My favourite oil stock has almost trebled since 2016 – but I’m hanging on to it

Four years ago in his “trade of the lustrum” Dominic Frisby discovered that the best stock to use to bet on oil is not actually an oil stock. It’s been doing rather well. But it’s not time to sell yet, says Dominic.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

Four years ago we discovered the word “lustrum”. A useful word, it means a five-year period. We are surprised it hasn’t found more use, especially in investment circles. Decades can be so very long.

It was back in March 2016: we conceived a “trade of the lustrum”. Today, as we do periodically, we check in on the trade and see how it’s doing. We have less than six months to go before expiry. So cast your mind back four-and-a-half years.

Ah, remember when $26 looked like the bottom of the market for oil?

In March 2016, oil had just capitulated at the very end of a two-bear market, one which began with oil (we’ll use West Texas Intermediate – WTI – as our benchmark) over $100 a barrel, and ended with it at $26. That was extraordinarily cheap, we thought. We’d never see $26 again. And so, as the price rebounded, somewhere in the $30s we recommended oil as our trade of the lustrum. Buy, hold, forget.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

This was of course several years before we learnt the meaning of two other words now in the mainstream – “coronavirus” and “Covid-19”. They pushed oil futures into negative territory earlier this year – even more extraordinary than $26 a barrel was in 2016. Today oil sits at $45, and it’s in an uptrend.

Oil can be a tricky investment proposition. The first low-risk vehicles to play oil that people think of are Shell (LSE: RDSB) and BP (LSE: BP), the two oil giants listed on the FTSE 100. But I’ve found over the years they don’t deliver the oomph you’re looking for. For example, today oil sits at $45, over $10 and 30% higher than when we recommended it in 2016. Shell and BP are both sitting below their March 2016 levels.

When oil went bananas in 2008 and shot to $147 a barrel, Shell and BP continued as if it were trading $100 lower. Shell and BP may have their merits – dividends, for example – but they are not the best proxies for the oil price by any means.

Also, when investing in a company, I look for management that believes in the product. It’s kind of important. If Bill Gates used Macs and Steve Jobs used Windows, you’d start asking questions. But both Shell and BP seem ashamed of oil – they’re desperate to present their green credentials and rebrand themselves in the renewable energy space. Maybe that’s the right thing to do. But it means their companies are set to become even poorer options as proxies for oil.

As an oil investor, I’d like to see a management that praises oil for the amazing things oil has done for the world, the progress it has made possible, the lives it has saved, the living standards it has improved. I don’t want to see management apologizing for the product.

The best stock to use to bet on oil is not an oil stock

Another means to invest in oil is via an exchange-traded fund (ETF) that tracks the price, but because of the complications of futures – backwardation and contango – often you find that the ETFs don’t track the price as closely as you would like.

You can spreadbet the spot price, but that produces a whole host of complications to do with the dark arts of spreadbetting. Despite what the firms may tell you, spreadbetting is hard, most don’t understand leverage and end up losing money. Spreadbetting is a skill in itself – great things can come of it – but it is not for ordinary investors who just want a simple proxy for oil in their SIPP.

There's no shortage of FTSE and Aim-listed oil plays, but individual company risk is a dangerous game in oil, especially with small and mid-cap oil plays that are focused on just one or a few properties in one country. Tullow Oil (LSE: TLW) is a play we have mentioned in the past, for example, which in theory could give you extra gearing, but unfortunately that has gone the way of the pear. We wanted a “buy and forget” story.

Another means is to find investment trusts or ETFs that invest in a basket of oil companies operating in the oil space. This is a good means to remove individual company risk, but it also means you end up owning the mediocre ones too.

So in the end the proxy we went for was BHP Billiton (LSE: BHP). The mining giant is best-known for producing metals. It is one of the world's largest iron ore producers, for example. Once upon a time it was the world’s largest silver producer – without owning a single silver mine. All its silver is produced as by-product.

And yet, more than 20% of its revenue and 30% of its earnings derive from petroleum. And if you plot a chart of BHP over WTI, you'll see that one tracks the other rather well. Even though it is a single company, it is hugely diversified within that company across both commodity and nation.

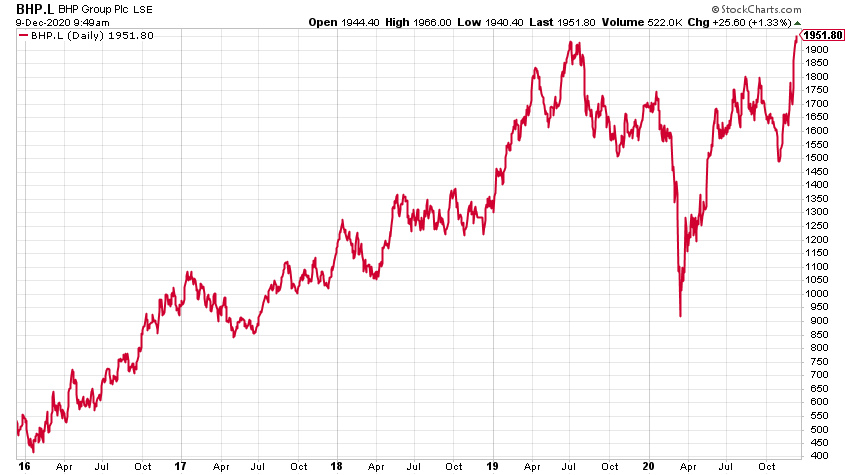

Back in early March 2016, BHP was trading at just over 700p, and it paid a dividend to compensate you in case you got your market timing wrong. It’s been a rocky ride – March 2020 and the Covid crisis was a particularly difficult period – but today it sits at 1,957p, and is retesting its all-time highs. That’s close to a triple in the last four-and-a-half years.

The lustrum trade expires, in theory at least, on March 2, 2021, but I’m bullish on oil and I’m bullish on commodities. New ESG (environmental, social and governance) regulations might encourage fund managers to invest in alternative energy and, effectively, put the brakes on oil investment. But that could easily backfire and send the oil price higher for lack of investment.

Because of Covid, we are going to be travelling less too (although more of us are driving) and that too could put the brakes on rising oil. But goods have still got to travel, and we are still going to need energy. Even if we are headed to a green Elysium of clean energy, irony of ironies, they are going to need lots of oil to build the infrastructure in the first place. The coming stimulus to rebuild economies after Covid is also going to mean oil demand.

In short, I think oil could easily be heading back over $100 – not next year perhaps, but certainly within the next lustrum. So I’m not selling my BHP just yet. If anything I’m adding.

Daylight Robbery – How Tax Shaped The Past And Will Change The Future is now out in paperback at Amazon and all good bookstores with the audiobook, read by Dominic, on Audible and elsewhere.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how

-

Halifax: House price slump continues as prices slide for the sixth consecutive month

Halifax: House price slump continues as prices slide for the sixth consecutive monthUK house prices fell again in September as buyers returned, but the slowdown was not as fast as anticipated, latest Halifax data shows. Where are house prices falling the most?

-

Rents hit a record high - but is the opportunity for buy-to-let investors still strong?

Rents hit a record high - but is the opportunity for buy-to-let investors still strong?UK rent prices have hit a record high with the average hitting over £1,200 a month says Rightmove. Are there still opportunities in buy-to-let?

-

Pension savers turn to gold investments

Pension savers turn to gold investmentsInvestors are racing to buy gold to protect their pensions from a stock market correction and high inflation, experts say

-

Where to find the best returns from student accommodation

Where to find the best returns from student accommodationStudent accommodation can be a lucrative investment if you know where to look.

-

The world’s best bargain stocks

The world’s best bargain stocksSearching for bargain stocks with Alec Cutler of the Orbis Global Balanced Fund, who tells Andrew Van Sickle which sectors are being overlooked.

-

Revealed: the cheapest cities to own a home in Britain

Revealed: the cheapest cities to own a home in BritainNew research reveals the cheapest cities to own a home, taking account of mortgage payments, utility bills and council tax

-

UK recession: How to protect your portfolio

UK recession: How to protect your portfolioAs the UK recession is confirmed, we look at ways to protect your wealth.

-

Buy-to-let returns fall 59% amid higher mortgage rates

Buy-to-let returns fall 59% amid higher mortgage ratesBuy-to-let returns are slumping as the cost of borrowing spirals.