The price of gold spiked yesterday, then collapsed – what happens next?

As Russia invaded Ukraine, the price of gold shot up spectacularly. But it couldn't hold on to all of its gains. Dominic Frisby looks at where it might go next.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

Gold’s time has finally come – or so I thought early yesterday.

As news broke of guns firing and missiles striking, gold rocketed.

The gold bulls had been waiting a long time for their day in the sun. Years of playing second fiddle to bitcoin, stockmarkets, bonds and energy – and now suddenly gold was shining.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Gold had a spectacular day yesterday – in all senses

In less than 24 hours gold rose as near as dammit by $100 – from around $1,880 to $1,974 an ounce.

In doing so it broke out above $1,920, which, as the old 2011 high that held for so long, is one of the pivotal price points of resistance that stood out like a sore thumb.

Silver looked even stronger, going from $24 to $25.60 an ounce in the same time frame.

There was a lot of crowing on social media.

And then something extraordinary happened, the likes of which I don’t think I’ve ever seen.

I remember reading an article by a veteran mining trader once upon a time in which he recommended, as part of his trading strategy in bull markets, to always listen to that little voice in the back of your head on the rare occasions that piped up.

Well, late yesterday morning, a little voice was definitely chirping. It wasn’t just gold and silver that had spiked of course: oil had gone above a hundred bucks; grains had gone up; platinum and palladium had gone nuts; the Dow Jones and the S&P 500 were capitulating – and I mean capitulating.

“America isn’t going to allow this to happen,” said the little voice. “It’s going to call in the Plunge Protection Team.”

Call me a conspiracist, but such a team exists. I guess it began in the Panic of 1907 – then the worst stockmarket crash the US had ever seen – when financier JP Morgan famously co-ordinated the major banks and wealthiest individuals over a gruelling week to provide the liquidity required to shore up the capitulating system. He was then seen walking about the floor of the stockmarket loudly and visibly buying shares, deeming these great companies bargains. Something similar happened in 1929.

Over the course of the last century or so Morgan’s effort has gradually formalised and in 1988, after the crash of 1987, Ronald Reagan signed Executive Order 12631 which established the “President’s Working Group on Financial Markets”, aka the PPT.

There’s only so much the PPT can do, of course. 2008 showed that. But it is at times such as yesterday that its services are required.

Gold is still a long-term hold, but don’t expect the ride higher to be smooth

It was one heck of a turnaround. The Nasdaq went from 3% down to 3% up for the day; the Dow and the S&P rallied; commodities pulled back; and precious metals took one of the biggest daily beatings I think I’ve ever seen.

Gold fell a hundred dollars in nine hours; silver, which had been at $25.60, went to $23.80. You’d think on the day that the threat of World War III was perceived to have drawn a great deal closer, gold stocks would rally. No, they fell.

Why bother with gold if, when Russia invades Ukraine and the divided politics of the US suddenly unites, as politicians from across party lines sign a letter asking President Biden to seek Congress approval to send troops to Ukraine – meaning a direct confrontation between soldiers from Russia and the US – it still can’t rally?

I tell you: investing in gold is like being stuck in a toxic relationship you can’t get out of.

At MoneyWeek we tend to advise tuning out the news where possible. Whatever intellectual process you use to make investment decisions – be it fundamental or technical analysis – is fine, but don’t let the news be your main decision-maker.

Unless you have some extraordinary source of early information that is. Such things are hard to come by, unless you are on Twitter 24/7 at which point you will drive yourself nuts. The problem with news-driven decisions is that there is always somebody who is getting the news before you.

That said, you can’t help thinking that these are news-driven markets. First the question was how serious is Russia? We have the answer to that: pretty serious.

Now we are asking – how long is the conflict going to go on for? A few days, or longer? How embroiled is the West going to get? Sanctions, it seems, are not going to be enough. With each development, markets are going to swing wildly.

But the bottom line for gold is this: plunge protection team or not, gold is going higher. On the daily chart, even with yesterday’s action, the short, medium and long-term averages are all sloping up and in golden alignment. The trend is up.

On a weekly chart the averages have all coiled and converged, they are starting to slope up and gold is starting to break out.

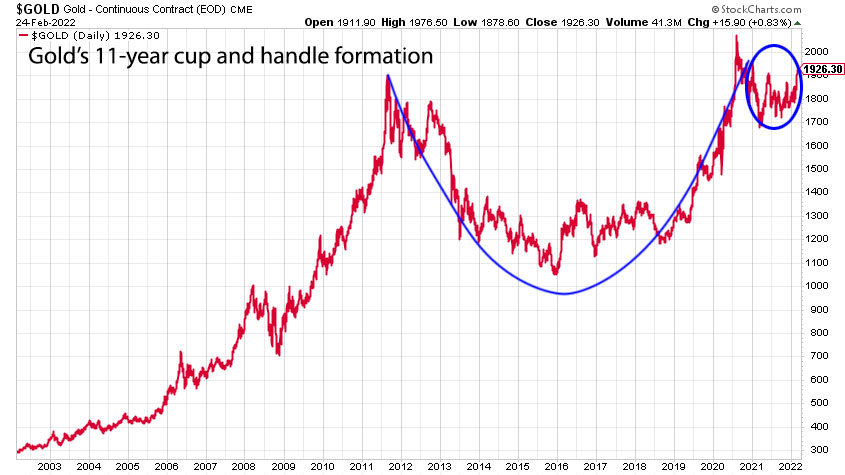

On the monthly chart, we have the most beautiful of cup-and-handle set-ups formed over 11 years (see the chart). This is widely agreed to be a bullish price pattern.

Don’t expect to be treated well. Gold will batter you, bruise you, lie to you and lead you up the garden path. You really don’t deserve such treatment. $1,920 is probably going to remain a problem – as will the old 2020 highs at $2,100.

I still say it’s going higher – and the other precious metals will follow.

Dominic’s film, Adam Smith: Father of the Fringe, about the unlikely influence of the father of economics on the greatest arts festival in the world is now available to watch on YouTube.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how

-

Halifax: House price slump continues as prices slide for the sixth consecutive month

Halifax: House price slump continues as prices slide for the sixth consecutive monthUK house prices fell again in September as buyers returned, but the slowdown was not as fast as anticipated, latest Halifax data shows. Where are house prices falling the most?

-

Rents hit a record high - but is the opportunity for buy-to-let investors still strong?

Rents hit a record high - but is the opportunity for buy-to-let investors still strong?UK rent prices have hit a record high with the average hitting over £1,200 a month says Rightmove. Are there still opportunities in buy-to-let?

-

Pension savers turn to gold investments

Pension savers turn to gold investmentsInvestors are racing to buy gold to protect their pensions from a stock market correction and high inflation, experts say

-

Where to find the best returns from student accommodation

Where to find the best returns from student accommodationStudent accommodation can be a lucrative investment if you know where to look.

-

The world’s best bargain stocks

The world’s best bargain stocksSearching for bargain stocks with Alec Cutler of the Orbis Global Balanced Fund, who tells Andrew Van Sickle which sectors are being overlooked.

-

Revealed: the cheapest cities to own a home in Britain

Revealed: the cheapest cities to own a home in BritainNew research reveals the cheapest cities to own a home, taking account of mortgage payments, utility bills and council tax

-

UK recession: How to protect your portfolio

UK recession: How to protect your portfolioAs the UK recession is confirmed, we look at ways to protect your wealth.

-

Buy-to-let returns fall 59% amid higher mortgage rates

Buy-to-let returns fall 59% amid higher mortgage ratesBuy-to-let returns are slumping as the cost of borrowing spirals.