Collectables: the scramble for blue diamonds

Coloured diamonds are securing bigger prices at auction, says Chris Carter

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Blue is beautiful when it comes to diamonds. Two of the top three to have fetched the highest prices for coloured diamonds at auction are “fancy vivid” examples – the top spot still belongs to the CTF Pink Star, which sold for HK$553m ($71.2m) in Hong Kong in April 2017.

Last week, the De Beers Blue joined this trio in third place. It sold for HK$451m, also in Hong Kong, with Sotheby’s – only just behind the Oppenheimer Blue, which fetched just $70,000 more in Geneva in May 2016 in nominal terms. It’s not every day that blue diamonds are unearthed in the rough. According to Sotheby’s, only one brilliant blue gem turns up for every 10,000 gem-quality diamonds found, with trace elements of the chemical element boron responsible for their colour.

Simply the greatest

The rough diamond from which the De Beers Blue was cut was dug up by London-listed Petra Diamonds at the famous Cullinan mine in South Africa last April. It was, at 39.34 carats, a whopper. At 15.1 carats, the resulting De Beers Blue is to date the only blue diamond over 15 carats to appear at auction; only five blues over ten carats have ever passed over the auction block.

Try 6 free issues of MoneyWeek today

Get unparalleled financial insight, analysis and expert opinion you can profit from.

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

The Gemological Institute of America (GIA) graded the De Beers Blue a deep-hued “fancy vivid”, an internally flawless diamond, underlining its exceptional rarity yet further. It is “quite simply the greatest blue diamond of its size I have ever seen during my 31-year-career at Sotheby’s”, says Patti Wong of Sotheby’s Asia.

And size matters as much for white diamonds as it does for coloured gems. The largest white diamond ever to appear at auction will be leading the Christie’s Geneva Magnificent Jewels sale on 11 May. Called The Rock, it is a 228-carat pear-shaped diamond, mined and polished in South Africa two decades ago. The GIA graded it as G for colour (meaning it is “near colourless”) and VS1 for clarity (“very slightly included” – an “inclusion”, in the jargon, is a blemish or imperfection within the diamond).

The Rock even comes with a letter from the non-profit institute attesting to its status as the biggest white diamond it has ever graded, far in excess of the second-place 163-carat gem, which sold for an auction record-high $33.7m in November 2017, also with Christie’s. That should give some indication of the price The Rock should fetch on Wednesday. Christie’s expects between $20m and $30m.

Going back to the coloured diamonds, pink still reigns supreme in the price stakes. As if a little reminder of that were needed to put blue-diamond enthusiasts back in their place, last month Christie’s sold the 8.8-carat purple-pink Fuchsia Rose above its upper pre-sale estimate, for $6.8m. Pink truly is the crown jewel of coloured diamonds – at least for now.

Dig (in your jewellery box) for victory!

During the First World War, Christie’s held a suite of auctions in aid of the Red Cross and the Order of St John, to help those affected and left struggling by the war. Among the lots was the Red Cross Diamond. At 205 carats, it is a canary-yellow cushion-shaped diamond with a pavilion faceted in the shape of a Maltese cross (the same as that used by the Order of St John for its symbol). The rough stone from which it had been cut had weighed 375 carats when it was dug out of the rock in South Africa in 1901. Following a “spirited bidding battle” on 10 April 1918, the Red Cross Diamond sold for “a staggering” £10,000 to London jeweller SJ Phillips, the equivalent of around £600,000 today, and more than three times the starting bid, according to Christie’s.

The day’s sale made £50,000 (£3m today) in total, while the Red Cross auctions raised a combined £320,000 (£13.9m) for the relief effort. Christie’s also held the Red Cross Pearls sale that December, in 1918, following a nationwide appeal for people to donate their pearls to raise funds for the treatment and care of those wounded in the war.

The Red Cross Diamond next appeared at auction in Geneva in 1973, when it sold for CHF1.8m, and it is appearing for a third time in just over 100 years at Christie’s Magnificent Jewels sale this month (see above). It is expected to sell for CHF7m-10m. A portion of the sale proceeds will be donated to the Red Cross.

Auctions

Going…

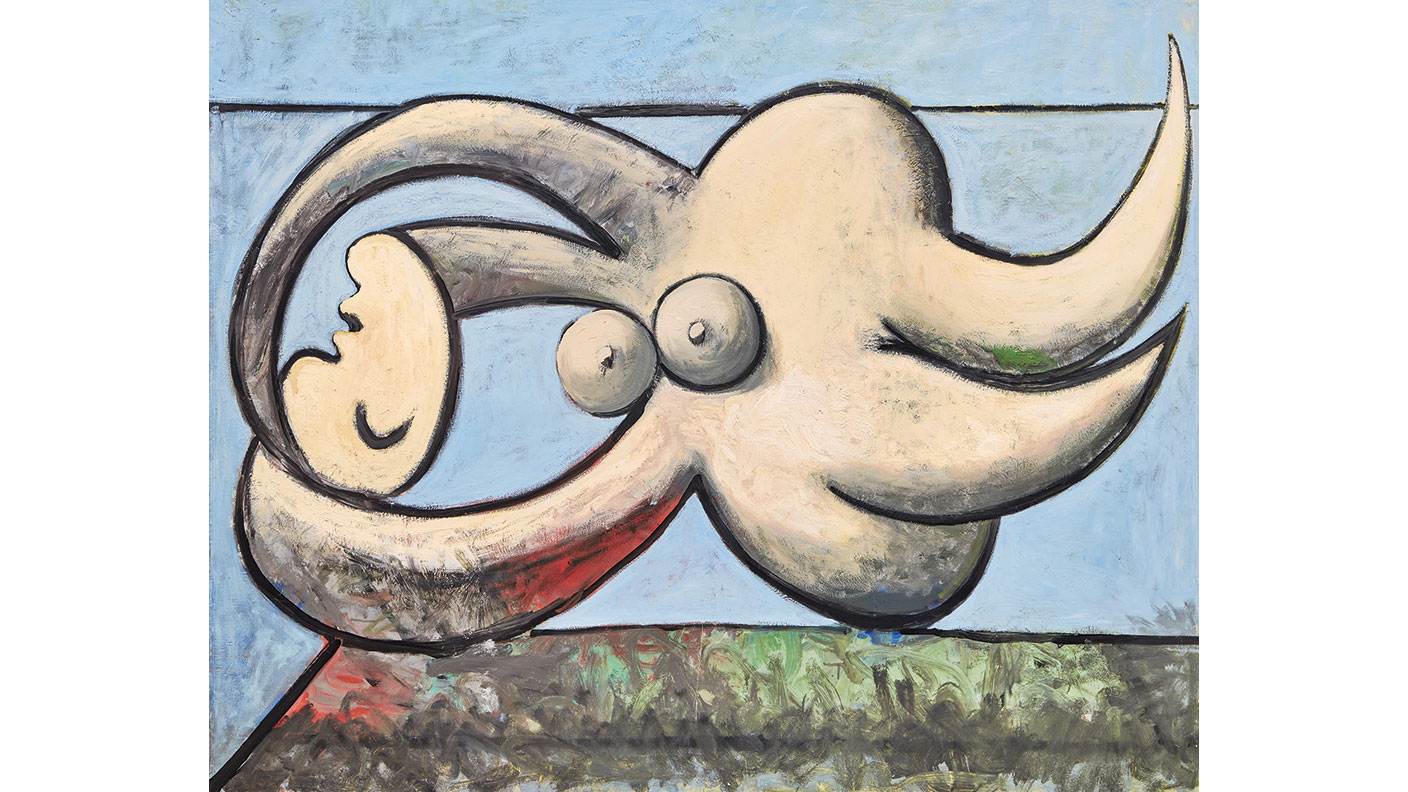

Pablo Picasso kept his extramarital affair a secret from the moment he met his lover and muse, Marie-Thérèse Walter, in 1927, when she was just 17. For the next five years, Picasso would introduce her into his paintings in coded form, sometimes embedded symbolically in the composition or rendering her unmistakable profile in the background, says Sotheby’s. Then, in 1932, his “annus mirabilis”, Walter fully emerged for the first time. In Femme nue couchée (above), painted that year, Picasso evokes Walter with “the strong and sensuous fin-like limbs of a sea-creature”. She was an accomplished swimmer, and together they spent “their headiest days” by the sea. The auction house expects it to fetch more than $60m in New York on 17 May.

Gone…

In 1935, while still in a relationship with Marie-Thérèse Walter – and married to his wife, Olga Khokhlova – Picasso met Dora Maar, a photographer 26 years his junior. “Both strong characters, their love affair was passionate and turbulent, the emotional intensity of which is suggested by the… fiery [red] background” of Dora Maar, a portrait Picasso painted in 1939, says Sotheby’s. Appearing in the painting in a “striking self-possessed and proud pose”, Maar is “contemplative and inscrutable”. Throughout their nine-year relationship, Maar remained “a constant companion and supporter” of Picasso and she appears in a number of the artist’s most familiar works, such as Weeping Woman (1937). The painting Dora Maar sold for HK$169.4m (£17.2m) in Hong Kong last week.

SEE ALSO:

The $15m violins up for auction

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

Financial education: how to teach children about money

Financial education: how to teach children about moneyFinancial education was added to the national curriculum more than a decade ago, but it doesn’t seem to have done much good. It’s time to take back control

-

Investing in Taiwan: profit from the rise of Asia’s Silicon Valley

Investing in Taiwan: profit from the rise of Asia’s Silicon ValleyTaiwan has become a technology manufacturing powerhouse. Smart investors should buy in now, says Matthew Partridge

-

Investing in Taiwan: profit from the rise of Asia’s Silicon Valley

Investing in Taiwan: profit from the rise of Asia’s Silicon ValleyTaiwan has become a technology manufacturing powerhouse. Smart investors should buy in now, says Matthew Partridge

-

‘Why you should mix bitcoin and gold’

‘Why you should mix bitcoin and gold’Opinion Bitcoin and gold are both monetary assets and tend to move in opposite directions. Here's why you should hold both

-

Invest in the beauty industry as it takes on a new look

Invest in the beauty industry as it takes on a new lookThe beauty industry is proving resilient in troubled times, helped by its ability to shape new trends, says Maryam Cockar

-

Should you invest in energy provider SSE?

Should you invest in energy provider SSE?Energy provider SSE is going for growth and looks reasonably valued. Should you invest?

-

Has the market misjudged Relx?

Has the market misjudged Relx?Relx shares fell on fears that AI was about to eat its lunch, but the firm remains well placed to thrive

-

8 of the best properties for sale with minstrels’ galleries

8 of the best properties for sale with minstrels’ galleriesThe best properties for sale with minstrels’ galleries – from a 15th-century house in Kent, to a four-storey house in Hampstead, comprising part of a converted, Grade II-listed former library

-

The rare books which are selling for thousands

The rare books which are selling for thousandsRare books have been given a boost by the film Wuthering Heights. So how much are they really selling for?

-

How to invest as the shine wears off consumer brands

How to invest as the shine wears off consumer brandsConsumer brands no longer impress with their labels. Customers just want what works at a bargain price. That’s a problem for the industry giants, says Jamie Ward