Commodities are on a roll – buy in with this cheap ETF

Profiting from raw materials isn’t as easy as you might think. A new ETF, however, is worth a look

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

Commodities are on fire. But for private investors, gaining access to a notoriously fickle and unpredictable asset class through a straightforward fund structure is easier said than done. The most popular route for private investors has hitherto been through commodity-equity funds, with the resources team at BlackRock dominating most lists. Their World Mining Trust has gained 53% over the last 12 months.

But commodity equities do not necessarily move in line with the underlying raw-material market. The share price of, say, Glencore or BHP moves for many different reasons, not least underlying cash flows and managers’ decisions.

Investors seeking more direct exposure to commodities tend to focus on funds that track a major commodities index, such as those offered by Bloomberg or S&P Dow Jones. The main vehicles here are either exchange-traded funds (ETFs) or exchange-traded products (ETPs). The most popular version of the ETFs tend to be broad commodity index trackers offered by the likes of WisdomTree or iShares. These broad trackers use a composite index comprising subsectors ranging from oil to agricultural commodities, such as hogs or wheat.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

A technical problem

Underlying these broad indices are futures contracts: promises to buy a specified commodity at some point in the future (one to 12 months is a normal range).The funds have no intention of taking physical ownership of the commodities, however. The idea is to “roll over” the so-called front-month futures each month. The fund manager sells futures contracts as they approach expiry and then buys the next month’s contract.

This is normal practice, but it can lead to a technical problem that reduces returns: negative roll yield. Just as bonds have a yield curve, with the interest rates on various durations forming an upward or downward slope, there is a commodities-futures curve: the futures price often diverges from the actual, physical spot price. If the futures curve slopes upwards (in other words, futures are pricier than the spot price), the market is in “contango”; if downwards, it is in “backwardation”.

If the market is in contango, then, as it usually is, next month’s contract is more expensive than the one just ending and the fund manager essentially pays a fee for buying a new contract. The cumulative impact of this negative roll yield can be substantial: most classic one-month rollover commodity-futures strategies tend to underperform spot prices over sustained periods of time.

This has forced the ETF issuers to experiment with complicated tweaks of the futures-based strategy. WisdomTree, for instance, has a successful range of enhanced funds that track one of the broadest commodity indices – the S&P GSCI – using a dynamic roll strategy. The aim is “to minimise the potentially negative effect of rolling future contract by determining the most efficient roll on the future curve for each commodity”. iShares has a similar fund called the Bloomberg Roll Select Commodity Swap, while XTrackers has something called the Commodity Optimum Yield Swap.

Incomplete coverage

There are other problems with these widely followed commodity indices. Some end up becoming dominated by energy prices, while others tend to exclude agricultural sub indices because they can be too volatile. ETF firms have responded with ideas such as ascribing equal weighting to various subsectors (Lyxor, for instance, has a Bloomberg Equal-Weight Commodity ex-Agriculture).

Currency movements are also a risk, with the core commodity markets transacting in dollars even though British investors are concerned with sterling returns. WisdomTree, among others, offers a full range of currency-hedged commodity trackers.

Weather is another potential risk. In natural gas, oil and agricultural markets, prices are affected by the season, while raw-materials markets can be susceptible to surges and dips as investors chase big themes.

Add up all these complexities and eccentricities and one can see why many institutional investors tend to avoid index trackers and opt instead for specialist commodity funds with active managers. They are experts at playing all these trends – the roll yield, seasonality, momentum – but they tend to charge for the privilege. The funds are also almost all inaccessible to private investors.

A cheaper option

Interestingly, however, Legal and General’s ETF arm – LGIM ETFs – has taken many of these ideas and incorporated them into a new listed ETF: the L&G Enhanced Commodities UCITS ETF (LSE: ENCG). The charges are much more private investor-friendly at 0.3% per annum.

The ETF takes various observed market processes and then builds a systematic series of strategies that aim to enhance returns. So with regard to the roll-over problem, the underlying index – from Barclays – uses a range of futures optimisation techniques. This might mean using a combination of one-month, three-month and one-year contracts.

The strategy also looks at the futures curve and then “allocates along the curves with the aim of optimising the roll yield characteristics”. In simple terms, instead of paying an active manager to stare at the curve, the quantitative system automatically allocates money to where the opportunity might be largest.

In addition, there is what’s called a “momentum alpha” strategy for agriculture and livestock sectors, which aims dynamically “to allocate to points of the curve that have historically outperformed”. The fund also aims to reproduce the market’s returns in the precious metals sector.

Add it all up and with luck you should get an optimised return on commodity markets at a relatively low cost. The ETF issuers have run a back test on the strategy, which suggests that the underlying index (the Barclays Backwardation Tilt Multi-Strategy Capped Total Return index) would have outperformed every year since 2009. All the fund lacks now is a currency hedge for sterling investors.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

David Stevenson has been writing the Financial Times Adventurous Investor column for nearly 15 years and is also a regular columnist for Citywire.

He writes his own widely read Adventurous Investor SubStack newsletter at davidstevenson.substack.com

David has also had a successful career as a media entrepreneur setting up the big European fintech news and event outfit www.altfi.com as well as www.etfstream.com in the asset management space.

Before that, he was a founding partner in the Rocket Science Group, a successful corporate comms business.

David has also written a number of books on investing, funds, ETFs, and stock picking and is currently a non-executive director on a number of stockmarket-listed funds including Gresham House Energy Storage and the Aurora Investment Trust.

In what remains of his spare time he is a presiding justice on the Southampton magistrates bench.

-

Can mining stocks deliver golden gains?

Can mining stocks deliver golden gains?With gold and silver prices having outperformed the stock markets last year, mining stocks can be an effective, if volatile, means of gaining exposure

-

8 ways the ‘sandwich generation’ can protect wealth

8 ways the ‘sandwich generation’ can protect wealthPeople squeezed between caring for ageing parents and adult children or younger grandchildren – known as the ‘sandwich generation’ – are at risk of neglecting their own financial planning. Here’s how to protect yourself and your loved ones’ wealth.

-

Silver has seen a record streak – will it continue?

Silver has seen a record streak – will it continue?Opinion The outlook for silver remains bullish despite recent huge price rises, says ByteTree’s Charlie Morris

-

'Investors should brace for Trump’s great inflation'

'Investors should brace for Trump’s great inflation'Opinion Donald Trump's actions against Federal Reserve chair Jerome Powell will likely stoke rising prices. Investors should prepare for the worst, says Matthew Lynn

-

The state of Iran’s collapsing economy – and why people are protesting

The state of Iran’s collapsing economy – and why people are protestingIran has long been mired in an economic crisis that is part of a wider systemic failure. Do the protests show a way out?

-

Why does Donald Trump want Venezuela's oil?

Why does Donald Trump want Venezuela's oil?The US has seized control of Venezuelan oil. Why and to what end?

-

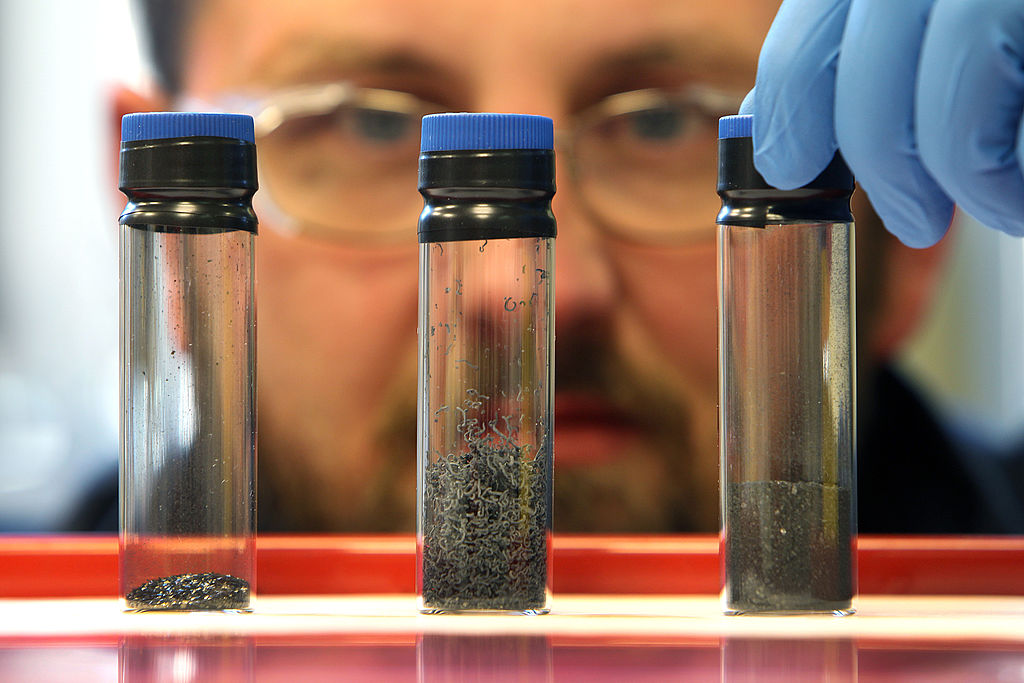

The graphene revolution is progressing slowly but surely – how to invest

The graphene revolution is progressing slowly but surely – how to investEnthusiasts thought the discovery that graphene, a form of carbon, could be extracted from graphite would change the world. They might've been early, not wrong.

-

Stock markets have a mountain to climb: opt for resilience, growth and value

Stock markets have a mountain to climb: opt for resilience, growth and valueOpinion Julian Wheeler, partner and US equity specialist, Shard Capital, highlights three US stocks where he would put his money

-

Metals and AI power emerging markets

Metals and AI power emerging marketsThis year’s big emerging market winners have tended to offer exposure to one of 2025’s two winning trends – AI-focused tech and the global metals rally

-

King Copper’s reign will continue – here's why

King Copper’s reign will continue – here's whyFor all the talk of copper shortage, the metal is actually in surplus globally this year and should be next year, too