Think the oil price is high now? You ain’t seen nothing yet

The oil price has been on a tear in recent months. Dominic Frisby explains why oil in fact is still very cheap relative to other assets.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

Back in 2016 we learnt a new word on these pages. “Lustrum”.

It means a five-year period. Given how long decades are, I can’t believe it doesn’t find more use.

Even if we don’t use the word, we investors often think in terms of lustrums. Many of the investments we make are made with a three-to-five-year time horizon in mind.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Which is precisely why I started using the word. We had identified a trade of the lustrum. It was oil.

So how’s it doing?

Oil still looks very cheap relative to most other assets

Very well, is the answer. But it hasn’t been an easy ride. At times we have really had to bury our heads in the sands. Crude was in the mid-$30s when we recommended it, but at one stage we found ourselves $60 underwater!

How is that even possible, you might wonder? Well, of course, oil went negative back in 2020.

But like all normal humans when presented with facts they don’t want to hear, we put our hands over our ears, shouted, “blah, blah, blah fishcakes” and went and played table tennis. It won’t last, we thought, and we were right. In fact, we should have bought more.

Our reasoning back in March 2016 was that oil was extraordinarily cheap relative to other assets, be they stock markets, tech stocks, houses, gold, or even other commodities.

It could go lower, we reasoned. Then again it might not. But, we observed, it was an anomaly that it should be trading at the same price it had been in the 1980s given how much money has been printed since.

So here we are six years later, with oil three times the price or more, how’s the trade looking now? Do we sell?

The trade is maturing nicely, I’d say. But, to use an analogy, although the wine in the cellar is getting finer all the time, it’s not yet at its most drinkable.

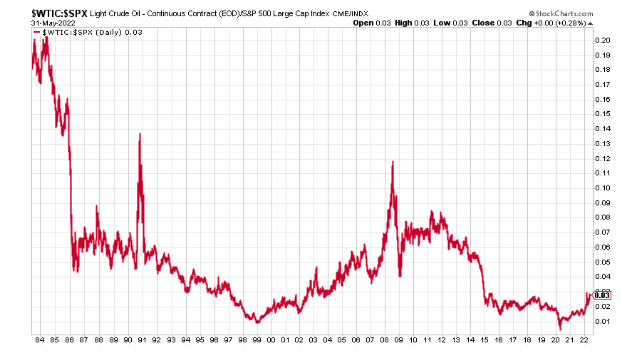

Let’s consider some long-term ratios, starting with oil vs stocks. This chart shows how many units of the S&P 500 you can buy with a barrel of West Texas Intermediate (WTIC – the US benchmark). Currently you get 0.03 of an S&P 500 unit (4,135) for a barrel of oil ($114).

When the chart is falling, oil is getting cheaper relative to stocks. When it is rising, oil is getting more expensive.

So you can see that it fell through the ‘80s and ‘90s, as the oil price declined, yet it rose through the ‘00s as the oil price made its way from $10 to $150/barrel.

You would expect this ratio to fall over time as oil production techniques improve and stock market valuations increase as economies grow.

Nevertheless, we are nowhere near the “sell” zone. If anything, we are still in the “buy” zone. The ratio is the same price it was in 2002. No reason here to sell our oil and move the money back into stocks.

Call me again when the ratio is at 0.07. That’s another way of saying I see oil getting at least twice as expensive relative to stocks as it is now before this is over.

If the S&P 500 is 4,000, a 0.07 ratio gives you an oil price of $280. Mark my words – $300 oil is not such an outlier.

Here’s WTIC vs the Nasdaq. Again you would expect Nasdaq valuations to improve over time versus oil because of the scalability of digital and the growth in that sector. But on a relative basis, oil again looks very cheap and is still a buy.

Using the ETF VNQ as a proxy for US housing, here is WTIC vs housing since 2004.

It was three times higher before the end of the last bull market.

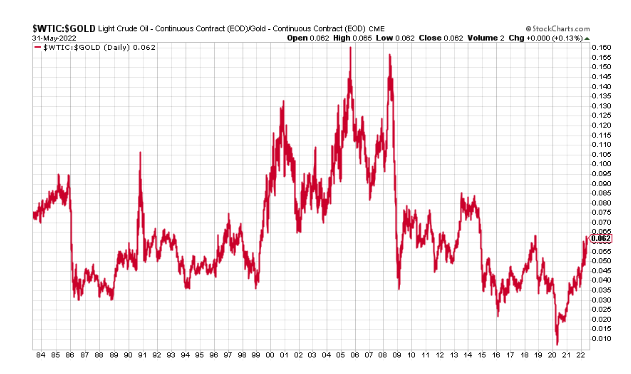

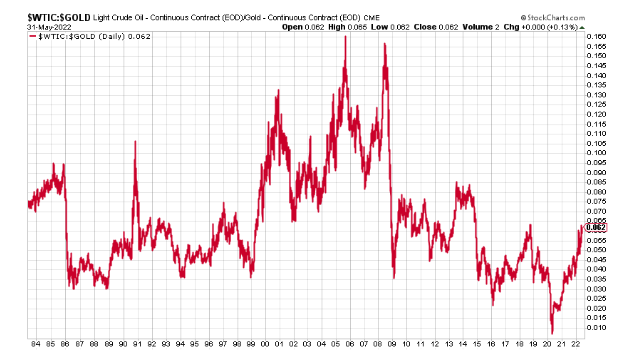

And finally here is crude against gold – how many ounces can you get for a barrel? The answer is 0.06 of an ounce.

This ratio tends to be much tighter over time – just as oil production techniques improve so do gold mining techniques, and there isn’t the growth-of-companies factor to push it lower.

We are somewhere in the low-to-middle range. Call me when it gets above 0.1. If gold is $1,850 an ounce that would mean oil at $185/barrel.

It’s not just relative – there are strong fundamental reasons for oil to go up too

So we’ve looked at relative valuations. What about the fundamental reasons to expect a higher oil price?

First, there’s 14 years of money printing and inflation. A lot of that money is going to go into the basic human requirement that is energy. Even if they print less, the money has still been created and oil is essential. Unless there is a sudden 2008-style debt destruction moment, that money will remain.

Second, despite the fracking revolution, and the improved productivity it brought about, for almost ten years now there has been huge underinvestment in the sector. From lack of new discoveries through to pipelines, this means higher costs.

Misguided anti-fossil fuel narratives perpetrated across the media and social media have made this sector toxic. Few want anything to do with it. Talent goes elsewhere, and with it investment. So productivity declines.

Governments have exacerbated the lack of investment with their pursuit of green energy and net zero. They clearly don’t get it. The narrative now is windfall taxes. That’s only going to further disincentivize investment. Policy-makers are attacking and blaming this essential industry, not helping it.

The Russian invasion of Ukraine has accelerated things. But this was all going to happen anyway. The hypocrisy of the net zero movement is that it is going to require the burning of one heck of a lot of fossil fuel to make it happen.

Fossil fuels are essential. Demand isn’t going anywhere. Not for a few years anyway.

The latest news out of oil cartel Opec has wobbled the price a little. I’m not concerned. I’m thinking longer term. What was my “trade of the lustrum”, is now my “trade of the decade”.

My preferred vehicle to play oil back in 2016 was, oddly, BHP Billiton (LSE: BHP). Known as a mining giant, something like 22% of its revenue and 34% of its earnings came from petroleum. And if you plot a chart of BHP over WTIC, you would see that one tracks the other quite beautifully.

However, BHP, for reasons stated above, is moving away from the sector. This will further help the oil price of course, but it also means its use as a proxy is no more.

Consider SPOG – the iShares Oil and Gas Production ETF (LSE: SPOG) – as a vehicle.

Another option is the Han ETF – Alerian Midstream Energy Dividend UCITS ETF (LSE: MMLP) – which yields around 6%. It gives exposure to midstream energy companies involved in the processing, transportation and storage of oil, natural gas and natural gas liquids in the US and Canadian markets.

Dominic’s film, Adam Smith: Father of the Fringe, about the unlikely influence of the father of economics on the greatest arts festival in the world is now available to watch on YouTube.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how

-

What's behind the big shift in Japanese government bonds?

What's behind the big shift in Japanese government bonds?Rising long-term Japanese government bond yields point to growing nervousness about the future – and not just inflation

-

Halifax: House price slump continues as prices slide for the sixth consecutive month

Halifax: House price slump continues as prices slide for the sixth consecutive monthUK house prices fell again in September as buyers returned, but the slowdown was not as fast as anticipated, latest Halifax data shows. Where are house prices falling the most?

-

Rents hit a record high - but is the opportunity for buy-to-let investors still strong?

Rents hit a record high - but is the opportunity for buy-to-let investors still strong?UK rent prices have hit a record high with the average hitting over £1,200 a month says Rightmove. Are there still opportunities in buy-to-let?

-

Pension savers turn to gold investments

Pension savers turn to gold investmentsInvestors are racing to buy gold to protect their pensions from a stock market correction and high inflation, experts say

-

Where to find the best returns from student accommodation

Where to find the best returns from student accommodationStudent accommodation can be a lucrative investment if you know where to look.

-

The world’s best bargain stocks

The world’s best bargain stocksSearching for bargain stocks with Alec Cutler of the Orbis Global Balanced Fund, who tells Andrew Van Sickle which sectors are being overlooked.

-

Revealed: the cheapest cities to own a home in Britain

Revealed: the cheapest cities to own a home in BritainNew research reveals the cheapest cities to own a home, taking account of mortgage payments, utility bills and council tax

-

UK recession: How to protect your portfolio

UK recession: How to protect your portfolioAs the UK recession is confirmed, we look at ways to protect your wealth.