How to invest in energy and metals as tech stocks crash

It’s been a terrible week for stockmarkets. But not everything is crashing – “real” assets such as metals and energy are holding up well and should have a good 2022. Dominic Frisby picks the best ways to buy in.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

It’s been one of those weeks – they happen unfortunately. There seems to be a perfect storm of negative news stories, and markets have got the jitters.

First, there’s the mounting conflict on the Russia-Ukraine border, the implications of which are tremendous. Never mind the potential imminent war, it has also revealed just how vulnerable the divided West now is.

Then there’s the triple threat emanating from the US Federal Reserve, America’s central bank, as it faces the challenge of inflation, which is now very real and present, even if you use the central bank definitions (asset price inflation has been rampant for decades, now it has spread into consumer prices).

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

So why do I say triple threat from the Fed? There is the likelihood that interest rates go up; there’s the tapering (with the Fed reducing the amount of money it prints to buy bonds); and there’s so-called “quantitative tightening” (QT) – whereby the Fed actually sells off some of the $9trn in assets it currently holds.

Whether the Fed will follow through with this triple threat remains to be seen. We’ll have more of an idea this evening (UK time) when Fed chair Jerome Powell makes his next utterance and tells us all what has been decided at its latest meeting. Tighter policy will be needed to control inflation, he has said – but how tight can the Fed go? “Not very”, is the answer; Wall Street is addicted to stimulus.

Goldman Sachs argued yesterday that the Fed will need to raise interest rates four times this year. Respected market historian Russell Napier estimates that 1.5% is the most markets can take. Currently, we stand at zero.

Add to this perfect storm the unwinding of one of the most incredible bull markets we have ever seen in history – the tech bubble or bull market of the last ten years, your choice of words will depend on whether you were invested or not – and you can see why it has been such a gruesome week.

The big names in the Nasdaq stock index propped it up in the latter part of last year, while the non mega-caps were in decline. But in 2022, even once-seemingly impervious big names such as Facebook, Amazon, Apple, Microsoft and Alphabet have taken a battering.

And, of course in the land of bitcoin another cryptocurrency winter is upon us.

The price of “real” stuff is holding up nicely

Times like this, however, can be very instructive. What holds up best will be the place to be when the inevitable rebound comes. I have bad news for Powell – what has held up best are metals and energy.

Usually when you get these periodic pops of the “everything bubble”, you would expect them to sell off harshly too. They have sold off a bit, but nothing like what we have seen in tech.

This bad news for Powell? Because the rising prices of metals and energy, especially, lead to a very apparent rise in the cost of living and are likely to make their presence felt in the forthcoming consumer price inflation data, putting more pressure on Powell to tighten.

Both Brent and West Texas International crude oil remain around $85 a barrel – seven-year highs. The same goes for heating oil and gasoline. Natural gas always seems to do its own thing, but it is making a low after its October-December sell-off.

Turning to the metals, in the base category, the uptrends in lead, iron ore, zinc and aluminium are all intact. Nickel to an extent too. Some have been more volatile than others, nickel especially, but the broader trend is upwards.

Copper is in consolidation mode after its bonanza in 2020 and the first half of 2021, but it is holding up near its multi-year highs.

Even the perennial disappointers – gold and other precious metals – have stood firm. Gold sits at $1,845 an ounce, having been rising steadily since early December. Silver has also been rising steadily since mid-December, though it has been weak these past few days (as you would expect in a broad market sell-off – it is a speculative metal). Even so, it is at $23.80 an ounce, when it was $21.50 a month ago. Platinum and palladium, the latter especially, have had a fair time of it too.

The short of it is this: it looks like metals and energy are going to have a pretty good 2022. They are the place to be.

The simplest way to play this is to own a company I have touted many times before, and continue to tout, BHP Group (LSE: BHP), which is diversified across the energy and metals sector. Or you might consider the BlackRock World Mining Trust (LSE: BRWM), the BlackRock Energy and Resources Income Trust (LSE: BERI) or iShares Oil & Gas Exploration & Production ETF (LSE: SPOG). These are all low-risk ways to play the bull markets in metals and energy.

Dominic’s film, Adam Smith: Father of the Fringe, about the unlikely influence of the father of economics on the greatest arts festival in the world is now available to watch on YouTube.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how

-

'Investors should brace for Trump’s great inflation'

'Investors should brace for Trump’s great inflation'Opinion Donald Trump's actions against Federal Reserve chair Jerome Powell will likely stoke rising prices. Investors should prepare for the worst, says Matthew Lynn

-

What happened to Thames Water?

What happened to Thames Water?Thames Water, the UK’s biggest water company could go under due to mismanagement and debt. We look into how the company got itself into this position, and what investors should expect.

-

How investors can profit from high food prices

How investors can profit from high food pricesA growing global population makes soft commodities a structural growth market. Amid rising food prices, here’s how to protect your profits

-

One day left for households to claim the £200 Alternative Fuels Payment to help with heating bills

One day left for households to claim the £200 Alternative Fuels Payment to help with heating billsAdvice Households could be due a £200 payment if they heat their homes using alternative fuel sources and aren’t connected to the mains gas grid - but time is running out to claim the money. We explain what you need to know.

-

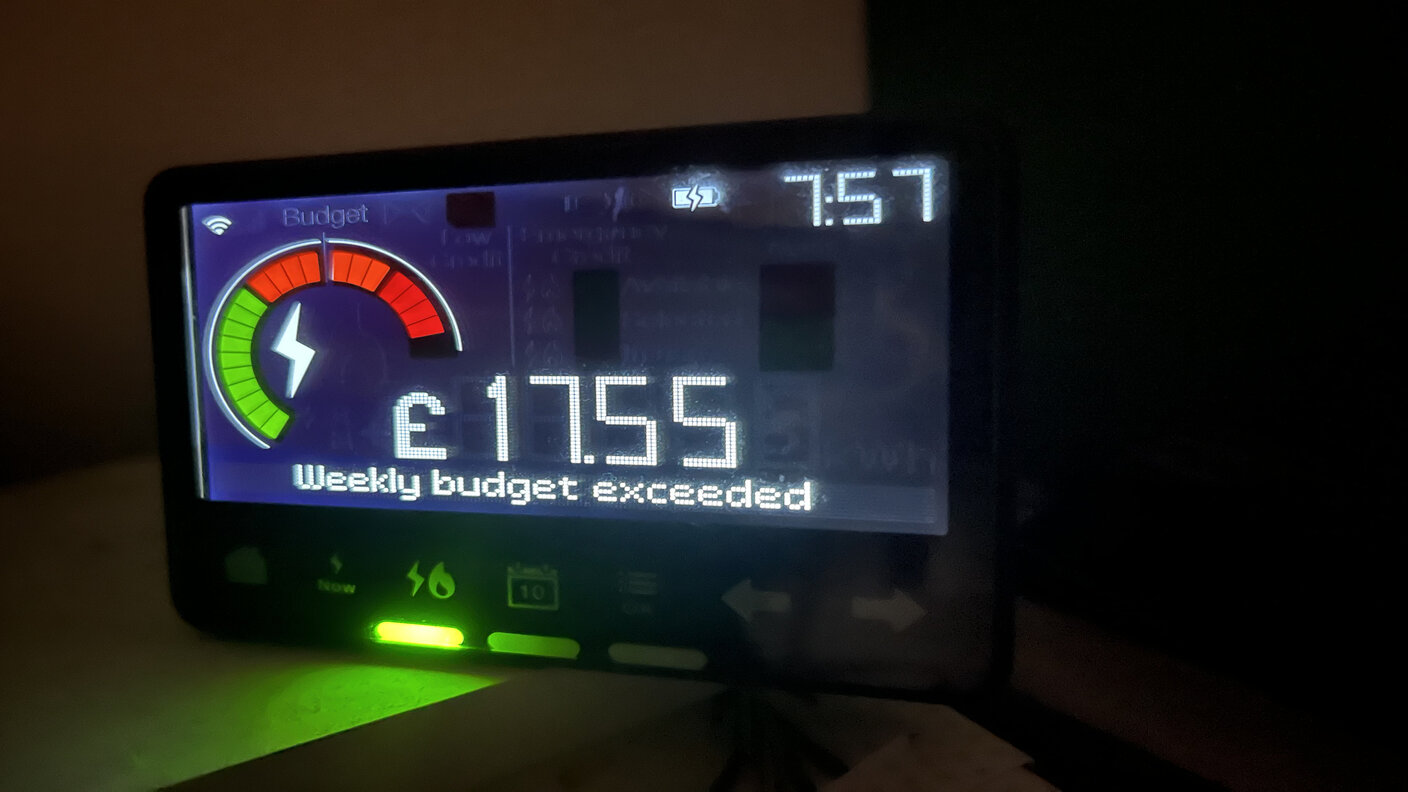

Energy bill to drop 17% this weekend as new price cap kicks in

Energy bill to drop 17% this weekend as new price cap kicks inNews Typical households on default energy tariffs will see their energy bills drop by £426 a year following today's energy price cap drop.

-

Don’t count resources out

Don’t count resources outAnalysis Commodities have performed poorly over the past year, but they tend to move in long and volatile cycles.

-

Energy bill refunds: Ovo and Good Energy to pay out £4m to customers who were overcharged

Energy bill refunds: Ovo and Good Energy to pay out £4m to customers who were overchargedNews Ofgem, the energy regulator, found the two suppliers had overcharged nearly 18,000 customers. Are you due a refund?

-

E.on Next, Good Energy and Octopus Energy pay £8m amid failures over late final bills

E.on Next, Good Energy and Octopus Energy pay £8m amid failures over late final billsNews Three energy firms have paid £8 million over compensation failures after lengthy delays in producing final bills to more than 100,000 customers when they switched suppliers