Investment trusts to consider for investors seeking yield

With dividends being slashed in all major markets, equity-income investors have to consider alternatives. Here are the best options.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

Royal Dutch Shell’s decision to slash its dividend last week has severely rattled equity-income investors. Dividends are being cut to the bone across multiple sectors and markets, sometimes at regulators’ insistence. And there’s no reason to think that it might get any better in the short to medium term. Earnings have fallen off a cliff and taken dividends with them. A fifth of both Euro Stoxx 50 (the index of eurozone blue chips) and FTSE 100 businesses have already cancelled their payouts.

Research the dividend-hero trusts

So what should investors do? I think there are four options. The first is to look at equity income-orientated investment trusts. Here there is some rare good news. Many of the biggest and most popular investment trusts have been growing their dividends for at least 20 consecutive years now (in the case of City of London, for 53 years) and have ample reserves to keep paying a sensible yield.

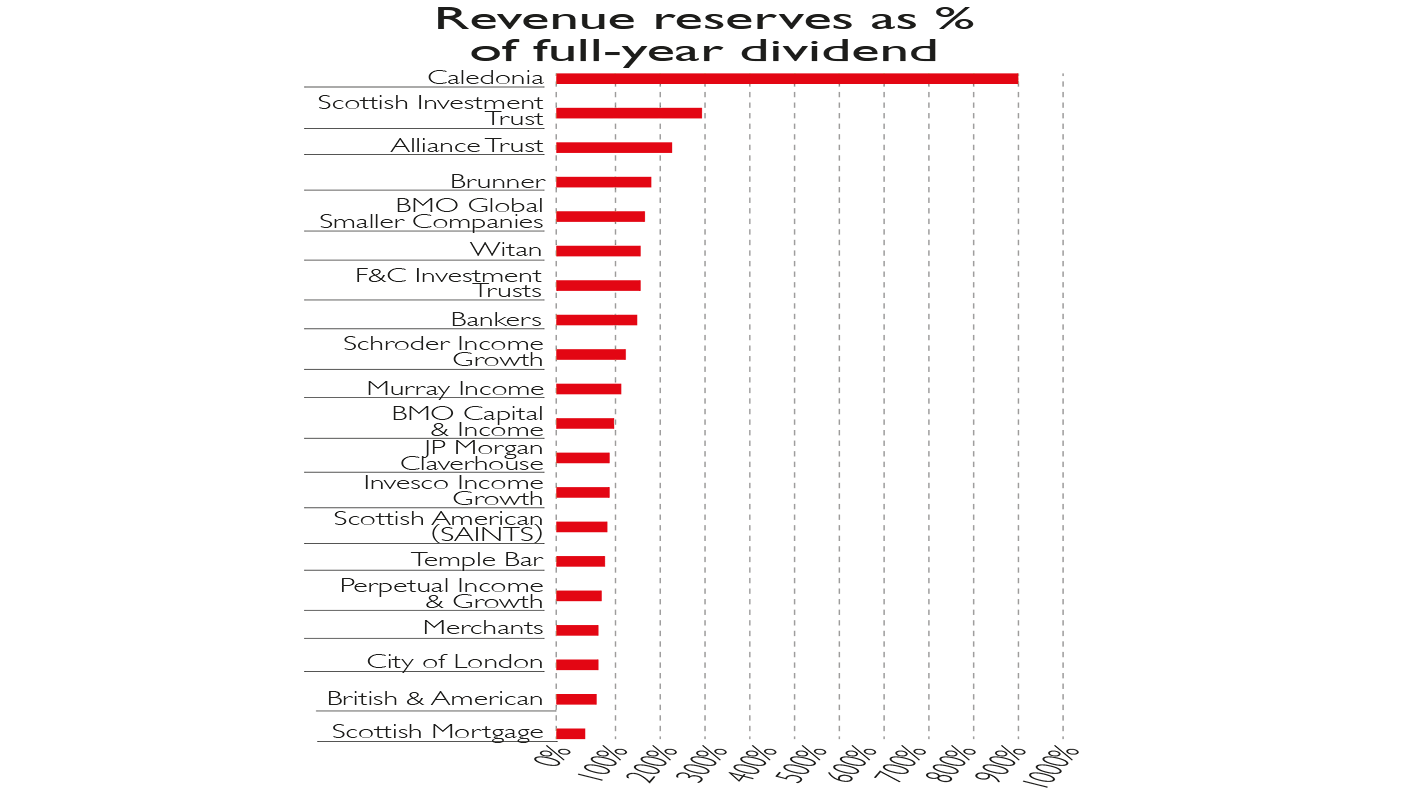

According to Winterflood Securities, which has assessed a shortlist of these “dividend hero funds” (see chart), the level of revenue reserve cover (the revenue reserve is essentially a rainy day fund for dividends) varies greatly, with the median level being 129%, while the median level of dividend cover (the extent to which dividends are covered by earnings) in the funds’ most recent financial year was 107%. Most of these funds, whose yields range from Scottish Mortgage’s 0.5% to Caledonia’s 9%, appear able to ride out the coming storms this year with their yield intact.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Go global

The next option is to stop focusing on the level of the payout and diversify beyond UK equity income. You could start with a general global investment trust such as Alliance Trust (LSE: ATST) or Witan (LSE: WTAN), which pays out a decent yield as a side-effect of a more strategic approach to picking global stocks. Both of these funds are trading at around a 4.5%-5% discount to net asset value (NAV) and pay a yield of 2% in the case of Alliance Trust and 3.2% in Witan’s.

My suspicion is that their final yields for 2020 won’t look quite as generous, but over the long term, if you’re patient and reinvest the dividend, you probably won’t see a very different return to that of a traditional equity income fund. Another form of diversification could be to pick a fund-of-fund approach such as BMO Managed Portfolio Trust (LSE: BMPI) with a 5.4% yield and trading at a 2.8% premium. This is run by the excellent Peter Hewitt and includes healthcare as well as alternative income funds such as Hipgnosis Songs (see below), along with infrastructure funds.

Focusing more on the idea of geographical diversification, I’d also keep an eye on some emerging market funds, including JP Morgan’s Global Emerging Markets Income Trust (LSE: JEMI) and the Jupiter Emerging and Frontier Income Trust (LSE: JEFI). They both yield 4.9%. For the adventurous among you, JP Morgan’s Russia Securities Trust (LSE: JRS), trading on a discount to NAV of 12.8% and yielding 6.5%, could represent good value.

Seek out infrastructure...

Another approach is to explore alternative funds where the income is less dependent on corporate profits and cash flows. Start with the four core classic infrastructure funds listed on the market. These are 3i Infrastructure (LSE: 3IN), BBGI (LSE: BBGI), HICL (LSE: HICL) and International Public Partnerships (LSE: INPP). These very specialist, fairly defensive funds invest in everything from heavily regulated PFI projects to more volatile economic infrastructure (including electricity grids and broadband provision). They are yielding an average of 4.8%. Their focus on government-backed cash flows hasn’t completely protected them from market turbulence: they have slipped by 8.1% over the last three months. But they are quality income alternatives nevertheless.

In the renewable energy sector it may be worth looking at Gore Street Energy Storage (LSE: GSF), Gresham House Energy Storage, where I am a non-executive director (LSE: GRID) and SDCL Energy Efficiency Income Trust (LSE: SEIT). These invest in everything from battery storage (Gore Street and Gresham) to combined heat and power projects and energy-efficient lighting (SDCL). Yields range from 4.5% to 7%.

Consider also two specialist infrastructure debt funds, Sequoia Economic Infrastructure (LSE: SEQI), which yields 6.4%, and GCP Infrastructure Investments (LSE: GCP), on a 6.6% yield. These debt-based funds have been hit by worries about declining demand for underlying investments in everything from ports to student housing, but are unlikely to be badly affected by Covid-19.

... and think laterally

One final alternative is to think laterally and consider a more esoteric group of income-orientated funds. Top of that list would be Ecofin Global Utilities and Infrastructure (LSE: EGL), which invests in infrastructure assets as well as utility stocks.

This is a well-established fund and most of its underlying investments are holding up well, largely because they are so boring and dull. It currently trades at a 3% discount to NAV on a yield of 4.4%; over the last three months its share price has fallen by just 7%.

If you are willing to take a bit more risk by investing in a basket of underlying higher-risk bonds, there’s also the equally well-established CQS New City High Yield Fund (LSE: NCYF), which yields a stonking 9.7% and trades at a 5% premium. Its manager Ian Francis has a loyal City following.

Biopharma Credit (LSE: BPCR) is another esoteric option. It’s trading a bit below its normal premium, on a 4% discount, and yields 7.3%. It focuses on the arcane world of royalties from drugs and structured credit to pharmaceutical businesses. As alternatives go, this is worth a closer look for the very adventurous.

Last but by no means least there is Hipgnosis Songs (LSE: SONG), which is about as alternative as you can get. This specialist fund invests in song royalties and boasts a 4.8% yield. It trades at an usually low premium of 7%. This fund should be immune to most ups and downs in the economic cycle, although investors will have to make an effort to get their head around the complex world of music royalties.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

David Stevenson has been writing the Financial Times Adventurous Investor column for nearly 15 years and is also a regular columnist for Citywire.

He writes his own widely read Adventurous Investor SubStack newsletter at davidstevenson.substack.com

David has also had a successful career as a media entrepreneur setting up the big European fintech news and event outfit www.altfi.com as well as www.etfstream.com in the asset management space.

Before that, he was a founding partner in the Rocket Science Group, a successful corporate comms business.

David has also written a number of books on investing, funds, ETFs, and stock picking and is currently a non-executive director on a number of stockmarket-listed funds including Gresham House Energy Storage and the Aurora Investment Trust.

In what remains of his spare time he is a presiding justice on the Southampton magistrates bench.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how

-

Halifax: House price slump continues as prices slide for the sixth consecutive month

Halifax: House price slump continues as prices slide for the sixth consecutive monthUK house prices fell again in September as buyers returned, but the slowdown was not as fast as anticipated, latest Halifax data shows. Where are house prices falling the most?

-

Rents hit a record high - but is the opportunity for buy-to-let investors still strong?

Rents hit a record high - but is the opportunity for buy-to-let investors still strong?UK rent prices have hit a record high with the average hitting over £1,200 a month says Rightmove. Are there still opportunities in buy-to-let?

-

Pension savers turn to gold investments

Pension savers turn to gold investmentsInvestors are racing to buy gold to protect their pensions from a stock market correction and high inflation, experts say

-

Where to find the best returns from student accommodation

Where to find the best returns from student accommodationStudent accommodation can be a lucrative investment if you know where to look.

-

The world’s best bargain stocks

The world’s best bargain stocksSearching for bargain stocks with Alec Cutler of the Orbis Global Balanced Fund, who tells Andrew Van Sickle which sectors are being overlooked.

-

Revealed: the cheapest cities to own a home in Britain

Revealed: the cheapest cities to own a home in BritainNew research reveals the cheapest cities to own a home, taking account of mortgage payments, utility bills and council tax

-

UK recession: How to protect your portfolio

UK recession: How to protect your portfolioAs the UK recession is confirmed, we look at ways to protect your wealth.

-

Buy-to-let returns fall 59% amid higher mortgage rates

Buy-to-let returns fall 59% amid higher mortgage ratesBuy-to-let returns are slumping as the cost of borrowing spirals.