What happened to the commodities supercycle?

There was much talk earlier this year of a commodities supercycle. But even as energy markets boom, other commodities have come back down to earth.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

Energy prices continue to soar. Brent crude oil was trading above $82 a barrel this week, a three-year high, after the Opec+ group of producers said it would not add additional production in response to the price spike. US WTI futures are at a seven-year high. On Tuesday Dutch wholesale gas prices went above €100 per megawatt hour for the first time. Prices have more than doubled since the start of September.

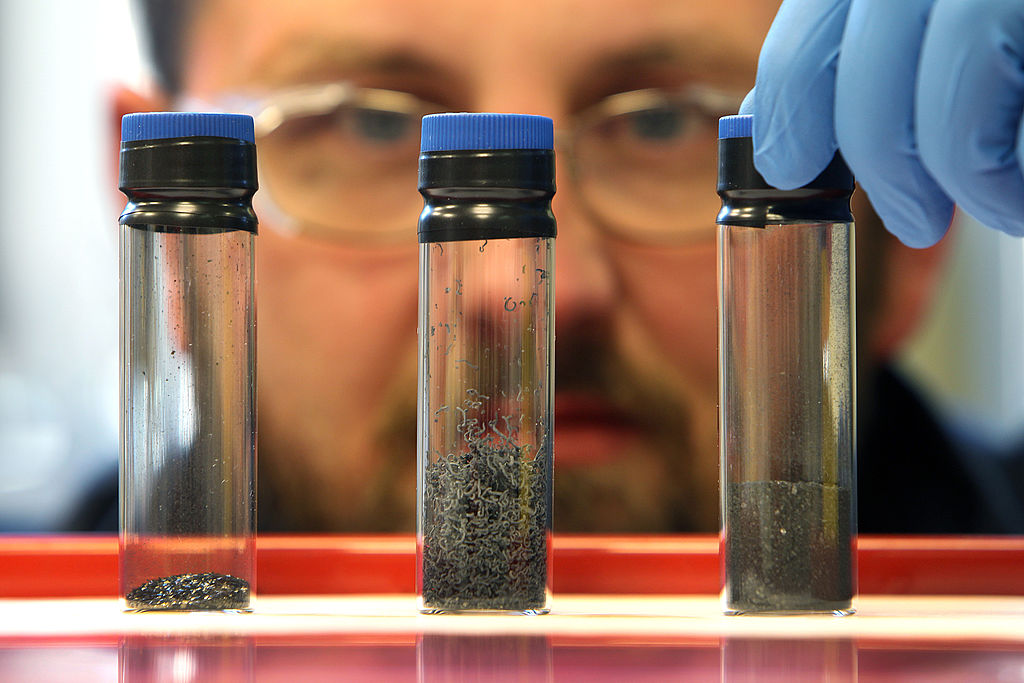

There was much talk earlier this year of a coming supercycle: a prolonged period of rising commodity prices owing to structurally higher demand. Yet while energy markets boom, other commodities have come back down to earth, says William Watts on MarketWatch. US lumber futures gained 600% between April 2020 and May 2021 but are now down by 40% since the start of the year. Copper rocketed to an all-time high in May this year, but has gone nowhere in recent months. Still, in aggregate, commodities are up: the S&P GSCI index of 24 major raw materials has risen by 40% in 2021.

“Most elements of the supercycle story remain unchanged,” says CME Group on Benzinga.com. The recovery from the pandemic, combined with lavish fiscal and monetary stimulus, should continue to power prices higher. Yet the prospect of coming interest rate hikes and signs that China’s appetite for raw materials is ebbing are sowing doubt. “The jury is still out.”

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Chaos, not a bull market

This year’s price movements look less like a supercycle than simple “chaos”, says The Economist. Stop-start lockdowns and geopolitical tensions are “interacting in unpredictable ways”. For example, “iron ore has cratered” on weaker Chinese steel demand. Yet coking coal, which is also used in steel production, is still “glowing hot” because of a lockdown in Mongolia, a major producer.

The energy transition is a key element of the case for a new supercycle. Plenty of copper and rare earth metals will be needed to build all the fuel cells and green power grids of the future, Steven Spencer of Spencer Associates tells Lexology.com. But more efficient use of raw materials can bring down demand over time. Higher prices also encourage users to switch to cheaper alternatives: witness “the use of aluminium power cables as a substitute for copper when the price of copper is too high”.

More efficient use of resources, combined with new exploration, means that commodities are a surprisingly poor long-term investment. Deutsche Bank’s Long-Term Asset Return Study notes that commodities have seen negative real returns of -0.8% per year over the last 100 years. Commodities should provide protection if inflation spikes. But think twice before buying them for your grandchildren’s trust fund.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Alex is an investment writer who has been contributing to MoneyWeek since 2015. He has been the magazine’s markets editor since 2019.

Alex has a passion for demystifying the often arcane world of finance for a general readership. While financial media tends to focus compulsively on the latest trend, the best opportunities can lie forgotten elsewhere.

He is especially interested in European equities – where his fluent French helps him to cover the continent’s largest bourse – and emerging markets, where his experience living in Beijing, and conversational Chinese, prove useful.

Hailing from Leeds, he studied Philosophy, Politics and Economics at the University of Oxford. He also holds a Master of Public Health from the University of Manchester.

-

Early signs of the AI apocalypse?

Early signs of the AI apocalypse?Uncertainty is rife as investors question what the impact of AI will be.

-

Reach for the stars to boost Britain's space industry

Reach for the stars to boost Britain's space industryopinion We can’t afford to neglect Britain's space industry. Unfortunately, the government is taking completely the wrong approach, says Matthew Lynn

-

Silver has seen a record streak – will it continue?

Silver has seen a record streak – will it continue?Opinion The outlook for silver remains bullish despite recent huge price rises, says ByteTree’s Charlie Morris

-

'Investors should brace for Trump’s great inflation'

'Investors should brace for Trump’s great inflation'Opinion Donald Trump's actions against Federal Reserve chair Jerome Powell will likely stoke rising prices. Investors should prepare for the worst, says Matthew Lynn

-

The state of Iran’s collapsing economy – and why people are protesting

The state of Iran’s collapsing economy – and why people are protestingIran has long been mired in an economic crisis that is part of a wider systemic failure. Do the protests show a way out?

-

Why does Donald Trump want Venezuela's oil?

Why does Donald Trump want Venezuela's oil?The US has seized control of Venezuelan oil. Why and to what end?

-

The graphene revolution is progressing slowly but surely – how to invest

The graphene revolution is progressing slowly but surely – how to investEnthusiasts thought the discovery that graphene, a form of carbon, could be extracted from graphite would change the world. They might've been early, not wrong.

-

Stock markets have a mountain to climb: opt for resilience, growth and value

Stock markets have a mountain to climb: opt for resilience, growth and valueOpinion Julian Wheeler, partner and US equity specialist, Shard Capital, highlights three US stocks where he would put his money

-

Metals and AI power emerging markets

Metals and AI power emerging marketsThis year’s big emerging market winners have tended to offer exposure to one of 2025’s two winning trends – AI-focused tech and the global metals rally

-

King Copper’s reign will continue – here's why

King Copper’s reign will continue – here's whyFor all the talk of copper shortage, the metal is actually in surplus globally this year and should be next year, too