Oil was my 2016 “trade of the lustrum” – but should you keep holding on?

A couple of years ago, Dominic Frisby picked oil as the best five-year trade you could make. Now it’s in the doldrums, he revisits his trade to ask: what next?

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Today we take a look at oil. It may be the most important fuel in the world, but, as far as the price is concerned, gravity has taken hold. It has, this past month or so, fallen off a cliff, as they say. And it continues to fall. From just shy of $87 a barrel at the beginning of October, Brent touched $58 on Friday, meaning it lost about a third of its value. It is currently sitting at $61. West Texas Intermediate (WTIC) did something similar, falling from $77 to $50 a barrel. It's currently sitting at $51.

One always likes to know why these kind of moves take place I often think the reason gets tacked on afterwards to make sense of the narrative. Nevertheless, the generally accepted reason for this current move boils down to perceived excess supply. A month ago there were fears that US sanctions on Iranian oil exports would mean a loss of something like a million barrels a day (bpd) to global supply. $100 oil was coming, they said. Then the US issued sanction waivers for eight countries importing Iranian crude. US production hit record highs the US now produces more oil than both Saudi Arabia and Russia. And, with stockmarkets, and thus economies, generally perceived to be weak, the forecast was that demand is going to tail off as well. In short, global markets are amply supplied.

US president Donald Trump, meanwhile, has taken the credit for the move, which is most unlike him, proclaiming: "So great that oil prices are falling (thank you President T). Add that, which is like a big Tax Cut, to our other good Economic news." To be fair, he had been having a go at oil cartel Opec over high oil prices for many months, and the sanction waiver does appear to have been a major trigger for the change in direction of the oil price. Lower prices were what he was gunning for. He is now urging Saudi Arabia not to cut its production, but it seems Saudi Arabia will, nevertheless, in an effort to stabilise prices, cut its own output by around 500,000 bpd, and urge other Opec nations to do the same.

Try 6 free issues of MoneyWeek today

Get unparalleled financial insight, analysis and expert opinion you can profit from.

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

How far will oil fall this time?

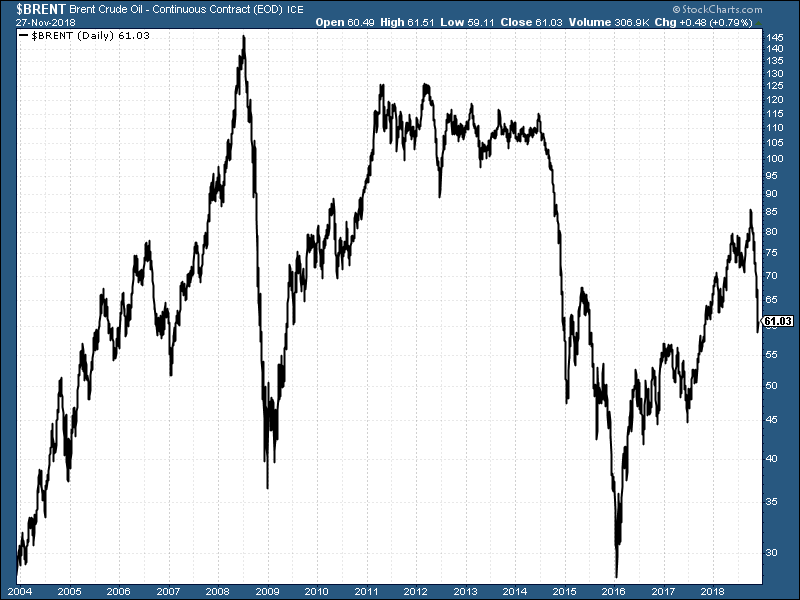

Oil seems to experience these violent sell-offs every few years. I still remember 2008 like it was yesterday. Oil had been in a bull market for nearly ten years that took it to almost $150 a barrel. Within six months, it gave back five years of gains and touched $36. 2014 saw another epic sell-off, now known as the Great Oil Bust. Brent had traded for around three and a half years, mostly in the $100 to $125 range. These kind of levels looked like the new normal. Then, not unlike now, president Barack Obama lifted US sanctions against Iran, US shale production surged and there was lower-than-expected global demand. Oil went from $115 to $45, bounced and eventually hit $27 a barrel in early 2016, an extraordinarily cheap number. Here are 15 years of Brent, so you can see the action.

In early 2016, I called buying oil "the trade of the lustrum" (a lustrum is a five-year period. It's an almost criminally underused word). Oil was $33 and our advice was to buy, hold and forget. Prices would go a lot higher, and they did. Our main vehicle for buying oil was not the usual suspects BP (LSE: BP) and Shell (LSE: RDSB), but BHP Billiton (LSE: BLT). Even though BHP is known for mining, oil is its biggest product and it tracks the oil price well better, bizarrely, than BP, Shell or the iShares oil and gas exploration and production ETF, (LSE: SPOG). BHP has actually held up very well in the face of this sell-off, currently sitting above 1,500p (we recommended it at 700p). BP, Shell and SPOG our other suggestions are now in downtrends.So the question now is, how far is the oil price going to fall?

I rather suspect this sell-off is going to be more like those of 2004, 2006 or 2012, rather than the monsters that were 2008 and 2014-15. That is just a feeling, by the way, a hunch it's not based on any detailed analysis of oil supply-and-demand statistics. But you do get a feel for the way a particular market trades the more you watch the price. I'm projecting Brent to make a low in the $45-$55 range. Thus I'm not sure this sell-off is quite done yet, although a bounce is probable. If Brent goes to $45 I think there is a real opportunity there and I'll almost certainly be looking to load up. Shell, at this point, is the one I really have my eye on, as well as BP. Dividends and all that. If they carry on declining and BHP holds, that is where the greater value might be. Short-term traders might even be eying BHP as a short, given the fact it has held up where others have fallen. Not for me that one, but I can see the argument.

As for the trade of the lustrum. This was a long-term trade with a five-year horizon. We are two and half years into it. Given oil went from $33 to over $80 there was a good argument to be taking profits up there. But if you sell now, will you be sure to buy back at lower prices? Will we even see lower prices? Questions, questions, questions. Buy, hold, forget was the strategy. So we stick with it.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

What do rising oil prices mean for you?

What do rising oil prices mean for you?As conflict in the Middle East sparks an increase in the price of oil, will you see petrol and energy bills go up?

-

Rachel Reeves's Spring Statement – live analysis and commentary

Rachel Reeves's Spring Statement – live analysis and commentaryChancellor Rachel Reeves will deliver her Spring Statement on 3 March. What can we expect in the speech?

-

Is the market missing the opportunity in energy?

Is the market missing the opportunity in energy? -

6 stocks to buy to invest in Latin America

6 stocks to buy to invest in Latin AmericaThe region is the world’s one-stop shop, boasting the raw materials required for the energy transition and key foodstuffs to cater for growing populations, says James McKeigue. Here’s how to profit.

-

The demand for oil is slowing and green energy is taking over

The demand for oil is slowing and green energy is taking overThe IEA forecasts oil demand growth to slow sharply in the next few years. The end of the era may be underway.

-

Is now the time to invest in oil as oil stocks top the S&P 500?

Is now the time to invest in oil as oil stocks top the S&P 500?Tips Oil stocks have enjoyed massive gains in the S&P 500. We take a look at the index’s best and worst performers and if now is a good time to invest in crude oil.

-

Fuel prices could rise again as Opec cuts production

Fuel prices could rise again as Opec cuts productionNews Major oil-producing countries have decided to cut oil production by two million barrels per day – could this mean higher fuel prices?

-

Why is the petrol price rising again?

Why is the petrol price rising again?Brits are being hit by a triple-whammy of increasing oil prices, a falling pound, and new fuel mix standards that are pushing up petrol prices

-

John Wood Group: needs polish, but has plenty of potential

John Wood Group: needs polish, but has plenty of potentialTips Oilfield engineer John Wood’s share price has underperformed, its prospects are solid and it looks too cheap

-

Five London-listed stocks to play the coming oil shortage

Five London-listed stocks to play the coming oil shortageTips After peaking in June, the oil price has fallen back and oil companies have fallen out of favour with investors. But with supply predicted to outstrip demand, there are plenty of opportunities to profit. Here, Rupert Hargreaves picks five of the best London-listed oil stocks to buy now.