Yield curve fear is back

One of the most reliable recession indicators in markets is starting to flash red. Investors should beware

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

Between war and inflation, markets have a lot to worry about. So fretting over an arcane-sounding bond market phenomenon may not be top of your priority list. But if history is any judge, it should be. We’re talking about the “inverted yield curve”. We explain exactly what a yield curve is here, but, put simply, when a yield curve inverts, it means that the interest rate on long-term government bonds is lower than that on short-term ones. That’s a sign that the market thinks interest rates will have to fall in the future, which implies slower growth, or even a recession.

The good news is that the most significant bit of the yield curve, the gap between the two-year US Treasury bond and the ten-year, is yet to invert. As of Monday, the ten-year yields around 2.3% while the two-year yields 2.1%. The bad news is that bond investors are betting that within three months, the two-year yield will be above the ten. And in the last 40 years, every time that’s happened, a recession has followed within 24 months.

It’s probably not different this time

No indicator is perfect and we only have a limited data set to draw on (recessions don’t happen that often). So it could be different this time. For example, Morgan Stanley strategists believe the curve will indeed invert, but that this time it won’t signal a recession, because of distortions related to quantitative easing. However, as Eoin Treacy notes on FullerTreacyMoney, “rationalisations for why this time is different crop up whenever the yield curve approaches inversion”. But what could prevent the inversion?

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Inversion is typically driven by markets fearing that Fed will raise interest rates too aggressively for the economy to handle. That’s exactly what’s happening now. So if anything prevents the inversion, it’s likely to be the Fed either getting cold feet, or clear evidence that the economy is genuinely running hot enough to handle rate hikes.

Perhaps a more important question for investors is: if we do face a recession, is there anything you should do?

Recessions are undeniably bad news for stockmarkets. Robert Armstrong, writing in the Financial Times, cites Bank of America’s Stephen Suttmeier, who reckons that “during the average recession, the S&P 500 drops by a third over 13 months”. Yet history also suggests that markets typically don’t hit a top until the inversion has happened, which implies the US market could still have a way to rise before it goes down. So despite the indicator’s strong track record, trying to use it to time the market is futile. A better bet is to make sure you have cash to take advantage of any opportunities that arise; and focus on buying at low valuations, rather than predicting the future.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how

-

Three key winners from the AI boom and beyond

Three key winners from the AI boom and beyondJames Harries of the Trojan Global Income Fund picks three promising stocks that transcend the hype of the AI boom

-

RTX Corporation is a strong player in a growth market

RTX Corporation is a strong player in a growth marketRTX Corporation’s order backlog means investors can look forward to years of rising profits

-

Profit from MSCI – the backbone of finance

Profit from MSCI – the backbone of financeAs an index provider, MSCI is a key part of the global financial system. Its shares look cheap

-

'AI is the real deal – it will change our world in more ways than we can imagine'

'AI is the real deal – it will change our world in more ways than we can imagine'Interview Rob Arnott of Research Affiliates talks to Andrew Van Sickle about the AI bubble, the impact of tariffs on inflation and the outlook for gold and China

-

Should investors join the rush for venture-capital trusts?

Should investors join the rush for venture-capital trusts?Opinion Investors hoping to buy into venture-capital trusts before the end of the tax year may need to move quickly, says David Prosser

-

Food and drinks giants seek an image makeover – here's what they're doing

Food and drinks giants seek an image makeover – here's what they're doingThe global food and drink industry is having to change pace to retain its famous appeal for defensive investors. Who will be the winners?

-

Barings Emerging Europe trust bounces back from Russia woes

Barings Emerging Europe trust bounces back from Russia woesBarings Emerging Europe trust has added the Middle East and Africa to its mandate, delivering a strong recovery, says Max King

-

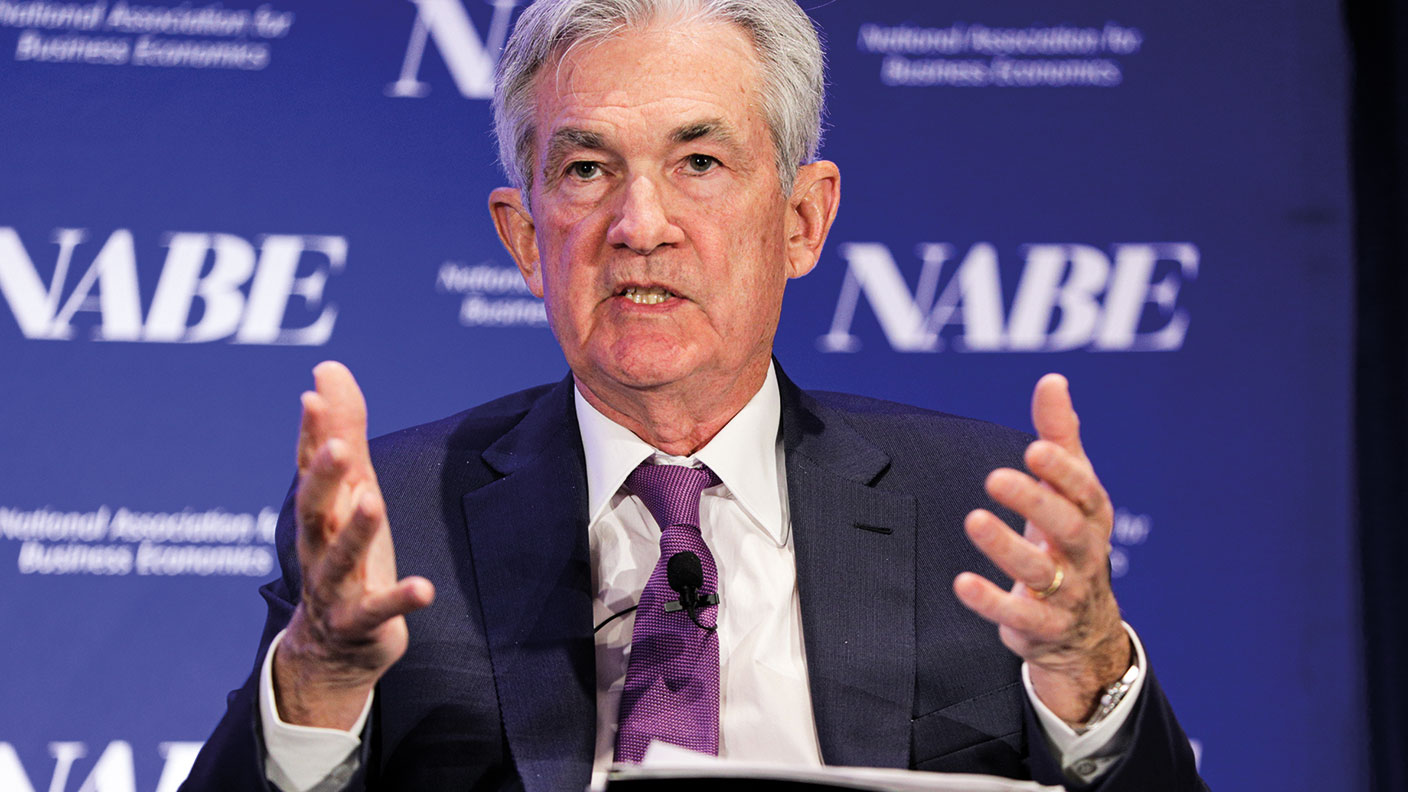

How a dovish Federal Reserve could affect you

How a dovish Federal Reserve could affect youTrump’s pick for the US Federal Reserve is not so much of a yes-man as his rival, but interest rates will still come down quickly, says Cris Sholto Heaton