woods. Non-American nations felt aggrieved that they had to produce $100 worth of goods and services to get a $100 bill, when the US could just print one. French finance minister Valéry Giscard d’Estaing called it “America’s exorbitant privilege”.

President de Gaulle, meanwhile, had had enough. He ignored the pool to turn all French dollars and sterling balances into gold. The French even sent battleships to New York to collect their gold. De Gaulle became the target of several assassination attempts – coincidence, I’m sure. There were rather more US dollars in the world than there was gold to back them, he felt, and he was right.

French President Charles de Gaulle called for a return to gold as the sole basis of international transactions.

By 1967, US foreign liabilities were $36 billion, but it only had $12 billion in gold reserves – a third of what was needed to back the dollar. West Germany, Spain and Switzerland began demanding gold for their dollars. Even the British, with sterling going through one of its quadrennial collapses, asked the Americans to prepare $3 billion worth of Fort Knox gold for withdrawal. Private gold demand was overwhelming.

In November 1967, the British government devalued the pound by 14%, from $2.80 to $2.40, in order to “achieve a substantial surplus on the balance of payments consistent with economic growth and full employment”.

In that month, the London market saw greater bullion demand than it would typically see in nine: as much as 100 tonnes per day. To stem demand, they banned forward buying, leverage and the purchase of gold with credit. The pool still lost 1,400 tonnes that year, more than a whole year’s mined supply.

Selling pressure on the US dollar only increased when the Viet Cong and North Vietnamese People’s Army of Vietnam launched the first of a series of surprise attacks on US armed forces in South Vietnam in January 1968.

Desperate to prop up the system, US military aircraft flew tonne after tonne of gold to RAF Lakenheath from where it trucked in military convoys to the back entrance of the Bank of England: at one point the floor of the Bank of England’s weighing room collapsed under the weight of all the gold.

Shoring up the system

In the four days between 11 March and 14 March 1968, some 780 tonnes were sold to market. The effort to protect the price was deemed hopeless. On 15 March, UK chancellor Roy Jenkins declared a bank holiday, and the gold market was closed for a fortnight, “at the request of the United States”.

Zurich also closed. Paris stayed open with gold trading at a 25% premium. All in all, the final 15 months saw over 3,000 tonnes sold to market to protect that $35 price. The pool had lost more than an eighth of its reserves.

Two days later, in the rushed-through Washington Agreement, governors of the central banks in the gold pool declared there would be one fixed gold market for official government transactions at $35/oz and another, free-market, price for private transactions. Not for the last time, central bankers were living in a world of their own.

Gold is one thing. Gold standards are another. They tend not to last, particularly bogus ones such as this one, under which citizens themselves did not handle gold. Keynes called them barbarous – ironic, perhaps, given that he was one of the architects of this one.

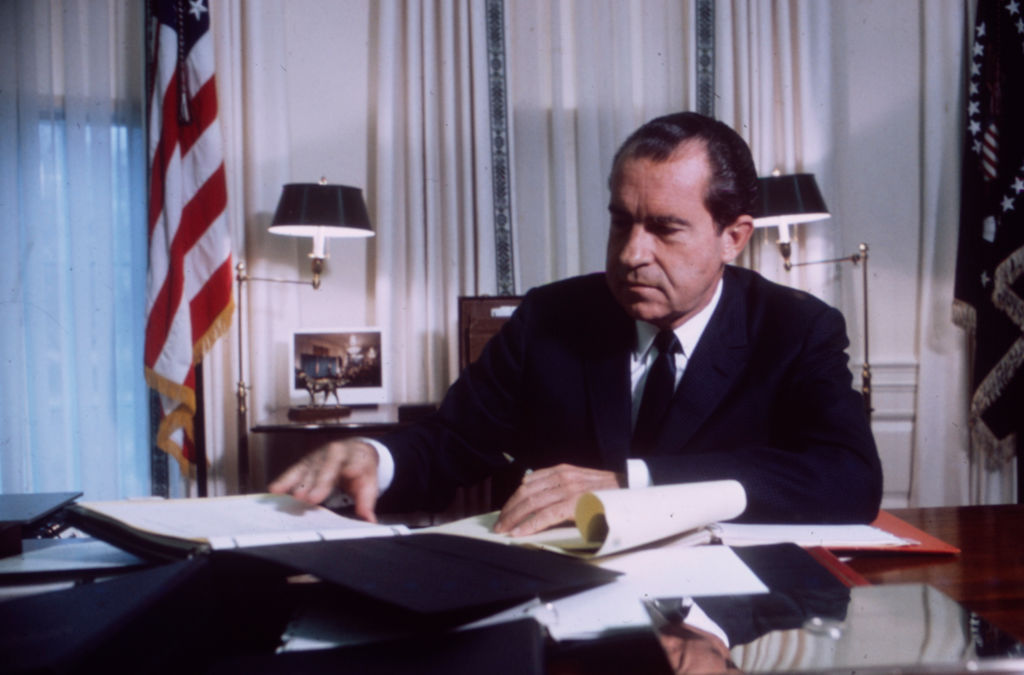

President Nixon took the US off the gold standard in 1971

In August 1971, president Nixon took the US off the gold standard, a “temporary” measure that remains more than 50 years later. For the first time in history, gold – Switzerland aside – played no part in the global monetary system.

Of course it was the fault of the speculators. It always is. “I have directed the secretary of the Treasury to take the action necessary to defend the dollar against the speculators,” Nixon said, deflecting responsibility, and “to suspend temporarily the convertibility of the dollar into gold”.

High time for a US gold audit

There are more than 4,000 tonnes of gold in Fort Knox

The US keeps its gold in four places: at Fort Knox, Kentucky (roughly 56% of its 8,133 tonnes); at the Federal Reserve Bank of New York (8%); and the remaining 36% at the mints in Denver and West Point. There has not been a proper public audit of this gold since 1953. There have been internal audits, especially between 1974 and 1986, but these were not transparent.

There are many people, among them gold experts, who do not believe the gold is there. The US spent it trying to suppress the gold price in the 1960s, they say. In this new age of American transparency, both Trump and Musk have repeatedly pledged that this gold will be audited.

There is talk of it being done on a livestream. Trump has even suggested the gold has been stolen. “We’re actually going to Fort Knox to see if the gold is there,” he said, “because maybe somebody stole the gold. Tonnes of gold.”

They’ve been making such light of it, one has to assume they know the gold is there. Musk was laughing about the conspiracies on podcasts, and he even posted a picture of a Fort Knox starter kit: a brick and some gold spray. I can’t see how they would be joking if there were any serious doubts.

Secretary of the Treasury, Scott Bessent, has said quite categorically that the gold is there. The last audit was in September 2024, he said in a recent Bloomberg interview, before looking down the camera and assuring the US people that “all the gold is present and accounted for”. But this would only have been an internal audit, and it would not have been a full audit.

According to the US Mint, “the only gold removed has been very small quantities used to test the purity of gold during regularly scheduled audits”. No other gold has been transferred to or from the depository “for many years”. How long is many years, though? As far back as the 1960s.

It’s quite astonishing just how secretive the whole thing is. They opened the vaults for a congressional delegation and certain members of the press to view the gold in 1974. There were rumours swirling about then too. “We’ve never done this before and we’ll probably never do it again,” said the then director of the US Mint Mary Brooks.

Then in 2017, during Trump’s first administration, Treasury secretary Steven Mnuchin and Senate majority leader Mitch McConnell were invited to view the gold. “The gold was there,” Mnuchin said. He is “sure” nobody’s moved it. There are “serious security protocols in place”. But there are more than 4,000 tonnes in Fort Knox. A tonne would be about the size of a medium to large suitcase. Did he see all 4,000 of them?

The other big issue is the purity of the gold. What is there might not all be of good delivery quality, meaning it would not be readily accepted in international bullion markets. If much of the gold is the bullion Roosevelt confiscated in the 1930s, it will be in the form of “coinmelt”: melted down coins.

The commonly confiscated coins, such as the $20 double eagle, were only 90% pure and mixed with copper to make them harder. When melted down, they were not always properly refined to modern standards, while the bars they were melted into weighed 320-330 ounces, not the 400 oz bars of good delivery standard today. In practice, this means Fort Knox gold would not be accepted without additional processing.

But, until a proper audit takes place, this is all speculation, albeit reasoned speculation. We don’t know the full facts. The reasons given for not conducting a full audit are flimsy: we don’t need to, it would be too much of an undertaking. Please!

If the US gold turns out not to be there, then the gold price goes up – potentially a lot. If it is there, it’s business as usual.

For now, I’d say the markets are behaving as though it is business as usual. They are climbing, and every dip is being bought, largely, it seems, by central banks (especially in Asia), who are diversifying their holdings and de-dollarising. But this audit cannot come quickly enough.

Finally, I would just like to debunk one theory doing the rounds. US gold is currently marked to market at $42/oz. After the audit, those 8,133 tonnes – assuming they are there and of good delivery quality – could be marked to market at current prices, meaning a significant uplift in the value of holdings.

The theory doing the rounds is that Treasury secretary Bessent will use some of the upwards revaluation to monetise the balance sheet – not unlike how Roosevelt did in 1933 – to create funds for, among other things, the strategic bitcoin reserve. But Bessent has quite clearly stated that is not his intention.

This article was first published in MoneyWeek's magazine. Enjoy exclusive early access to news, opinion and analysis from our team of financial experts with a MoneyWeek subscription.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

Investing in Taiwan: profit from the rise of Asia’s Silicon Valley

Investing in Taiwan: profit from the rise of Asia’s Silicon ValleyTaiwan has become a technology manufacturing powerhouse. Smart investors should buy in now, says Matthew Partridge

-

‘Why you should mix bitcoin and gold’

‘Why you should mix bitcoin and gold’Opinion Bitcoin and gold are both monetary assets and tend to move in opposite directions. Here's why you should hold both

-

Investing in Taiwan: profit from the rise of Asia’s Silicon Valley

Investing in Taiwan: profit from the rise of Asia’s Silicon ValleyTaiwan has become a technology manufacturing powerhouse. Smart investors should buy in now, says Matthew Partridge

-

‘Why you should mix bitcoin and gold’

‘Why you should mix bitcoin and gold’Opinion Bitcoin and gold are both monetary assets and tend to move in opposite directions. Here's why you should hold both

-

Invest in the beauty industry as it takes on a new look

Invest in the beauty industry as it takes on a new lookThe beauty industry is proving resilient in troubled times, helped by its ability to shape new trends, says Maryam Cockar

-

Should you invest in energy provider SSE?

Should you invest in energy provider SSE?Energy provider SSE is going for growth and looks reasonably valued. Should you invest?

-

Has the market misjudged Relx?

Has the market misjudged Relx?Relx shares fell on fears that AI was about to eat its lunch, but the firm remains well placed to thrive

-

8 of the best properties for sale with minstrels’ galleries

8 of the best properties for sale with minstrels’ galleriesThe best properties for sale with minstrels’ galleries – from a 15th-century house in Kent, to a four-storey house in Hampstead, comprising part of a converted, Grade II-listed former library

-

The rare books which are selling for thousands

The rare books which are selling for thousandsRare books have been given a boost by the film Wuthering Heights. So how much are they really selling for?

-

How to invest as the shine wears off consumer brands

How to invest as the shine wears off consumer brandsConsumer brands no longer impress with their labels. Customers just want what works at a bargain price. That’s a problem for the industry giants, says Jamie Ward